The best crypto exchanges in 2025!

Few can be trusted with your money.

There are not many crypto exchanges you can trust. Most trade against you and farm their users.

Time to expose how exchanges make money and which ones you can trust.

Before I will give you my review of the top crypto exchanges, I will first explain how they are classified and make money at your expense. Let’s begin.

Become a Patron for lifetime access to our exclusive private alpha on Discord!

Classification of exchanges

Tier 1 exchanges - top ones in terms of volume like Binance or Coinbase

Tier 2 exchanges - good for specific use cases, like avoiding KYC (e.g. MEXC)

Tier 3 exchanges - the rest, best to avoid them as they are high risk

Generally, it is recommended to stick with Tier 1 exchanges, but that does not mean they are the best ones. Regardless of their tier, they are all working to extract as much value from you as possible.

However, the lower their tier, the more shady their practices become in farming you. While Binance or Coinbase have enough users to be less aggressive in their extractive operations, that does not mean they don’t do it! More on that later.

If you plan to park money or coins into an exchange (which I don’t recommend), then only use Tier 1 exchanges. Tier 2 and 3 exchanges will likely block you or steal your money if you hold too much cash or are too profitable on their exchange.

Since Tier 2 and 3 exchanges also market themselves by not requiring KYC details (Know Your Customer) they can freeze and take your money at any time since you have almost no protection from such practices as a non-KYC user.

How do exchanges make money?

Let’s start with the obvious methods and then dive into the less obvious and mostly illegal methods.

Here are the classic ways exchanges make money:

They charge a fee when you trade (buy or sell)

They farm funding fees when users trade using futures

They liquidate users using leverage and farm liquidation fees

They lend money to users using leverage at a cost

They offer “earn” services which offer a lower APY than market rates and they pocket the difference

They sell you their exchange token (printed from thin air) for a fee discount if you hold said token (like BNB)

They hold your cash on which they may farm an APY without you knowing

While the above are legitimate ways to make money, most Tier 2 and 3 exchanges have very few actual users to farm. This is why they use different ways to generate additional profits, most of which are also illegal in traditional markets. Tier 1 exchanges may also use such practices, but have less incentives to do so.

Here are the less known (or legal) ways in which exchanges make money:

Their orderbook is fake. Whenever you buy or sell, you’re actually trading against the exchange trading desk. A recent example is Bitget which was accused by Hyperliquid of doing that. Essentially, such exchanges funnel the trading liquidity from users and farm them by providing less optimal rates on all trading pairs while they pocket the difference.

They trade against users. Exchanges know at what prices they can liquidate their own users so they artificially move prices until they farm that liquidity by triggering liquidations. In a nutshell, they liquidate their own users for profit. I believe almost all exchanges are doing this together with their market maker partners.

Stealing funds. If you’re too profitable on any Tier 2 or 3 exchange you will eventually be flagged and your assets frozen. That’s because you’re essentially taking money from the exchange since in most cases you’re winning at their expense as indicated in the above two points.

Farming project listings. The token listing prices vary by exchange from $5,000 to $500,000. Most exchanges also request tokens as payment, but they dump the token as soon as possible, crashing its price. Most exchanges do not provide any benefits for paying such a high listing fee. All they do is add a few lines of code so that the token is available to be traded on their platform.

Liquidity farming. Whenever a new token is listed, the token team also has to provide its own liquidity to the exchange by using market makers. These market makers have to be paid and the team has to provide a certain level of liquidity for their token. The exchange makes money from the trading fees paid by users and market makers. Exchanges take no risks. Worse, they may trade against you and your token.

Copy trading scams. The exchanges set-up fake user accounts which real users can follow using their “copy-trading” feature. These fake accounts show huge profits. These are also fake because any losses are removed from the profit calculation. Real users lose money and the exchange profits from that.

