STOP Buying that Altcoin if You See This!

Here are six signals that should turn you away from buying that altcoin.

Over the years, I’ve learned to spot when an altcoin is a trap. In this guide, I’ll show you my top six signals with real examples:

Hype cycle is over (price exhaustion)

Fundamentals changed (they never worked)

Rebranding (the original failed)

Privacy focused (prone to banning)

Does not hold its own IP (everyone gets rekt)

Extractive tokenomics (a rug in slow motion)

The last part under point 5 will surprise you. Let’s begin.

Hype Cycle is Over - SOL

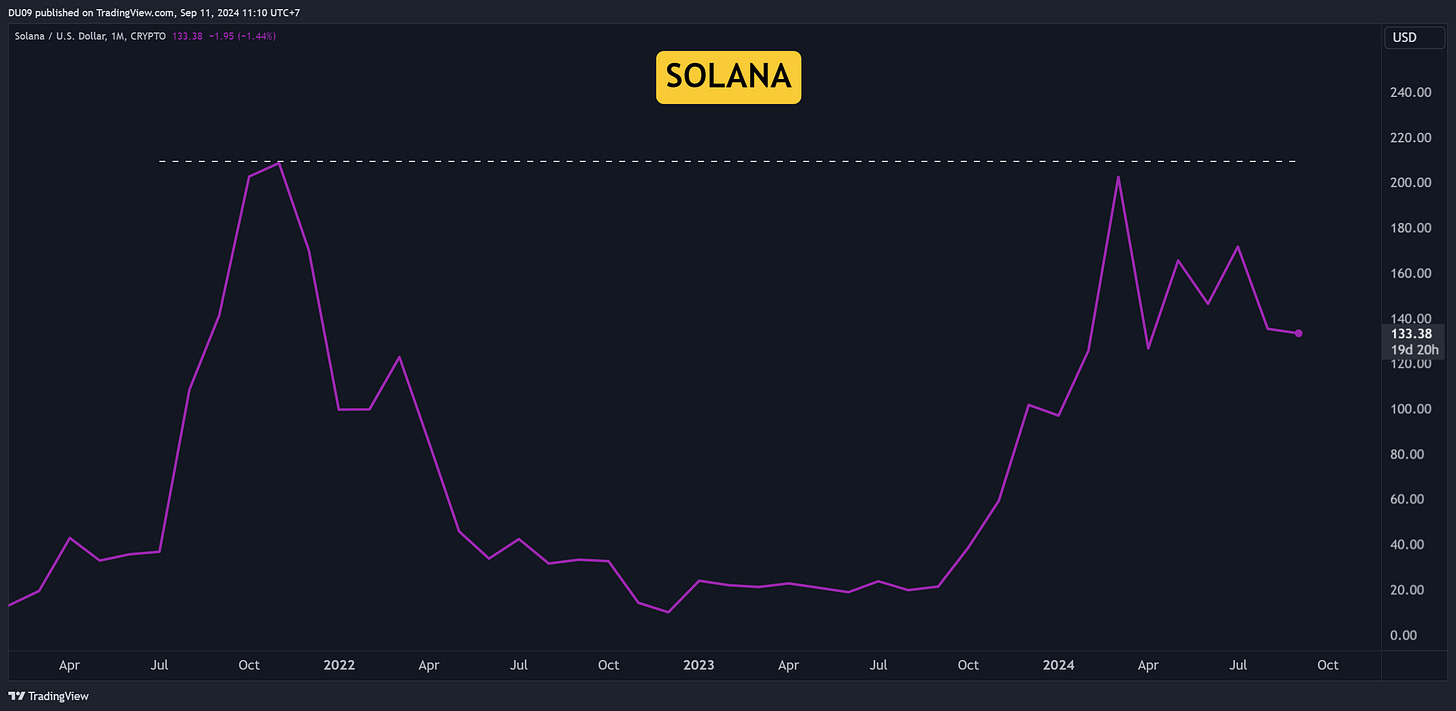

A good example of this is Solana. Since its 2022 bottom, SOL did a 25x and reached the top five biggest cryptocurrencies by market cap. Some charts suggest this coin already topped in this cycle.

If you take an objective view, the biggest gains on Solana were already had in this cycle. The price can still pump from here, but you’re already late to this party. This is why I avoid such coins. If you’re late in the hype cycle, seek better opportunities. Being early is how you win at crypto and being late is how you lose.

