Fed Decision Today is About to Break the Market

Which one will it be? 0.25% or 0.50% cut?

This may be the first real opportunity in over six months for Bitcoin to leave its current range that has trapped its price since March 2024.

Whatever the Federal Reserve decides, today is important. Here is why.

The interest rate on the US dollar is managed by the Federal Reserve (or Fed) and is just another way to look at the cost of money.

It answers the question of how much does it cost you to borrow $1 million dollars and buy Bitcoin with it. Right now, that’s around 5.5% in interest per year if you have a bank account at the Fed.

The Fed is expected to cut the interest rate today for the first time in four years and this is hyping up the market. Everyone is happy that they can soon buy more Bitcoin at a lower cost. But there is a catch.

If they cut too fast, inflation will return. If they cut slowly, recession starts. You see, no matter what the Fed does, the consequences are pretty big.

But Bitcoin will benefit.

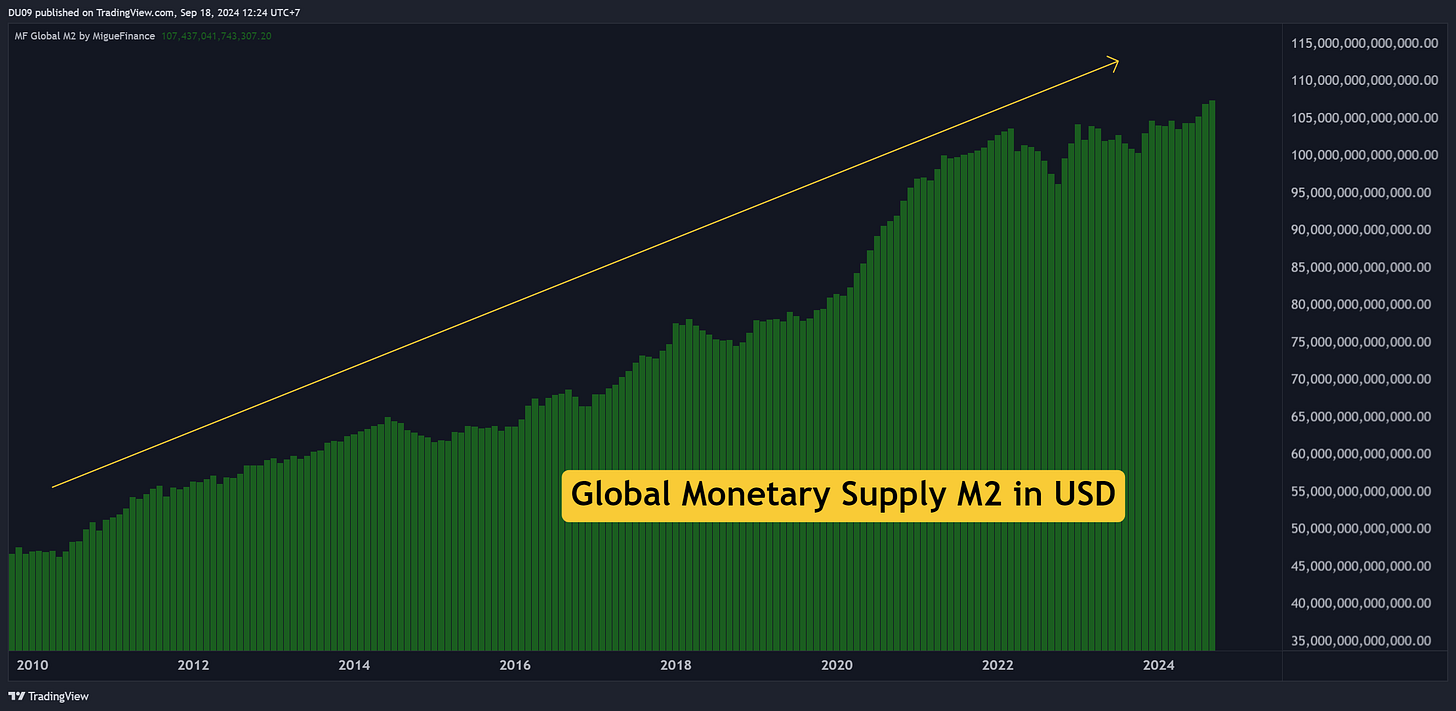

If we remove the price volatility to the side, there is only one chart you should look at. That’s the Global Monetary Supply of the richest and most populous countries, denominated in USD. That includes USA. What do you see?

The chart is making higher highs and it just broke a new record at over $107 trillion dollars. That’s basically new money being printed by central banks that are flooding markets. Some of that will reach Bitcoin.

The US Fed has been quite slow this year and it will only start cutting rates today. Other central banks already did it, like the European Central Bank that already cut rates twice this year. Historically, that was pretty bullish for crypto.

With USA joining the train in making fiat money cheaper, I do not believe it will take long until Bitcoin breaks its current range to make new historic highs. The upcoming rally will likely start soon and top sometimes in 2025.

The below chart looks at Bitcoin’s price vs the Global Monetary Supply. As you can see, the two mirror each other quite closely over the years. However, in 2024, we have a strange divergence. BTC’s price is falling while the money supply is breaking new records.

I don’t expect this divergence to last and eventually Bitcoin will catch-up fast. The Fed cutting rates may be the trigger for that. We will know by the end of 2024 if this holds true. Enjoy the ride!

This newsletter is made possible with the generous support of our community Patrons and partners. Upgrade your experience to show your support by clicking the subscribe button or reach out to us on X or Discord to partner.

All info is provided for educational purposes only and is not financial advice.