How I'm Farming the Next 20x Airdrop!

There's money to be made in this guide.

The XPL airdrop provided users with an instant 20x on their money upon token launch. This next airdrop could be similar.

If you have idle USDC, this guide is for you!

Even if this airdrop will offer a lower return, this opportunity is basically free money on top of any yield you generate with USDC. Let’s begin!

Become a Patron for lifetime access to our exclusive private alpha!

USDai - The Basics

This first part serves as an introduction. For the airdrop guide, scroll down.

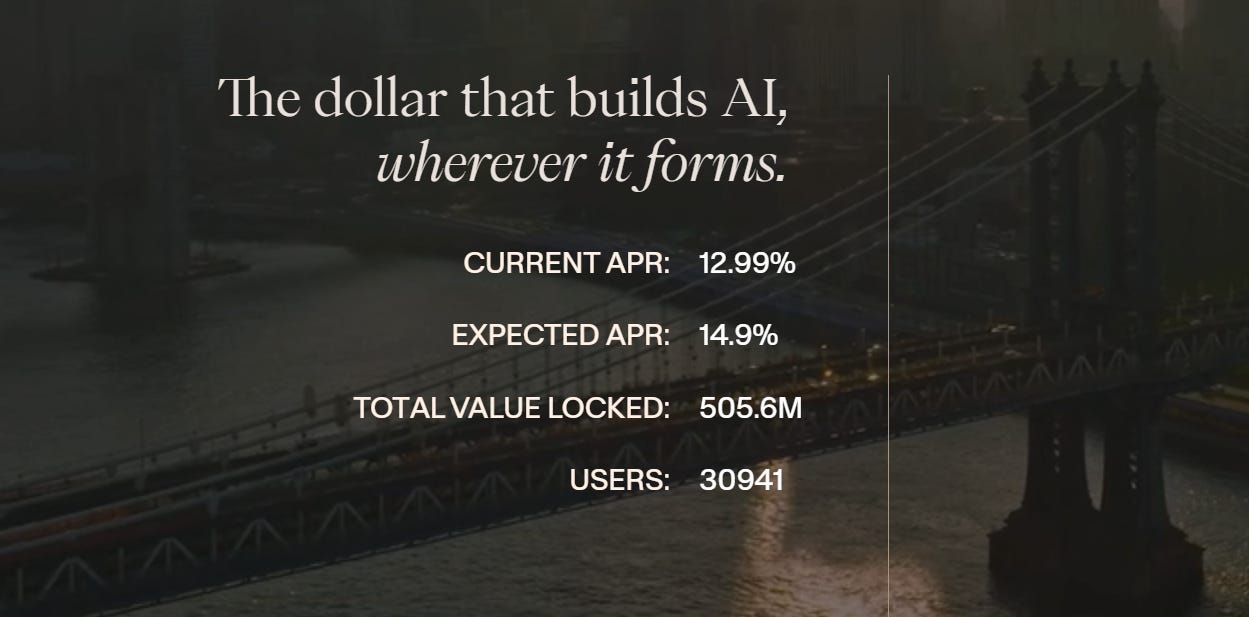

USD AI is quite novel in the space because it takes stablecoins like USDT or USDC and packages them into loans to AI companies that need to buy compute power. That hardware is the collateral for USDai and also generates a revenue.

We call this InfraFi = decentralized financing that enables hardware-backed infrastructure to access onchain liquidity without selling tokens or relying on centralized lenders.

AI companies have a major bottleneck in compute, so demand is huge.

These companies pay an interest for this privilege at around 15% APY. That interest is the yield you get on your money via stacked USDai tokens. Since companies keep their hardware to generate revenue, they can pay the yield or risk losing their equipment bought with the loan.

