This is How Much Bitcoin Will Pay You in 10 Years

If you start today, you're going to celebrate a decade later.

Now that you know how to earn a passive income in crypto, it is time to show you how much you can make with Bitcoin a decade from now.

Even the most conservative scenario will pay very well. TLDR at the end.

Become a Patron for lifetime access to our exclusive private alpha!

Before I show you how much Bitcoin will pay you, let me explain something important. Many so-called experts make the following mistake when talking about Bitcoin. They say that “it does not generate any earnings, revenue, or cash flow, its price is determined exclusively by supply and demand”.

That is false!

Worse yet, it shows a flawed understanding of crypto in general and a primitive understanding of Bitcoin’s role in this new emerging financial sector.

First of all, crypto is a new sector that digitalizes and brings the old and dated traditional finance to the age of the Internet. You no longer need to wait three days for a bank transfer from USA to Europe or Japan. Using crypto, this is now instant with almost zero fees and no third parties needed.

Secondly, Bitcoin is not just an asset to speculate on its price. It’s so much more than that. It is the base liquidity layer of everything built in crypto. Think of it as the Central Bank of Cryptocurrencies. When crypto prices crash, where is the liquidity of last resort coming from to absorb that shock? Bitcoin.

Thirdly, because Bitcoin serves as the base liquidity layer for this new sector, it will always be in demand, particularly in terms of providing liquidity to Decentralize Finance (DeFi) which has real use cases. AAVE, for example, is similar to a bank, but 10x better. Guess where it sources most of its liquidity?

70% of AAVE’s liquidity is from BTC and ETH assets.

That wrapped BTC or wBTC is generating around 1% in borrow interest per year on average and provides $2.3 billion in liquidity to AAVE users. This liquidity allows users to borrow say USDC to start a business, invest, or cover various expenses. These are real use cases driven by organic market dynamics.

The above is just one example. There are dozens if not hundreds of use cases for the Bitcoin network. Inscribing ordinals with art or text that can never be censored is another function of Bitcoin that adds real value.

Bitcoin is not some speculative asset living on an island disconnected from reality. It’s fully integrated into the world economy. With the ETFs approved and DeFi growing, Bitcoin will become one of the pillars of finance in the future. One that is predictable, reliable, and always serving as a key liquidity layer, among others.

That’s exactly what a thriving economy needs. Bitcoin is not tulips.

Do not worry about Bitcoin not generating any earnings. That’s the wrong approach. What you should worry about is not having any when it will be in huge demand years from now. Time to explain why.

The model

Based on Bitcoin’s historical price action, we can plot two lines. The Average Price (in blue) and the Lower Bound Price (in green). The blue line is the optimistic scenario and the green is the conservative one. This comes in handy to understand the next part.

The optimistic scenario - $10,000 to $20,000 per month

Based on its current price projection, within 10 years from now, you will be able to comfortably retire with Bitcoin. The optimistic scenario (the blue line) shows that with one Bitcoin in 2034 you will be able to withdraw between $10k to $20k a month and be fine.

To understand what I mean, read this previous post on the 4% rule. If you have more than one Bitcoin, you’ll be able to do that even earlier than 2034 based on these assumptions. Study the below chart and find your place on its scale.

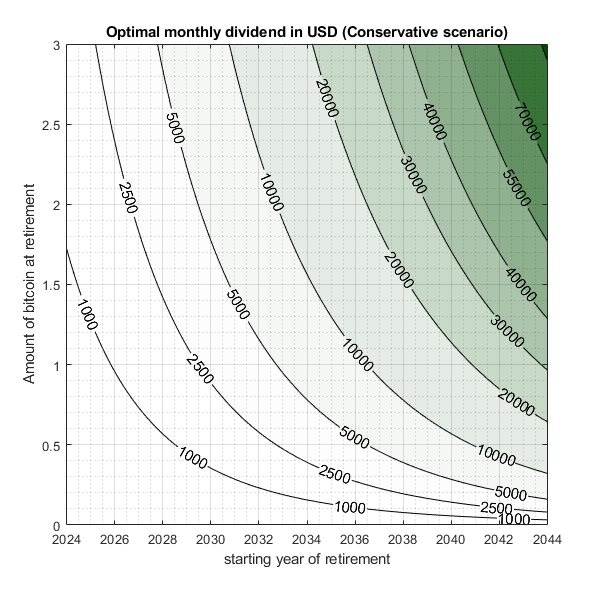

The conservative scenario - $5,000 to $10,000 per month

The conservative scenario (the green line) assumes Bitcoin’s price will not grow at its current average rate and slow down over the coming years. Nevertheless, even if we assume the lowest level of growth, you can still comfortably withdraw $5k to $10k per month by 2034 with one Bitcoin.

If you have more than one Bitcoin, you’re basically going for $10k or more per month even in this - less optimistic - scenario. Impressive numbers regardless considering Bitcoin is $62,000 today. Where was Bitcoin 10 years ago? Under $500. It is pretty clear where we are headed if this trend continues, right?

You won’t find anything in all of finance that can be as predictable as Bitcoin. Its price may be volatile on a specific day, but if you zoom out, Bitcoin is mathematically predictable due to its fixed issuance rate for the next 100 years. After some basic math, it quickly results in a price over a million dollars per coin in the next decade.

This is one of the best bets you can make with your future!

If you will have one or more Bitcoin a decade from now, you will be in a very exclusive minority. It is the ultimate asset. Don’t listen to those experts that dismissed it a decade ago already. Follow your gut instead.

TLDR & Tips to Remember

Don’t believe the experts, they’ve been wrong about Bitcoin since 2009

Bitcoin is the base layer of liquidity in crypto. Reducing it to a tulip is naive

Bitcoin is integral to Decentralized Finance and its multiple use cases

In time, Bitcoin will become a part of the real economy = mass adoption

Ignore the price volatility, focus on accumulating as much as you can

In 10 years, withdrawing $5k to $20k / month against your BTC is realistic

If current trends maintain, Bitcoin is a generational bet. Do not miss it

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page.

All info is provided for educational purposes only and is not financial advice.