Ethereum Has an Existential Crisis!

Even blockchains can have a midlife crisis.

There is a new narrative in town and it has to do with Ethereum (again).

Decentralize finance is growing fast, but not on Ethereum. Vitalik must find a solution soon or there’s big trouble ahead. Moreover, the rise of Layer-2 networks has put into question ETH’s future. Yikes!

Here’s how this impacts you. TLDR at the end.

In 2022, Ethereum decided to scale by moving from Proof of Work (PoW) to Proof of Stake (PoS). The promise was faster transactions, cheaper fees, and the creation of an everything ecosystem on Ethereum.

That worked well until now.

During this transition to PoS, Vitalik also decided to scale Ethereum using Layer-2 networks (or L2s) like Arbitrum, Optimism, or Base. These are networks on top of Ethereum that use the native chain for their security. They are independent and ran by different teams.

The idea of using L2s was pretty simple.

Instead of paying $100 for a transaction on Ethereum, you could pay say 1 cent on Arbitrum, bundle up many 1 cent transactions on that L2 and post them in one go on Ethereum for final settlement. This is how L2s “pay” for security via posting bundled transactions on Ethereum.

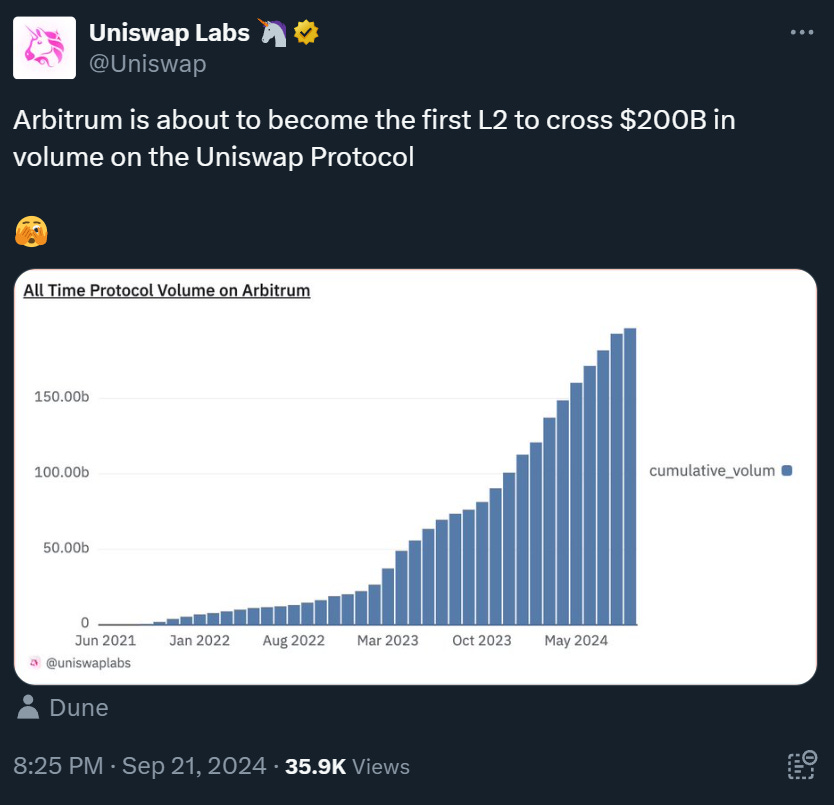

This worked so great that a new problem emerged. Take a look at the below chart.

Today, most of the volume and transactions no longer happen on Ethereum, but on its L2s. Users are simply ignoring Ethereum which has become a legacy network for whales that don’t mind the high fees in exchange for more security.

The first major takeaway from this quite striking.

