YCC Crypto Alpha #09

Our latest community alpha & portfolio updates.

No time to scroll on X or Discord? I got you covered!

These posts are your gateway to the latest market alpha, top coins to watch and our community updates. It also keeps our busy Patrons happy and informed.

This issue covers:

Latest market outlook

Top three passive income strategies

YCC portfolio updates

Market tip of the week

Market Outlook

TLDR: The Bitcoin ETF approval was bound to create volatility, and it did, in both ways! After a brief pump to 48k, the price is now found at 42k which is a critical support. If Bitcoin falls under 40k, that’s a rare opportunity to buy more in this bull market.

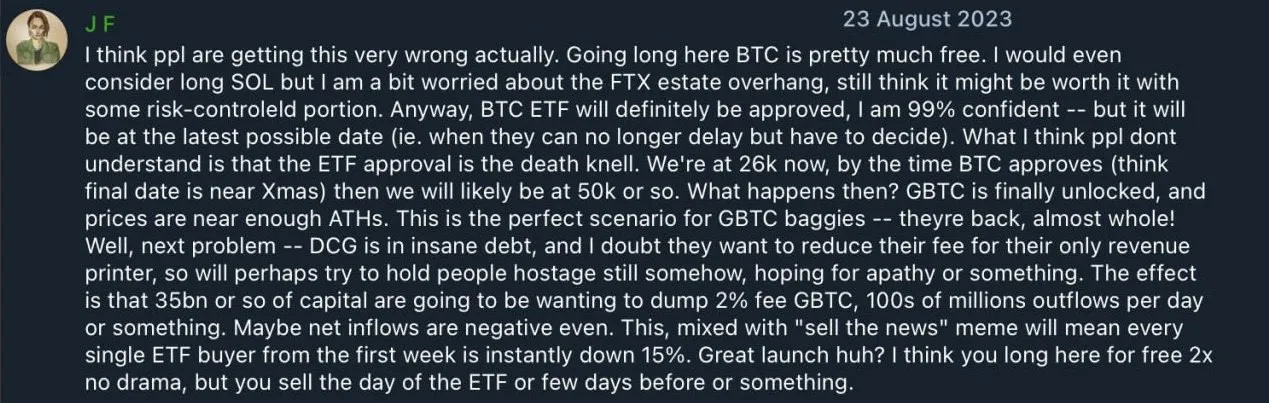

The Bitcoin ETF was approved this week and with it the market took quite an unexpected turn. Altcoins pumped, particularly Ethereum, Bitcoin made a new high, and then everything dumped. Quite the story and surprisingly, this guy predicted it in August 2023.

On the first day the ETF went live, Bitcoin spiked to the 48k resistance, but sellers held firm and the price quickly tumbled from there. With Grayscale’s ETF approved (GBTC), over $20 billion in Bitcoin can now be sold on the open market which was not possible before. Many waited for this moment to exit GBTC.

This explains why the price is now back on the 42k support. My bias here is neutral since the price can go either way. If Bitcoin stays above 40k, I am optimistic and I lean bullish. If it falls under 40k, then I will turn bearish short-term.

I will be a buyer if the price falls under 40k and there is strong support between 36k and 32k. Any buys in that range would be a rare opportunity in this bull market. Watch the price action on Monday as that will be decisive.

Top three passive income strategies

If you play this bull market right, you should be booking profits. Some already made a killing on Solana, Injective, Kujira, meme coins like BONK or Bitcoin ordinals.

With those profits in hand, most go straight ahead and buy more meme coins or random alts to lose it all within a year or two. Don’t be that person. Instead, I propose another strategy.

Take your profits and PROTECT them. Focus on wealth preservation, not wealth generation since you already 10x to 100x your money. That means you reduce your risk profile, you don’t increase it!

In what follows, I have prepared three strategies with different risk profiles that can continue to increase your profits while reducing risks bearing in mind that we still have at least one to two years of bullish price action in this cycle.

If you made a 10x on a meme coin, you can turn that initial money into a 20x with these strategies, while protecting profits. Sounds amazing right? Let’s dive in.