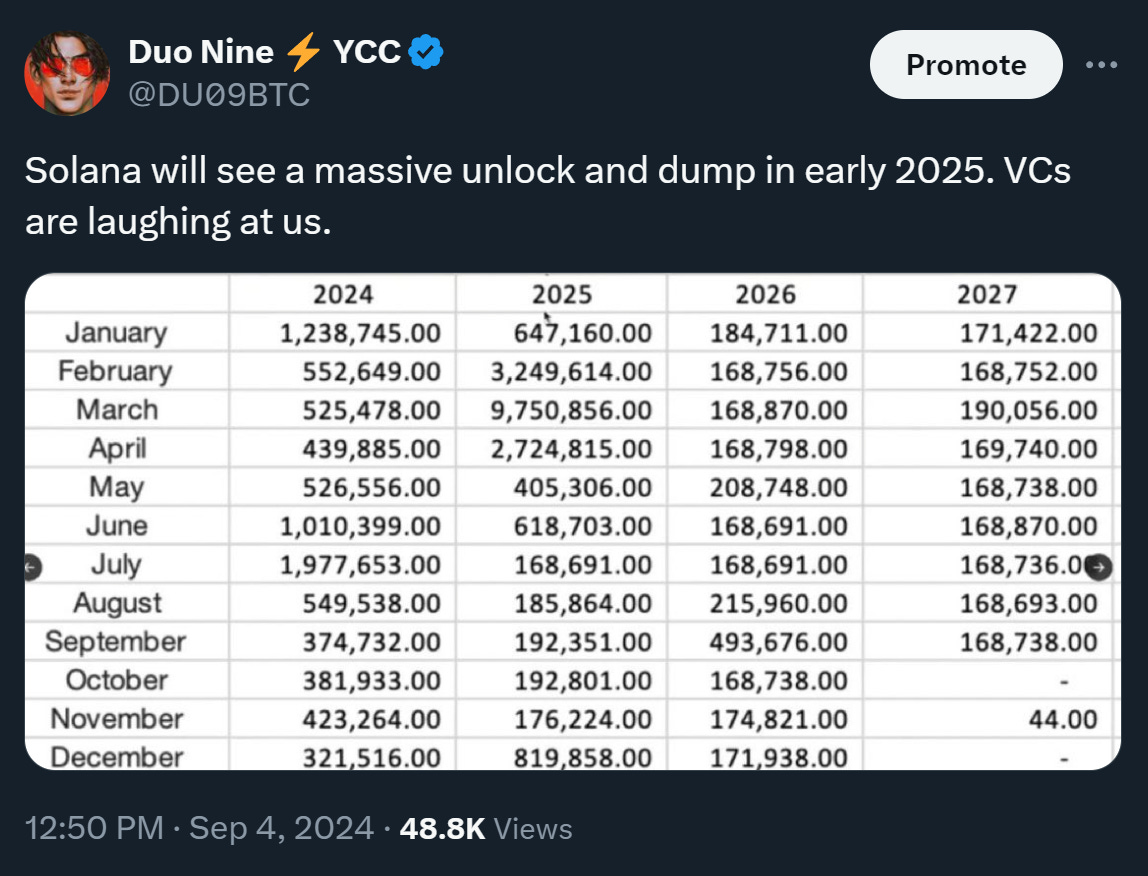

Joining the Solana train when the big boys (VCs) are exiting will most likely leave you holding the bag. Just look at the above unlock schedule for SOL tokens. Millions will be dumped in early 2025. You don’t want to be there when it happens.

The other related argument is price exhaustion.

Even if Solana did a 25x in terms of price (from its 2022 low at $8), it never did a new all-time high to date. This should concern anyone that is still bullish on Solana. Remember the rule: higher highs = bullish; lower highs = bearish.

Ethereum suffers from the same problem in this cycle. It didn’t do an all-time high. Thus, whenever you spot this with any altcoin, treat it as a red flag and re-consider your investment, particularly if Bitcoin made a new high.

The reason Solana’s price could not break into new highs is because of inflationary tokenomics. They simply printed too many new tokens from thin air and inflated the market cap which already did a new record. Interesting, right?

Solana may have topped already in this cycle based on the above chart. The name of the actual coin is irrelevant. Whenever you see such price action, stay away.

