Hyperliquid Breaks Above $50! Where Will it Top?

When in doubt, bet on winners like HYPE.

This year was quite disappointing for altcoins. Most underperformed with one major exception: HYPE.

Why is Hyperliquid different and where will it top?

I’ll answer this question in a minute. Meanwhile, in the last 24h, HYPE broke its all-time high at $50 and is well on its way to make new highs this year.

This newsletter is sponsored by Grvt, the world’s first licensed institutional-grade self-custodial onchain exchange. Open an account to qualify for the $GRVT airdrop and farm maker fee rebates!

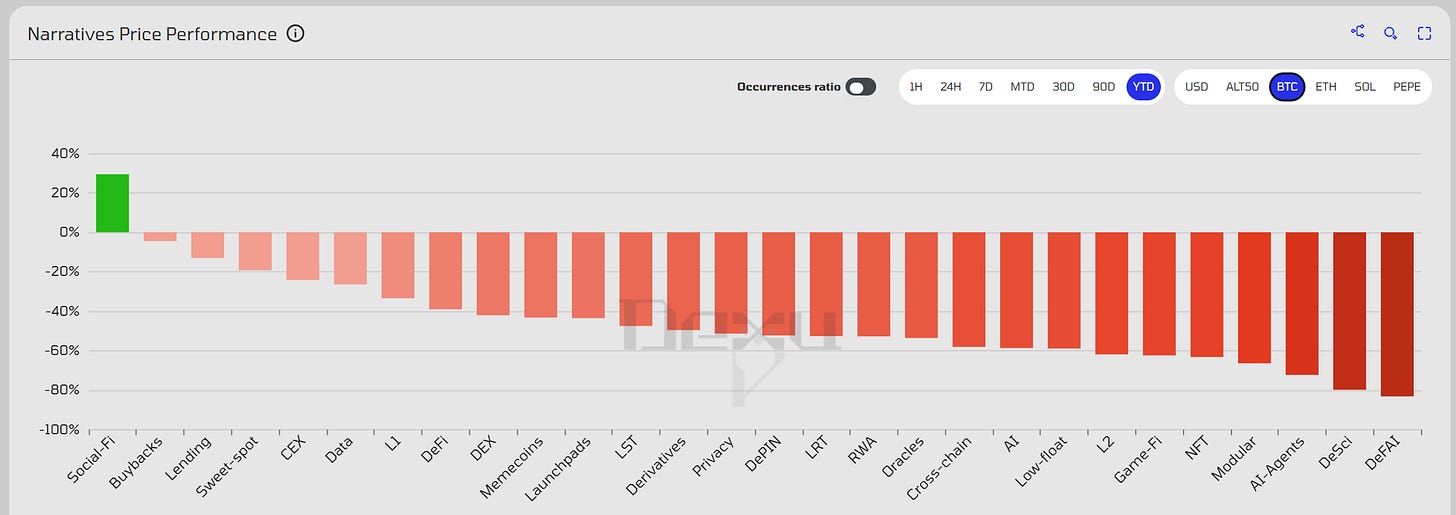

First, a quick look at the year-to-date performance of most altcoins against Bitcoin. Notice anything in the below chart? Except for Social-Fi, everything is in red.

In other words, just holding Bitcoin was the better trade in 2025. The outlier, Social-Fi, includes tokens like Cookie, Kaito or Zora. The latter did a 15x recently and I covered it in my last Alpha Post.

Once you filter performance against Bitcoin, the pool of altcoins to choose from becomes very narrow. One of those privileged alts is HYPE, the Hyperliquid governance token. Let’s start with the first part of our original question.

Why is Hyperliquid and HYPE different?

TLDR: Most of crypto is about how to extract value from users. Hyperliquid flipped that on its head and did the opposite.

It’s important to define the term extractive before we get to some examples. It means protocols or chains take their users money and never put any of that back into their ecosystem. That cash vanishes in the bank accounts of such teams.

This practice happens over and over again under new brands and names every cycle. The actors behind are usually the same people repeating their scheme to part users from their money in a legal way.

Let’s take a few recent examples illustrating this:

Pump.Fun - They made billions in fees by pumping out endless meme tokens on Solana. Later, they raised billions selling their token to investors before its launch. Yet, the PUMP token crashed 67% as soon as it was listed. A lot was taken from users, not much was given back.

Cronos - Crypto.com created CRO in 2018 with 100 billion tokens. In 2021, they burned 70 billion tokens to support the price. Yet, in March 2025, they minted back 70 billion tokens after a vote dominated by insiders. This token was created at the expense of users, not for their benefit.

TRUMP/MELANIA/YZY - These meme tokens are the definition of extractive practices. Once some celebrity agrees to this, the token is created in private and allocations are made to insiders. Upon launch, those tokens with a cost basis of zero are sold for hard cash. Nothing is put back in, all is taken.

