My top 5 crypto trends in 2025!

The market is changing at a fundamentals level. Can you spot the trends?

A number of obvious signals are appearing that the market is changing. What worked in the past is no longer working today.

You either adjust to the new reality or will quickly be left out in the cold.

In what follows, I explore five such changes which are becoming too big to ignore. Dive into these emerging trends by scrolling down.

Rush to safety - Gold

Before we dive into crypto proper, I want to take some time to talk about Gold. If you didn’t know, this week, XAU or Gold made a new record price and nearly hit $3,000 an ounce. Its price almost doubled in the past two years. Why?

Because someone is buying a lot of it.

Why would they do that?

To hedge against market risks and other geo-political risks.

I suspect the buyers are a mix of nation states and large investors aware that we’re entering some uncertain times in the future. If the world explodes with trade wars and even kinetic wars, then gold is one of the safest bets to hedge those risks.

Trump wanting Canada to join USA as its 51st state, take over the Panama canal, take Greenland from Denmark, and possibly take over Gaza as a real-estate project gives others plenty of reasons to buy gold. Adding tariffs on everyone on top just compounds those fears more.

However, another major reason gold is pumping is because BRICS+ and their allies are slowly moving away from the US dollar in their bilateral trade. This puts huge pressure on the USD and incentivizes said nations to back their own currencies with as much gold as possible.

This new demand for gold is driven by a new incentive that did not exist before. In the past, everyone traded internationally with USD and that was it. Now, countries are opting out and they do that by using their own currencies backed by gold.

How does this relate to crypto?

Well, Bitcoin is gold 2.0. If gold keeps pumping, that’s bullish for Bitcoin and much more than that. See next point.

Bitcoin decouples from the rest of the market

If you look at the market right now you will see something strange. Something that did not happen since Bitcoin was created in January 2009.

The price of Bitcoin has decoupled from the rest of the market, namely altcoins.

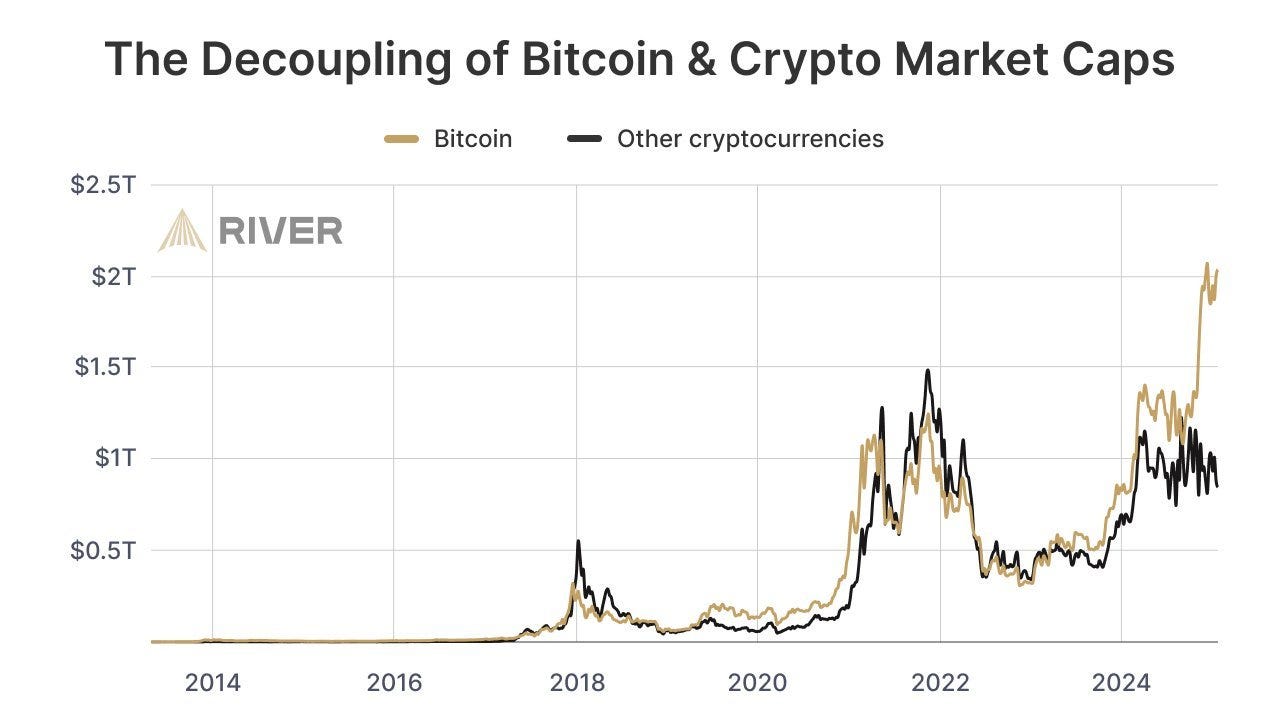

Look at the below chart. While Bitcoin is making higher highs, altcoins - as a whole - are not. This never happened before.

