Crypto Tokenomics and HOW to avoid common traps! #25

Six red flags with clear examples. Steer away from drowning by being smart with your money.

Whenever you decide on buying a new coin or token (there is a big difference between the two), take some time to study their tokenomics first. Such information is critical to inform your purchase or simply make you avoid it completely!

Here are six red flags you should always scout for during your research:

Inflation rate

Cap or no cap on supply

Circulating supply vs total supply

Number of coins or tokens

Distribution of tokens

Market cap (mcap) manipulation

In what follows, I will give you a breakdown of each. Hit that subscribe button to never miss out! Below also in video format! Enjoy.

First, know what you are buying.

Coins

These are native to their blockchain and operate on their own sovereign network. The best coins are proof-of-work ones whereby to generate or “create” one coin you have a cost to input in the form of energy (e.g. mining BTC or LTC). You can’t create them out of nothing (in contrasts to tokens). This is a good thing as it prevents abuse.

Other examples include XMR, ADA, XRP, DOGE or ETC (used to be ETH). The current form of ETH has moved to a proof-of-stake model. It takes no real costs to generate new ETH tokens now. This is bad.

Tokens

They don’t operate on their own native network and are issued on existing blockchains like Ethereum. With a few clicks and code lines any developer can generate out of thin air millions or billions of new tokens. They act similarly to coins, but there is usually no costs associated with creating them. A scammer’s paradise.

Examples include memecoins like PEPE, Shiba Inu and Floki Inu which are all on ETH network. There are also more legitimate tokens on ETH like stablecoins USDT, USDC and DAI. Other blockchains like BNB, SOL, ADA or ATOM have multiple different tokens within their ecosystem. Usually, best to buy native coins/tokens not derivatives (like BTC on Bitcoin, ETH on Ethereum).

With that out of the way lets dive into the red flags.

Inflation rate 🚩

Avoid buying high inflation tokens. At 100% it would mean the total supply doubles in a year. If everything stays the same that equals to a price crash of 50% per year.

