Why MicroStrategy is Trolling Us

There are major red flags with Saylor and his Strategy for Bitcoin.

If I were to use just one word, I’d say the biggest red flag is a severe lack of…

Transparency.

There is no way to prove Saylor actually owns over 555,000 Bitcoin on-chain. He keep buying Bitcoin, but shows no proof. This is just the tip of the iceberg. Let’s dive in to see how Saylor is trolling us.

Become a Patron for lifetime access to our exclusive private alpha!

There are multiple risk vectors to Saylor’s Strategy to accumulate Bitcoin. My recent thread went viral on that, but it only addressed part of the risks involved. The following aims to complete that analysis with six key red flags.

Before we dive into the details on that, let me explain to you Saylor’s current Bitcoin Strategy in two paragraphs:

Saylor expects Bitcoin to be much higher within 10 years. The math and Bitcoin’s price action since 2009 supports his assumption. This is why he is going all in into Bitcoin using Strategy (formerly known as MicroStrategy).

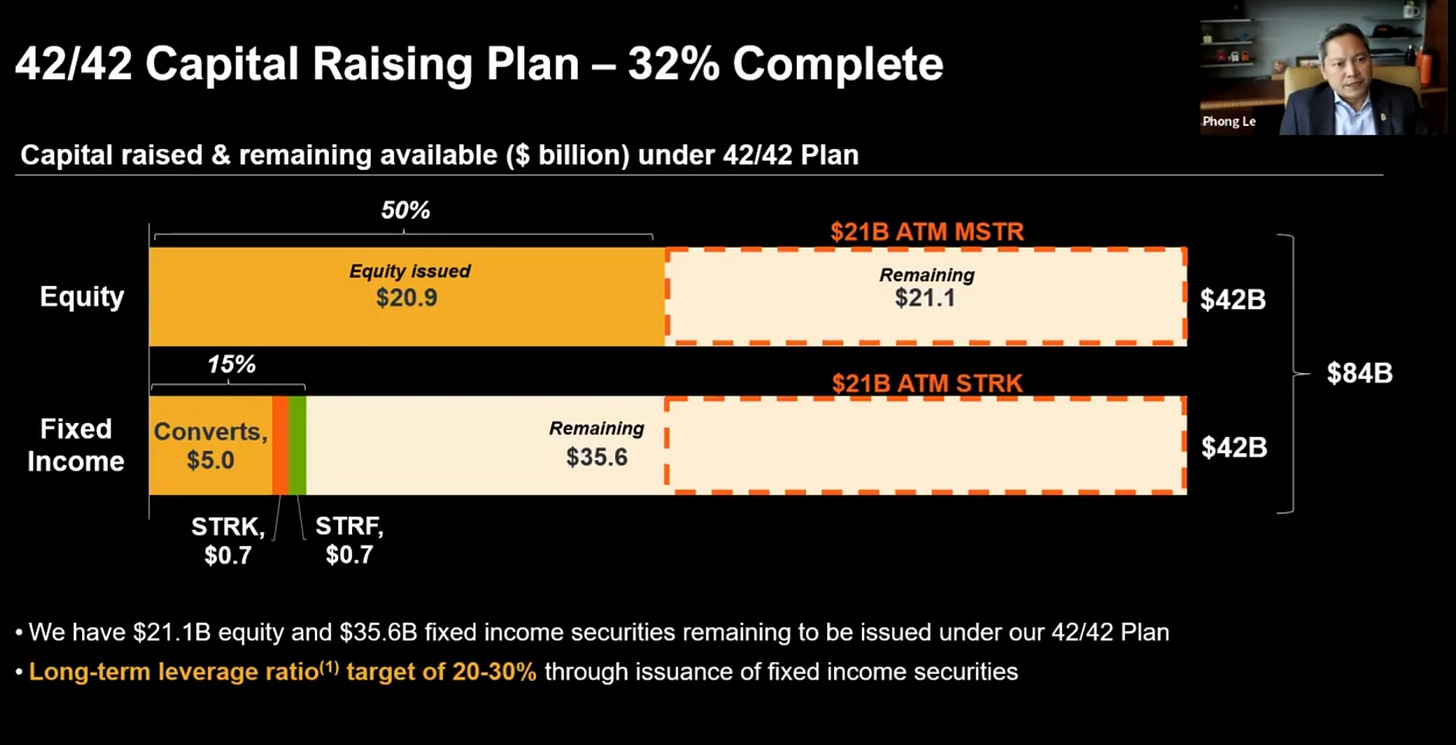

He wants to buy as much as possible TODAY because he sees a clear asymmetric bet, but he lacks the cash. To off-set that, he is issuing a lot of debt via MicroStrategy. Over $84 billion and plans for more. However, this only works if Bitcoin continues to go up and what he is doing may reverse that!

