In this crypto bull market trade attention not fundamentals!

This is a legitimate degen strategy to apply in a heated market.

If you are in crypto to make money, then there are two paths you can take:

Find projects with strong fundamentals and build your position during a bear market. Then take profits after the market turns bullish. This is an established path to success.

The degen strategy involves little research and is based purely on sentiment, market hype and attention. This strategy only works well in a bull market.

Both strategies can net you significant gains with the caveat that the latter can be quicker to make you money if you time it right. On the other hand, poor timing can get you rekt.

Since we’re in a bull market, it’s worthwhile to explore this degen strategy further and how you can profit using three key metrics. TLDR at the end.

My advice is to focus on asymmetric bets whenever you get into high risk / high reward plays. If you’re right you get a huge payout, but if you’re wrong the losses are manageable.

A good example of that is my bitcoin frog story. Risking $200 to make $40,000 is a bet I’d take any day. Always put the odds in your favor, that’s how you win.

To help you, I’ve put together three key metrics you should look for if you plan to use the degen strategy.

Emerging Narratives

Every bull cycle brings about new narratives. They have to be new, otherwise they would gather little attention.

Project teams, investors and developers sometimes purposely delay their projects or big announcements until a bull market is on the horizon. Suddenly, when prices go up, the market explodes with new projects and narratives. That’s no accident.

The emergence of NFTs on Bitcoin is a good example of a new narrative that was actually worthwhile. It started in early 2023 and its momentum intensified ever since to the point that some think the whole NFT market on Ethereum is under threat.

This narrative is strong because who doesn’t want their precious JPEGs on the most secure network on the planet? There is more value to hold NFTs on Bitcoin versus Ethereum. Those that saw this potential early already made a killing.

Bitcoin Frogs, Bitcoin Punks or NodeMonkes used to trade under $100 in early 2023. By the end of the same year, some were selling at prices exceeding 1 BTC and floor prices increased by a factor of 100x!

While this is an example of a narrative that actually delivered for early investors, there are plenty of narratives which are just a rebrand of something that didn’t work last cycle.

One such example, in my opinion, is the new and flashy narrative called DePIN or Decentralized Physical Infrastructure Networks. The DePIN narrative leader, in terms of market cap, is ICP or a coin that crashed by 99.5% after it was released.

My problem with the DePIN label is that it’s full of projects that are actually not new and are looking for a way to market themselves better during this new bull market. Don’t fall for such rebrands! There are plenty of such examples and their only purpose is to create hype under a new name. You can ride the hype, but make sure to get out when the profits are good.

Another narrative that I see lately is called DeSo or Decentralized Social Media. Whatever new narrative you find, make sure it offers asymmetric returns if you go for it and is actually new, not a re-package of something we’ve had already.

