Bitcoin Explodes Higher - Here's My Gameplan

Many were surprised by this move by Bitcoin. 30% pump in two weeks? Is this a bull market now? Let's find out.

It’s not often that we see Bitcoin increase by $5,000 in one day like it did on 23 October. This is worthy of a closer analysis and this newsletter explores that in more detail.

There are three factors that are now converging which have turned Bitcoin extremely bullish. If you play this right, you can capitalize on this momentum.

Let’s take a closer look.

Here are the three fundamental reasons why Bitcoin is extremely bullish right now:

Bitcoin ETF approvals are around the corner

Next halving event is due in April 2024

Bitcoin’s market dominance just experienced a major breakout

Taken together, these three factors are forming a perfect storm for Bitcoin to out-perform most of the market in the next six months until the halving. The Bitcoin market dominance shows that very clearly (chart below, click to make bigger).

Bitcoin is keen to reach 60% or even 70% crypto market dominance which was not seen since the 2021 bull run. In light of this, having most of your crypto exposure to Bitcoin can be one of the best trades in the coming months.

The BTC pump this week is also attracting fresh money which will only increase if an ETF will be approved. However, Bitcoin will eventually hit a ceiling in terms of dominance (at 60%, 70% or higher), and that’s when altcoins will shine as money will rotate and spill over to them from BTC.

Insiders are already hinting that a Bitcoin ETF approval is likely, either at the end of 2023 or early 2024. The timing for this could not be better considering that the halving event has historically been bullish on the price prior to it.

Are we in a bull market? Not quite.

If you look at the total crypto market capitalization, there is this key resistance at $1.3 trillion that needs to break. The first attempt was rejected in April 2023.

This second push higher gives good reasons to be optimistic as each re-test of a key resistance makes that level less likely to hold. A breakout above it would quickly settle the case and that could also trigger many altcoins to perform well.

My gameplan

In the next six months, I have a strong bullish bias towards Bitcoin.

Some altcoins will also perform well like Solana, Chainlink, Kujira or Rune. However, most alts will lag behind so long the total market capitalization stays under $1.3 trillion.

I also expect ETH to underperform versus Bitcoin. Simply put, since September 2022, Bitcoin outperformed Ethereum. Lately, this only intensified. Take a look at this ETH/BTC chart. If ETH’s price fails to hold at 0.05 BTC and breaks below it, then it’s game over for Ethereum.

This pennant is huge and formed since 2017! A break below it would be pretty bad. It can also mean BTC pumps hard while ETH just moves sideways in USD terms.

Post-halving, we could see some corrective moves on BTC’s price. Either way, I am a buyer if the price dips under $30,000 for any reason during this time.

Still waiting for BTC’s price to fall under $20,000 is now a sweet dream I’m afraid and extremely unlikely. I don’t expect a new black swan event to happen, we already had plenty of that in the bear market. Frankly speaking, buying Bitcoin is a hedge in such cases.

Right now, Bitcoin needs to break above $36,000 to continue its uptrend. That is not an easy ask considering it pumped 30% in the past two weeks. A pullback is more likely and a breakout could come later once the ETF rumors crystalize into concrete action.

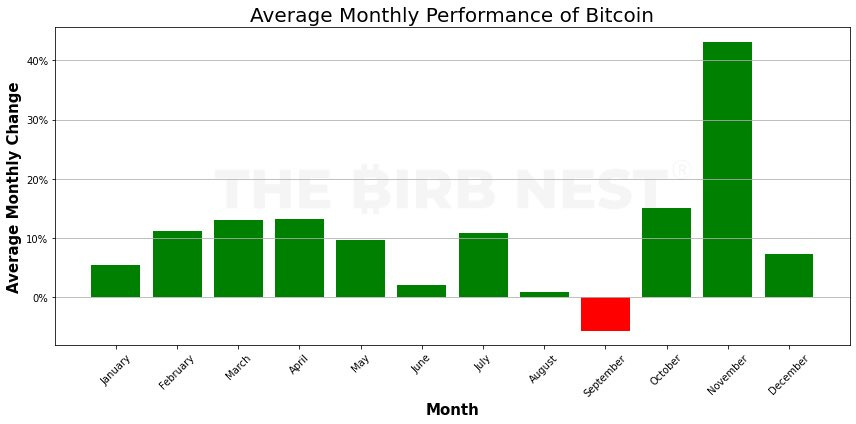

All in all, I expect a bull market to start sometimes in 2024. Historically, October and November have been the best performing months for Bitcoin. Exciting times ahead in 2023 and expect plenty of volatility as we enter 2024.

You should also mentally prepare for Bitcoin to have swings in excess of $10,000 per day in the coming bull market. This will become the new normal. I’ve made a post on that and possible targets below.

What is your gameplan? Leave a comment below or hit me up on Discord / 𝕏.

P.S. This is not financial advice.