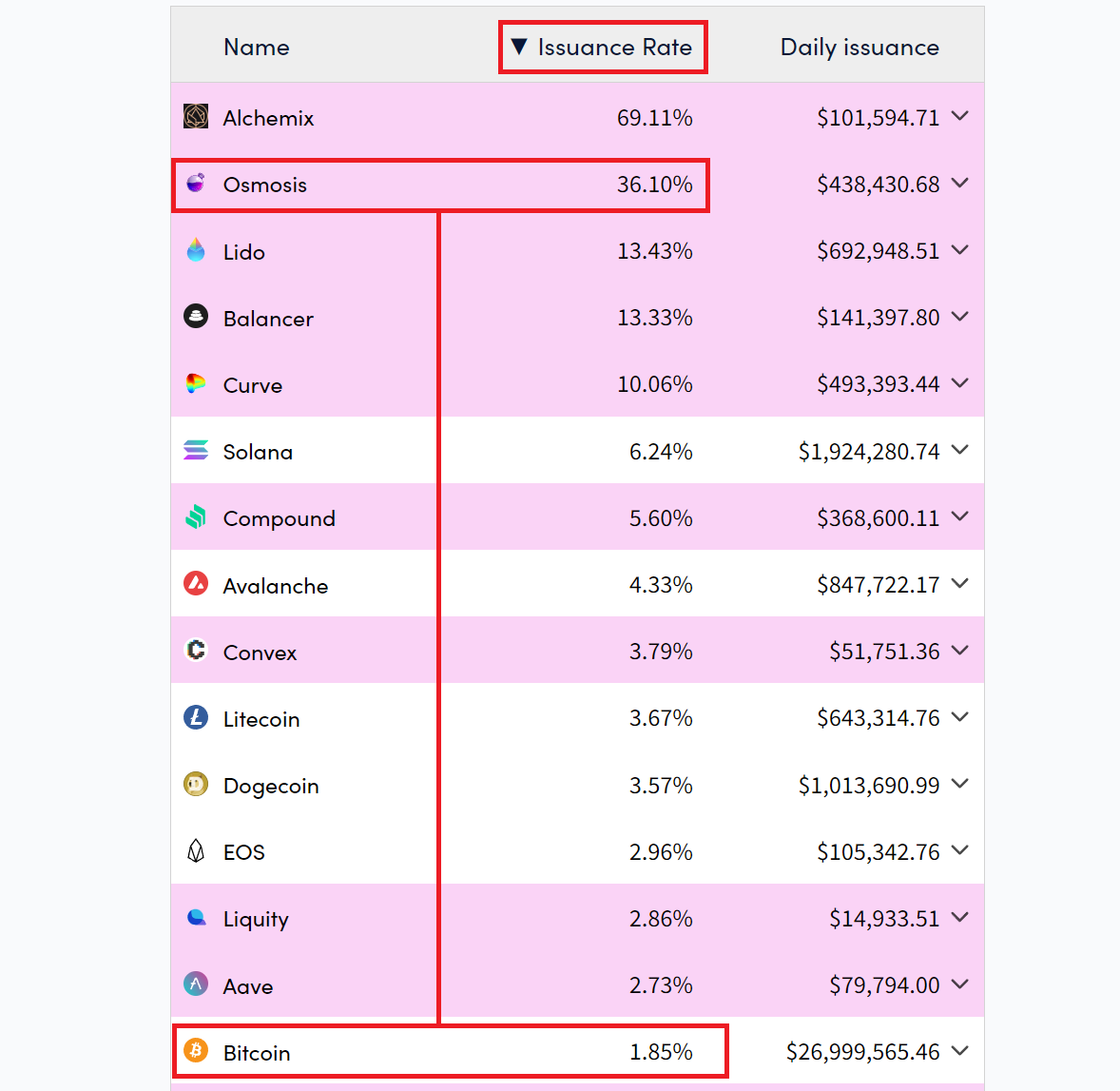

At 36%, OSMO is a poor long term buy versus BTC at 1.8%. The link to the table below is here if you want to study this more.

No cap on maximum supply of tokens 🚩

This is a red flag. Dilution will destroy the value of your tokens over time. Avoid holding for long periods of time. Speculate, sell for profit and forget.

ATOM is nice but has infinite supply and 10% inflation = Bad long term.

