Biggest Crypto Crash in History - Here's What Happened!

Instead of UPtober, we got billions in liquidations.

Between 10 and 11 October, crypto suffered its biggest crash in history. $20 to $100 billion vanished overnight. Who caused it?

Binance is the most likely culprit based on available data.

Once the liquidation cascade started on Binance, it spread everywhere, with Hyperliquid users being hit hard. In the process, Ethena’s USDe also lost its peg and fell by 35% on Binance. I wrote about this exact scenario in the past.

If this is your first major crash, this is a must read to the end. Scroll down.

Become a Patron for lifetime access to our exclusive private alpha!

Because the crash started on Binance, we need to talk about exchanges and why they are a necessary evil. I will ignore the necessary and focus on the evil part in this article which is an extension of this post I made on X.

But first, the damage of this massive crash.

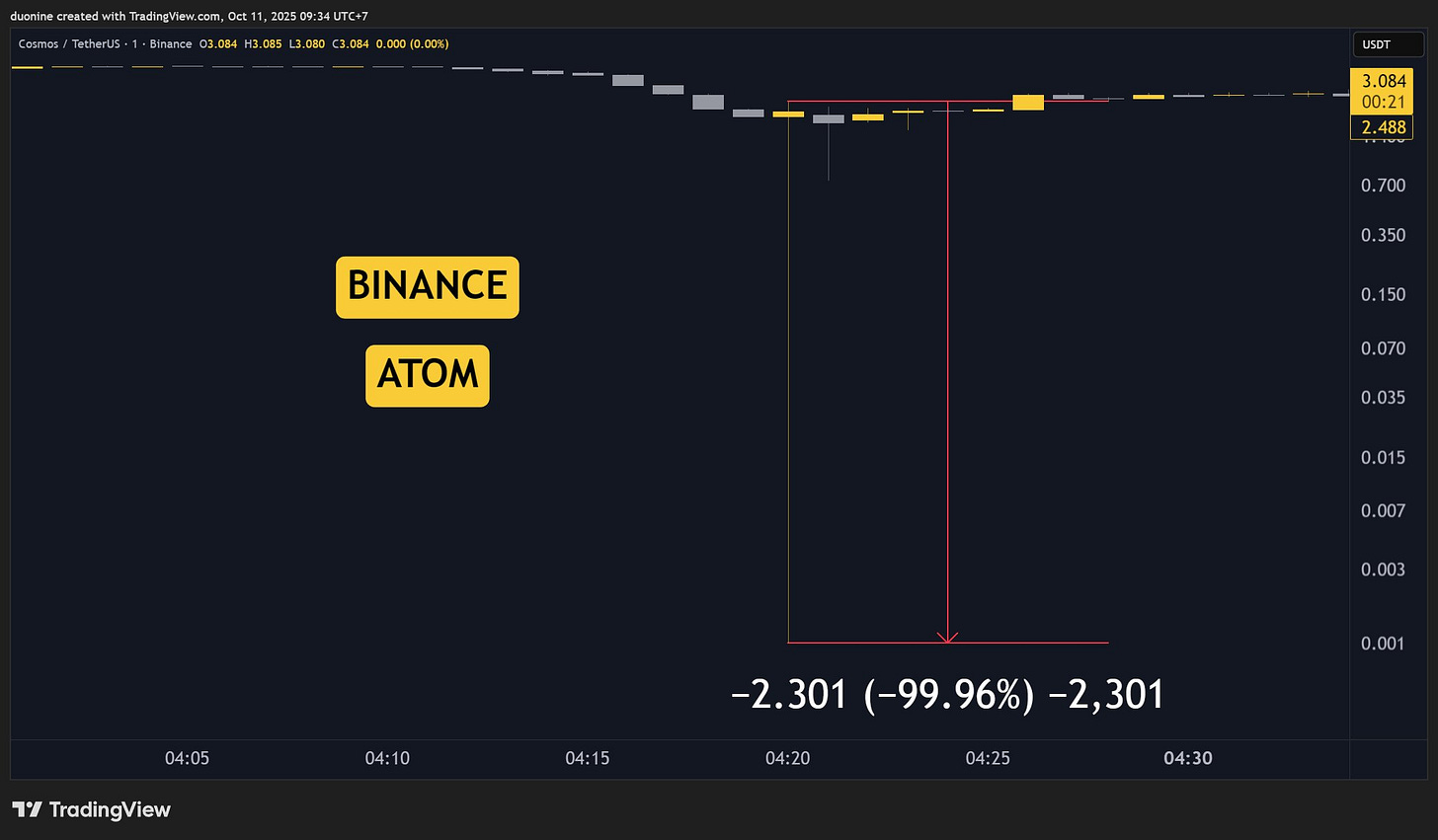

It was so bad that some altcoins like ATOM literally went to zero on Binance or $0.001, which in liquidation terms, is the same.

