The Coming Bull Market: Dreams & Hopes

Where and when will Bitcoin top in the coming bull market? Here are my best guestimates.

With seven months left until the next Bitcoin halving (expected in April 2024), people are starting to wonder when the next bull market will start and how high will the price of BTC go this time around.

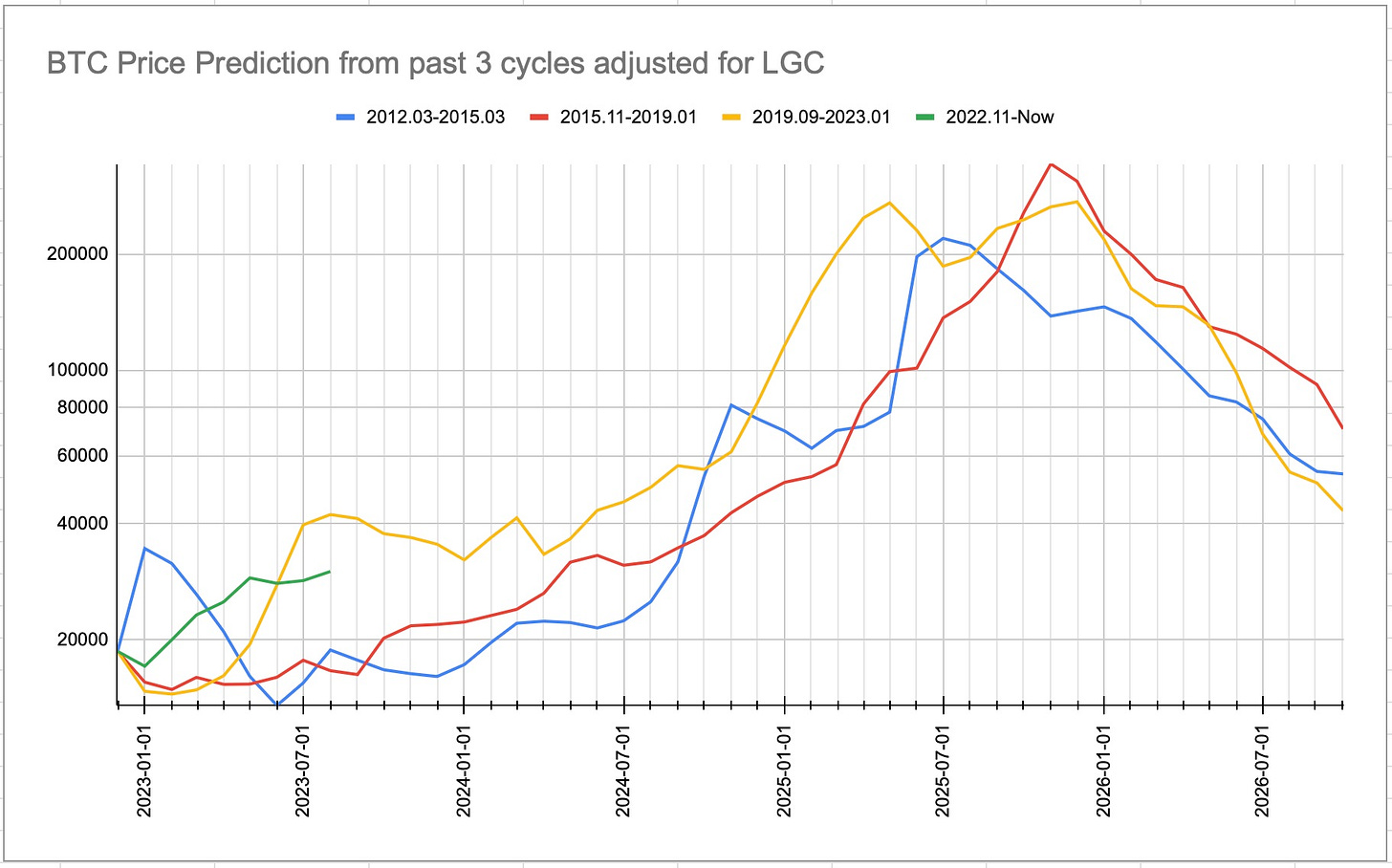

There is an interesting chart circulating on 𝕏 that plotted the current cycle against all past bull markets and the results deserve attention.

