10 Market Trends to Watch in the Coming Bull Run!

Prepare for prices to start moving rapidly soon.

Everything is set for a massive rally in the coming months. This will be your opportunity to strike.

To help you, I’ve collected ten market trends you should watch closely. Number nine will surprise you! Let’s start.

Become a Patron for lifetime access to our exclusive private alpha!

The first five market trends are how you make money. The last five are macro related and will improve your success in terms of timing.

Be aware of any changes in these trends as they will provide you with instant alpha when they happen. Your role is to react immediately as they shift.

1. Bitcoin Dominance & Altcoin Season

At the time of this article, the Bitcoin dominance is in a clear uptrend and has been so for over two years. As long as this continues, you make money holding Bitcoin. That’s the safest bet in crypto right now.

As soon as the Bitcoin dominance tops, and the price on the below chart falls below its uptrend line, you make more money holding altcoins. Do the switch when this trendline turns into a resistance as dominance falls.

If I am to guess, the Bitcoin dominance will top around 60% to 70%. There is plenty of room left for Bitcoin to still pump in the coming months.

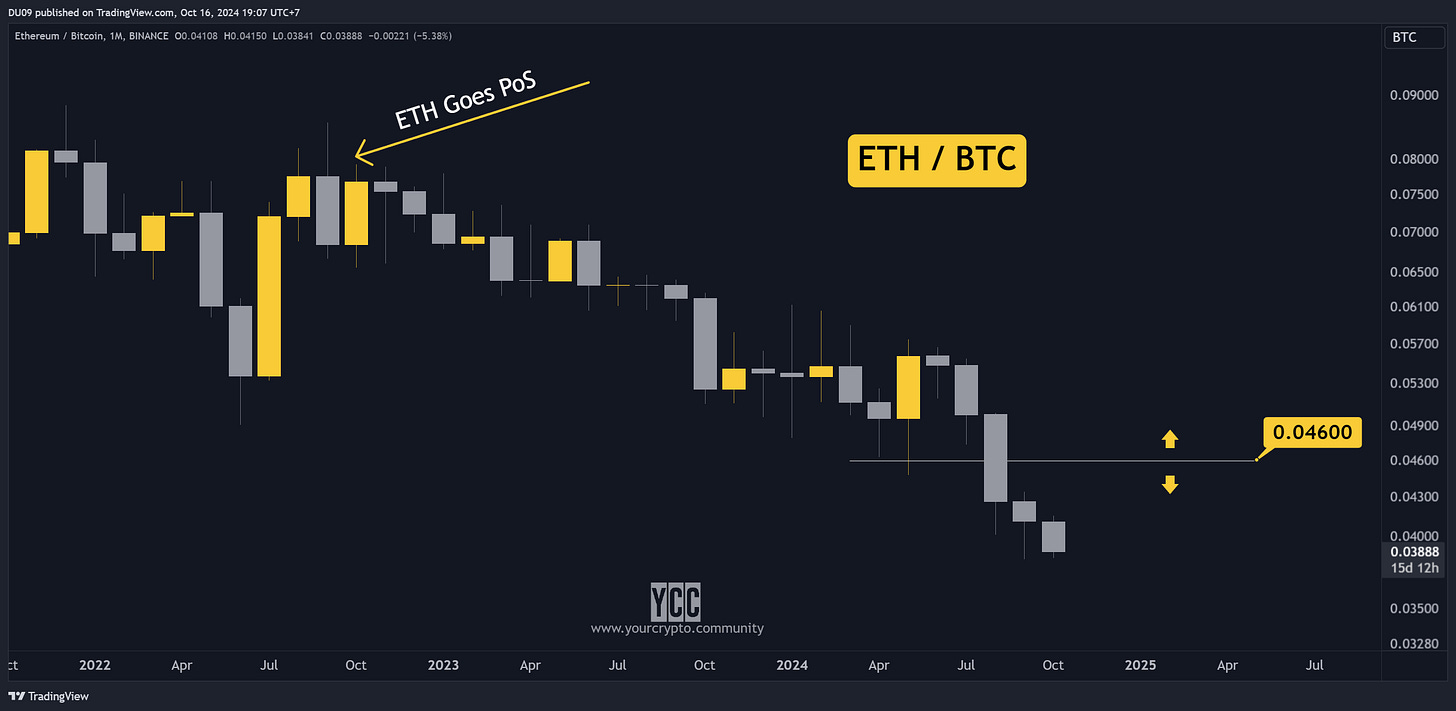

2. ETH/BTC Trend Reversal

If you hold Ethereum and are getting impatient, you are not alone. It has been under-performing against Bitcoin since 2022. Nevertheless, when the Bitcoin dominance tops, Ethereum could wake up with a vengeance and rally hard. It will be the most hated rally in crypto when it happens.

Either way, keep a close eye on the ETH/BTC price chart and as soon as you see ETH making higher lows and higher highs against Bitcoin, it’s time to turn bullish on Ethereum. That means you buy and ride it.

3. Memecoins Supercycle

The memecoin supercycle has been with us for some time now. If you already made money on it, well played! This will only intensify as Bitcoin makes another ATH and the market heats up. Be sure to book solid profits as prices pump!

If you don’t have much money to invest, don’t go for the $1 billion market cap memecoin, try to scout the ones under $100 million. Ideally on the Solana ecosystem which has generated quite a lot of hype in the past.

Since this trend is far from over, it is a great place to make money (or lose money if you hold too long). Watch out for scam coins, there are plenty of those too.

Do not go all-in into one memecoin at $1 million market cap. Spread that money across a few coins. Check liquidity as well since even if you see $1 million in profit, you can’t materialize it if that meme has only $50k liquidity. Don’t get trapped on that.