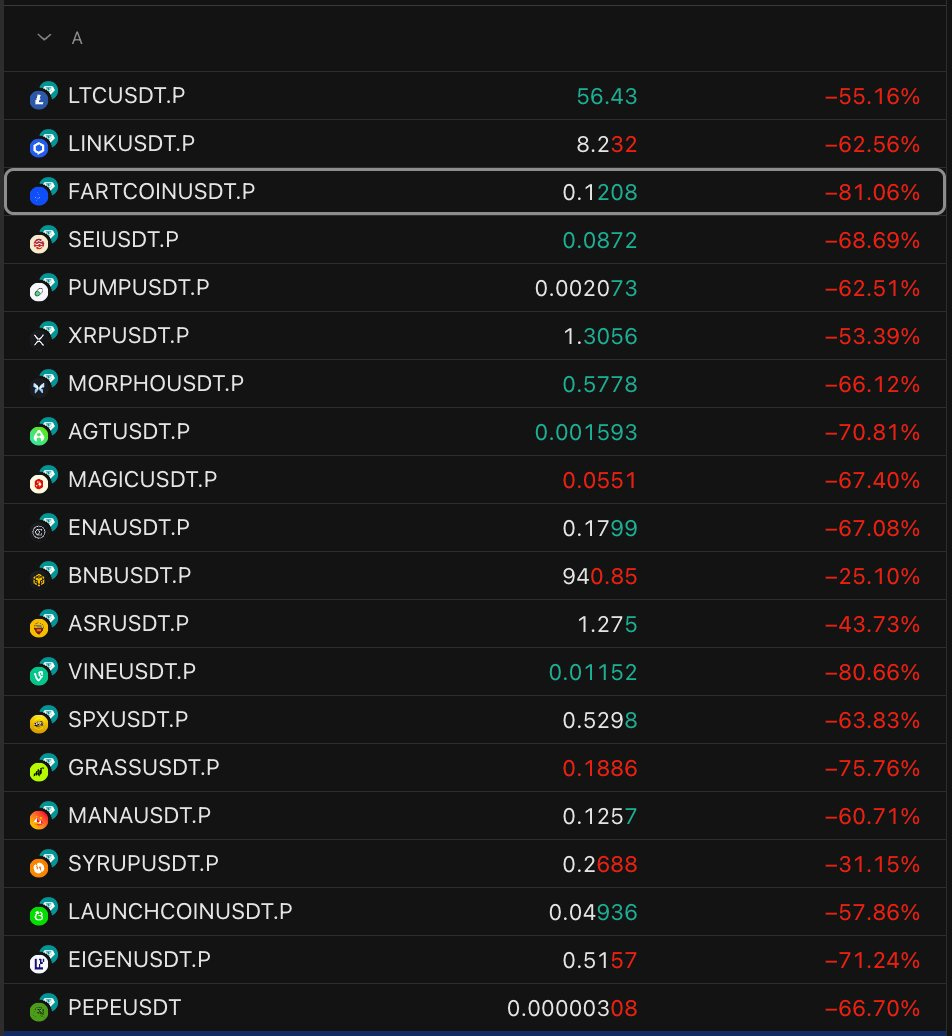

Anyone that had an open position with any leverage on Binance, and was long altcoins, got liquidated. There was no escape. Most altcoins crashed by 70% or more. Coins with billions in market cap went to zero in minutes. The illusion was broken.

This quickly spread to other exchanges, one of the biggest being Hyperliquid. Let’s look at that first then move to the other exchanges and also Ethena’s USDe.