Below is why.

Saylor is farming a premium on Bitcoin in a market that just opened to it in 2024 via the Bitcoin ETFs. I’m talking about Wall Street. Demand for Bitcoin is real and generates a premium on MicroStrategy shares.

This is because accessing and holding Bitcoin on-chain is not possible for everyone. For some, the only solution is to buy MicroStrategy shares which gets them EXPOSURE to Bitcoin, not actual Bitcoin.

This premium allows Saylor to create and sell his MSTR shares at a higher market price than the value of the Bitcoin he holds. He’s in effect farming this difference which is an arbitrage opportunity or market inefficiency. He does this to the tune of billions of dollars by printing new MSTR shares out of nothing.

He uses the profits from selling to buy more Bitcoin, then repeats the strategy ad infinitum. Saylor can do this until his strategy will no longer work.

I can’t tell you WHEN this will happen, but I can tell you WHY it will happen. I’ll update my thesis as time passes and new information is released. Make sure to follow me on X and join our Patrons group for first access to my alpha.

Saylor also has an advantage. He was the first to implement this strategy and MicroStrategy was listed on the stock market even before they bought their first Bitcoin. But now, everyone is starting to do it.

New companies are popping up copying his strategy like mushrooms after a rain. What do you think will happen to the premium Saylor is farming once everyone will do it?

Crash. The Strategy will stop working.

Could this be why Saylor wants to issue 84 billion in debt (42/42 strategy) and then follow it with 168 billions (84/84 strategy)? He wants to buy NOW as much Bitcoin as he can. Is that because he wants to get as much exposure as possible before his strategy stops working = no more premium?

Moreover, by buying more Bitcoin he fuels his strategy further by generating FOMO = premium to farm. Ideally, he hopes his actions will lead to a higher BTC price and others following him. This is his incentive to tweet every time he buys more.

Any action that increases Bitcoin’s price increases Saylor’s premium on his shares. He can then print more shares from thin air = free money machine.

His strategy depends on Bitcoin going higher over time. Otherwise, his strategy can fail. This is because he is increasing his risks and leverage every time he issues more debt to buy Bitcoin.

What does all of this look like to you?

A bubble.

Not for Bitcoin, but for Saylor’s strategy and his company shares. If he does this too fast or buys too much without Bitcoin pumping to balance it, he will have a big problem down the line as his debt levels increase to $168 billion or more.

Since January 2024, Saylor has bought 10x more Bitcoin than in any other year since he started his Strategy or over 300,000 BTC worth $29 billion at the time of this post. On top of that, many other companies have started copying him in the past year.

What did Bitcoin price do since January 2024?

It increased by 165%. While Saylor and others already 10x their buying power, Bitcoin did not 10x its price. He can’t continue to do this without increasing his risks.

This raises a bigger question. Is Saylor actually buying real Bitcoin or something else? Why is Bitcoin price lagging behind despite all this new buying pressure?

Time to discuss six major red flags and why Saylor is trolling us.

No proof of reserves

Saylor tells us he bought and holds 555,450 Bitcoin, but he provides no proof that is verifiable on-chain. Yes. You read that right. There is no proof to account for this total and no list of public wallets that add up to 555,450 Bitcoin.

The chart you see above is based on his tweets saying he bought Bitcoin, how much, and when. But without proof on-chain, anyone can tweet the same.

But for the sake of this article, lets assume we trust his words, as ridiculous as that sounds when speaking about Bitcoin. If Saylor holds 555,450 Bitcoin, where does it sit? With a custodian, just like with Bitcoin’s ETFs.

Custodian risk

Coinbase and Fidelity are the custodians of most Bitcoin ETFs and also MicroStrategy, among others we may not know. Not only do we not know in what wallets his Bitcoin sits, but we also do not know who holds control over those wallets.

Saylor is right to use more than one custodian to spread risk. However, there is no transparency on his Bitcoin holdings. Below the Bitcoin ETFs custodians.

It’s clear that Coinbase is turning into the biggest honey pot ever from the above table. If Saylor also keeps a few hundred thousands BTC with them, then Coinbase may have a bigger bag than Satoshi.