Now lets look at Hyperliquid.

They launched a decentralized exchange that started with rebate fees given to anyone that added liquidity to their orderbook (we call them makers). Basically, makers got paid to create limits orders by splitting the fees paid by takers between Hyperliquid and makers (you can still do this on Grvt today).

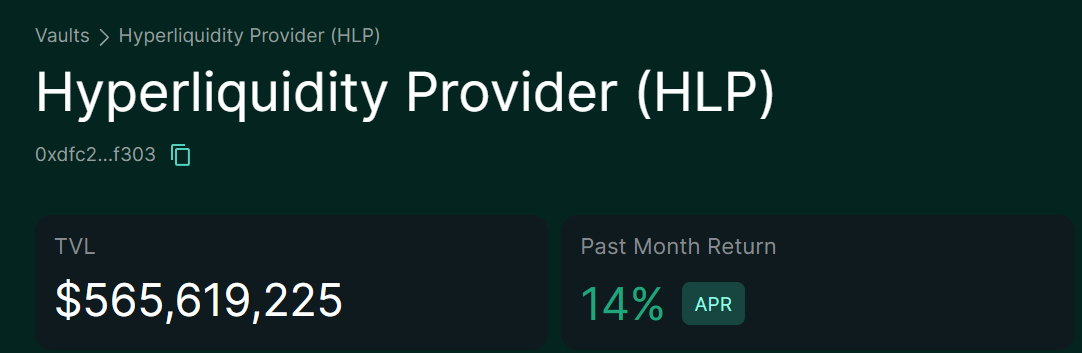

To further boost their exchange liquidity, Hyperliquid also created the HLP vault where anyone adding USDC to that vault would receive a share of the fees from liquidations on top of other trading fees. Centralized exchanges like Binance or Coinbase take all liquidation fees for themselves.

Up until this point, there was no HYPE token. However, anyone trading on Hyperliquid was accumulating points. Later, these points translated into a HYPE airdrop to anyone that traded on their exchange.

The first airdrop (there could be more later) distributed 31% or 310 million HYPE to traders that used Hyperliquid. This airdrop coincided with the launch of their spot market. Unsurprisingly, HYPE went from $2 to $51, as of today. Traders that got the airdrop received the tokens for “free” based on their activity metrics.

They were the insiders and this turned the boat for Hyperliquid in a major way.

