The bull market is coming. Asymmetric bets you can't miss! #17

Don't be on the wrong side of this market. Plan now for the next bull run. Here is how to build your portfolio and action plan. Execute your exit when FOMO starts.

As I watch the price action, the obvious is staring in my face. The bear market is over and it’s time to plan for the bull market. Some bulls are calling for all-time highs (ATH) this year. Bold.

What could be even better than that? Finding the best asymmetric bets in this market.

They should reward you well if you start planning now. It’s irrelevant when the market will do a new ATH. What matters is that you are well positioned. Then all you need to do is… wait and execute your exit.

Are you with me? Let’s go.

This newsletter is sponsored by AmazeWallet, a third generation blockchain!

Before talking about asymmetric bets, we need to do some due diligence together. All good things in crypto start with a minimum level of risk management.

Time for your own self-assessment.

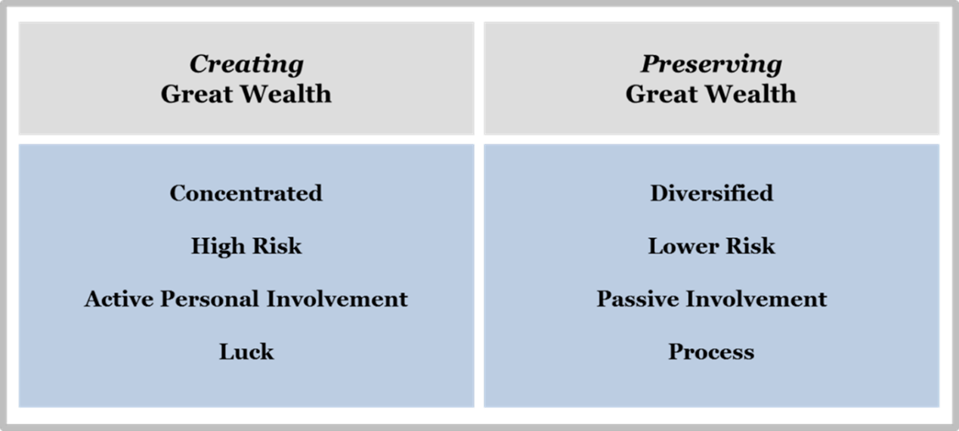

You need to place yourself on the wealth continuum. Imagine the continuum as a long horizontal line. On the left side is wealth generation and high-risk picks. On the right side is wealth preservation and low-risk picks. The mid-point is 50/50. Time to find your ratio.

Are you on the wealth generation side or wealth preservation?

Wealth Generation vs Wealth Preservation

I assume most of you are on the wealth generation side. This has consequences in terms of risk. The above table gives you a good map on where to place your portfolio risk profile. Notice that on the left side it also says luck. Keep that in mind.

To further refine your self-assessment, I give you another benchmark.

Your portfolio, under or over $100,000?

Portfolio is under $100,000:

Your focus is wealth generation. This means high-risk plays, particularly if you have $10k or less. If you get lucky, don’t get cocky. PROTECT those gains.

Portfolio is over $100,000:

Your main focus is to PROTECT your capital and wealth. That is paramount. Anything less is being irresponsible.

With this in mind, we can build a portfolio profile for you.

Let’s start with with wealth preservation, then move to wealth generation, and then degen mode. Adapt these to your case and remember the wealth continuum ratio from above. If you have $1 million or more to spend, consider an allocation of 80% in Bitcoin, if not more.

Wealth preservation portfolio (over $100,000)

50% - BTC (low risk, wealth preservation)

20% - ETH (medium risk, wealth generation)

20% - Altcoins (high risk, wealth generation)

10% - Gold/Cash (no risk, wealth preservation)

Your aim here is to 2x to 5x your money within 1-2 years. In this set-up, 60% is in low risk assets (low risk by crypto standards). Bitcoin is at 50% and up to a 5x is realistic in the coming bull market. Ethereum should outperform BTC and so should quality altcoins. Your real risk is 20% in altcoins, but one good pick (10x return) can offset much of the downside risk.