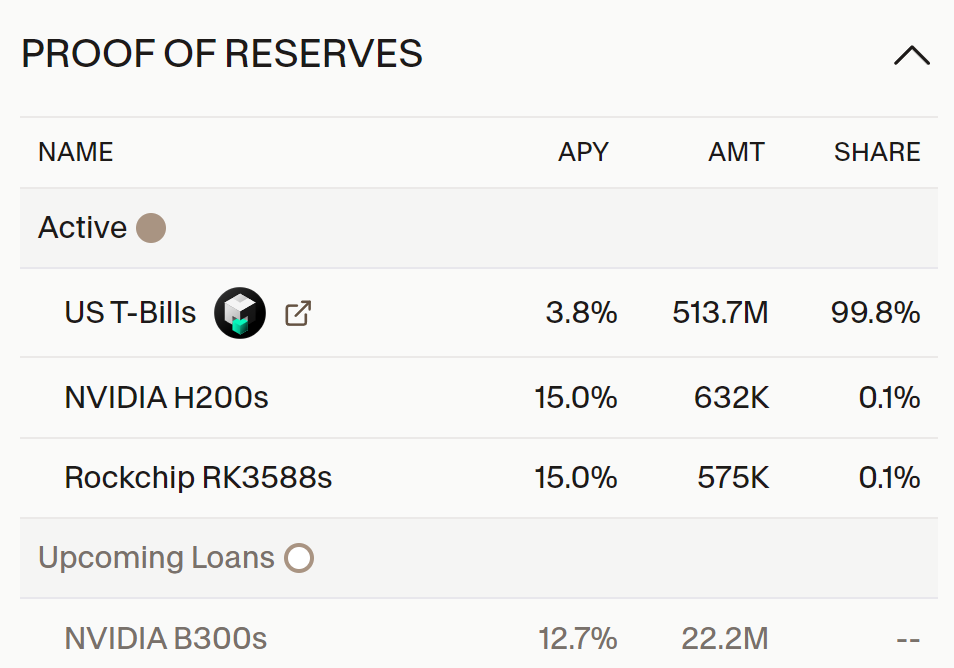

At this time, the majority of the deposits are kept in US Treasury Bills, which makes the USDai stablecoin similar to USDT or USDC. However, there are many loans in the pipeline at better rates than 4%. See below an example.

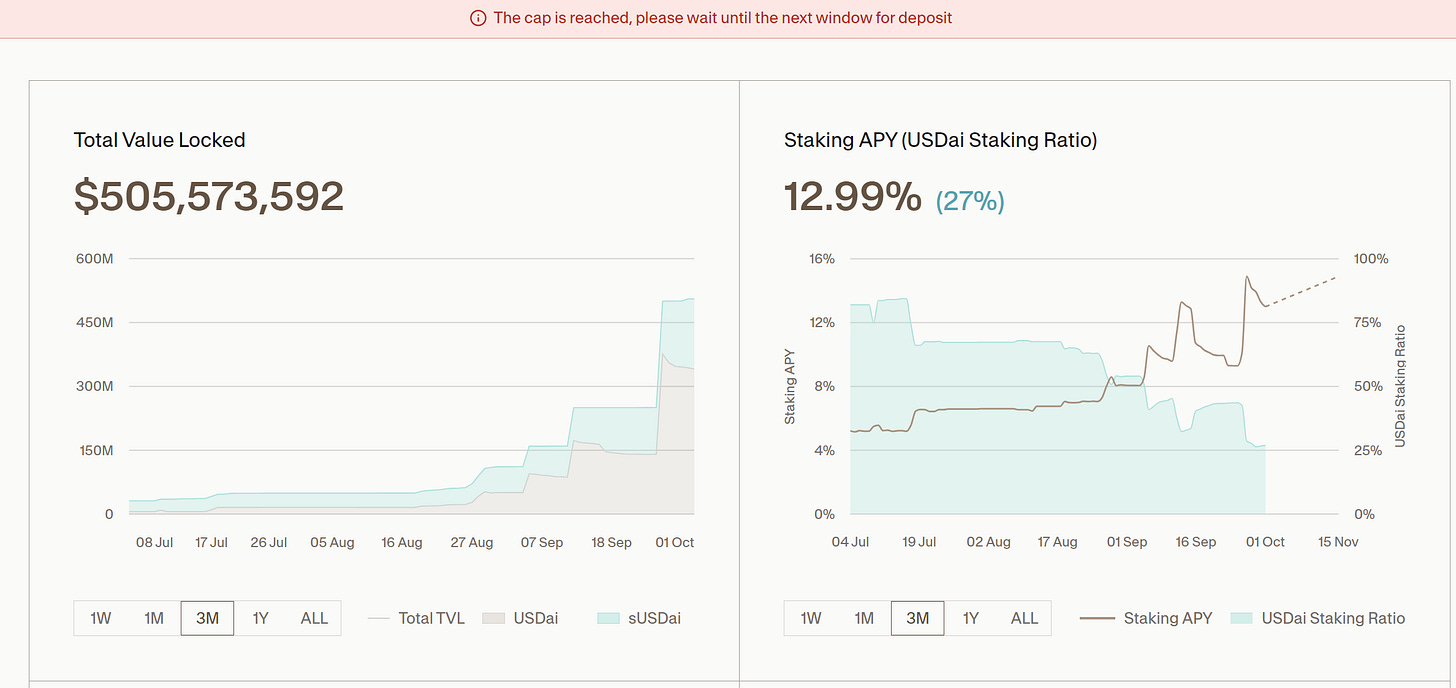

Demand for USD AI tokens such as USDai or sUSDai (its staked version) is so high, they’ve consistently hit their maximum capacity. The current cap is $500 million which is maxed.