🔥 Evil 1: Exchange solvency above all others

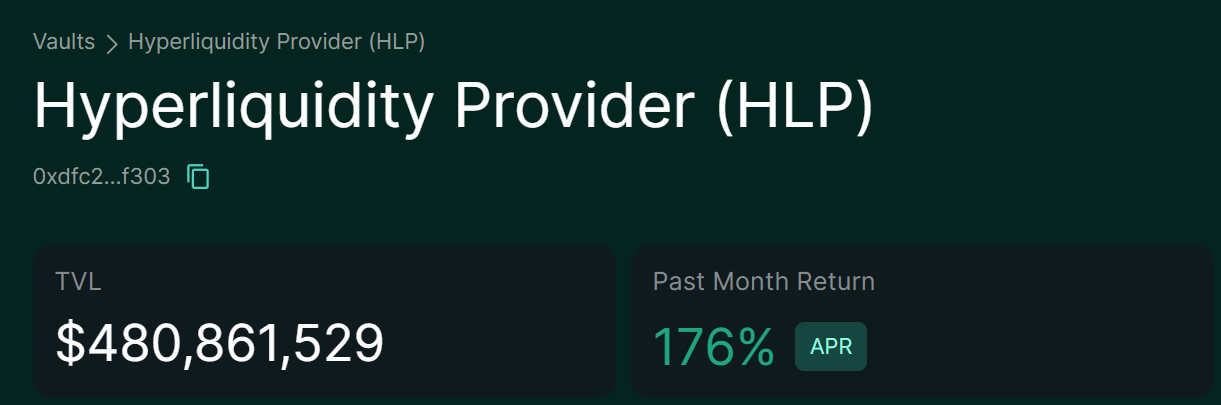

After last Friday, many HYPE fans probably woke up from their dream. Anyone with a 2x long on most altcoins got liquidated. Open interest on the exchange was cut by more than half. Billions lost.

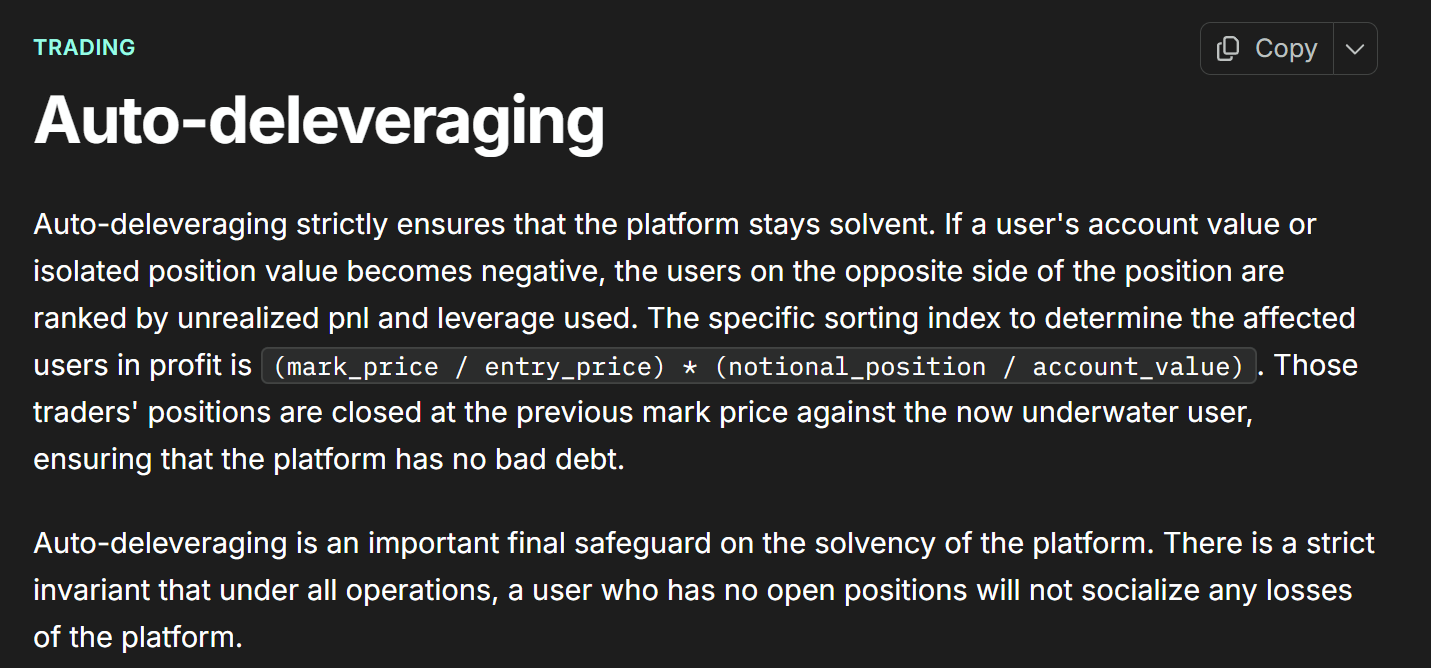

During the madness, Hyperliquid prioritized its solvency above all else. That comes at your expense. This was made clear on Friday and users learned a new term: ADL or auto-deleveraging.

