How Ethena and Fluid will CRASH the Crypto Market

I will only post this once.

Ethena and Fluid will crash the crypto market hard once bears return.

This is certain and I explain how it will happen below.

The same mechanism that is pumping Ethena's USDe market cap right now will be the one that will crash it later.

Where did we see this before?

Become a Patron for lifetime access to our exclusive private alpha!

Since the last alpha post PUMP is up 30% and RAT Escape 25%!

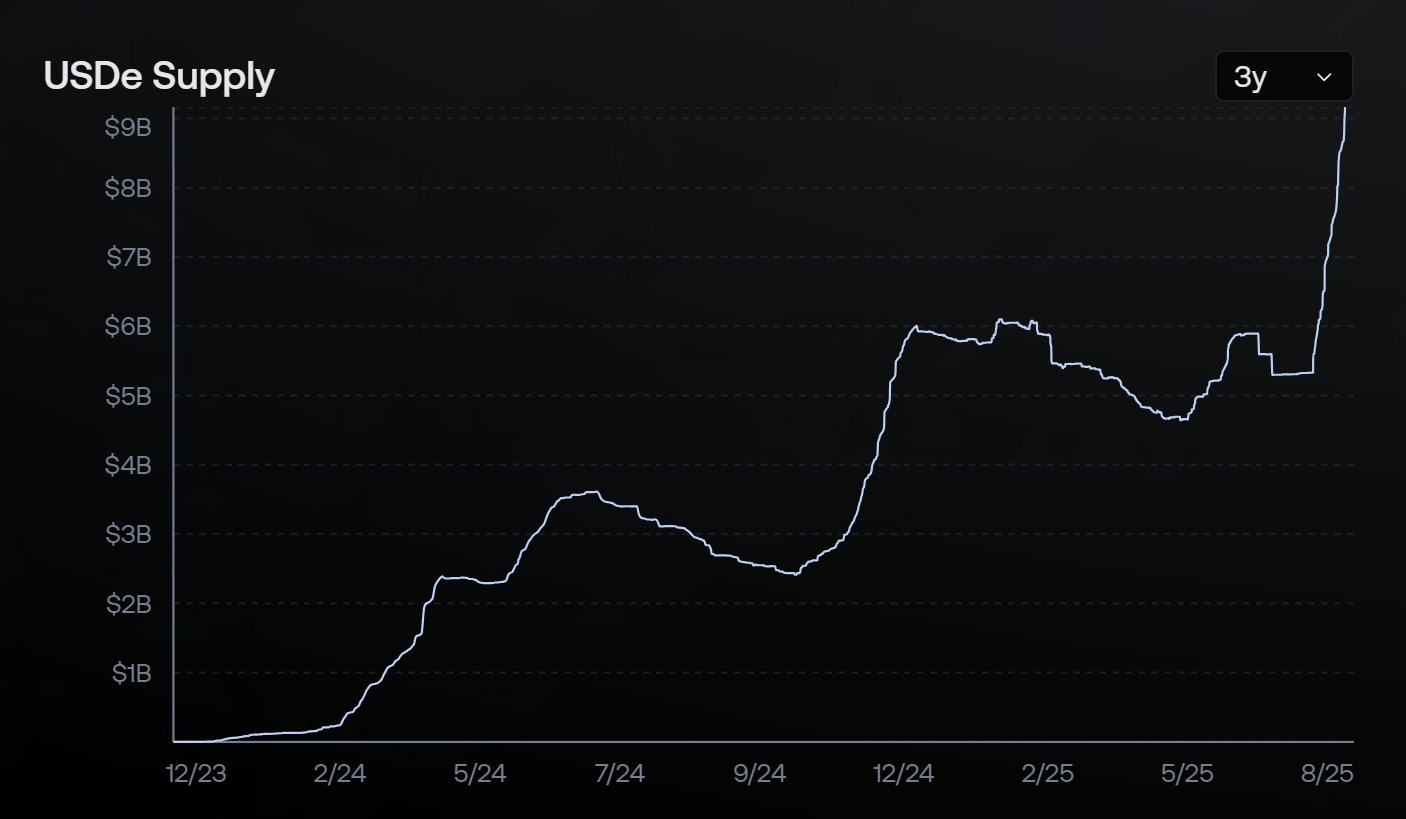

Ethena’s USDe mcap is closing on $10 bil as I write this, the third largest stablecoin today. This should not excite you, but worry you. The reason is that most of this growth is not on solid ground, but mostly based on hot air.