Momentum & Money Flow

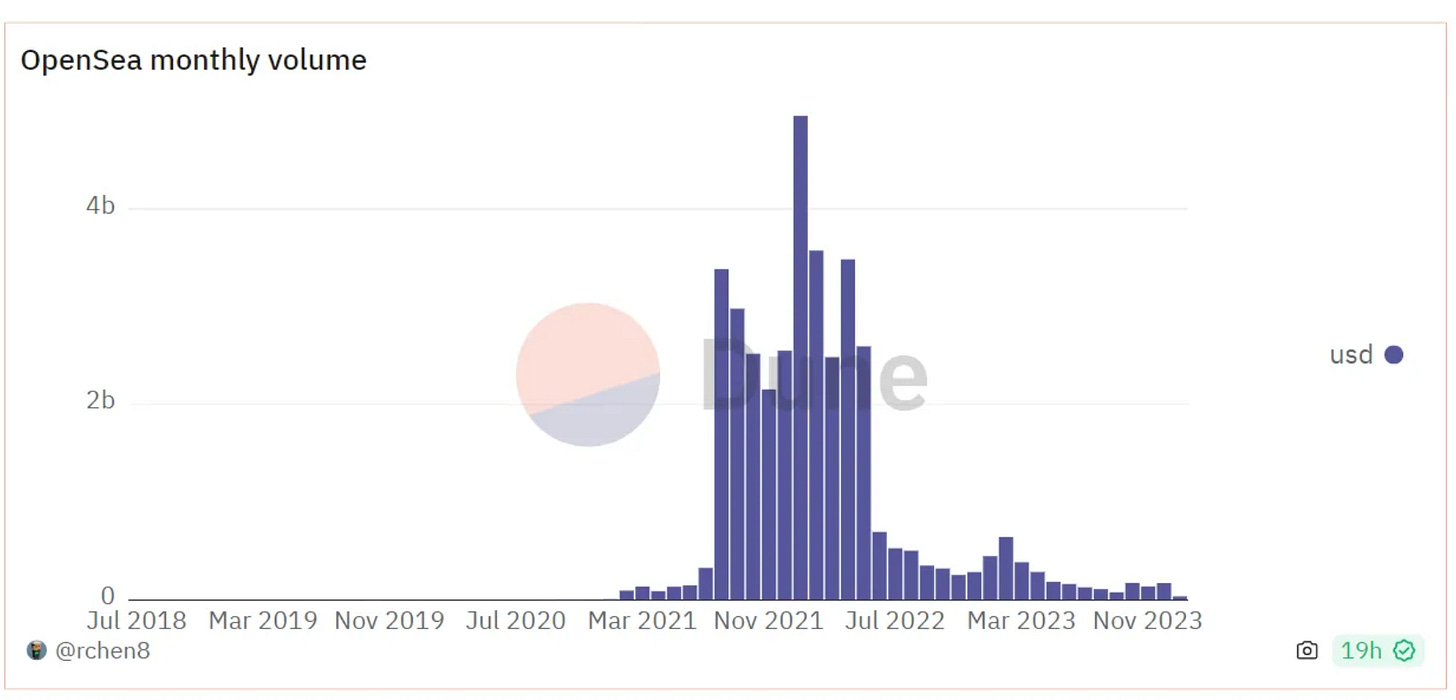

This one is easy. Follow the money. Where it is going and why. A good example is how the NFT market on Ethereum was bled dry as whales moved to Bitcoin to speculate on NFTs.

On both OpenSea and Blur, the biggest markets for NFTs on Ethereum, the volume continues to make lower highs since 2021. On the other hand, the volume for NFTs on Bitcoin made new highs all year in 2023.

If you want to make money, make sure you are in a growing market. Crypto as a whole is such a market, but within it, some narratives are losing momentum while others are just starting. Use that as a guide on how to position yourself.

There are many tools to look at how money is flowing, in the below example from wormwholescan we can see how money is moving between different chains. What this tells you is if a particular chain is getting fresh money that could translate in higher prices for its token or ecosystem.

Whatever tool you use, make sure the trend is your friend. A growing market will lift all boats, that includes your bag in this bull market.

Low Market Cap Plays

The degen strategy would not be the same without its meme coins and low market cap projects. You don’t focus on fundamentals, you focus on being first in a low market cap degen play with meme potential.

If you get lucky, a $5 mil mcap token can go to $50 mil mcap or even $500 mil on hype alone. That’s an easy 10x to 100x, if you can sell it.

The risk with such plays is liquidity. Many times, meme coins are created with a huge token supply but a $50k liquidity. Even if your bag may be worth a million dollars on paper, you can’t sell it for that amount without crashing the price to zero.

Either way, the folks at Solana realized that they can pump their ecosystem and SOL price by simply releasing a ton of new meme coins on their chain. When this happens, make sure to sell when the FOMO is strong, not after.

With this development, meme coins have a real use case! They bring attention to an ecosystem. Solana is a great example. Its meme coins made the news round and back for weeks and “revitalized” their ecosystem.

This is now a legitimate marketing trick to bring more eyes on your project and Avalanche Foundation even has a dedicated budget to pump meme coins on their chain. This is another new narrative with real money behind it.

TLDR & Tips to Remember

There are many paths to making money in crypto, find your niche

If you choose the degen path, make sure you focus on asymmetric bets

Find new narratives and join them early, then cash-out when they go big

Follow the money. In crypto, money rotates and you rotate with it

Be in a growing ecosystem and don’t forget to sell when it explodes

A bull market prompts old coins to rebrand to ride the hype, ignore them

If you’re late to join a trending narrative, skip it and find new ones

There will always be another opportunity in crypto, it’s a growing market!

This newsletter is made possible with the generous support of our community Patrons and partners. Upgrade your experience to show your support by clicking the below button or reach out to us on X or Discord to partner.