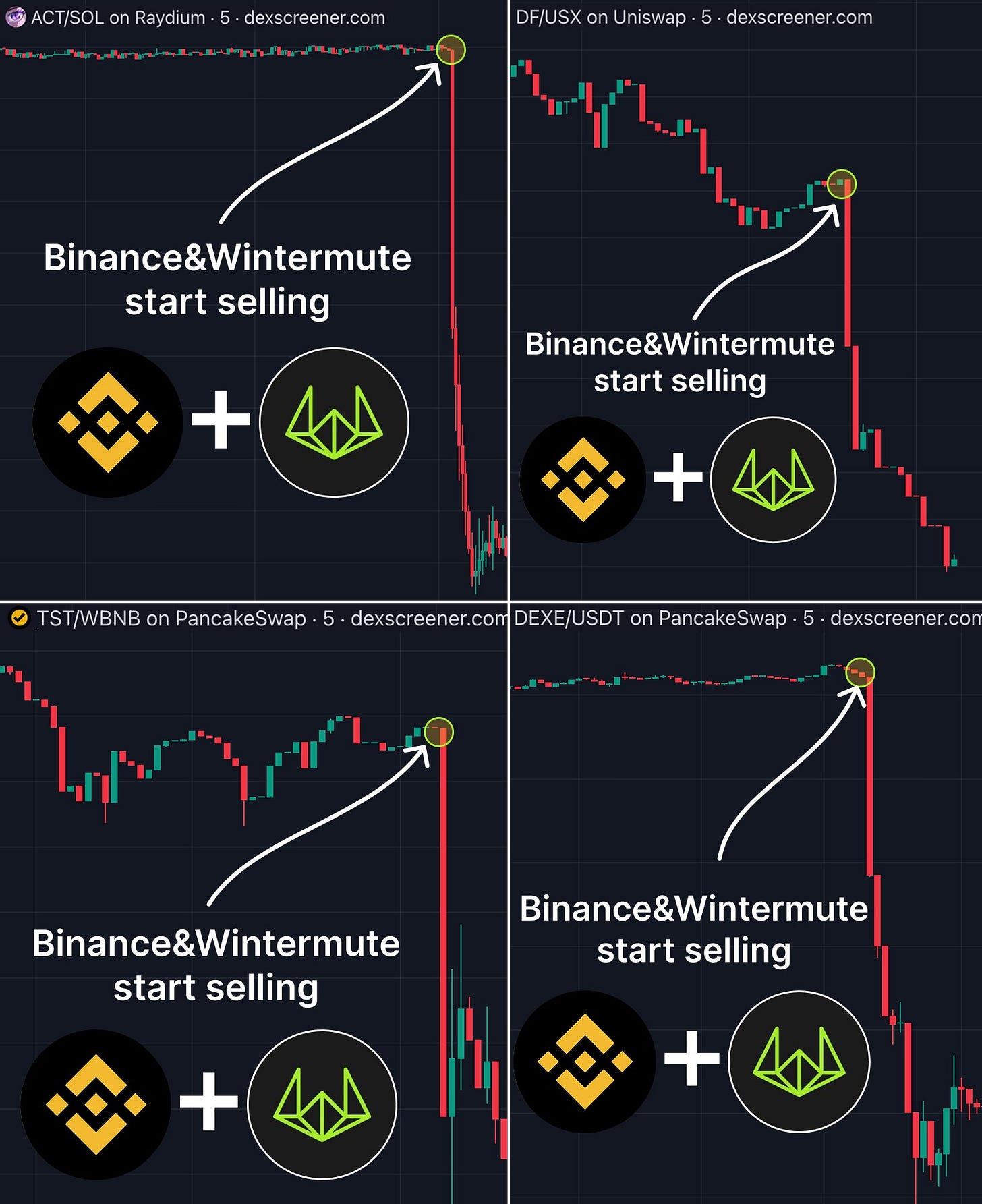

Plain market manipulation. Binance has been listing many low market cap meme tokens recently. The listing announcement pumps the token price outside of Binance. Before that, insiders (or market makers like Wintermute) are already loaded up. Once listed on Binance, the token crashes as Binance users are used as exit liquidity. This is a common practice with large exchanges.

Exchanges sell their users in various forms. One example is to pool all user liquidity or trading activity and sell it to another platform for a fee. This was done by Robinhood in the past. Another way is to sell users to projects looking to list on said exchange with marketing language like “We have 2 million users ready to buy your token”. Most of those users are fake of course. Another example is air-dropping tokens from various projects to their fake users as a marketing campaign. Since most users are fake, those tokens are dumped on the market immediately after. Real users and project teams lose.

The above list is not exhaustive and there are plenty of other methods used by exchanges to farm their users. As you can tell by now, it’s quite obvious that the most profitable way to farm users is not by charging them a trading fee, rather it is by doing things that are not immediately obvious to unsuspecting users.

If you like to learn more about such practices, join our Discord and send me a message. We also have hundreds of Patrons there with a lot of market experience.

The best crypto exchanges in 2025!

Let’s first look at the most reputable exchanges, their advantages and disadvantages, and then I will select my top three at the end.

Binance - this is the best if you want deep liquidity for your trading. Perfect for non-US users. However, their recent listing practices, and generally since CZ stopped being their CEO, has eroded their level of trust among users.

Coinbase - while this is the to-go exchange for crypto newbies in the US, it is extremely expensive in terms of fees and has poor internal security. Many users have been drained or hacked by impersonators that got access to their data.

Kraken - one of the best alternatives to Coinbase and Binance. While liquidity may not be as high, their leadership is very much following the ethos of Bitcoin and Satoshi. It also has much better fees than Coinbase which makes it ideal for US users.

Bybit - a great platform for futures trading. However, they were recently hacked and lost over a billion in ETH. While the exchange remained solvent, I don’t recommend it after this event.

OKX - similar to Bybit, but with a better user interface. They saw good growth after their rebrand into OKX and leveraged their crypto wallet and the NFT space quite well among users.

MEXC - great if you don’t want to KYC, but be careful if you’re moving size on this exchange or are too profitable, they may freeze your funds. They are also famous for dumping most project tokens after listing.

Crypto.com - they diluted their users via their CRO token and also farmed their users with their crypto cards which they pulled out from the market since. Would advice caution based on these practices.

KuCoin - used to be great, they had management problems and they no longer command the influence of the past. There are better alternatives today.

Bitfinex - one of the older exchanges. Great for trading, but not the best entry point for new users to the space.

Bitstamp - one of the oldest exchanges with a focus on Europe and EUR pairs. Good for newbies, but fees are high. Best to seek alternatives if you’re more advanced.

Bitget - they were accused of trading against their users, best to avoid.

Upbit - good exchange focused on the South Korea market.

Gate.io - good exchange focused on China and Asia market.

My top three exchanges:

Binance - still the best overall if you are a non-US user

Kraken - the best if you are from US or don’t like Binance

OKX - a great all-around alternative

Let me know which is your favorite exchange in the comments. While I spoke only about centralized exchanges in this post, it’s best you also get comfortable with decentralized exchanges like Hyperliquid which allow self-custody.

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.