Let’s dive in.

Below is the current cycle (in green) plotted in relative scale against the past three bull markets. As you can see, we’re at the infancy of a new bull cycle that will really kick into gear after mid-2024.

This means that until the halving event in April 2024 (more on the later) and some time after it, there won’t be any significant rally to turn this market euphoric.

You still have almost a year to accumulate and get prepared.

However, after mid-2024, things could really start to heat up and in 2025 a new Bitcoin All-Time High (ATH) may be reached.

The next ATH could approach $200k sometimes in mid to late 2025. This seems both realistic and conservative.

More bullish takes could see it reach up to $250k or $300k. But I have even a more ambitious take, provided the stars align for Bitcoin.

The big unknown is the possible approval of several Bitcoin ETFs in the US. This does appear likely in the next two years and coincides with the timeline for the next ATH. If you don’t know what ETFs are, they stand for Exchange-Traded Funds that track specific indexes. In this specific case, we’re talking about an ETF tracking the price of Bitcoin. Every ETF share has to be backed by real Bitcoin.

Why is a Bitcoin ETF approval in the US important?

It’s because with a Bitcoin ETF available, big investment funds, pension funds, and really anyone can suddenly get exposure to Bitcoin. This is especially so for funds that were not able to do so to date since holding actual BTC is cumbersome for them in the current environment. This is a fancy way to say more people (with lots of money) can buy Bitcoin once an ETF is live = prices go up.

Worldwide, there are $115 trillion of assets under management (AUM) run by different funds. If a Bitcoin ETF is approved, then even if one big investment fund decides to buy Bitcoin, the others will have to do the same or risk becoming uncompetitive as BTC’s price goes up (this is inevitable). They will be forced by peer pressure to keep up and also get Bitcoin into their funds.

Any respectable fund that integrates a new asset into their portfolio will allocate at least 1% to that investment. Therefore, if 1% of the worldwide AUM is invested in Bitcoin in the next few years (around $1 trillion) the market capitalization of Bitcoin will triple on that alone (from $500 billion today to $1.5 trillion).

During the last ATH, BTC market cap reached $1 trillion. This was achieved thanks to retail buyers, venture capital, MicroStrategy and everyone else that has been around this space since 2009. A Bitcoin ETF will bring in new buyers which will be on top of the existing ones. Plus, there will never be more than 21 million BTC available. The only thing that can go up to keep up with the new demand will be BTC’s price.

In light of this, a $200k ATH could be too conservative.

However, we have no idea when an ETF will be approved and how quickly money will flow into Bitcoin. But once the gates open, the previous bulls cycles may pale in comparison as hundreds of billions will pour into BTC from different funds. Cathie Wood from ARK Invest made a similar point a while back (see video).

In such a scenario, the above predictions are blown out of the water and we need a new model. It’s hard to predict the top in the next cycle, but taking some profits around $200k is probably sensible. Remember, never sell all your Bitcoin.

A note on the halving event.

The most recent halving of Litecoin took place in August 2023 and that turned into a bearish event. LTC’s price fell by over 30% post-halving. This pattern was also seen on Bitcoin after the last two halving events, as the below graph shows.

I expect the price of BTC to rally prior to the halving in April 2024, but then correct and possible crash after it. Later, the rally will resume. Therefore, it’s best to buy well before the halving and sell just prior to it if you plan to trade it.

Pledge your support if you find my writing awesome. You won’t be charged until subscriptions are enabled. I will announce it when that happens.