Fed Interest Rate Decision Arrives Today!

We're hours away from massive market volatility.

Bitcoin at all-time highs, gold at all-time highs, stocks at all-time highs, real estate at all-time highs, food prices at all-time highs. What is not at an all-time high?

The US Dollar.

An interest rate cut, which is almost certain, would weaken the dollar further and push the above assets to new historic highs.

Let’s analyze that next.

Become a Patron for lifetime access to our exclusive private alpha!

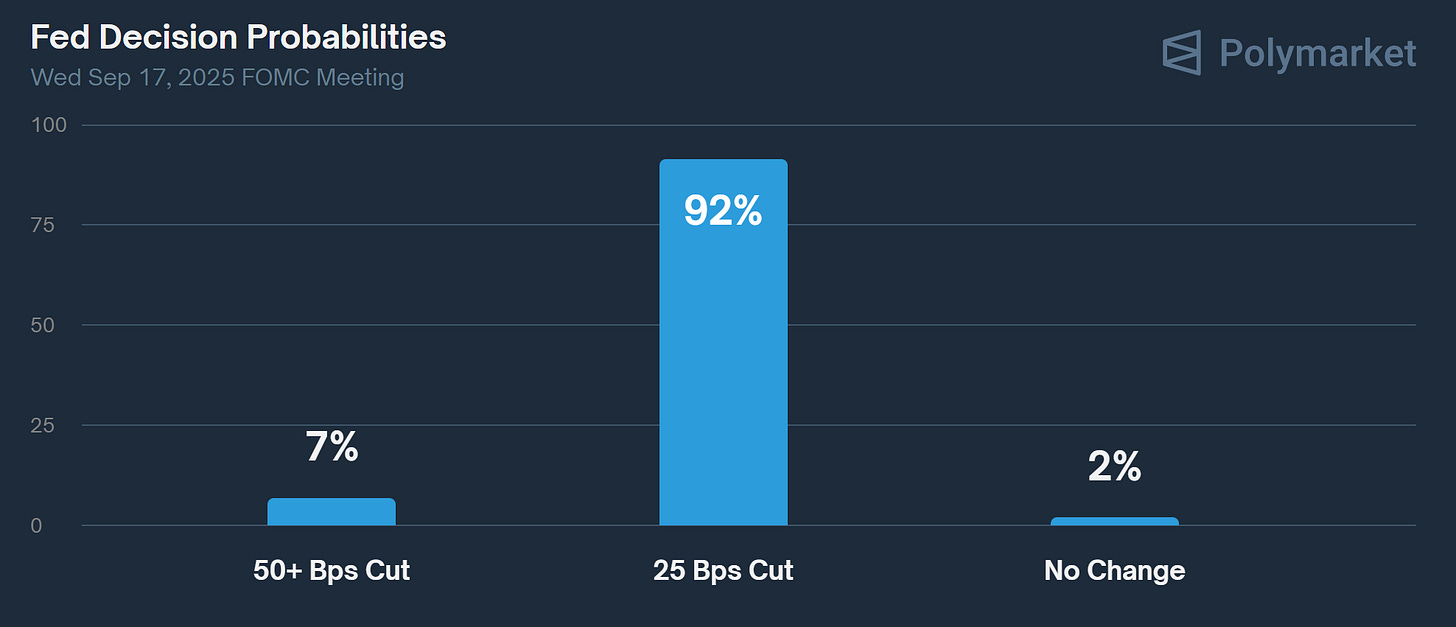

According to Polymarket, the Fed will most like cut the ongoing interest rate by 0.25% today. There is a small chance the cut could be 0.50%, but that’s unlikely. Looking at the market we can see a lot of this was already priced in.

Nevertheless, a cut in September opens the way for further cuts in October and December, both with a chance above 65% according to Polymarket.

What does this mean for you?

If you hold Bitcoin, gold, or really any assets, expect their prices to go up. At least in USD terms. This is a deliberate US policy to weaken the dollar and boost exports and domestic production.

This weakening can be visible on the DXY chart. Year-to-date, the USD has lost 12% of its purchasing power. That’s a lot of devaluation within a year.

Worse, the chart shows a massive breakdown from a historic uptrend that started back in 2008. This is no small feat and will likely have repercussions for years to come. If you hold a lot of USD, consider diversifying your exposure.

Once the rate cut is confirmed today, we can expect two more this year. That’s why the period October to December is likely to be an extremely bullish one for crypto.