Why is demand so high?

Because any deposits in USDT or USDC for sUSDai means you earn an APY of 13%. On top of this, depositors will accrue “allo” points that will qualify them to join the ICO (initial coin offering) or token airdrop.

The ICO or token airdrop will be on top of any yield you receive on your money. That means the actual APY can be 100% or 2,000% like for XPL which I also discussed in Alpha Post #77 (see section after the Bitcoin part).

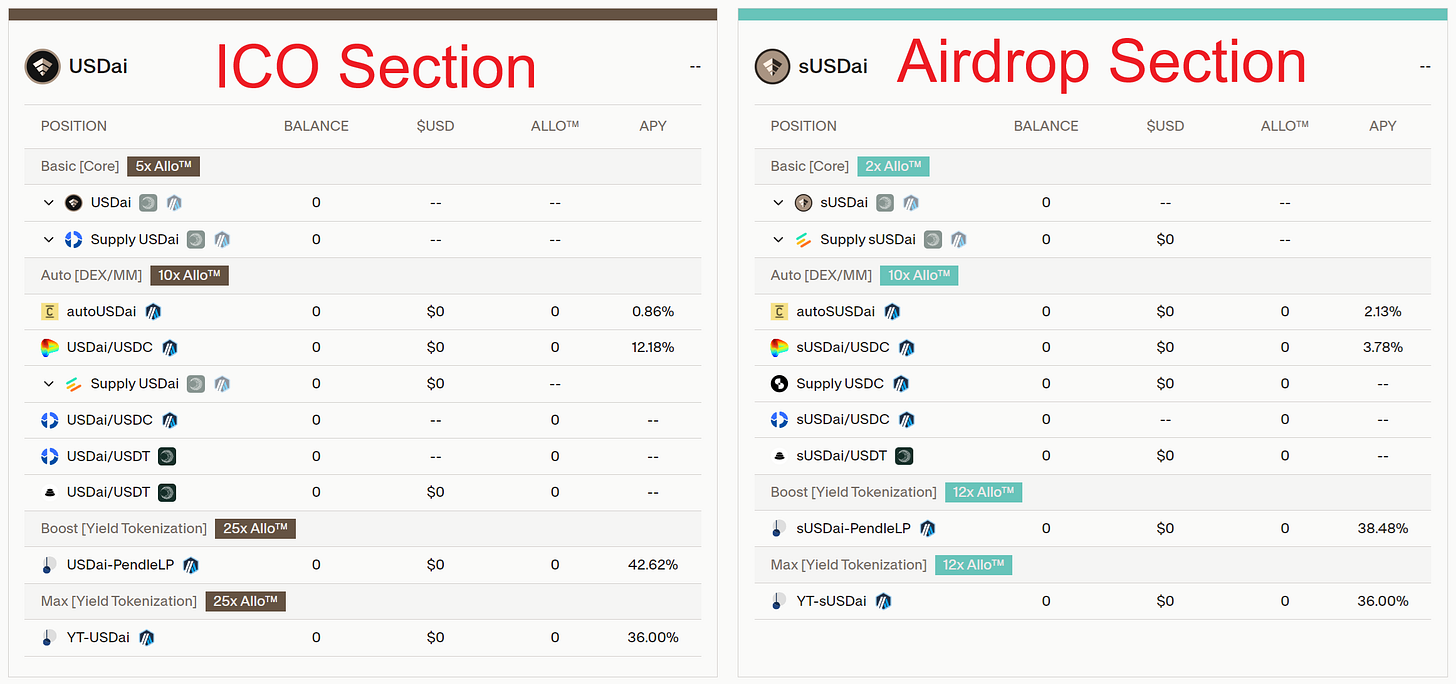

ICO details:

You need to KYC to qualify and buy the tokens at a discounted price

You need to hold USDai to generate allo points (no yield here)

You need to qualify for the ICO by having an allo above average

70% of tokens go to ICO participants

Airdrop details:

You don’t need KYC (you’re not buying anything, airdrop is free)

You need to hold sUSDai to generate allo points + yield

30% of tokens go to airdrop participants

For the purposes of this guide, we will focus on the airdrop part since that is free and does not require KYC. All you need to do is join one of the above DeFi activities in the right section. That means you want to hold sUSDai that generates a double digits yield, plus any future airdrop.