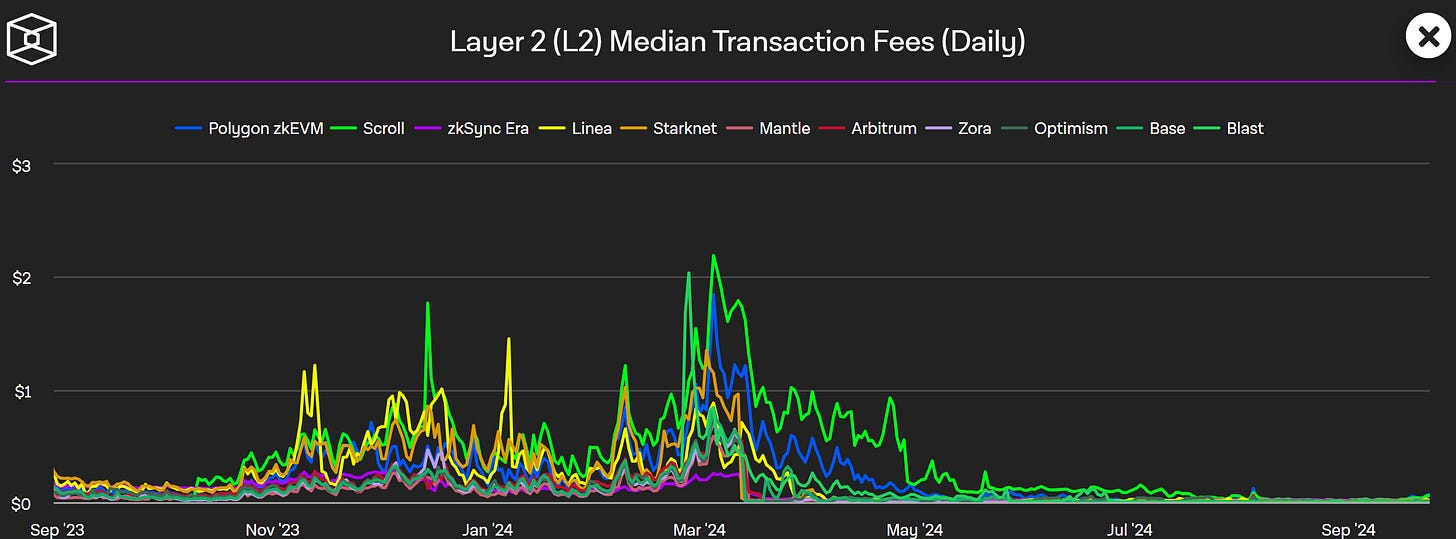

If new users are not going to the Ethereum chain, then there is absolutely no reason for ETH’s price to increase. That’s because demand for Ethereum block space is at an all-time low! Just check this chart on ETH fees. Lower highs since 2021!

The second major takeaway from this is where the midlife crisis starts.

The L2 networks that are “scaling” Ethereum with cheap fees are not paying their share to compensate for the users they took away from Ethereum. This is where things get serious. If nobody is really paying up, what will happen to Ethereum?

If this trend does not change, at some point in the future, Ethereum will literally become deserted in terms of users and be left as an infrastructure network supporting the above layers. In other words, L2s are growing at the expense of Ethereum! I don’t think Vitalik had this in mind originally.

That also kills the bullish case for its price long term and may even compromise its security and the security of its L2s! You need actual users to hold and stake Ethereum to secure its network and the layers above. If demand for ETH falls off a cliff, all that is in danger because the network become vulnerable.

But it gets worse.

L2s are so good and cheap now, that decentralize finance is shifting to these networks. In early 2024, an upgrade to Ethereum allowed L2 fees to be reduced by a factor of 10x (see chart). No wonder that millions of users and billions of dollars are no longer using Ethereum. Why would they?

This begs the question if it was wise for Ethereum to scale in this way and push users away from its network? Perhaps it was better to scale its native network rather than off-board users to a different chain, even if an L2.

The obvious example here is… Solana. It has no L2s and all activity happens on its chain. Solana has been quite a success with users, despite its shortcomings. The quick criticism is that Solana is a centralized database while Ethereum is actually trying to balance speed, fees, and decentralization. Not an easy task.

Perhaps fixing fees on Ethereum was the more elegant solution than encouraging users to change networks. Either way, we’re at a crucial point right now and Ethereum developers better wake up soon because this has consequences. Let’s mention a few:

Decentralize Finance 2.0 is here and is experiencing a renaissance

AAVE is the leading protocol in decentralized finance with $20 billion in total value locked. With 13 networks and counting, more and more money and users are ignoring Ethereum. If nothing changes, DeFi 2.0 will see users forget Ethereum exists. This has big consequences for ETH’s future and price.

On the other hand, AAVE is making new highs and I mentioned it to our Patrons when it was $80. It more than doubled since!

L1 return in focus

If you are a developer on Solana, the last thing you want is to scale using L2s. You don’t want to end up like Ethereum and lose your users. In this way, many projects and developers are waking up to the realization that they have to focus on L1 networks instead. Other examples of L1s include Sui, Ton, Cardano, or Near which are just as cheap as any ETH L2.

That means money will flow to L1s which could see such networks and associated ecosystems thrive in the future.

Ethereum changes course and returns the focus on its L1

The writing is on the wall for Ethereum. Scaling via L2s is no longer sustainable if it wants to stay relevant. Therefore, I expect some changes in their developer roadmap to account for this. Their next move is hard to predict, but it can make or break Ethereum in the future.

It must be said that their focus on L2 scaling was to a large extend a major success looking at the results, but it left Ethereum in the background. Their next move may bring it back into focus. There are too many interests at stake to not do it.