The risks of concentrating so much Bitcoin into one entity is obvious. They can make a mistake like Bybit and get drained of billions. They can be attacked, hacked, or drained by malicious insiders. Either way, the risk is real and with catastrophic consequences for those holding MSTR shares or Bitcoin ETFs.

It also raises questions about Coinbase. It’s starting to look like a bank for Bitcoin and we do not know if they actually hold enough Bitcoin to cover the claims from MicroStrategy and others.

This creates another layer of risk in the form of paper or fake BTC that’s just an entry in a register with no backing on-chain.

A bubble in the making via debt issuance

Saylor is creating a huge bubble by increasing his leverage as he issues more and more debt (or shares) to buy more Bitcoin. This works until the premium becomes negative.

You cannot create new MSTR shares from thin air and sell them on the open market if there is no demand for them. This is what a negative premium implies. It can also create a situation where buying MSTR shares will be more profitable than buying Bitcoin.

For that to happen, MSTR shares have to crash until they trade at a discount compared to the value of Saylor’s Bitcoin holding. In that moment, it’s better to buy his shares than actual Bitcoin.

Will Saylor sell his Bitcoin to buy his own shares? It will get very interesting very fast at that point since this can turn into a death spiral, especially if Saylor is forced to sell Bitcoin to cover his debts.

As mentioned before, if more companies copy Saylor’s Strategy, that premium will vanish faster. Him also issuing hundreds of billions in new debt to buy more Bitcoin will also eat into that premium, especially if Bitcoin does not pump fast enough to keep up.

You are the yield

Lately, Saylor is also issuing preferred shares called STRK / STRF which have a yield attached to them between 8-10%.

Who pays that yield?

You.

Saylor pays a yield on those shares by… selling more shares! People love the yield until they understand it’s circular with money moving from one pocket to the next.

This is ridiculous of course because Bitcoin has no yield! He holds 555,450 Bitcoin that pays no yield, but he buys more of it by issuing debt which pays a yield to its shareholders.

This is only sustainable as long as Bitcoin’s price goes up and the premium on his shares is positive. Do I need to tell you that Bitcoin price can also go down?

MSTR shares already crashed by 90% in the last bear market. What do you think they will do during the next bear market when Saylor’s leverage and debt are 10x to 100x higher than in the last bear market?

Greed is going exponential

By buying more Bitcoin and issuing more debt at an exponential level, Saylor is getting greedy. He’s buying a lot of Bitcoin at over 90k and his average buy price has increased to almost $70,000.

This aggressive change in his Strategy prompted me to write this article because I can sense this bubble will not last long at this rate and you need to know the risks.

Was Saylor ever wrong?

Yes.

Before the last bear market, Saylor said Bitcoin cannot crash by more than 50%. Bitcoin proved him wrong and crashed 78%. Bitcoin may prove him wrong again in the future.

Why?

Because Saylor is creating the conditions for Bitcoin to crash harder in the future and his average buy price is getting higher and higher. With more leverage, more debt, and more risk Saylor is literally begging for it to happen in the future.

Saylor is trolling us

Saylor is smart. He saw a gap in the market and decided to exploit it until it breaks. Anyone that buys Bitcoin helps Saylor’s Strategy. The catch?

He’s using your money to do it and has no reasons to stop, even if his actions will get us closer to the bubble popping.

The best part?

Saylor is risking zero dollars himself and the biggest risk is held by MSTR shareholders. In this process, he accrues more and more weight in Bitcoin.

Saylor got so far in his Strategy that he’s starting to say that owning MSTR shares is better than holding Bitcoin. You get higher returns on your money and a yield! This is a major red flag as soon as I saw it in his latest quarterly presentation.

Do you see the contradiction?

His only collateral, Bitcoin, pays no yield and underperforms MSTR. Yet, MSTR is better? There’s a lot of air in this bubble and it’s becoming obvious.

Saylor is famous for saying “there is no second best”. MSTR holders will eventually learn that too once this bubble pops. Yes, it will get volatile. Yes, you can make money in this bubble.

Enjoy it while it lasts, but don’t let yourself be trolled by Saylor. Get out early at the first sign of trouble and keep your Bitcoin in self-custody.

Satoshi created Bitcoin to remove trust from transactions, Saylor added it back and people are paying a premium for this privilege. Ironic.

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

Great analysis and writeup!!!

Is it possible that what Saylor is doing with MSTR shares and Bitcoin, criminal?