Circulating supply vs total supply 🚩

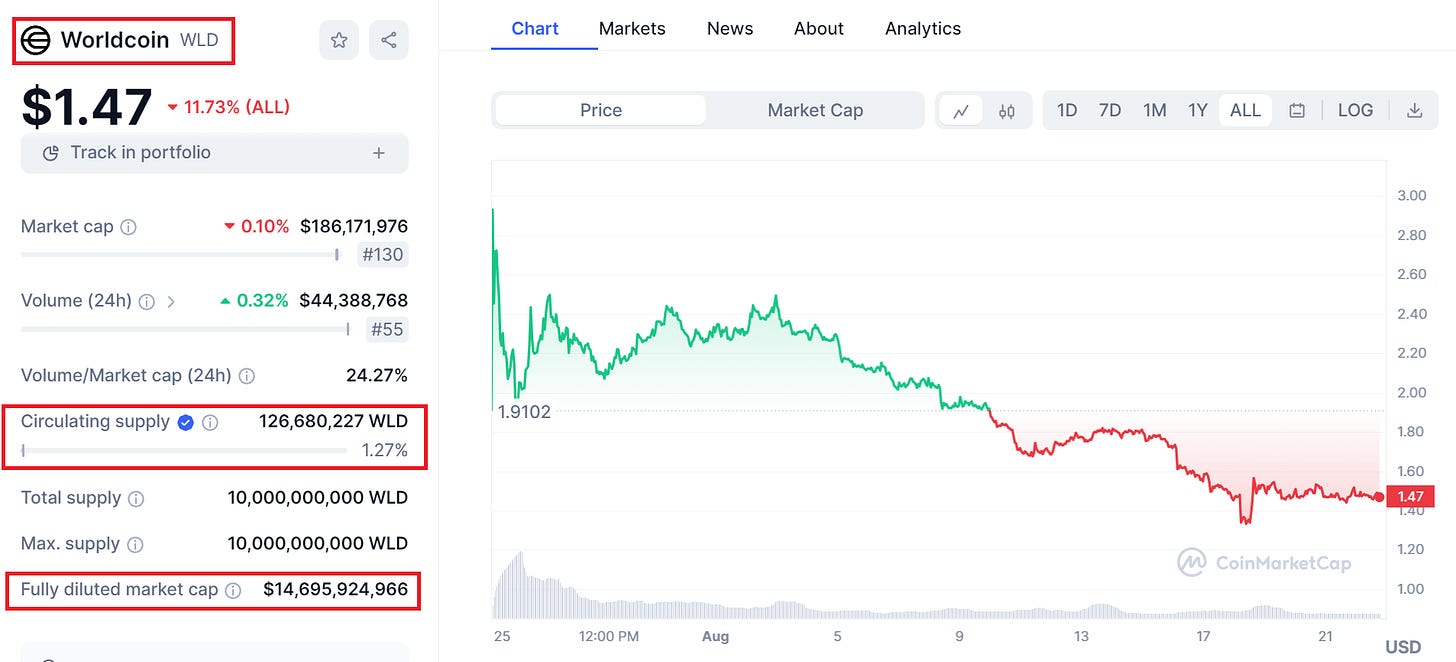

Avoid coins and tokens with low circulating supply. Another red flag. Worldcoin was shilled left and right and at 1% circulating supply, it's super easy to manipulate.

Why? The 14 bil mcap is inflated (fake). That is misleading.

Only 126 mil tokens are circulating (1%) not 10 bil. This makes the price easier to manipulate and overstate its mcap. This was also how FTX artificially overstated their FTT valuation on their balance sheet. They had "billions" in FTT tokens that were worth zero.

Don't fall for it.