Not all is bad for Ethereum

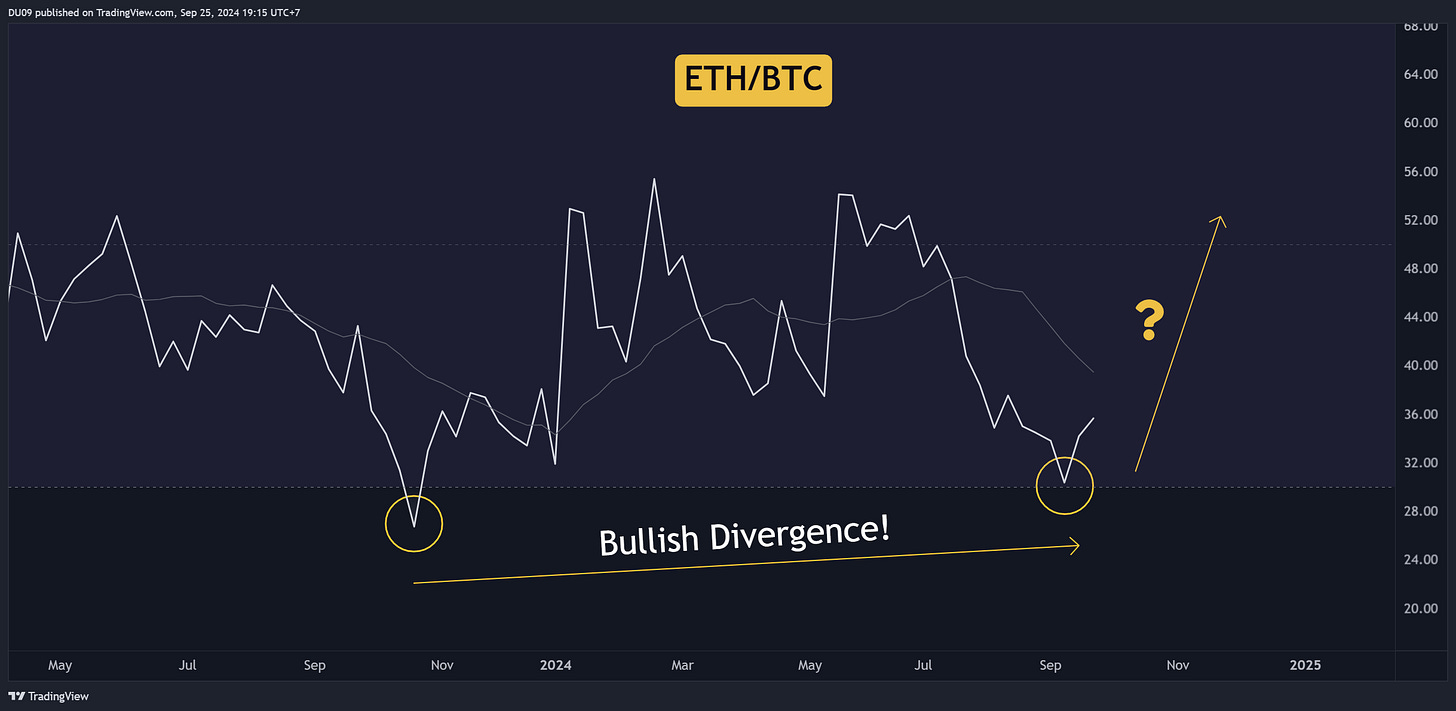

Since a lot of money passed around Ethereum and went directly into its L2s, the price suffered. However, there are signs that ETH may have bottomed in this cycle against Bitcoin.

As I mentioned in my last Alpha Post, the ETH/BTC chart shows a massive RSI bullish divergence on the weekly timeframe (see below). This has not happened in years! If it holds true, the best may still be ahead for Ethereum, particularly if Vitalik wakes up to change direction and return focus on ETH.

TLDR & Tips to Remember

Ethereum has an existential crisis due to falling demand for its block space

Users look elsewhere to put their money now and ETH’s price shows it

Ethereum is a victim of its own success after scaling via L2s

L2s don’t compensate for the value they siphon out from Ethereum

If nothing changes, the DeFi renaissance may totally ignore Ethereum

L1s like Solana will thrive as long as Ethereum fails to attract users

Ethereum needs to refocus on its L1 or suffer the consequences

The price action shows ETH may return into focus later in this cycle

This newsletter is made possible with the generous support of our community Patrons and partners. Upgrade your experience to show your support by clicking the above button or reach out to us on X or Discord to partner.

All info is provided for educational purposes only and is not financial advice.