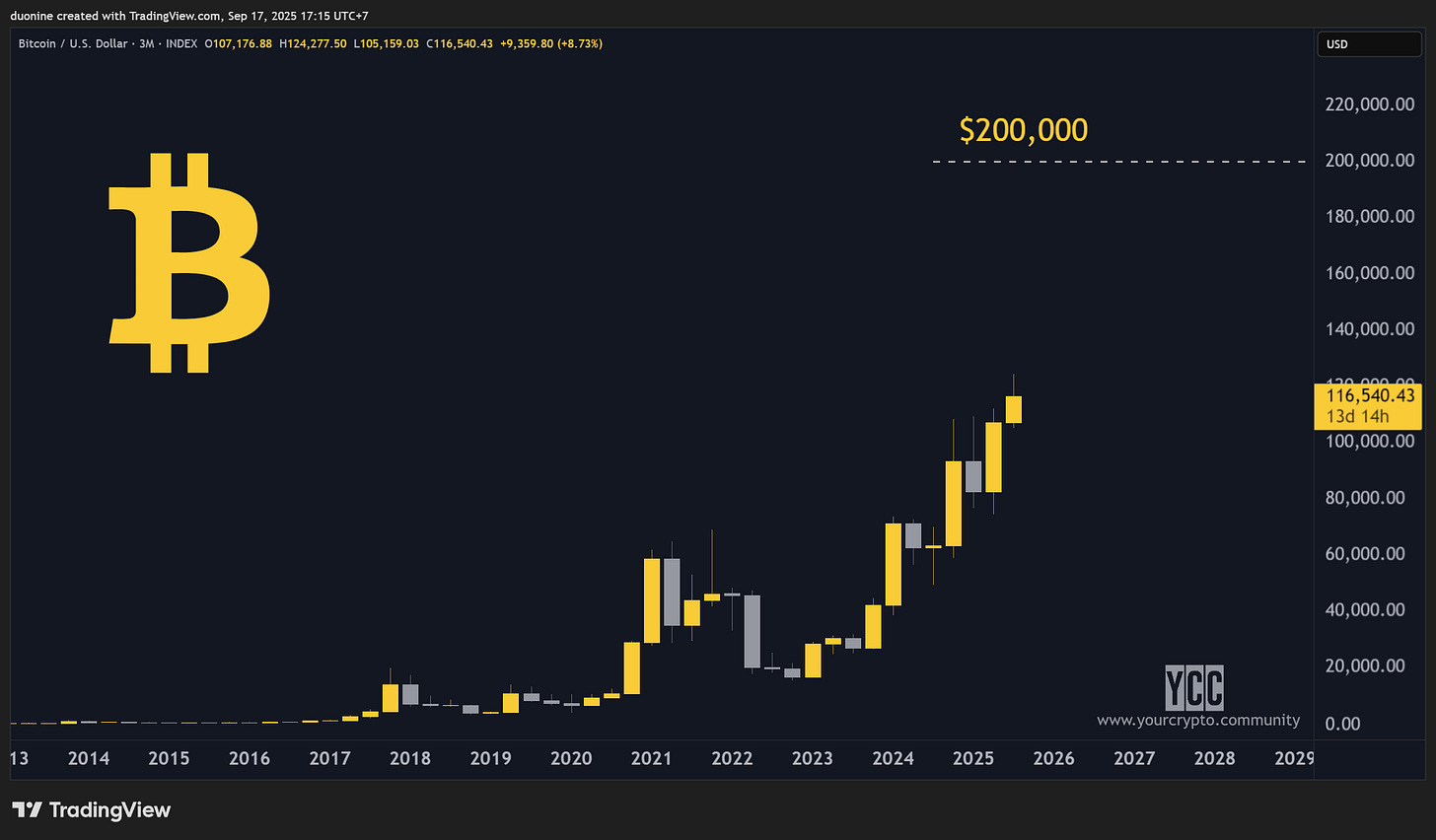

I expect Bitcoin, which has underperformed so far this year, to rally hard towards the end of the year as Christmas holidays approach. A weakening dollar will just amplify that further.

A mere 70% pump from today would get BTC to $200,000. Ethereum pumped 80% in two months between July and August 2025. Seems doable if FOMO returns.

However, measuring assets in USD is misleading since you’re measuring them against a falling denominator. A better way is to measure them against gold. This is where the picture becomes a bit different, especially with Bitcoin.

The reason Bitcoin has to pump is because of this chart which shows it priced in gold. As you can see, Bitcoin has been underperforming gold since the end of 2024 and made a lower high in 2025. Year-to-date, gold is up 42% while BTC 22%.

The price is also brushing against this trendline which has to hold. If not, Bitcoin will not only continue to underperform gold, but could signal that a crypto bear market is approaching. Keep a very close eye on this.

The key takeaway is to expect increased volatility towards the end of the year. That can be expressed in higher prices, but also increased market risks.

Take good profits in the coming months if things get euphoric and secure them with gold so you are prepared during the next bear market. At that point, swapping gold for BTC and key altcoins is a winning strategy to multiply your profits later.

You can easily do that by buying gold tokens such as PAXG (by Paxos) and XAUT (by Tether). Use swap aggregators on the Ethereum network for that since it has the best liquidity for such tokens.

If you’re looking for specific altcoins to speculate on, you can read the list from my last alpha post. With a bit of luck, you have a good chance to double your money before the end of 2025. Then aim to reduce your risk in the market.

What is your strategy for the end of 2025? Reply in the comments and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

Great read

https://substack.com/@synapsetech8?r=2q4a7s&utm_medium=ios&utm_source=profile

let me know what you think and don’t forget to like comment and subscribe

Sell the news event, be ready