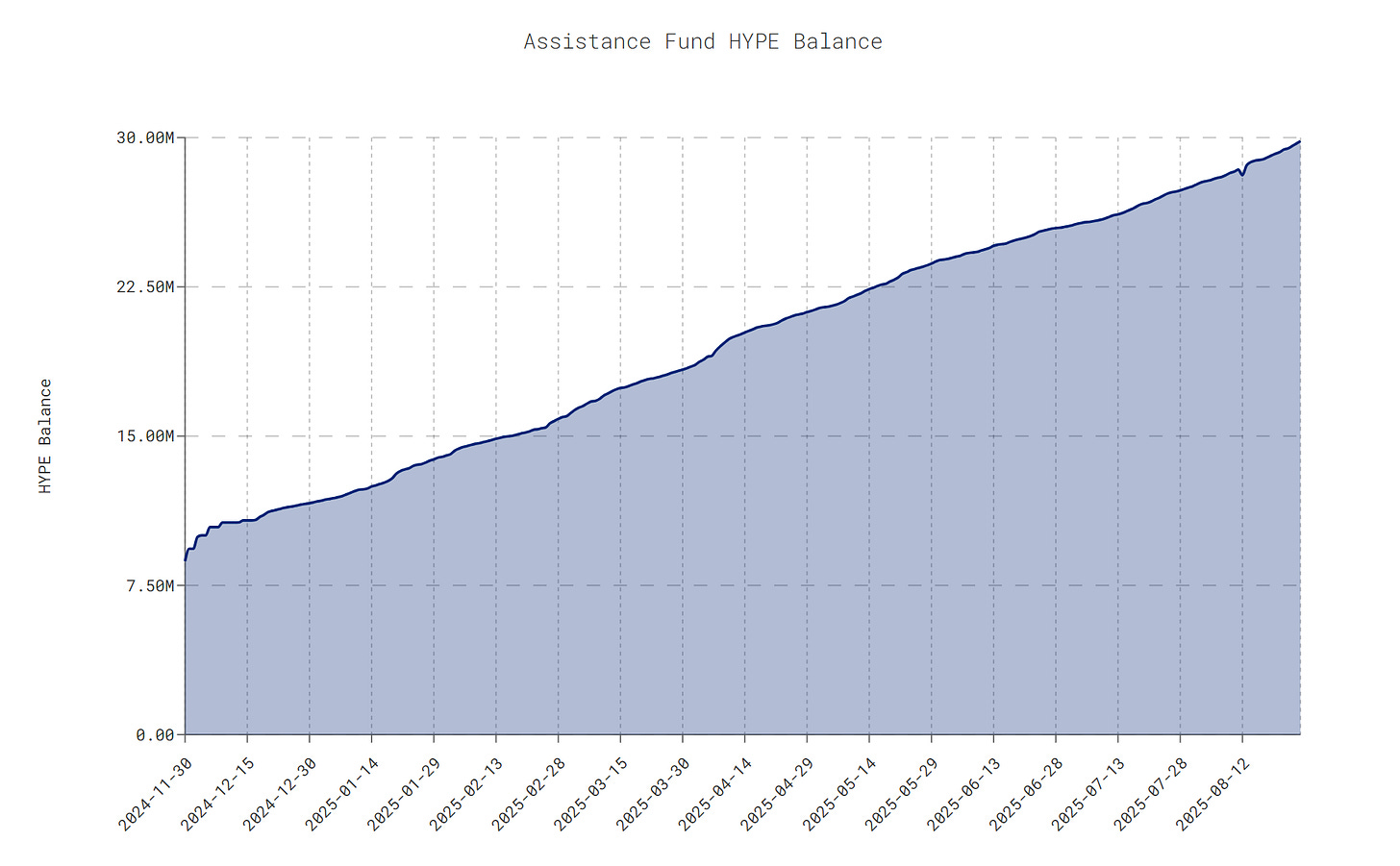

Moreover, right now, Hyperliquid is using 97% of its revenue to buy back its own token. They plan to reach 99%. Essentially, that means any fees you pay to trade on Hyperliquid are used to buy HYPE and boost its price.

If you happen to stake a lot of HYPE to get discounted trading fees, you’re in effect paying yourself by trading there. Almost 30 million HYPE valued at around $1.5 billion was bought to date by the Assistance Fund.

While others take a lot from users and maybe give something back, Hyperliquid gives back 97% and soon 99% of what users put in. Users noticed and this is why HYPE is an outlier and will continue to be one that eats into the market share of centralized exchanges which mostly take from users.

Such competitors also happen to be the ones arguing that the 30 million HYPE in the Assistance Fund will eventually end up being sold by the team.

No.

I’d argue the team is more likely to burn those tokens which will 2-5x HYPE’s price overnight.

Why would they burn the tokens in the Assistance Fund?

