Gold did the impossible. Is Bitcoin next?

There is a new narrative in town.

Hard money is going up exponentially.

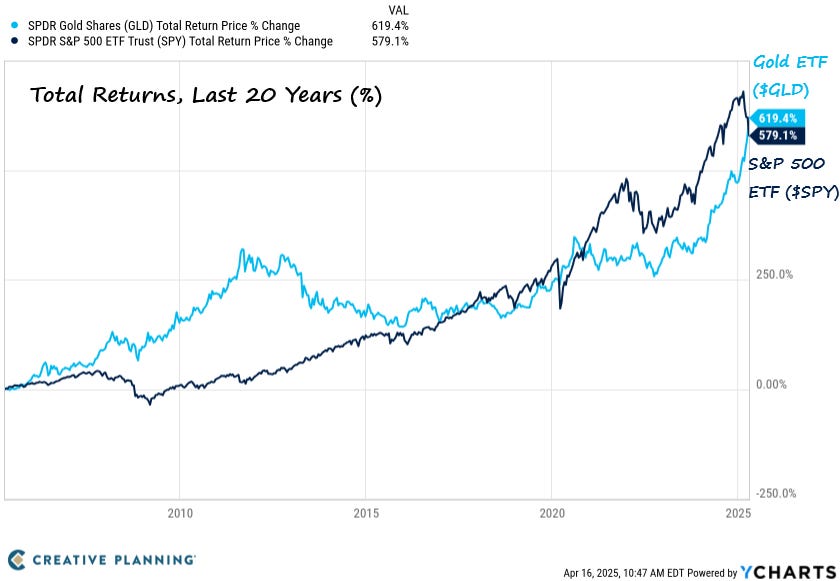

Gold just outperformed the S&P 500 in the last 20 years!

Yep, a piece of shinny metal just outperformed the top 500 companies in the US. How is that even possible and what does this tell us about Bitcoin? Time to find out.

Become a Patron for lifetime access to our exclusive private alpha on Discord!

There are only two assets that qualify as hard money: Gold and Bitcoin.

No matter how you look at it, over time, hard money always wins. Let’s start with Gold. It’s going up exponentially, breaking $3,300 an ounce most recently. This is sending a major signal to the market.

Moreover, the Gold ETF was launched in 2004. If you bought Gold back then, 20 years later, you’d outperform the S&P 500 today. Just look at the chart. The lines are inverting! Gold sits at 619% and the S&P 500 at 579% over a 20 year period.

The last time Gold outperformed the stock market, that lasted for more than a decade and we appear to enter such a new decade right now.

Another way to look at this is to use the S&P500/Gold ratio. Gold outperformed between 2000 and 2013, then underperformed until around 2021. Since 2022, holding Gold was better, and in early 2025, the S&P 500 suffered a major breakdown against Gold. See the yellow circle on the chart.

The momentum clearly favors Gold today and it can continue to outperform the S&P 500 for years to come based on this price action. The previous bottom at 0.60 implies that Gold can still double from today’s value towards $6,000 an ounce before this major trend, that started in 2022, may reverse.

Alternatively, for Gold to continue to outperform, it does not need to pump in USD terms necessarily as long as the S&P 500 price continues to fall. This opens up a new subject that takes us to Bitcoin.

