How to farm $1,000 in airdrops today!

You can do this right now. Keep reading.

In a bull market, airdrops are a lucrative business. You can make thousands of dollars by simply interacting with protocols, holding an NFT, or parking some liquidity in a new protocol.

This is a real guide with a real example.

Round 2 is live and you can farm future airdrops right now. All it takes is some liquidity, but make sure you read the risks too. TLDR at the end.

Yesterday, Ethena did its first ENA airdrop to early supporters. Anyone that held USDe was eligible after only six weeks! This is the hottest DeFi protocol in crypto right now and I wrote about it in since February, see Alpha Post #15.

The YCC Fund made almost $400 that will go to its Patrons. Some YCC members made much more!

The good news is that you can still farm Ethena airdrops!

Round 2 just started and you can join it now. Use our YCC link to access it below. Our YCC Fund will receive 10% bonus on any future airdrops if you use our link. After this introduction, you’ll find my step by step guide.

In Round 1, users were airdropped over $1,000 in ENA tokens if they held more than $5,000 in USDe for as little as six weeks.

That’s a huge return in such a short time!

In about a month, you received over 20% on your money! As I write this, the ENA token keeps pumping and that percentage may be much higher if you hold the token. Plus, all big exchanges listed ENA yesterday, including Binance.

How to farm Ethena airdrops - A short guide

The basics

In Round 1, users collected shards as rewards for engaging with the protocol. These shards were later converted into ENA tokens during the airdrop. The trigger for the airdrop was when USDe market cap reached $1 billion.

In Round 2, users are collecting sats as rewards. These too will be converted into ENA tokens during the next airdrop which will be triggered when USDe reaches $5 billion in market cap.

Shards or sats are just marketing labels, think of them as points.

1 USDe = 1 point (before multipliers).

The more USDe you lock, stake or provide liquidity with, the more points you will get which will translate in more ENA tokens later.

Notice that depending on how you use your USDe, the multiplier for the points will differ. Aiming for the highest multiplier, 20x to 30x, is the best. The most accessible is locking your USDe for a 20x multiplier.

Some users also got an ENA airdrop for simply holding a particular NFT collection. Lucky for them that the folks behind Ethena are fans of Milady collection. They got $2,000 to $3,000 in ENA tokens per NFT.

Earning points

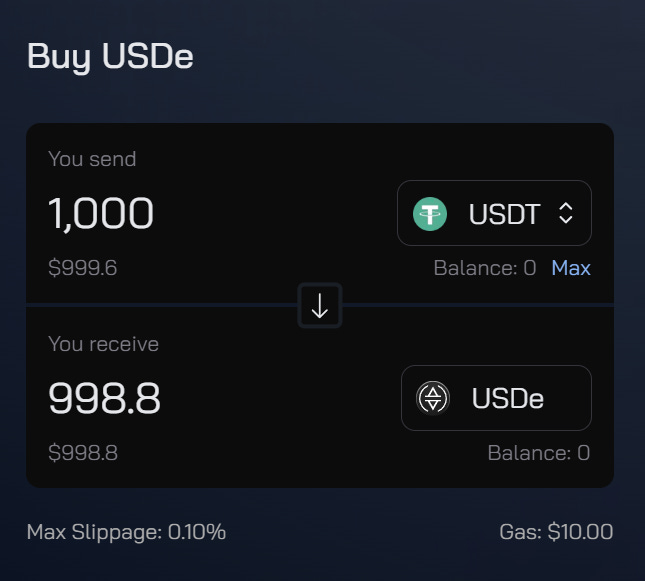

To start earning points or sats in this second season you will need USDe. You can easily buy them on Ethena’s site via the swap function, as shown below.

Note that Ethena is currently only available on the Ethereum network! That means gas fees can be painful. If you plan to do this with less than $1,000, then the fees may erode your returns later.

The gas for a simple swap is $10 right now. You will need to pay more in gas if you stake, lock or provide liquidity with your USDe, which you should.

Make sure you aim for that 20x multiplier! Then you simply wait. Those that got in early during season one got an extra boost in this season, if they didn’t exit.

As time passes, you’ll get more and more sats or points in this second round. Do not move them, do not unstake or unlock. If you do, you may lose your access to the airdrop, depending on when Ethena does their snapshot.

We do not know when the snapshot will be taken for the airdrop, but likely close to when USDe reaches $5 billion or by September, whichever happens first. You can also add/stake/lock more USDe to the same wallet with no consequence.

That 5 billion will come faster than you expect! Be early and don’t delay if you want to play this game.

Claiming ENA tokens

Once the second season ends, you’ll be eligible to claim your ENA tokens! Make sure you only click on the official link on Ethena’s page. There are many scammers ready to steal your coins with fake links - do not click on any Twitter links!

On the main page, connect to your ETH wallet, click claim and voila. You are now the proud owner of ENA tokens. You can choose to sell them or speculate further. Up to you. Now lets talk about risks.

Risks - a must read!

Notice that this whole marketing campaign is pretty smart and designed to keep people engaged and “locked” into the Ethena ecosystem on a long-term basis. That means you lock your money into this honey pot. Because it is one.

They don’t want you to leave. They want that USDe market cap to reach tens of billions. To do that, they need your money. They use your money to buy ETH and also open short positions to farm the funding rates paid by traders on exchanges.

That’s how staked USDe or sUSDe makes that yield. This works well in a bull market, but it comes crashing down in a bear market once funding rates turn negative.

Effectively, in a bear market, Ethena will lose money due to negative funding rates (Ethana pays traders, the game is reversed). This puts USDe at risk, and also your money.

ENA tokens are being used as incentives to keep people playing, but the value of ENA will be diluted hard as time passes. I don’t plan on holding ENA beyond this year or USDe. Airdrops and rewards in ENA tokens will also diminish per user as more and more people pile into this honey pot.

I wrote a long thread on how Ethena could turn into a systemic risk to crypto. You see, the name shards refers to Ethereum being used as a collateral to short the market. The name sats refers to their intentions to move to Bitcoin as a collateral next which they will also use to short the market.

In their mission to reach over 10 billion USDe market cap and farm yields, Ethena will spread to all major coins to farm open interest in the futures market. This can quickly turn into disaster once the bull market ends. Billions in USDe may need to quickly exit Ethena as the yields turn negative. No bueno.

Play the game, but know when you need to stop and get out. Being a member of YCC will help you with that. Join us!

TLDR & Tips to Remember

Opportunities in crypto are everywhere, but they can easily turn into traps

Explore opportunities while risks are low, Ethena is one of them

Farm the points, shards, sats, and airdrops. Play the game, but be careful!

Don’t stay in protocols like Ethana beyond this bull market

Exit early and don’t look back, protect those profits at all costs

Don’t be greedy

This newsletter is made possible with the generous support of our community Patrons and partners. Upgrade your experience to show your support by clicking the below button or reach out to us on X or Discord to partner.

All info is provided for educational purposes only and is not financial advice.

5bn September?! Say May better