A hot war against Bitcoin has started. This is how you win it. #16

Operation Choke Point 2.0 is in full swing. Its aim? To stop you from escaping the fiat system. Here's my guide to break those chains.

The aim of Operation Choke Point 2.0 is simple - prevent dollars from leaving the fiat system into the Bitcoin economy. Bitcoin, and by extension crypto in general, is an existential threat to the current centrally managed financial order.

The recent de-peg of USDC stablecoin has shown how fragile the fractional reserve system is. In theory, every USDC has to be backed by $1 in the bank, but banks barely hold any dollars. It appears traditional finance is a systemic risk to crypto, not the other way around.

Time to hedge those risks and prepare for what’s coming! This newsletter contains a guide on how you can do that, plus more:

Operation Choke Point 2.0

How to protect yourself

The future of Ethereum: Arbitrum

Win 50 LQTY - Liquity Giveaway

Operation Choke Point 2.0 aims to keep you under serfdom

The window to buy and safely store Bitcoin in your private wallet is shrinking. Particularly if you are living in the US.

The Federal Reserve (Fed) and its government agents have declared war against any crypto friendly banks and most were already seized. Even Coinbase, for the first time ever, is considering expanding outside the US to avoid the current harassment against the crypto industry. Bittrex - an exchange from 2014 - also announced today that they will leave US completely.

Here’s a TLDR video for a nice summary on Operation Choke Point 2.0. Subscribe to my channel and scroll down for my advice on how to protect yourself.

The current doom scenario on Twitter is that Bitcoin will hit $1 million in 90 days due to hyperinflation after almost 200 US banks asked the Fed to print more money (from thin air) to save them.

If this becomes reality (extremely unlikely to happen within 90 days in my opinion), most people will have more important things to do than track the price of Bitcoin. Hyperinflation is no joke, prices can double overnight and from one hour to the next. If you stop by in Beirut for a day you can experience it by simply ordering a coffee from the same place in the morning and in the evening. The second coffee will cost more a few hours later.

The Fed is at a critical moment. They need to print more dollars to provide liquidity to the banks which are on the brink of collapse. But they also need to destroy money (since they printed too much) by raising interests rates to control inflation. Something has to give. If you ask me, they will just print more dollars as 200 banks collapsing in quick order is probably too much to accept.

This means only one thing. Bitcoin’s price goes up. If you checked the price chart, this is exactly what is happening after the Fed injected $300 billion into the banking system in March. And it will not stop. Probably it will never stop as long as the Fed exists.

What will also not stop is the Fed & Co doing everything they can to keep you trapped in the fiat system. Escaping to a Bitcoin economy is not an option. Your time is running out. Time to act. See next.

What can you do to protect yourself?

Start accumulating assets with intrinsic value that can’t be diluted

Examples include Bitcoin, gold or real estate. Hyperinflation of the US Dollar means rich people, which are more sensitive and aware, will seek to immediately spend (get rid off) their dollars and buy something of value that retains or protects their wealth. This also compounds the problem. The collapse of the Silicon Valley Bank in 48h showed how quickly things can escalate once big money is on the move.

At this time, the hardest asset you can possible hold to protect yourself from hyperinflation and the incoming dilution is Bitcoin. You have to STOP thinking of Bitcoin in USD terms.

1 BTC = 1 BTC.

A Bitcoin economy will be deflationary and all prices will be in Bitcoin. The BTC value in USD will be irrelevant. This is also called hyper-bitcoinization, aka the moment when Bitcoin becomes the world’s dominant form of money.

Immediately remove any Bitcoin you hold with third party custodians

You need to cut any path that would allow for its confiscation. You need to be the sole custodian of your Bitcoin in a cold wallet that only you control (Ledger is a great choice). If hyperinflation arrives, capital control, including on your Bitcoin will be enacted. All crypto exchanges and related third parties will no longer be able to honor your withdrawal request.

Get exposure to Bitcoin now, don’t delay

Banks will start limiting or outright ban purchases of Bitcoin “for your own protection”. You will no longer be allowed to transfer USD to any third party that sells Bitcoin. This is why it is critical to get exposure to Bitcoin now. Not tomorrow. NOW.

If you’ve delayed that purchase, it’s time to reconsider. If you have only one bank account, open a few extra ones as a back-up. The time invested today can prove a critical advantage later when you need to act quickly.

Avoid altcoins

They are not there to protect your wealth, rather, they are there to take wealth from you or dilute it. Don’t be fooled. If you think you will be protected by holding altcoins, then read on what happened to Japan in the 19th century when it still used silver as money instead of gold. As countries moved to the gold standard, those using silver faced dilution as more silver was mined and dumped on the market.

The hardest form of money always wins because it can’t be easily diluted. If the price of silver increases, it becomes profitable to mine more of it to flood the market. You can’t mine more Bitcoin, no matter how much energy is spent. The only consequence of that is a more secure network.

When you buy Bitcoin, make sure it is real and you can touch it

Do not hold fake Bitcoin or paper gold. If the Bitcoin you hold is called wBTC, bBTC, hBTC or renBTC you are not holding actual Bitcoin, but a derivative. Worst still, if you don’t have the keys or seed to your Bitcoin, you do not own any Bitcoin, somebody else does.