Users that had delta neutral positions or multiple positions across altcoins (that means longs and shorts open) were first auto-deleveraged on their short positions.

Those shorts were in profit preventing user liquidations.

After the ADL system closed their shorts, the exchange proceeded to liquidate users on their long positions which were no longer hedged by shorts. The longs were now naked as prices went to zero = liquidated, RIP.

Basically, the exchange cut users from additional profits and then liquidated them to protect itself. All in the name of solvency. Auto de-leveraging is a necessary evil that puts the platform above users. It’s a measure of last resort to keep system solvency.

But every winner needs a loser in ADL.

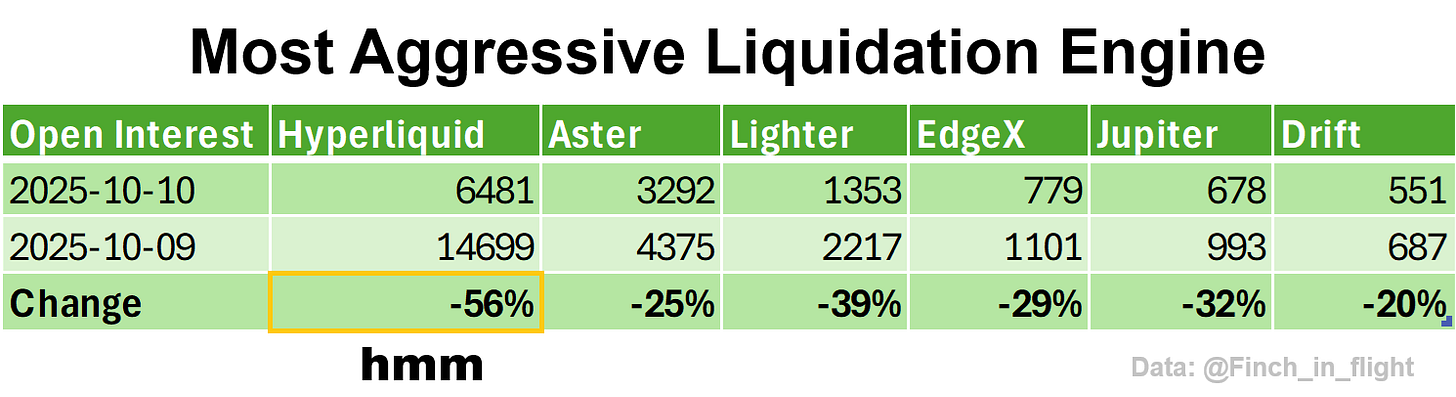

Hyperliquid was the most aggressive liquidator of all DEXs at 56% or $8.2 billion wiped in open interest (see image).

Based on this data, Hyperliquid is the last place you want to trade on because the odds of getting liquidated there are the highest.

Anyone trading altcoins on Friday got hit. This is why celebrating statements like “Hyperliquid worked flawlessly” or that “the HLP vault made $40 million in 30 minutes” loses sight of what actually happened.

Yes, Hyperliquid worked flawlessly to liquidate its users and keep itself solvent at their expense. In the process, it cut open interest by more than half.

If ADL had failed, then the HLP vault would have been drained next. The HLP vault is mostly user money too.

Who survived?

People that traded Bitcoin or Ethereum.

That whale that shorted BTC/ETH before the crash, took its $200M profit and called it a day. That’s because there was enough liquidity on such pairs. BTC does not go to zero in 20 minutes like ATOM.

Why did altcoins go to zero? How is that possible?

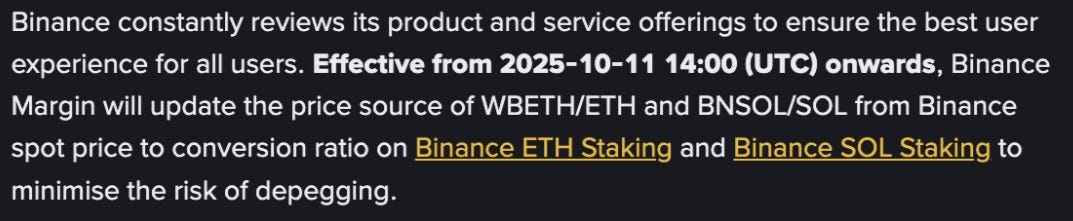

Because something went wrong at Binance HQ and market makers pulled out from the orderbooks. The crash also happened exactly during a scheduled update to their margin price source for wBETH and BnSOL.