TLDR: Leverage looping is driving this bubble!

The Bubble

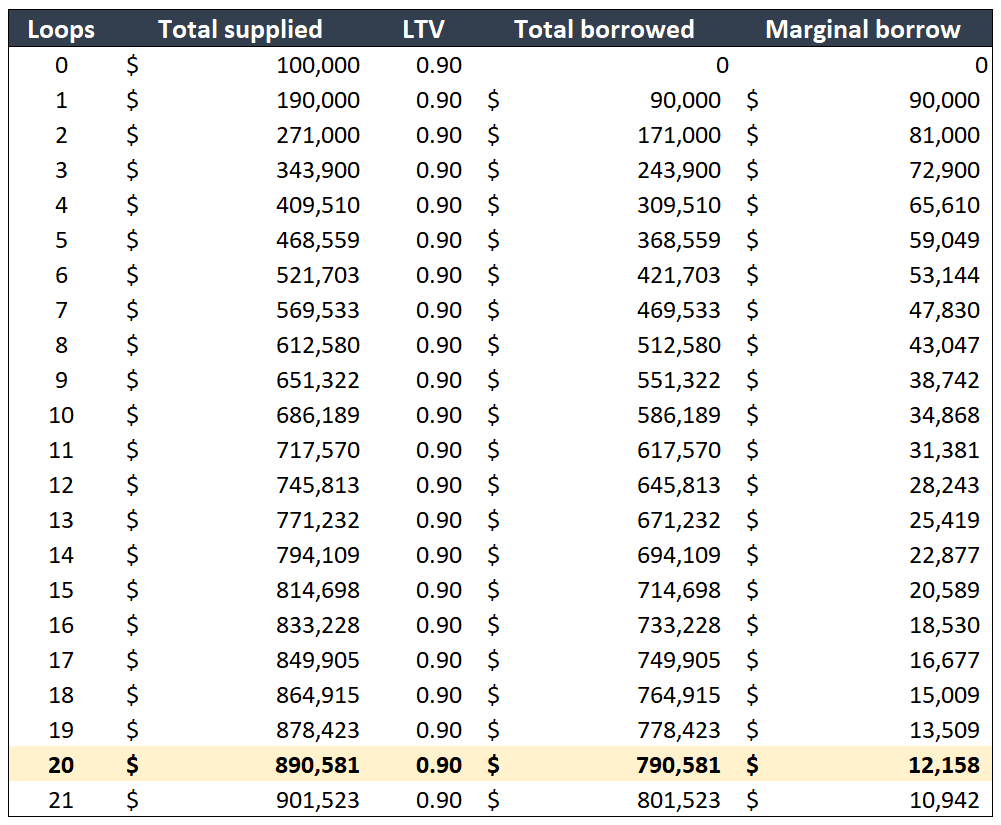

Here's how you can create $1.7M with $100k. Luckily you can do this in one click on Fluid by using their "leverage" strategy. This is how they overstate their TVL.

You take $100k, swap if for USDe and deposit it as collateral in one of Fluid's stablecoin pools like USDT-USDC. You then borrow $90k USDT and swap it for $90k USDe.

Deposit the $90k USDe as collateral and borrow $81k USDT. Swap for USDe and repeat this cycle 20x times. After 20x cycles your borrow power is $10k. Congratulations, you've just created magic Internet money.

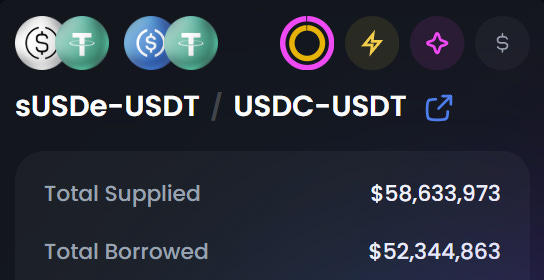

Thanks to Fluid and other protocols this is very easy to do today. If you check Fluid's stablecoin pools you'll notice almost all are nearly maxed.

For example, the USDe-USDT / USDC-USDT pool has a ratio of 89.2% between borrowed vs supplied. The max collateral factor is 90%. At 92% you get liquidated.

What happens if USDe depegs by 2% against USDT/C? More on that later.

Why people buy USDe?

Because it has the best yield!