Bitcoin is now separated from altcoins in terms of price action. It has become a distinct asset class that is no longer tied to the rest of the crypto market. It’s independent of that and will likely mirror gold more than anything else in the future.

That’s why I started this article with the gold chart.

Bitcoin graduated to rival gold sometimes in 2024 after the BTC ETFs went live. Not surprisingly, soon after, BTC price action started to diverge from the altcoin market as seen above.

The conclusion?

Bullish on Bitcoin (and gold).

This trend will likely last for quite some time and be compounded further by any additional printing of money by nation states as they finance their trade wars or other conflicts with more worthless fiat.

It will be interesting to see how the Bitcoin four year cycle will be affected by this. Will its price pump and dump like in the past or do something else? Time will tell.

Altcoin dilution and inflation

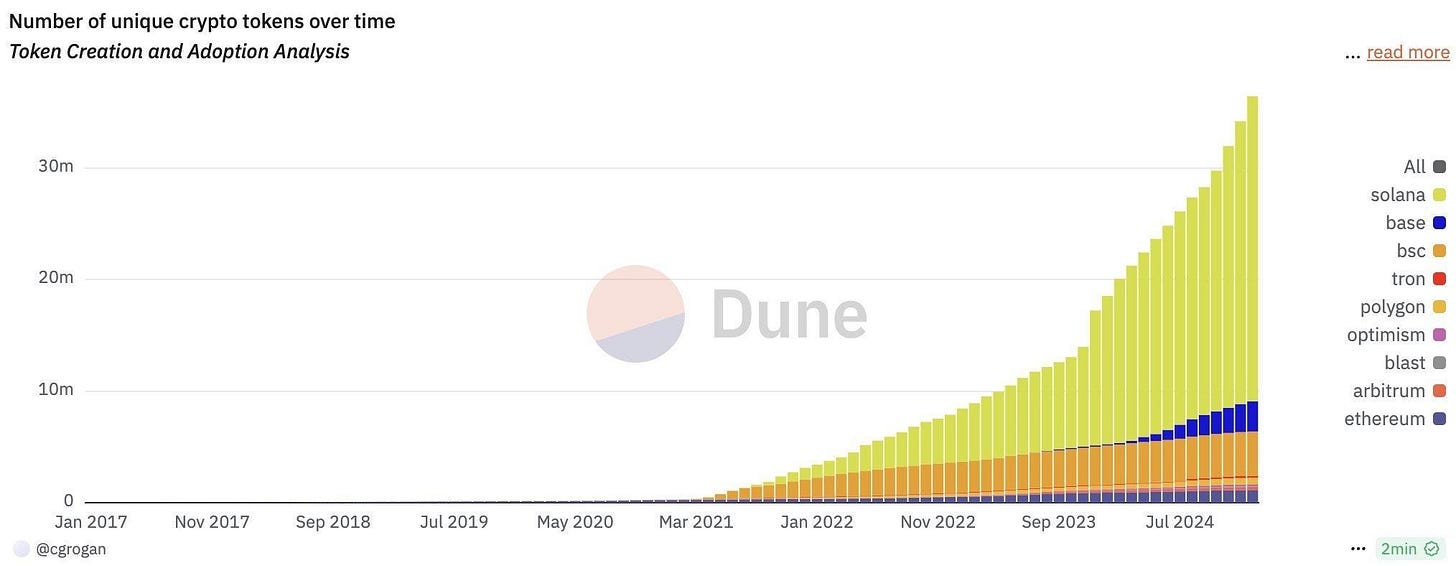

Part of the reason why altcoins are lagging behind is because there are just too many of them. The Solana ecosystem is printing millions of new tokens per month while the total liquidity in crypto is flat. It did not really increase.

I also explored this in a recent thread on X. The math is simple.

You can’t divide the same money more times and expect a higher price. On the contrary, on a net basis, every altcoin losses as they have less dollars in liquidity at the end of the day.

This is bearish over time for altcoins.

You can’t print value out of thin air by issuing more tokens. Solana did capture a lot of value by diluting the altcoin space with millions of tokens. However, this is not a sustainable path forward as long as the total altcoin liquidity is not increasing.

Someone has to lose in this game and you better make sure it’s not you. If you want to play it safe (because the odds are against you), you’re better off avoiding the altcoin game all together.

I mean, think about it. You could have almost doubled your money on gold alone in the past two years or 5x your cash with Bitcoin in the same period. On a risk adjusted basis, these returns beat almost all altcoins. Why even bother with them?

4. Apps > blockchain jargon

Solana demonstrated one thing very clearly. Users prefer easy to use applications with an intuitive interface. They do not care about technicalities. Make it simple and easy is king.