The gold/cash position is there to give you a buffer in times of need or serve as liquidity in case of new crypto narratives (see tips section below). Until then, put the cash (USD) into money markets with a 4-5% yield.

Wealth generation portfolio (under $100,000)

50% - Alts (high risk, wealth generation)

30% - ETH (medium risk, wealth generation)

20% - BTC (low risk, wealth preservation)

Half of your portfolio is aimed to 10x your investment or more. The second half is there to get good growth, but also protect your wealth. Be smart and when you 10x on an altcoin, sell it into BTC or Gold. Nothing else. Don’t overtrade or get greedy. Hold those profits a minimum of one year, don’t lose them gambling a FOMO market. You buy in the next bear market.

Degen portfolio (under $10,000)

100% - Alts (high risk, wealth generation)

Your aim is to 10x or even 100x your portfolio. Always pick a high probability 10x over a low probability 100x. Aim to make enough to buy 1 BTC. Never sell that BTC. It will get to $1 million one day. You will then borrow against that BTC as much as you need (never sell it, it’s your retirement). That is your final goal.

In this scenario, you’re on the left side of the wealth continuum, or rather, you just fell off its left edge. Get it right and it can be life changing. Get it wrong and you can live to try again another day. Don’t do this with money you need. Don’t be that guy.

Asymmetric bets

Asymmetric bets are coins or tokens (there is a difference!) that have a good probability to significally increase in price in the next two years. The ideal risk / reward ratio should be above 1:3 or ideally 1:10 or more. This means you risk $1,000 to get $10,000 back and you do not lose that profit due to greed.

Now some juicy examples:

BTC

Considering Bitcoin is about to experience a DeFi boom on its network (e.g. ordinals, inscriptions, stamps), you don’t want to miss out on the best asset in the world. For any traditional investor (TradFi), Bitcoin is already an asymmetric bet.

ATH: $69,000 | Today’s price: $30,500

Take profit: over $129,000 (4x conservative target, never sell all your BTC)

ETH

Any wealth generation portfolio should have ETH. This is the altcoin king. For degens with some risk management sense, I still suggest at least 20% in ETH. A lot of Layer-2 solutions are built on top of ETH (like Arbitrum). This is bullish for Ethereum.

ATH: $4,860 | Today’s price: $2,100

Take profit: over $9,000 (4x, could go higher)

KUJI

One of the top real yield tokens and autonomous networks in the Cosmos / ATOM ecosystem. KUJI has its own liquidation engine (Orca), stablecoin (USK) and decentralized exchange (FIN). Their dev team is one of the best in crypto. If you are interested in ATOM, you may be better off finding a gem in their ecosystem. KUJI is one of them. Plus it does not inflate like ATOM.

ATH: $4.8 | Today’s price: $0.7

Take profit: over $9 (13x, easy 2x from ATH)

LQTY

If you are bullish on Ethereum, then LQTY is a no brainer. This token accrues the feed from all LUSD vaults to its holders. LUSD can only be minted against Ethereum and its market cap exploded recently after the Binance listing. LUSD minting also exceeded that of DAI. Decentralized stables are in high demand!

ATH: $73 | Today’s price: $2.4

Take profit: over $15-$30 (6x - 12x, ATH was with low token supply)

AR

Arweave stands out with its unique use case as a permanent and immutable wikipedia. A permanent information storage blockchain. Low token supply too. Yet, Bitcoin may compete with this due to the launch of BTC inscriptions.

ATH: $91 | Today’s price: $9

Take profit: over $190 (21x, only 66 mil tokens)

LINK

The GMX exchange will pay Chainlink for their oracle services. If LINK starts accruing real yield to its holders from other similar partnerships, then it will run.

ATH: $53 | Today’s price: $7.8

Take profit: over $90 (11x, if their real yield bet works)

API3

Similar to LINK and focuses on connecting real-time assets prices across different networks with apps in Web3. An expanding market is bullish for API3 due to new demand.

ATH: $11, Today’s price: $1.7

Take profit: over $19 (11x, easy 2x from ATH)

CRV

crvUSD is about to launch. That is a decentralized stablecoin by the de-facto leader in stablecoin trading. Considering the fundamentals, Curve Finance and its CRV token should do very well in the coming bull market.