Fundamentals changed - KUJI

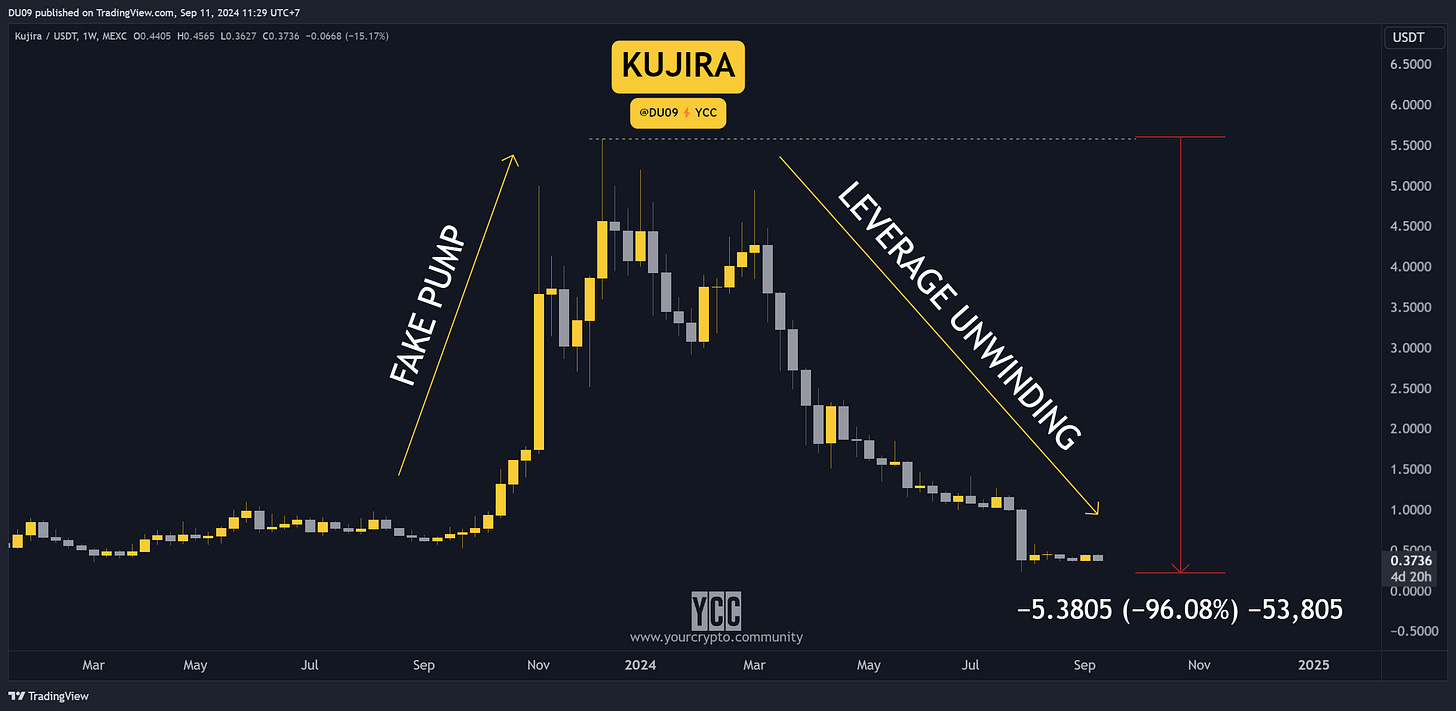

Kujira showed a lot of promise in this cycle, it did a 15x from its lows and then everything went wrong. The price crashed by 96% and the whole project was reformed. Should you invest?

No.

Whenever you see a project turn bad. Stay away. Do not touch it again.

Kujira’s 15x pump turned out to be on fake money and leverage. The team basically used users money from their ecosystem to leverage their token price. When the market turned bearish, their ecosystem became insolvent.

Over $4 million in users money was locked (or lost). However, someone decided to bail them out and acquire the project! People got excited again. Should you invest?

No.

The guy that bailed out the project decided overnight that he will move the Kujira team to building RUJI. This is a new token and anyone that holds KUJI tokens can convert to RUJI with a catch.

If you have 100 KUJI, you get 50 RUJI or a 50% haircut. After a 96% price drop, KUJI holders were rugged again with no say in the matter. When a project fundamentals, ownership, or focus makes a massive shift, expect the worse.

