When is the best time to invest in crypto?

Trends. They matter.

There are two times when people reach out in crypto to sell you stuff:

When the market is hot & everyone rushes to make money as fast as possible.

When the market is dead and they double their efforts to find the money.

Guess which one applies today? TLDR at the end.

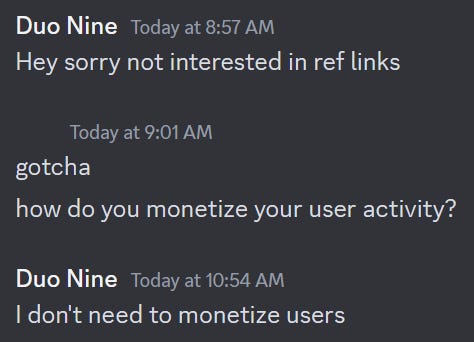

Most people that reach out and don’t know me assume I am ready to shill anything for some dollars. This is why I get questions like the one below.

I write here because I enjoy doing it and did it for over a year before I enabled the paid subscription option. This is because I always believed you have to let people choose, including if to support YCC.

Then they can decide what’s best for them.

Your support makes a difference. It motivates me to continue. As a creator, I value that very much. YCC is more than this newsletter, it’s my home in crypto. I am happy to see thousands of members also decided to make it their home.

And we’re different!

I am happy to explore opportunities and partnerships, but I will always do it on my terms. More on that later.

Generally, what I noticed is that there are two times when people reach out to sell you stuff. Let’s explore that first before answering the question in the title.

When the market is hot & everyone rushes to make money as fast as possible.

This is a very dangerous time to go around throwing money at anything. Euphoria is the last stage of a bubble, not the first one. The first stage is a bear market when smart money (read it as VCs) deploys capital on promising projects they plan to pump.

I already explained how that works in my last post about the crypto pyramid.

That euphoria leads developers, creators, and other folks to create anything for a quick profit. Ignore those. Usually a 10 minutes due diligence and research will expose them.

Some projects that are more legit have been preparing since the bear market and choose to time their release with the bull market. Those are definitely worth more of your time and attention.

Lastly, truly innovative projects don’t need to reach out. They usually stand on their own merits and can be successful without much effort. Bitcoin or Ethereum are good examples.

When the market is dead and they double their efforts to find the money.

We’re here today. After an early pump this year, the market went flat, at least for Bitcoin. However, for altcoins, the market is in a full blown bear market. Just look at this chart. Brutal. This is just one example.

Since many folks make the mistake to ignore Bitcoin and focus on altcoins in their search for riches, they get trapped in moments like these. Hard.

Suddenly, there is no more easy money. Their reaction?

Double down on efforts to find that money and reach out to everyone to pitch the latest altcoin that won’t make it in the first bear market. This is the second dangerous time to be throwing money at anything.

Be very careful who you trust and where you put your money. Start by trusting your own research first and judgement. Do not buy or invest in an altcoin just because someone else says it’s a great project or because the price is up. No.

The best time to invest in crypto is in a bear market. Full stop.

That’s when your own research pays. You pick your bets in a bear market after careful research. If you missed the bear market, then do the same research at any other point in time.

As long as you don’t buy euphoria or an altcoin shilled by someone else your bet is going to be safer than most, provided you did your research. Trusting others with that task, or your money, means your interests may not align.

As long as you send them money, they will tell you anything you want to hear about this amazing new altcoin that is going to revolutionize the world. It won’t. That was only for you to click the buy or send money button.

Since most people fall for that trap, you can profit from trending narratives like meme coins. If you choose that path, make sure to exit early once in good profit and don’t get back in to avoid being trapped. If you’re late to buy a trend, then accept your loss and do better next time. See my guide on that too.

What am I interested in?

First of all, as more time passes and I get older, I start to value Bitcoin even more than before. I don’t think I am the only one and I’ve been in this space for over 10 years now.

This is happening not just because its price is going up, but because of the simplicity it brings into your life. Instead of worrying about 15,000 altcoins, I can put my trust in the one that actually succeeded in the past decade.

Then, I can use the time I’m saving (this is important) for other things in my life. Opportunity cost is real and spending it on altcoins may literally be a waste of your time. That’s the first observation.

The second point is about innovation. Very few altcoins actually bring something new to the table. If you have this filter in your research you will quickly see that 95% to 99% of altcoins will not present any interest.

Moreover, most altcoins only exist because of their token and they force a use case on something that does not even need a token to exist. See where I’m going? In other words, they are useless. That’s the second observation.

Lastly, there are the gems. These are coins or tokens that actually have a legitimate use case. This is where I am interested in investing, buying, partnering, or collaborating.

A good and recent example is Ethena. However, there is a problem there. The innovative part is actually their USDe digital dollar, not their governance token called ENA.

You can’t buy a stablecoin and get rich. Ethena innovated more than most in this cycle and they did it with a synthetic stablecoin. I do not really recommend buying or holding their ENA token long-term. In my opinion, it has no use case for retail. It’s mostly for VCs to pay themselves and others to hype USDe.

Generally, I don’t believe in governance tokens. They fall under the useless category.

When I see an exciting project, I do get excited, but those moments are rare. If it happens, I always share it with our community Patrons on YCC discord.

Still, I always encourage everyone to do their own research, no matter what I say. Remember the rule, if you buy because someone else said it, it’s probably a trap. Especially in crypto.

TLDR & Tips to Remember

Do not buy euphoria or stuff shilled by others, do your own research

The best time to buy anything is in a bear market, after your research

Very few altcoins are worth your time, most are a waste of time

Betting on trending narratives only works in a bull market, then reality hits

Seek innovation and real use cases and bet on them instead

This newsletter is made possible with the generous support of our community Patrons and partners. Upgrade your experience to show your support by clicking the below button or reach out to us on X or Discord to partner.

All info is provided for educational purposes only and is not financial advice.

Are there any alts you like now?