Our $1.7M position generates $30k in yield a year on $100k initial capital today. That's 30% APY, after borrowing costs (8% APY on collateral - 5% APY on debt, see image).

If sUSDe basis trade yield increases even more, that APY can go to 50% or 100% on the same principal. Smart, right?

It's smart only if you leave before the music stops. As we know from the past, there is no free lunch. Someone has to pay for it and make sure you're out of the casino when that happens.

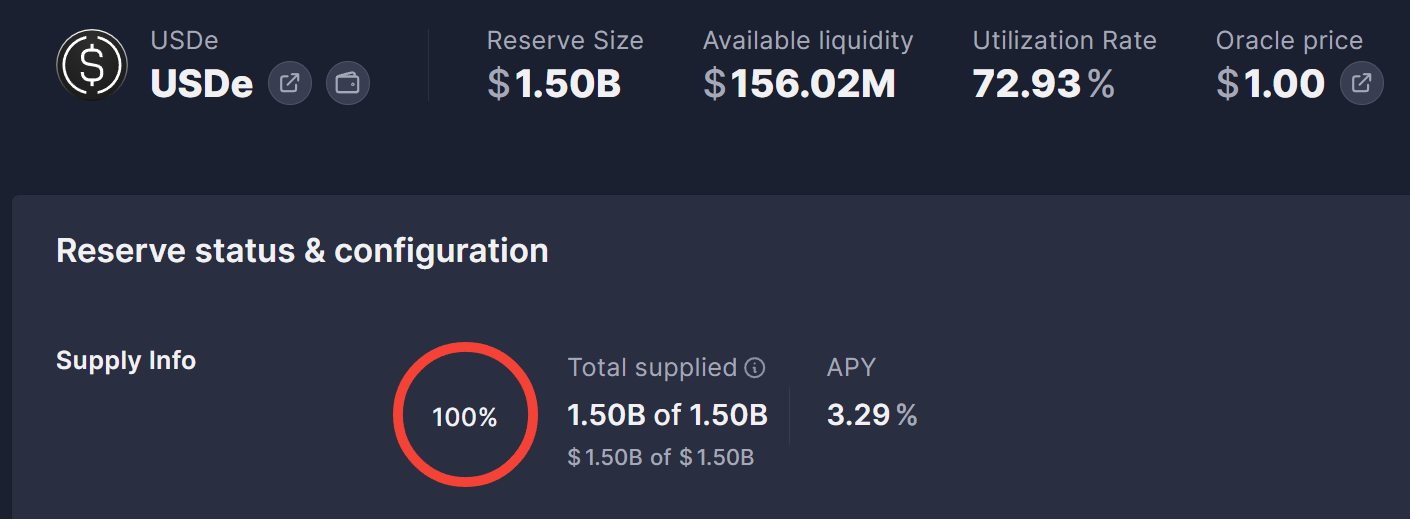

Otherwise, this will erase all your capital in one evening, especially if you reinvest that yield back into the loop. As I write this, AAVE's USDe supply of $1.5 billion is maxed on ETH network. People are maxing out this leverage play.

While the music still plays, the USDe bubble will break record after record. When its market cap increases by $1 billion per day or similar, make sure you exit in full. The top will be near and someone has to pay for that lunch.

Make sure it's not YOU!

The Crash

The crash is 100% guaranteed to happen at this point. Why do I say this?

Because the bigger the USDe market cap gets, the higher the pressure to unwind this bubble when the music stops.

Essentially, the USDe peg will crash harder and faster the higher the USDe market cap grows when bears return. This means a 2% depeg will be easy to achieve which will trigger massive liquidations on Fluid, making things worse.

⚠️ The USDe peg falling is the relief valve for this massive bubble!

At that moment, everyone on Fluid and other protocols doing any form of leverage looping will get hit by liquidations. Suddenly, hundreds of millions in USDe are sold on the open market.

The USDe peg can fall by 5% or even more as liquidation cascades start. Many are wiped out. This can lead to contagion and will impact whole DeFi ecosystems. It can get really bad, really fast.

Moreover, the trigger for this crash can also be lack of demand in the market that can push the USDe basis trade APY lower and lower (or even negative) until leverage looping becomes unprofitable i.e. borrowing costs are higher than the yield.

This will hit Fluid leverage loopers first with liquidation notices and then the USDe peg will be hit if cascade liquidations are started. Nobody can predict when it will happen, but it will definitely come at this rate.