Moreover, Kujira’s original team leader left after the price implosion drama. He probably left rich and no longer cares about Kujira. His job was done. The new owner has other plans for the remaining team and the KUJI token was left dead in the water.

These changes expose two things:

When fundamentals change and team members are leaving, treat that as a red flag and consider bailing.

Most crypto projects are “decentralized” in name only.

In Kujira’s case, one person decided the fate of all token holders TWICE! The original team leader gambled with their users money and the new owner decided unilaterally to drop the KUJI token.

It’s hilarious to think Kujira had a governance structure and Kuji stakers could “vote” on decisions in their ecosystem. It was all a front and lie. One person, with the press of a button, could take everyone’s money.

Now realize this is the case in probably 95% to 99% of all crypto projects. If your money is not on the Bitcoin or Ethereum networks, it is at risk due to such centralization of power.

Rebranding - MATIC / MAKER

Rebranding in crypto is a fancy way to say the project failed or the original scope is no longer relevant. Rebrands are usually marketed as a big reason to invest in the project due to bold promises. It’s not.

A good example of this is MATIC or Polygon. They rebranded into POL. The new name sounds worse than the original. Regardless, MATIC failed to capture market share and was overshadowed by other Layer-2 chains like Arbitrum or Optimism.

Its price is also at bear market bottom levels. The rebrand did nothing to change this price action. Don’t expect a name change to fix it either.

The thing with Layer-2 networks built on top of Ethereum (like MATIC) is that they do not need a token. It has no use case and is redundant. Why do you need MATIC tokens when you can pay fees in ETH or USDT on its network?

A rebrand won’t fix a useless token. Treat it accordingly.

A more interesting rebranding case is MAKER or the creators of the DAI stablecoin. They recently rebranded MAKER to SKY and DAI to USDS. They are so clever with their language that they say DAI was “upgraded” to USDS.

Changing the DAI stablecoin name to USDS may not be such a bad choice if you want mainstream adoption because the average Joe will have no idea what DAI is, but USDS may give him some ideas.

However, USDS is not better than DAI. It’s actually worse if you go back to the original vision of DAI. You see, DAI was created to serve as dollars no one could freeze/block/take away from you because it was decentralized. With USDS they can.

MAKER team decided they want to be greedy and leave their niche. To do so, they had to discard their old vision for DAI and change its name to USDS that allows centralized authorities to freeze those dollars on request.

This is similar to how Tether (the creators of USDT) or Circle (the creators of USDC) can freeze their stablecoins on demand in anyone’s wallet if they have a reason to do so. You could argue MAKER decided to take this route for compliance reasons and to reach mass adoption.

However, DAI actually had a unique use case and brand among a sea of centralized stablecoins. Now, they just became another centralized stablecoin. Granted, DAI is not dead and will continue to exist, but the team has moved on to better cows to milk.

Perhaps this will allow a new decentralized stablecoin to fill the gap created by DAI.

Privacy focused - XMR / TORN

While privacy focused coins are attractive, they have one major downside. They usually end up being banned or delisted due to compliance reasons. I don’t recommend such investments.

On a fundamental basis, Monero or XMR is a great coin. Its privacy features are one of the best in the space. However, that also makes it a target for regulators. This is why it was delisted by Binance.

Simply put, fundamentals become irrelevant if your favorite token or coin cannot be traded due to regulations. If you’re looking to make a return on your investment, then buying privacy focused coins is likely a bad idea.

Another example is Tornado Cash. The developer of this project was arrested and the site banned because of illegal activities where stolen ETH was mixed in order to wash it. The associated TORN token did well until regulators banned the site.

The problems with such sites or any privacy-focused coins is that while they have legitimate use cases, these can also be abused by actors for illegal purposes to cover their tracks. Since there is no way around this, regulators simply ban or delist such projects irrespective of their legitimate use cases.

We all love privacy, but if you want to make money, don’t invest in that area. It usually ends badly.

Does not hold its own IP - WRLD / ATOR

Crypto is a wild west and part of that includes projects that work with intellectual property (IP) that they don’t own or control. If such projects get any traction or success the lawyers start knocking on their door. Don’t invest in projects that don’t own their IP.