For Pendle opportunities, be careful, as there you essentially lose your USDC in exchange for points (you buy points over time). That works well if you expect the airdrop to outweigh any USDC losses. This looks attractive for ICO farmers too.

USDai - How to Farm the Airdrop

Since the cap of $500M is already reached, people may be wondering if they can still farm this or need to wait for the cap to be increased to buy USDai. You DO NOT have to wait if you get exposure via DeFi.

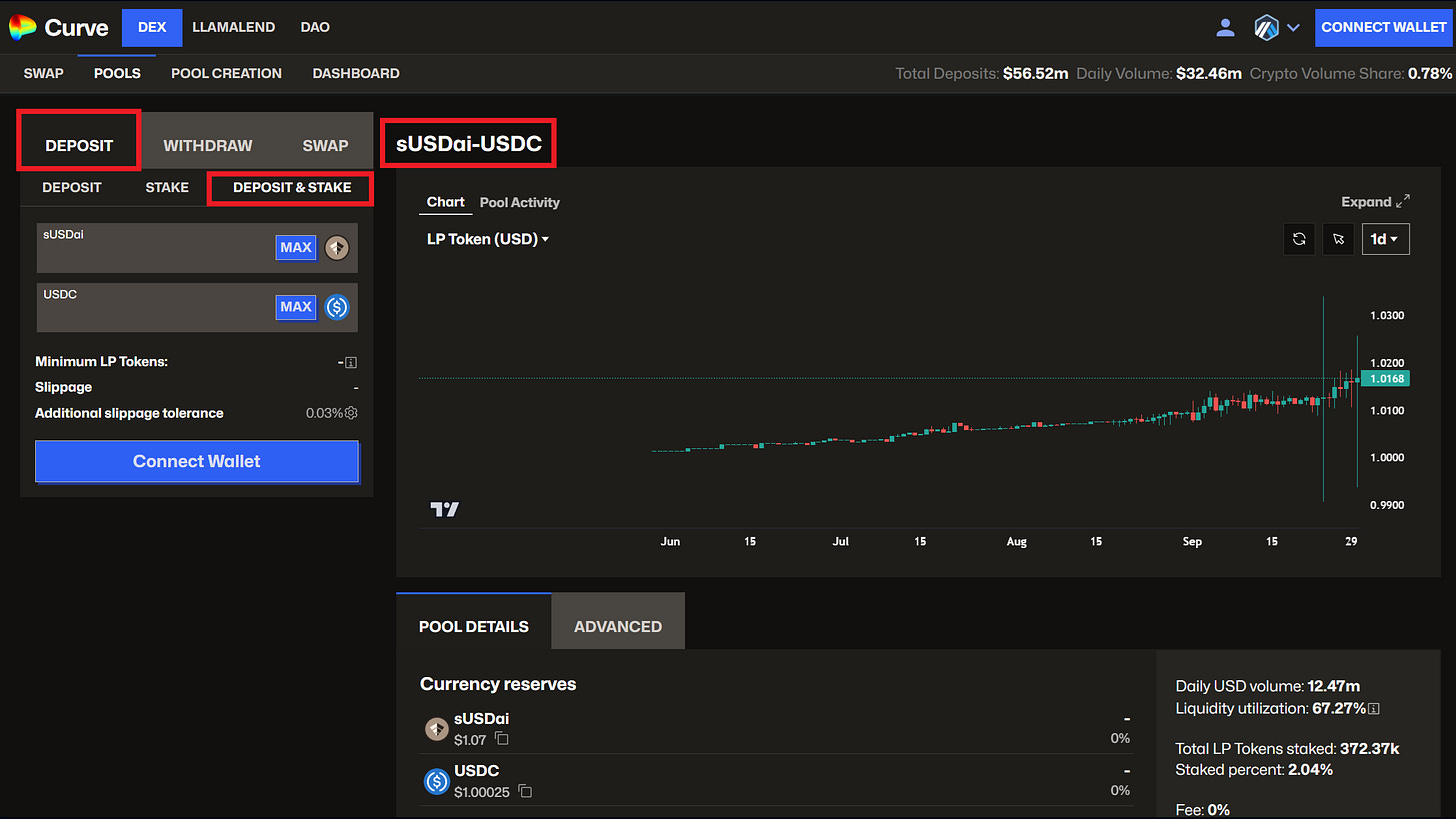

Every day counts because every day means more allo points. In this guide, I have chosen the Curve pool sUSDai/USDC with 10x allo. This will qualify you for the airdrop, protect your USDC, and also pay you a nice yield on top. This is the best risk/reward option and has the biggest liquidity = less slippage.