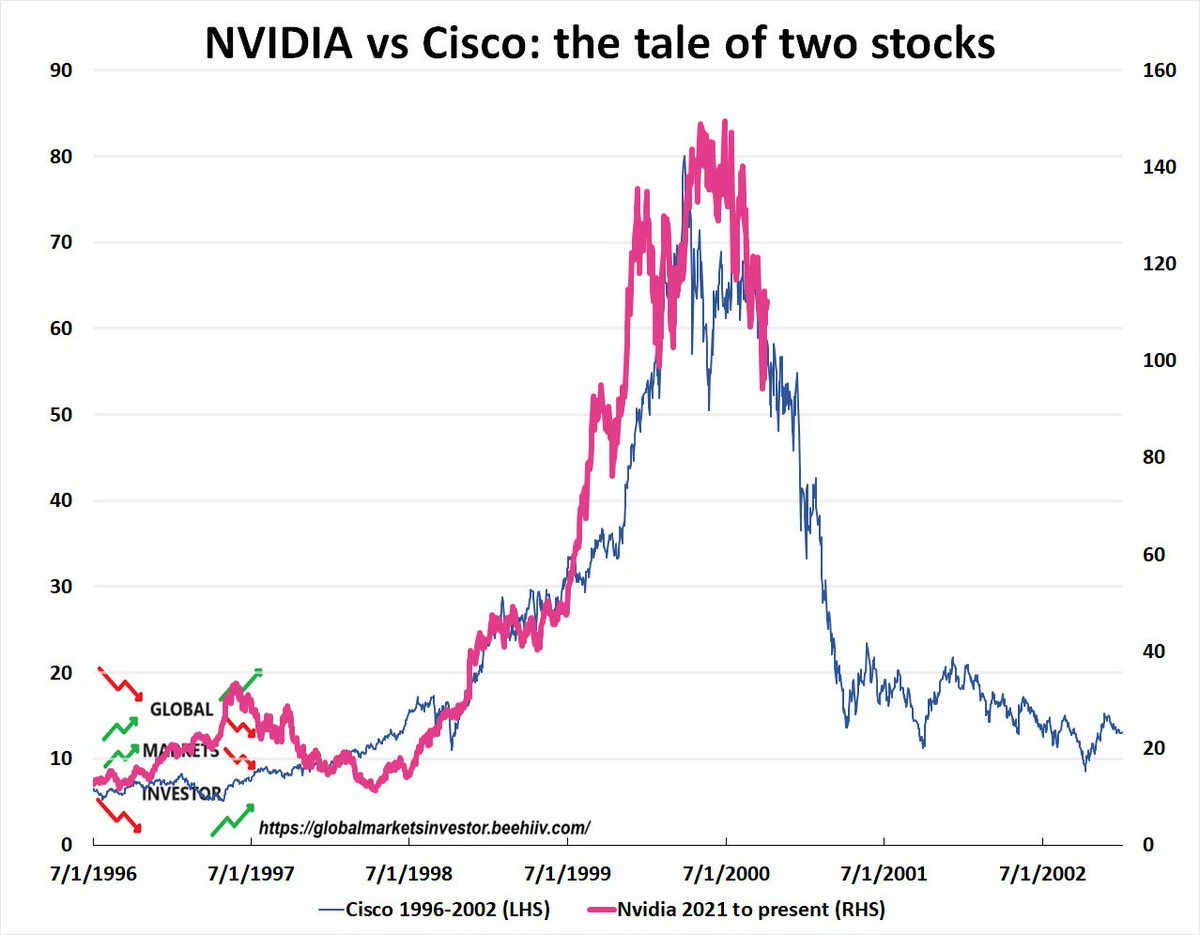

Bitcoin never experienced a financial crisis since it did not exist back in 2008. This is the first time in its history when it can act as a safe heaven to a declining stock market and inflationary economy where central banks print more and more money out of thin air to combat an incoming recession.

In this context, I don’t think it will take long for the market to recognize that Bitcoin is just like Gold, if not better. Plus, Bitcoin had its ETFs launched in early 2024. The stage is set. All pieces are on the table.

If Gold serves as an example, then the decade after Bitcoin got its ETF may see one of the biggest rally in its history. The resilience of BTC’s price to stay flat around 80k in the past few weeks while the S&P 500 crashed 20% is already a great sign!

You won’t get any better FOMO than a stock market that’s crashing while Bitcoin is breaking into all-time highs. Gold is already doing it. Why can’t Bitcoin?

I believe it is only a matter of time. Get ready for Bitcoin to follow.

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

Nice write up Duo, thanks.

However, if it happens and continues, I don't think this downtrend will last a decade.

Over the years those big companies have learned to be more flexible and to adapt faster than before.

Now the companies are suffering because of Trump's daily moods, once it calms down they'll take action to optimize the situation and go forward again.

Gold has already stood the test of time as we know, in this day and age you can't go wrong with BTC and stocks ... they're stocks.

I must take the moment to point out an incongruence in your post. BTC. Is an electronic fiat currency- it is not butt definition Money. Money is and can only be Gold or Silver- I’ve made this point before. BTC. Is not money- BTC. Is an excellent way to spend or even save( those that bought at $110k would disagree w you) BTC is not money nor will it ever be. As long as the internet remains free BTC. Will continue to be a valuable resource. No internet? No BTC thanks for your article just a definition issue on my end.👀