Number of coins / tokens 🚩

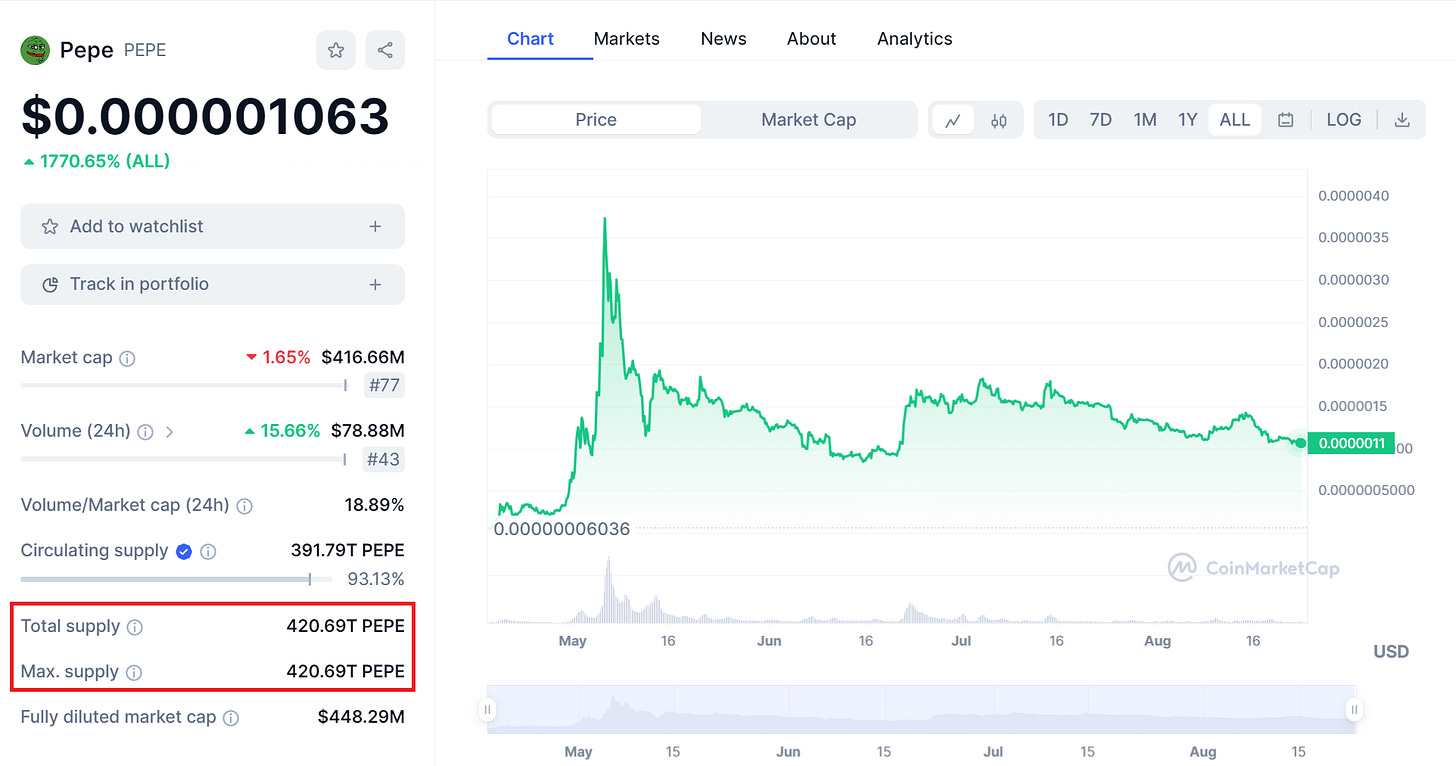

Another classic way to scam people is with a high supply of tokens. How? You make 1 token dirt cheap to buy. "Look mom I have 1 mil PEPE tokens, I am rich!" It's a psychological play.

PEPE has 420 trillion - TRILLION - tokens. The purpose is simply to make you spend any money you have on PEPE and feel good about your "inflated" bag with millions of tokens.

One PEPE token is worthless and has NO purpose. This is written on PEPE's main website. See pic below.

