How to build your crypto portfolio.

No matter the size of your bag, crypto is your best shot at becoming rich.

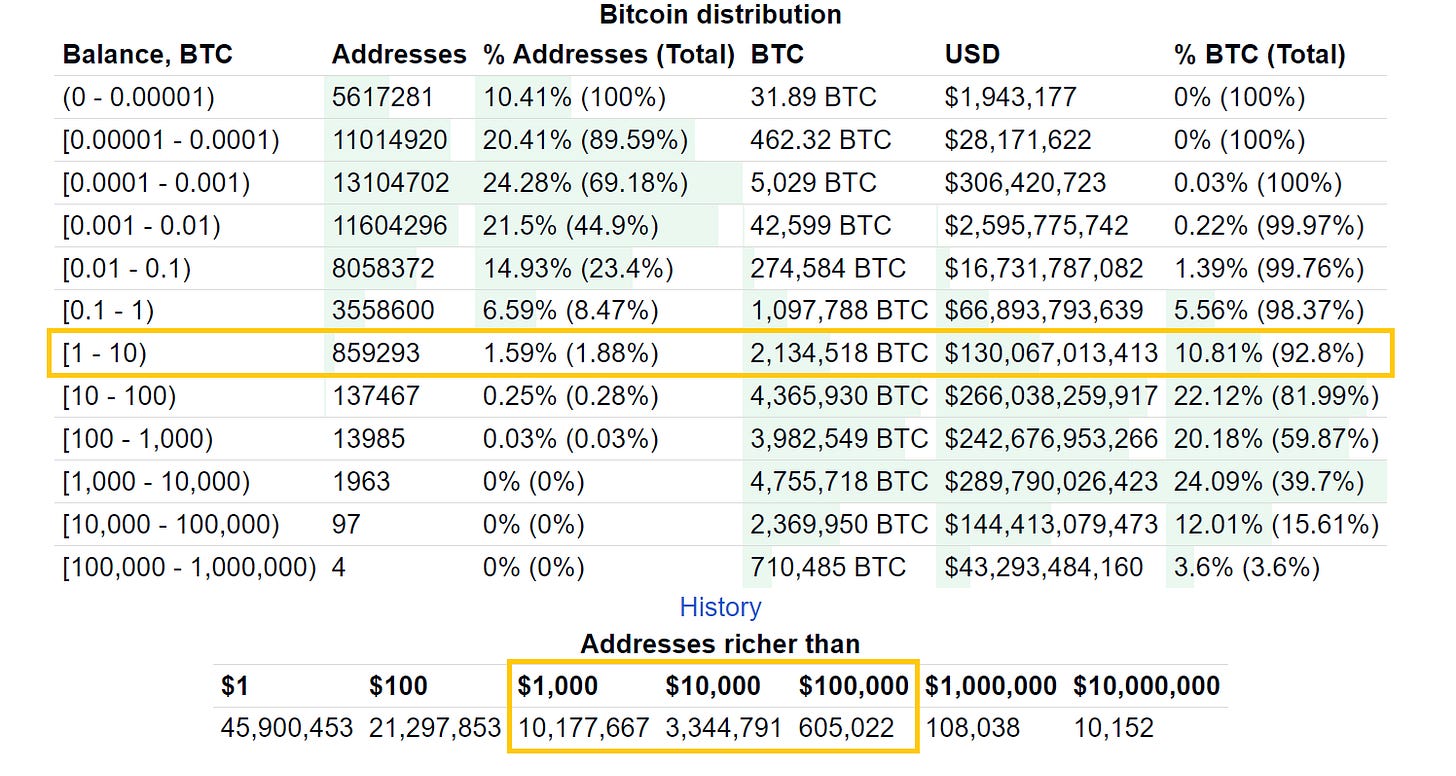

This guide is designed for three categories of crypto investors. Here is the value of their bags:

$1,000 - Beginner

$10,000 - Competent

$100,000 - Expert

I’ll assume all of you are here to become rich and crypto is your best shot at that. Let’s begin. TLDR at the end.

If you have 10k or 100k in your bag or ready to invest, there is one question most will ask themselves:

Should I start a business or buy Bitcoin?

Unless your future business can outperform Bitcoin, don’t even bother doing that. This brings me to an important point valid for all portfolios, irrespective of their size.

If you’re not outperforming Bitcoin, you’re wasting your time!

Take a minute now and measure the returns of Bitcoin since you first started crypto and compare that to the returns of your portfolio. If you didn’t outperform Bitcoin, then it’s time to re-evaluate your investment thesis and assumptions.

Having said that, let’s begin with the basics. We have three categories of portfolios: 1k, 10, 100k. Interestingly, they mirror very well the distribution of Bitcoin as well. Let’s explore them one by one.

Beginner - $1,000

You are at the bottom of the crypto pyramid. But crypto is your best shot at making top dollar. Your advantage is that you can take high-risk bets and losing this amount will not impact your life too much.

Your portfolio is small and you won’t get rich with Bitcoin overnight. Don’t bother much with the Top 100 coins unless you reach the next two levels. You’re here for one purpose only.

Whatever you buy, it must have a good chance to 2x to 10x at a minimum. That usually means you invest in low market capitalization coins with potential. This includes hype-based coins like meme coins.

You do not buy to hold, you buy to sell at a profit. Your main goal is to seek alpha and sell it whenever the chart starts pumping. In and out. Do not get attached to any altcoin. Their only purpose is to make profit and increase your bag.

Since you don’t have time to waste, do not hold forever and hope for a coin to pump. Chase trends, narratives, and hype. Discard old narratives and jump on the new ones as soon as possible, even if that means you need to sell at a loss sometimes. Do not hold losers long either. Move on.