Imagine you create a new meme coin called Popeye. Everyone loves Popeye and the token pumps. However, there is a problem. Long term, this project is destined to fail because the owners of the Popeye brand are Warner Bros and they didn’t create this meme coin, nor endorse it. You don’t want to be sued, do you?

This also happened to NFT World or WRLD which was building on top of the Minecraft IP. Everything went well until the IP owners basically said they will ban any such use. The token quickly crashed afterwards and they “rebranded” by shifting focus. That didn’t help.

Another interesting example is ATOR which is building on top of the TOR network which is focused on anonymity online. In this case, the TOR community did not approve the use of its network in this way nor the release of any such tokens.

However, considering that the TOR network is decentralized, this is a bit of a more nuanced situation. This could also explain why the ATOR token did so well despite such headwinds. I mentioned this coin to our Patrons on Discord when it was around 10 cents! It did a 34x since that point. This is a rare outlier.

Always be mindful of IPs and if they can become a problem before you invest.

Extractive tokenomics - XRP / APT / ICP

Some altcoins are designed to be extractive. They have little use case, apart from serving their investors. There are too many examples to count, but a few will help illustrate the problem.

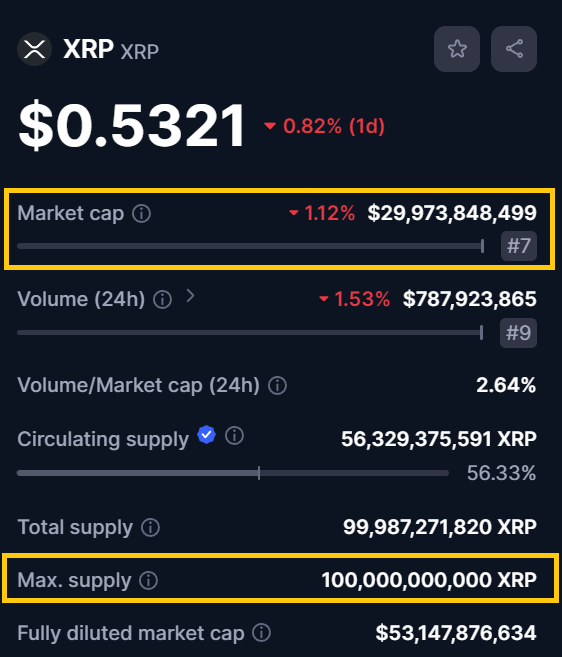

Coins with tokenomics like XRP, APT, or ICP are basically a rug in slow motion. Just look at XRP. They have over 50 billion tokens in circulation and a maximum supply of 100 billion tokens. They might as well say they have infinite supply like APT or ICP.

However, this is no accident!

A large number of tokens allows them to inflate their market capitalization. What that means is when you multiply the token price by the number of tokens you get astronomical valuations like the one for XRP at $30 billion dollars (at the time of this post).

Obviously that’s not real money. It’s fake.

The objective of doing this is simple. To get as high as possible on coin ranking sites like CoinMarketCap. XRP is ranked 7th, ICP 21st, and APT 27th right now.

The other reason is to have plenty of tokens to sell whenever the price pumps in a bull market. The insiders that hold most of the XRP, APT or ICP tokens do not care about the price that much. That is because they can sell almost an infinite amount of tokens to extract maximum value.

Whenever these type of tokens start pumping due to retail hype, their price fails to make a new high. That’s because insiders sell into all that buy pressure and absorb it. The price is irrelevant since they are farming those buyers. They can keep selling to infinity since they have infinite tokens.

Once they extract the amount they wanted or buy pressure fades, they stop so they don’t let the token crash to zero. That’s the whole point of these tokens. Their official use cases are like the “decentralized” label on Kujira’s site (see point #2).

Understand that such projects don’t care about their token price. Their use case is to extract and sell into any buy pressure whenever it comes. While retail hopes for certain price targets to be hit, these folks sell you the tokens they created from nothing. It’s a very smart way to take your money, legally.

This newsletter is made possible with the generous support of our community Patrons and partners. Upgrade your experience to show your support by clicking the subscribe button or reach out to us on X or Discord to partner.

All info is provided for educational purposes only and is not financial advice.

May I ask where you get the source of the SOL unlock data? I was not aware of the increase in supply in Jan and Feb of 2025, although I am aware of the cliff unlock from FTX in March.

Wow a lot of alpha and secrets here 💯💯