While I don’t expect Bitcoin to hit $1 million dollar this year, I believe this is inevitable, eventually. As more dollars return to their home from abroad, the US will no longer be able to export its inflation to other nations that may choose to adopt Bitcoin as a legal tender (see El Salvador). At that point, the US dollar reserve status will shrink and decentralization of money will follow. That is a golden opportunity for Bitcoin to shine.

Relocate to a crypto friendly place

While El Salvador may not be at the top of your list, they just passed a bill that eliminates all taxes on income, property and capital gains for technology innovations. If you plan to retire with Bitcoin, then this is definitely something to consider.

I expect the current crypto market rally to continue until summer and then enter into a correction. However, the big year to watch for is 2024. That is when Bitcoin should really take off at speed. For this reason, I believe you should use the remainder of this year to accumulate. Done right, you should be well rewarded later. I also made a video on this, check it out.

A few remarks on Ethereum next.

The future of Ethereum: Arbitrum

As the bull market returns, an old problem will resurface. High gas fees on Ethereum. Luckily this time, there is an alternative built on top of ETH called Arbitrum One or ARB. Layer-2 solutions will shine because of that.

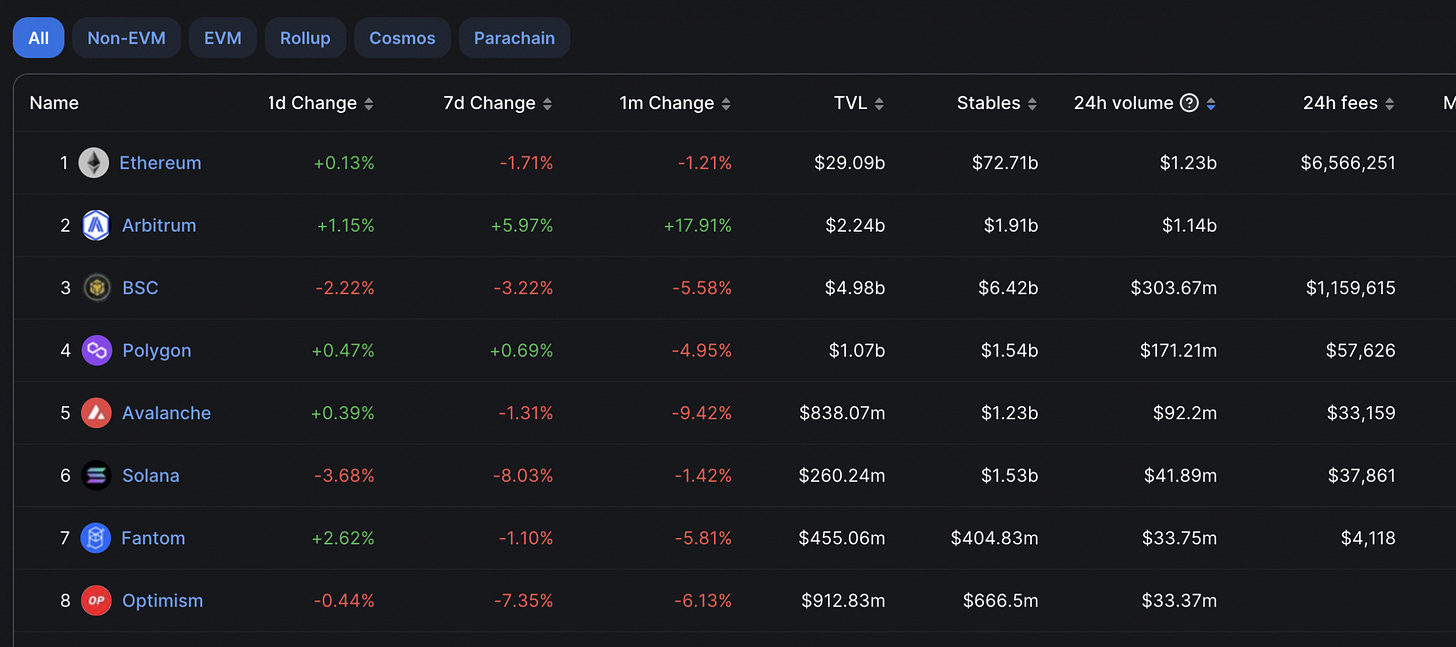

We already have proof that this assumption is correct.

Just look at the below image. The 24h volume on Arbitrum is second only to Ethereum at $1.14 billion. Ethereum is at $1.23 billion. The next bull market may see Ethereum fall to second place in total volume!

This is bullish for ETH. I suggest you start immersing yourself in the Arbitrum ecosystem (look into GMX and GMD). This month, Arbitrum also airdropped millions of ARB tokens to its users that interacted with their network before mid-February. The ecosystem is growing. Draw your own conclusions.

Liquity giveaway - win 50 LQTY!

I’m doing a giveaway of 50 LQTY (~$100). To win all you need to do is follow me and Liquity on Twitter and re-tweet the below. I will select the winner in the next 24h using a random Twitter selector. You get extra points if you join me on Discord as well.

Good luck!

Hey you,

If you enjoyed the above, I invite you to be part of my community and share this newsletter. If you want to learn more about YCC, head to the About page.

To get started on your crypto journey use one of my referrals (scroll down on the link) and then consider becoming a Patron. You can find me on Discord for any questions and if you want to start a collaboration, reach out!

Don’t forget to follow YCC @ Twitter ◇ YouTube ◇ TradingView

Yours,

Duo Nine - YCC Founder