Here is what you need to do to start farming allo points:

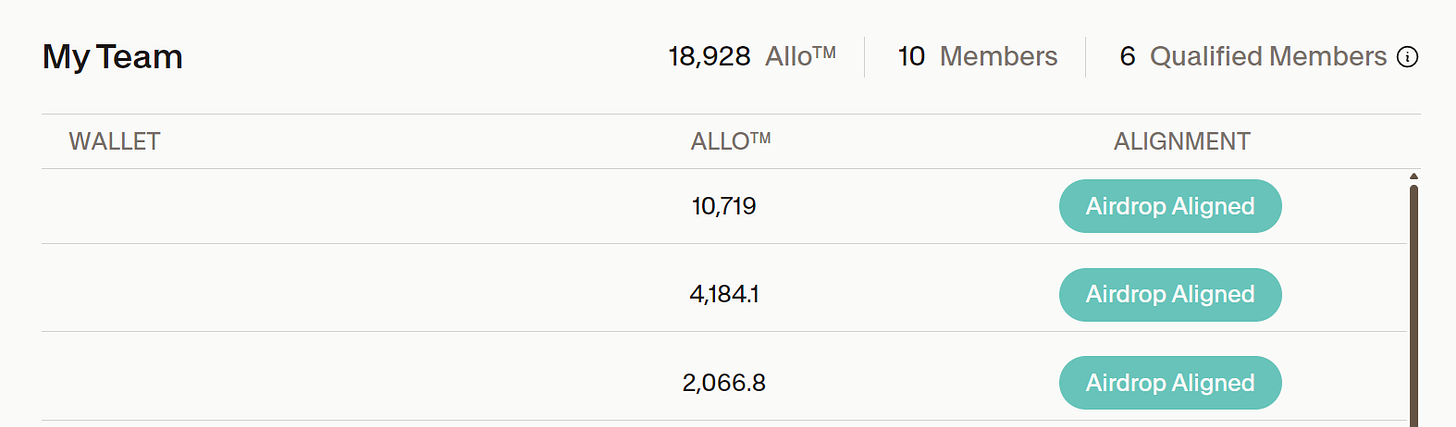

Have a wallet on Arbitrum network, then register/connect using this ref link (code: m6lot). This way we can all act as one team to qualify for the airdrop, not ICO. A team also has a chance to get a 3% bonus allo.

Have USDC on Arbitrum network and in the wallet used to register.

Go to Curve’s liquidity pool sUSDai/USDC select deposit, then deposit & stake. Connect wallet, approve tokens, then deposit USDC as in the image. You do not need sUSDai for this. However, there will be a small slippage due to this (0.03%). Once done, you will hold LP tokens (sUSDai+USDC).

Since both USDai and sUSDai are scarce and in high demand, always monitor slippage when you buy or sell them. As the cap increases, this will be less of a problem. While USDai is a stablecoin, sUSDai will slowly increase above $1 as the yield is added to it over time.

Enjoy farming the APY and wait for the airdrop = Easy Win!

You can look at the full list of farming opportunities at this link. If you don’t understand something, just ask in our Discord.

Caveats and Risks

Our Curve strategy is balanced and the best of both worlds. Protects capital while earning a similar APY like holding USDC in AAVE and qualifies you for the airdrop

We do not have information about tokenomics

We do not know when the airdrop will happen, probably late 2025

If the allo points farming lasts a long period, that means people will be diluted as more farmers join. This can turn unprofitable if you only buy points via Pendle.

Smart contract risks exists as this is a new protocol

This is an excellent opportunity for passive farming with your stablecoins. USDai is unique in their use case and acts as a bridge with traditional markets where demand for such AI loans is increasing.

That’s a win for everyone involved. I will update this once we get more information about the airdrop timing and details. Enjoy farming and leave a message on Discord if you managed to get in with our team code.

Are you planning to farm USDai? Reply in the comments and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

Did you ape in?

Any idea on timing of the airdrop?