The survivors will be those that do not have a liquidation point or a very low one. USDe will likely recover its peg once the leverage is flushed.

The scenario that can mitigate this is a slow and gradual unwinding of the USDe bubble, but present conditions make that unlikely since the market can be quite violent in its reversals, especially with a > $10 billion bubble.

This Happens in Every Cycle

This time is NOT different. It's the exact same script I've seen cycle after cycle. Ethena, Fluid, and many other protocols are all actively building the conditions for this crash.

Nobody talks about this because it's not sexy.

Ethena loves it because USDe mcap goes up and their revenue explodes. Fluid loves it because their TVL explodes and revenue grows. Note that they are not the ones to pay the bill for that lunch. They are the restaurant.

This is why we have cycles in crypto in the first place!

Bear markets are the moments in the cycle when leverage is flushed. Bull markets are when the bubble grows on leverage.

Nothing new under the sun.

A Personal Note

I farmed Ethena from the beginning and what they achieved to date is impressive. But I do not hold any USDe nor do I plan to at this point. The risks are too high.

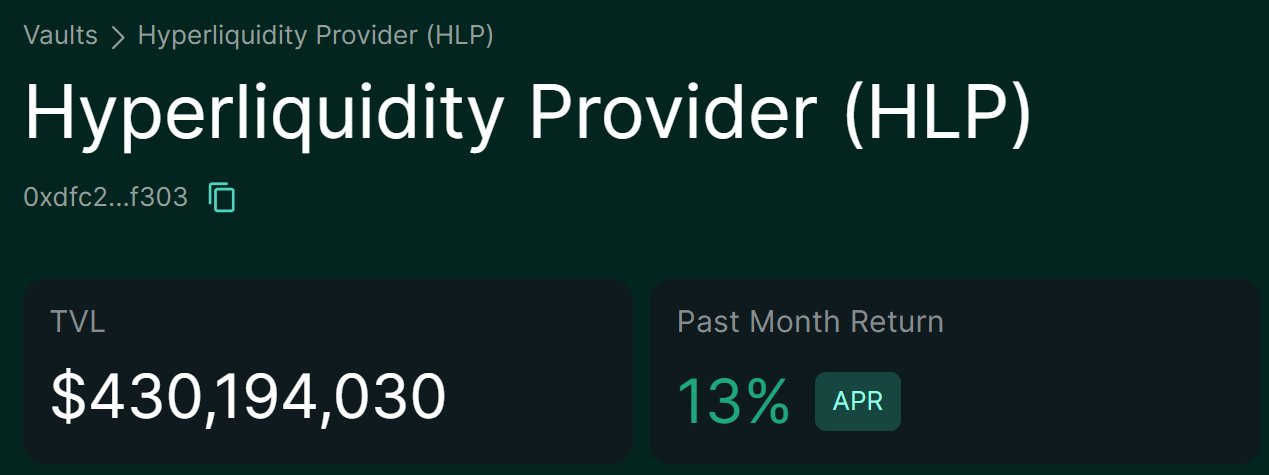

There are better protocols out there generating similar or better APY with lower risks. Resolv USR/RLP is an example of that or Hyperliquid's HLP vault. You can't leverage loop on HLP and that's a good thing.

As for Fluid, they also innovated. They allow users to generate more yield on their stablecoins and made leverage loops so easy anyone can do it. To their credit, their growth shows it.

However, both these protocols and those building on top of Ethena or Fluid are growing a massive bubble. I am warning people because I've seen this too many times.

I have nothing against these protocols per se, they are just the biggest actors in this bubble right now and more are joining them.

I'll end by saying that Bitcoin is the liquidity of last resort in crypto. That means when things go wrong, Bitcoin absorbs the shock and its price suffers to save people from the bubble they created. Eyes on Saylor and his MSTR bubble too.

Same stories with new actors in every cycle. Nothing changes.

Do you agree, do you disagree? Reply in the comments with your take on this and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

Ena will crash hard, but not before reaching its cycle high.

Its actually my favorite coin to trade given its huge volatility

Excellent analysis Duo! I know you don't have a 100% certain answer but how do you see this affecting other parts of the AAVE ecosystem? Say I run a "safe borrow loop" using ETH as collateral with a "safe" LTV of 40% and compounding/adding monthly? Do you estimate the market crashing forcefully or will it be relatively controlled?