Distribution of tokens 🚩

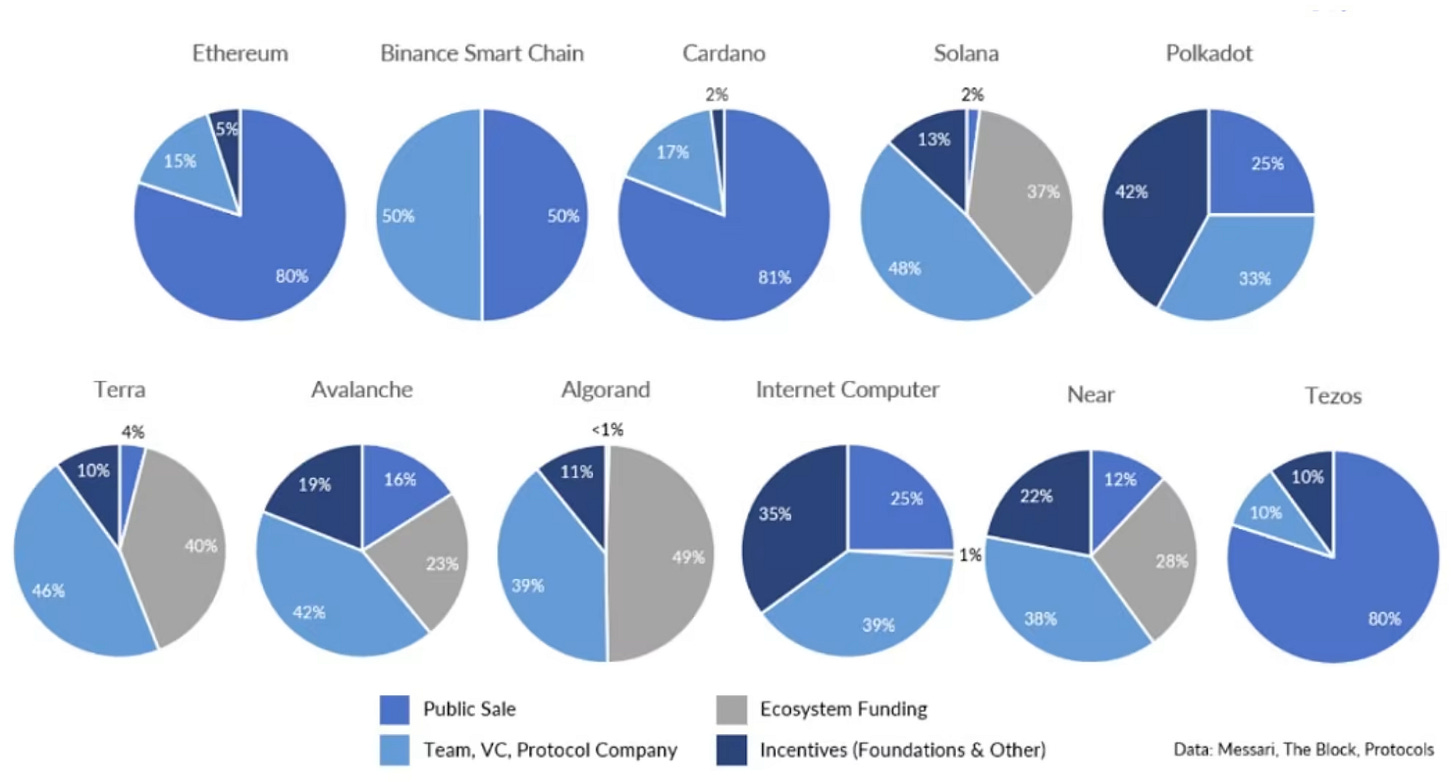

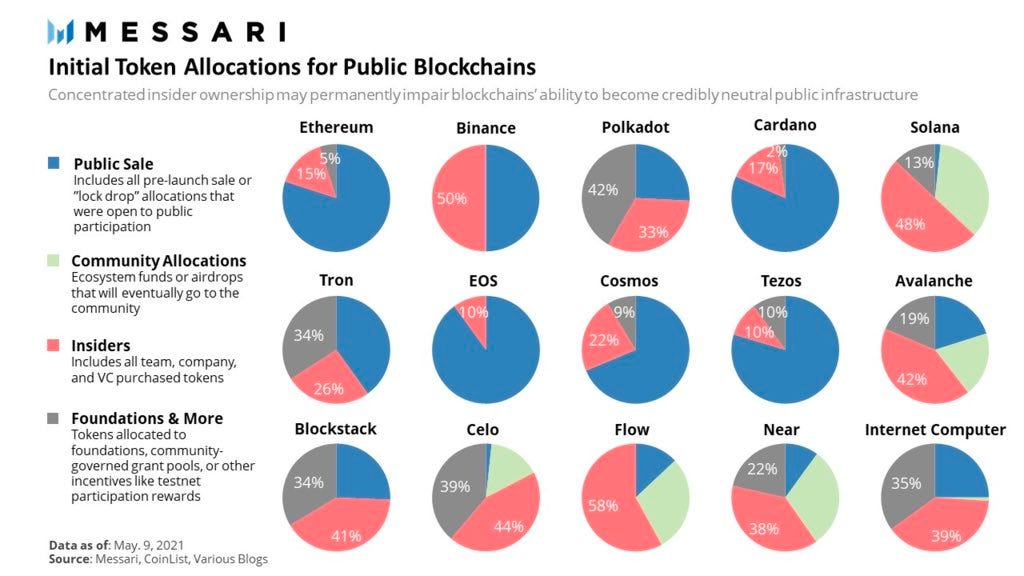

Tokens (e.g. ARB) are created from thin air, while coins (e.g. BTC) require work (energy via mining) to create. This means teams behind token launches can easily make themselves rich by allocating a lot of tokens to themselves.