Nobody wants to think about gas or fees when they buy or sell the latest meme token. Nobody wants to move money cross-chain and use bridges. Nobody wants to approve and then confirm a transaction like on Ethereum. It’s poor design.

Nobody cares about Layer-2 networks, decentralization, consensus mechanism, and network security. It’s not something regular users think about. Solana understood this and focused on creating easy to use apps for their user base.

And they won.

Users flocked to Solana to gamble in their meme casino.

With more users, liquidity followed and so did developers working on more apps. The flywheel was put in full motion, even if it was driven primarily by greed and memes.

This only made everyone else in the altcoin space a loser. Like Ethereum.

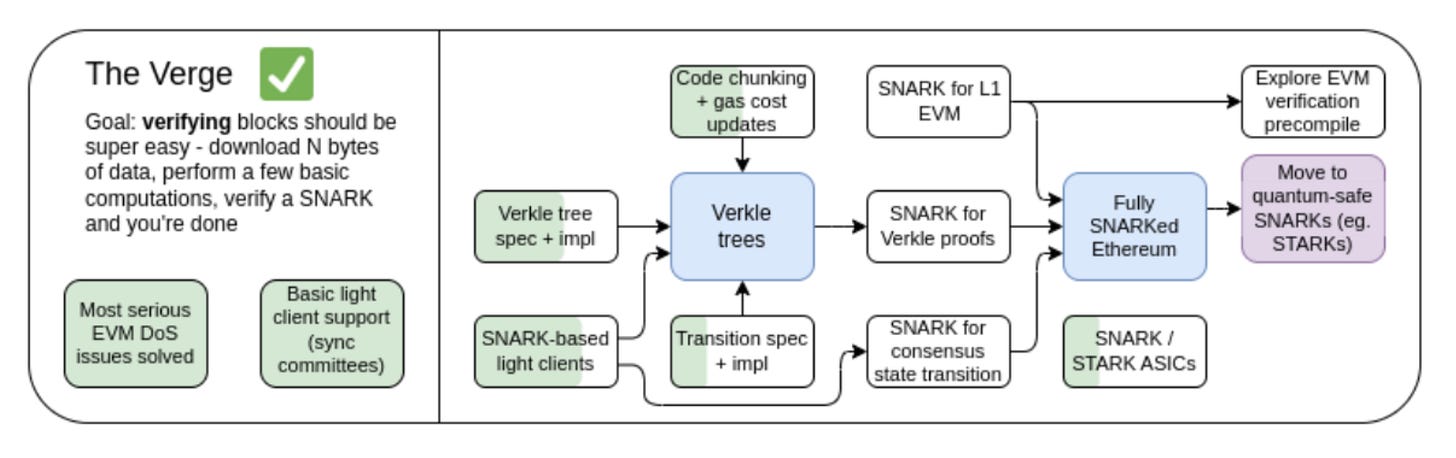

Part of this is normal. The crypto space is evolving from blockchain software engineer language to more mainstream user facing applications where all that technical language becomes secondary and a niche. Vitalik has not understood that yet. He’s still stuck in the past. I mean, look at the below ETH roadmap.

Crypto is no longer just a niche for nerds concerned with the byzantine generals problem. It outgrew that stage years ago. Therefore, bet on where users are going, not tech jargon.

So far, Solana won this game, but more will come to compete here. That’s where you need to put your money. Which brings me to my last point.

DEX > CEX

In the past, centralized platforms like crypto exchanges were kings and dominated the market. Part of the reason was that they offered users an easy interface to get into crypto.

However, in recent times, decentralized applications are starting to compete or outperform centralized platforms in terms of user experience and costs. This is becoming more obvious by the day.

I wrote a full post about one such example in Alpha Post #52. Plus, the TRUMP token was launched in January using solely decentralized tools. Traditional exchanges were left out in the cold scrambling to get exposure.

Over time, I expect decentralized applications to dominate the market and take over from current incumbents which are mostly centralized. The growth in DEX trading volume also shows that, having a noticeable increase in 2024 (see chart).

Why trade on Binance when you can do the same on a decentralized platform where you are rewarded to do so or can benefit from a share of the profits by simply using said app? Moreover, you always have full control over your crypto assets and the user interface is even better. Here, AAVE also stands out.

This brings me to the final point.

Invest in crypto ecosystems that blend decentralization with smart user-facing applications that rival Solana. Those will be the winners of tomorrow as centralized entities are too slow to innovate and keep up.

Solana is leading today, but they have two huge problems. Their network is centralized and they are diluting their ecosystem with millions of tokens which have already saturated the market. Stay on the look out for new ecosystems that will do better. I touched on that as well in Alpha Post #53.

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

Thanks, very educational and veré assertive.

GM Duo. Do you think that a solution to this dilution is that people get jaded and then start moving their money away from memes, away from garbage blockchains and ecosystems into projects that are decentralised with good UI and UX?

So, when that happens, we have an altseason for those select altcoins?