It was a technical error at best that cascaded everywhere or intentional at worst.

Time to introduce another evil.

🔥 Evil 2: All exchanges trade against their users

When you buy or sell on an exchange, those orders are treated as flow. Most of this flow goes to the exchange trading desk first and their partner market makers.

You’re literally being farmed.

On most centralized exchanges, the orderbook you see is fake. It’s not real. Most of those orders are a market marker or the exchange itself trading against you!

What happens when they pull out their buy orders? ATOM goes to $0.001 like on Binance and you are liquidated in seconds.

Why is this bad?

Because the exchange also knows your liquidation price. Suddenly, you realize you’re playing a loser game. The odds are against you.

The exchange knows the exact price it needs to hit to nuke you, take your money, and thank you for your time. Then the price goes back up.

Worst, they throttle you while their trading desk nukes everyone. That’s why the user interface does not work on your end. They are busy taking your money. Afterwards, they blame the market volatility.

But it does not end there.

After centralized exchange liquidate you, they under-report their liquidations. For example, Binance or Bybit only report 1 in 20 liquidations and they blame the API limits.

Why?

So that they look good to their users, or their sheep. They can say Hyperliquid had $8 billion in liquidations and they only had $1 or $2 billion. See image above.

At least Hyperliquid can’t fake their data, it’s honest.

The worst part is that this crash was CEX induced and Hyperliquid fell for it.

That’s because Hyperliquid sources asset prices via oracles based on centralized exchange prices, among others. Binance has the highest weight in that price oracle formula.

Since Binance led the charge to zero across most alts, Hyperliquid followed via oracle prices. This is a vector of attack against Hyperliquid which should be mitigated in the future.

We know Binance and others want Hyperliquid gone. Nuking their users is a good step in that direction. Retail is collateral damage here while exchanges print money fighting each other.

One in two users on Hyperliquid got wiped on Friday, or close to that.

That’s why exchanges are not your friends.

🔥 Evil 3: Insiders are always privileged at your expense

Did you know that Ethena’s open positions on Binance or any CEX are not subject to ADL?

While your shorts were closed by the system, the same shorts held by Ethena are excepted. Essentially, users are liquidated first on identical positions!

That’s why Ethena’s USDe peg did not go to zero, because they were excluded from the liquidation cascade.

Despite this, USDe still lost peg on Binance by 35%. Before this, Ethena boasted that users on most exchanges, including Binance, can use USDe as collateral when trading.

That USDe collateral crashes by 35%, making things worse! You needed even more collateral to cover your longs. Any leverage, including 1.1x was liquidated.

DeFi users were mostly spared from USDe related liquidations because on AAVE the USDe peg was hard-coded to the USDT price.

This saved many because only if USDT lost peg, USDe would follow. Another privilege, but this one protected users and Ethena.

🔥 Evil 4: Crypto is a highly extractive industry and exchanges are its biggest promoters

Want to list a coin on Binance? $1 million please.

Want to market make a coin with Wintermute? 10% of the token supply please.

Want to trade on leverage? Great, looking forward to liquidating you.

The system is designed so that at every stage someone is being farmed. Retail is just the base layer. Projects and teams are being farmed, VCs are being farmed. Big fish eats smaller fish until the top.

Know the casino you’re playing in and exit early to survive.

🎯 How to protect yourself from such evil?

The easiest is to not engage. Nobody can liquidate your Bitcoin stored in a hardware wallet. Those holding spot positions were not affected, unless they panic sold the bottom. That’s just a side event from the liquidation party.

I’ve been in this space for over 10 years and I can say most of it is just noise. The ultimate alpha is stacking and holding Bitcoin and ignoring most of the other stuff.

Days like Friday prove it.

Who wants to invest in “blue chip” altcoins that crash to zero in minutes? It’s all fugazi. Bitcoin is one of the few real things in crypto and is the reason this industry even exists.

Focus on that.

I began being intentional about it in the last few years. Sold most alts and my portfolio is 90% Bitcoin in a hardware wallet. This gives me peace of mind and I value that.

Took me a few crashes and bear markets to be here, so if this was your first, keep at it.

It gets better with time.

Did you survive the crash? Reply in the comments and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

With a liquidation event of this magnitude, do you think a larger player might have gone under ala 2022? That there might be dead bodies stuffed in a closet that make take a few months to reveal?

I mostly own BTC & ETH these days but it's a little unsettling and has me leery of the near/mid-term