If you’re new to crypto, the altcoin market is the hardest one to play with. Most altcoins are scams and many will shill them to use you as exit liquidity. Don’t fall for those games, exit when in good profit, and never look back.

Spend time to understand tokenomics, market dynamics, and the pump cycle. If you get lucky and get a 10x or more, put it in Bitcoin. Ideally, don’t go all-in into one altcoin, spread that risk into 3-4 bets. If one rugs, you can still continue.

The chance of you losing that $1,000 is high.

If you can’t stomach that or won’t have another $1,000 for some time after, then think really hard if this is the path you want to take. If investing $1,000 in yourself or your family can have a significant positive impact, think twice about it.

If I spot micro caps that show potential, I share them with our Patrons on YCC Discord. I suggest you join a few groups with real alpha and knowledge. It will help you to quickly get a sense of which groups are scams and which are not. If all they do is share signals, it’s likely a scam group using members as exit liquidity.

Competent - $10,000

You still focus on growth, but high-risk bets should no longer be the main purpose of your portfolio. Start thinking how to protect your profits as well. This will become more important as it grows larger from here.

If you reached this level and started with $1,000, well done! But it’s time to upgrade your mindset. Before this point, all your attention was on finding alpha and coins that can pump. Now you also need to protect your newfound wealth!

You do this by allocating a part of it to Bitcoin. Take your portfolio and decide what percentage of that you plan to continue to risk and what percentage of that you plan to protect. You protect with Bitcoin and you risk with altcoins.

If your portfolio is over $10,000 and you have no Bitcoin, then you are greedy. Don’t fall into that trap. Do this instead:

Decide how much of your portfolio you want to protect. Put that in Bitcoin and never sell it. NEVER. Not even for promising altcoins. You hold this for life as it grows and you add to it any future altcoin profits.

Congratulations for making a huge step in your financial independence. Few reach the stage where their main goal becomes more Bitcoin. It’s quite tragic how many never leave the altcoin mindset and make it their only focus with disastrous consequences.

That Bitcoin bag will slowly turn into a place of comfort, a source of balance and relaxation to contrast the stress of gambling with altcoins. Whatever happens on the altcoin front, you will know that your Bitcoin is safe. This will make you a better investor over time since you’re grounded in sound money.

As your portfolio grows in size, aim to reach at least one Bitcoin and never sell it. That’s your financial independence and retirement. If you’re young reading this, time will work in your favor. Let it do its job. You really don’t have to do anything else on that front.

Expert - $100,000

You just entered a different league. Six figures is more than one Bitcoin at the time of this post. Congratulations, you’re in the top 1%! Now do your best to never lose it. Your main goal is to increase it and manage risks.

You are now in a very exclusive minority. Few reach this point and most only dream about it.

You are in the top 1% globally in terms of crypto!

But it gets better, out of 8.2 billion people you can be among those 605,022 who have more than $100,000 in Bitcoin. That’s actually 0.007%. Crazy, but these numbers are factual.

Therefore, at this level, instead of gambling to get rich, start thinking you are already rich. Not because you have $100,000. That’s not it. But because you have 1 Bitcoin or more. That’s actual wealth. Having $100,000 in a bank account is not wealth.

Being in the top 0.007% means out of 100,000 people, there are only 7 like you. A very exclusive club. Therefore, you have only one mission now.

Protect your wealth!

Anything less is irresponsible.

You do this by maximizing the amount of Bitcoin you have over time. Ideally, you never sell that Bitcoin and definitely you don’t do that if you have only one. As such, altcoins should NOT be your main concern.

At best, altcoins should represent anywhere between 1% to 10% of your portfolio. They should be asymmetric bets with a good chance to 10x, and when they do that, you swap them back for more Bitcoin. That’s it.

If you have Ethereum, it should always be a much smaller allocation compared to Bitcoin. Long term, you should aim to sell all your Ethereum because the macro does not favor it and has been underperforming Bitcoin since 2022. Don’t hold an assets that does not beat Bitcoin, remember?

On a long time horizon, you should always be bearish on altcoins. That’s why you never hold them long term. This short video will help illustrate some parts of what I mean. Listen carefully to what he says about Ethereum, Solana, and altcoins.

It will become harder and harder for altcoins to actually find an edge as they erode market confidence over time. This will only reinforce the thesis that Bitcoin is the better bet. If you’re rich, betting on Bitcoin is how you will stay rich.

Lastly, if you have 100k and just joined crypto, just buy one Bitcoin. Don’t complicate it further than that. It’s a cheap price to be in the top 1% forever.

TLDR & Tips to Remember

If you’re not outperforming Bitcoin, change your investment plan.

Beginners must take high-risk bets on asymmetric opportunities.

After a point, you must learn to protect your portfolio, not just grow it!

Once you reach six figures focus on Bitcoin, anything less is irresponsible.

On a long time horizon you should be bearish on altcoins.

Bitcoin is the only sound money in the world right now, apart from Gold.

If you’re rich, protect your wealth with Bitcoin to stay rich.

This newsletter is made possible with the generous support of our community Patrons and partners. Upgrade your experience to show your support by clicking the below button or reach out to us on X or Discord to partner.

All info is provided for educational purposes only and is not financial advice.

Love the simplicity of this! Altcoins are alluring, and they're difficult to resist. Their "siren song" has left me dashed on the rocks time & time again, as it's easy to think we can just get rich by following trends online (I'm finally learning my information edge is shit).

Well after 4 years in crypto, it's steadily becoming clear what the only sure bet is...