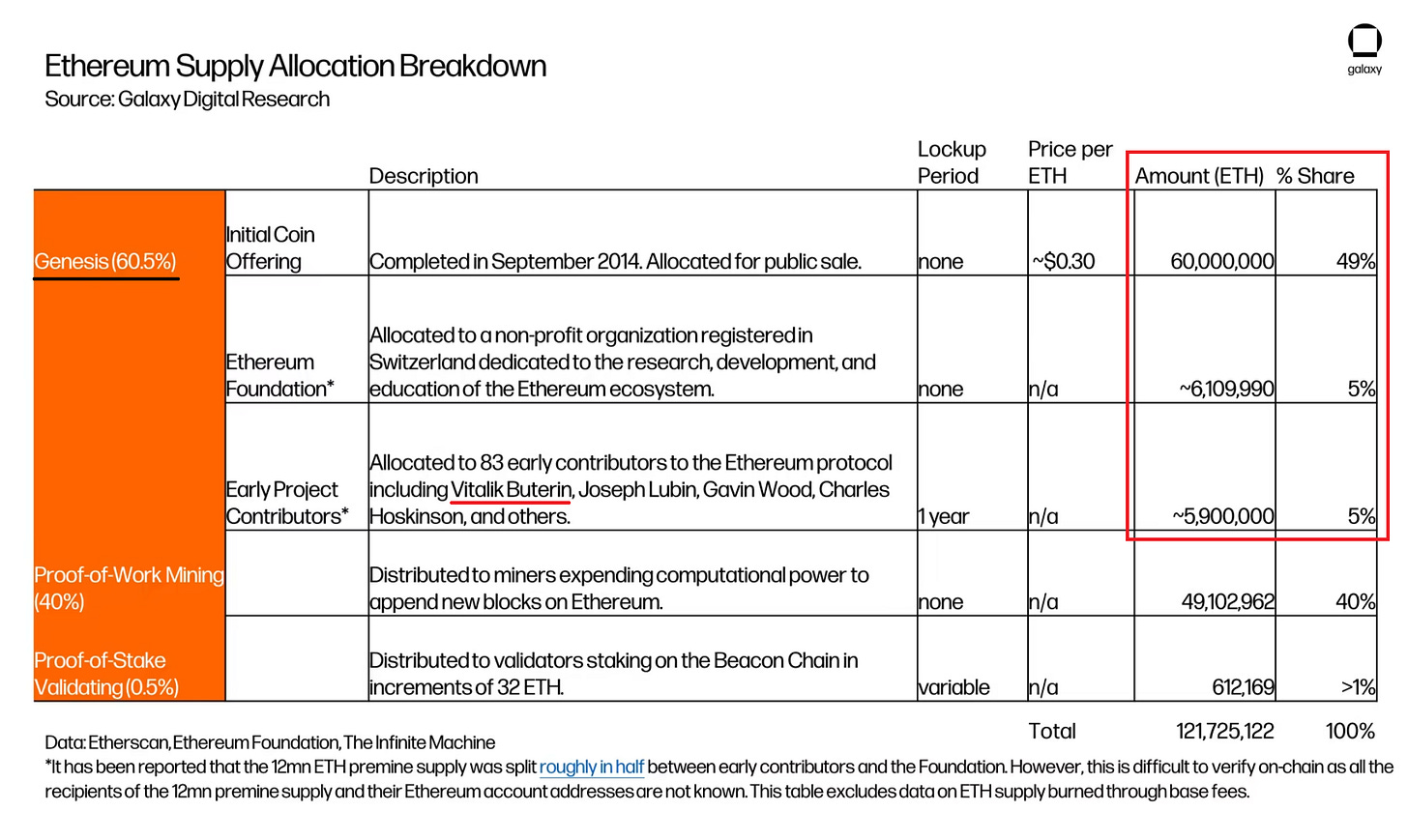

This is how Vitalik (ETH founder) got rich. They generated 72 mil ETH out of thin air at genesis (see below table). They created money out of nothing, then their token took off and cashed in.

Avoid teams that allocate more than 10% to themselves and less than 50% to the community / users.

Market cap manipulation 🚩

A lot of tokens are backed by venture capital (VC) and they strive to:

Keep initial circulating supply low

Pump the coin on launch

Dump as FOMO starts

They dump on retail the tokens they created from thin air. Guaranteed profit at ANY price since their cost to create said tokens was zero!

Their only real risk is when they pump the token someone may sell. But if they manage the supply well, there will be no one to dump before them in any significant quantity. Win-Win.

Bottom line

Study tokenomics before you click that buy button. If you're greedy, then at least do it to know what you are getting yourself into. Good tokenomics can mean long term bets with good returns. Bad ones means you speculate for short timeframes and then pull out. Never hold a bag too long, especially if it’s inflationary. Don’t be that guy.

A good exception to this is Bitcoin since it has 21 million total coins of which 19 million are already circulating and under 2% inflation per year. This is an excellent long term bet.

Pledge your support if you find my writing awesome. You won’t be charged until subscriptions are enabled. I will announce it when that happens.

Hi Duo9. Thanks for this great and very informative article. How can one buy BTC on Bitcoin or ETH on Ethereum? If I buy BTC on Binance for example is that BTC on Bitcoin?

Assuming someone has no position in alts... Other than BTC, are there any coins or tokens worth considering buying today and holding? At least until the next bull run? ETH, LTC, LINK, SOL, XRP, SNX???