ATH: $55 | Today’s price: $1

Take profit: over $9 (9x, CRV supply has increased a lot since ATH)

RUNE

RUNE is a momentum coin, once it runs, it will be fast. Thorchain is now also offering real yield to native BTC and ETH liquidity providers on their saver vaults. As their ecosystem grows, this should perform well.

ATH: $21 | Today’s price: $1.7

Take profit: over $18.9 (11x, sell under ATH)

DOGE

Don’t dismiss the Elon Musk effect. Meme coins have outperformed other coins with real use cases. Dogecoin will run again. Don’t ignore it.

ATH: $0.74 | Today’s price: $0.09

Take profit: over $0.99 (11x, sell after new ATH)

KSM

After a great run last cycle, Kusama is a key token to watch if you are bullish on the Polkadot (DOT) ecosystem. With under 10 million tokens, this token stands out.

ATH: $624 | Today’s price: $38

Take profit: over $390 (10x, ATH levels is ambitious)

GMX

GMX is the governance and utility token of the decentralized exchange with the same name. GMX should continue to accrue a lot of value so long its exchange remains a market leader. Watch Arbitrum (ARB) and Avalanche (AVAX) too, two blockchains on which GMX is built.

ATH: $89 | Today’s price: $88

Take profit: over $490 (5x, market cap is already large to push 10x)

UNI

Uniswap failed to accrue real yield value to its token. This could change as they innovate more and try to replicate the success of other real yield tokens. Good to keep some exposure just in case they can pivot well. Uniswap is also one of the biggest decentralized exchange on the market.

ATH: $45 | Today’s price: $6.3

Take profit: over $39 (6x, sell before ATH)

AAVE

The market leader to borrow and lend. As a liquidity protocol, many other protocols plug into AAVE for their various needs. This won’t change and their token should continue to perform considering it has only 16 million total tokens.

ATH: $670 | Today’s price: $83

Take profit: over $490 (6x, sell before ATH)

What about ADA, XRP, MATIC, SOL, DOT, LTC and so on?

If you plan to buy the top 10 or 20 coins by market cap, you are better off buying the market leaders: BTC and ETH. Why buy LTC when you can buy BTC? Why buy MATIC / SOL / DOT / ADA when you can buy ETH? Buy the best, forget the rest. Only buy the best or coins with unique use cases. Remove the noise.

What other altcoins stand out? Leave a comment below.

Advice & Tips

Avoid copy-cats and seek real utility and innovation. Buying copies of good protocols or coins will not make you a winner. Buy established winners instead. Like BTC and ETH. Also avoid inflationary tokens as much as possible (e.g. APE, CAKE, ARB, OSMO) since they dilute too fast any gains.

The crypto market moves in narrative cycles. If you spot an emerging narrative early, getting exposure and selling the FOMO is an excellent strategy to book quick gains. Sometimes, buying that meme coin everyone speaks about (like Doge) may yield better results. Never hold narratives, sell them for BTC. Only hold BTC long term.

Prepare now before the FOMO starts. Have a plan.

During the bull market, you execute your plan. Most of the time, this last bit means you wait for your trigger sell points to be hit (ladder your exits). The time to act and position yourself is now. Buying during a bull market (FOMO) means you will be late already and taking on more risk than needed.

If your mother or friends start calling you about crypto, then you better start selling soon. They are an excellent top indicator.

Your allocation and choices of coins/tokens is up to you. The above list is indicative and there are no guaranteed results. Never blame others for your actions when you are the one pressing that buy or sell buttons. Use common sense and don’t fall for common pitfalls like greed, fear, FOMO, FUD or overtrading. Good luck!

Disclaimer: Nothing written in this newsletter is financial advice and all information is provided for educational purposes. Buying and selling cryptocurrencies involves substantial risks. YCC takes no responsibility for any losses incurred as a result of the information derived from this newsletter.

I do want to refocus my portfolio. But finding it difficult to convince myself to sell my MATIC, DOT for LINK and ETH. What about QNT, NEAR, HBAR and EGLD???