4. New project launches

As soon as the market starts pumping again expect many new releases in crypto. Established protocols will announce new features and new projects will get listed or launch their tokens. A good example of this is Hyperliquid which will launch its own network and token in the future.

Ethena is another example. They started with a delta-neutral stablecoin called USDe and now they are building their own network and ecosystem around USDe and their governance token ENA.

Where’s the opportunity to make money?

If you are early to join such projects you can profit massively. For example, those that farmed liquidity using USDe got a fat airdrop in ENA tokens. I posted about this in February and March in my alpha newsletters. To not miss future opportunities, become a Patron!

5. Ordinals Pump 2.0

The first wave was in December 2023. The next one is around the corner. I made a 200x bet on the first one. Let’s see what the next one will bring. If you didn’t load up on some ordinals, you should consider it. In terms of risk, this falls in a similar category like meme coins. Turning $200 into $40,000 was worth it last time!

I recommend you go to Magic Eden and have fun there!

6. Stablecoins Market Cap

To know if you should risk money in this market, simply check the market cap of major stablecoins like USDT and USDC. As long as their market cap is going up you’re in the right place. If you see weakness or a fall in market cap, start to cut your risk appetite.

7. M2 Money Supply

This is the same indicator like the previous one, but applied to the broad world economy. Basically, how much money in USD terms is flooding the world markets. It is represented in blue on the below chart. The yellow line is Bitcoin’s price.

As long as the blue line goes up, it means there’s more fiat money to buy crypto and risk on Bitcoin. To be bullish you need the blue line to make a new record like it just did recently. Bitcoin usually follows soon after.

8. ETFs inflows including new listings

Bitcoin nearly touched 68k yesterday after massive ETF buys. A good way to know if there is demand in the market is to simply check crypto ETF inflows and outflows.

Ethereum demand is severely lacking, but Bitcoin is thriving with over $1 billion in buy pressure in just three days this past week. Look at the table totals.

XRP also applied for an ETF and Solana is still a question mark. While ETFs have been quite a hit with Bitcoin, the same cannot be said of Ethereum. We will have to see if this was just a problem with Ethereum or other altcoins will follow on its footsteps.