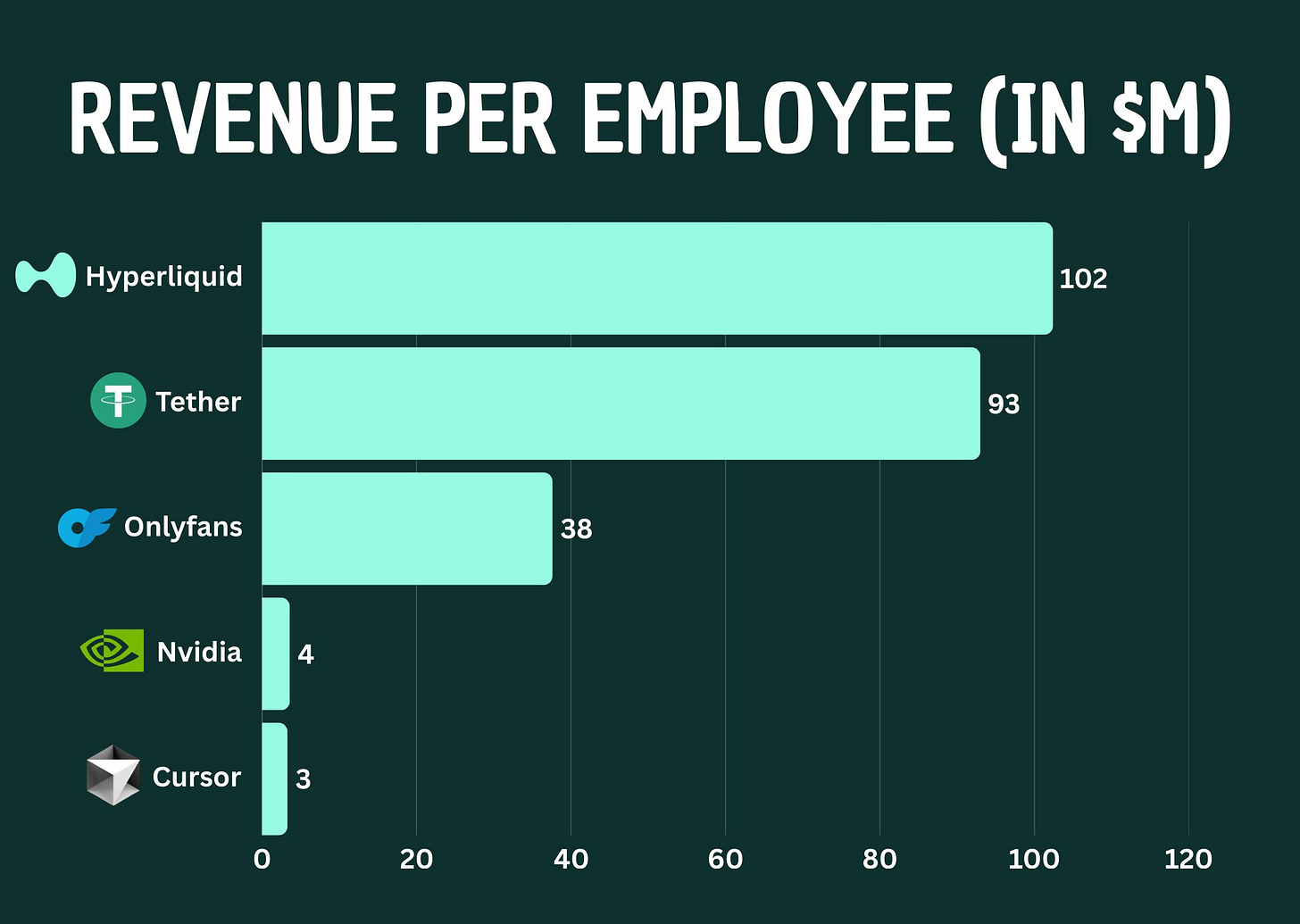

Because it benefits their users and ecosystem. Perhaps it’s important to note here that Hyperliquid is managed by 11 people with a revenue per employee of $102 million. This is the highest in the world!

Let me say it again, eleven people! The Hyperliquid team also happens to make most of their money by market making. They do not need to sell HYPE to be profitable. All they need is a successful exchange and they already have it.

Having said that, let’s look at HYPE’s price action next.

Where will HYPE top?

As you can see in the below chart, the price is in an ascending channel with borders between $40 and $60. A price above $50 is not as exciting as it would be if it goes above $63, the top of this channel.

I believe that target at $109 or around $100 acts as a magnet for the price and HYPE will eventually visit that level, likely after breaking above $63.

Of note is that the price action is less aggressive compared to its April to June rally. Despite having millions in buy-backs every day, HYPE has reached a capitalization large enough that such buys are less impactful, but still significant.

HYPE is also in the top 10 cryptocurrencies by market capitalization, if we ignore stablecoins. This is already a huge achievement in itself. Should HYPE hit $100 later, then this would double its current market cap and place it close to Dogecoin and below Solana.

I believe that is a respectful top for this cycle. HYPE’s price could go higher, but for that to happen, it needs its ecosystem of protocols and users on HyperEVM to grow. That will come in full swing in the next cycle if everything goes well.

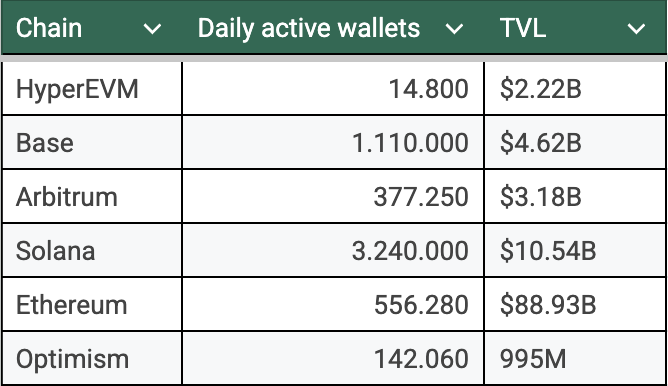

As of today, the HyperEVM has about 15,000 users, most of them traders from Hyperliquid (the exchange). This is peanuts compared to Solana or other chains like Ethereum or Arbitrum. Until that changes, HYPE’s upside potential is limited to the performance of their exchange.

Currently, onboarding users to the Hyperliquid exchange is pretty straightforward. However, the same cannot be said about HyperEVM. There is still a lot of friction there, but it is getting better with recent integrations like native USDC.

Moreover, major exchanges like Coinbase or Binance did not list HYPE to date. This is another limiting factor to onboarding new users to HyperEVM. There is a lot of envy and Hyperliquid brushed many established market incumbents the wrong way with their success.

In a space dominated by takers, Hyperliquid came and reversed the game on its head. This made them stand out and become a favorite among users. If they can keep this up and avoid a black swan event (since Hyperliquid is still very much centralized), HYPE has only one way to go. Higher.

Where will HYPE top in 2025? Reply in the comments with your best guess and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

Its about to retrace now