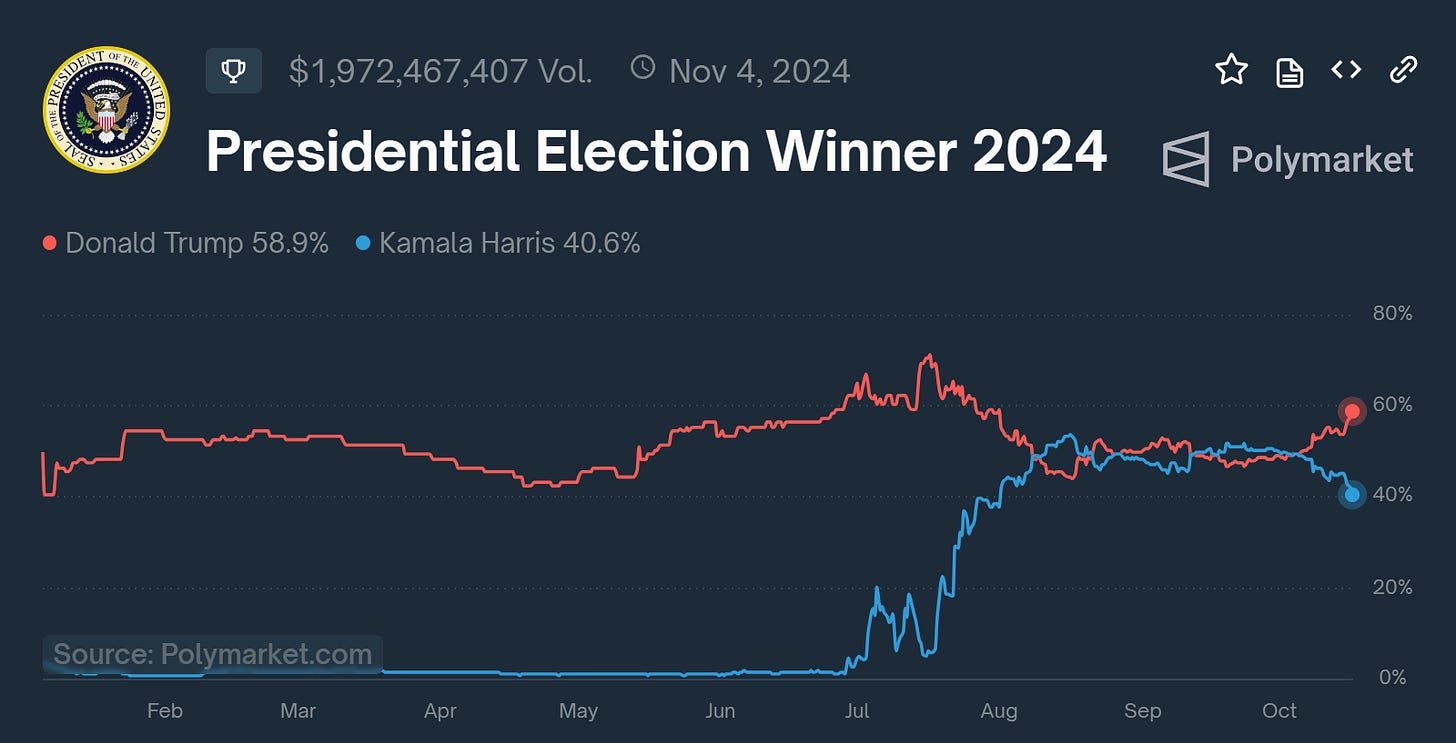

9. US Elections Result

The outcome of the US elections in November can be a massive catalyst for a bull run. The polling stations are favoring a Trump win at 59%! This should be bullish for crypto.

I think the market will remain bullish for a few months post-election as well, but 2025 will likely see the market top and start to crash. Therefore, ride the wave as it builds up, but don’t forget to exit as well. The pump won’t last.

Most of the gains in crypto are made in a few weeks before the top. Then the market turns.

10. Fed Interest Rate Cuts

The first US interest rate cut in 2024 took place in September. A month later, Bitcoin appears ready to pump. With two more rate cuts expected this year, in November and December, the market is primed for a massive pump.

The rate cuts are expected to continue into 2025 as well. Therefore, the first part of 2025 should be bullish as well. After that, it’s hard to predict how the market will react. If you check the above figure you can see that a recession started soon after rate cuts began in 2007 and 2001 (shaded areas).

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page.

All info is provided for educational purposes only and is not financial advice.