YCC Crypto Alpha #33

Our latest community alpha & portfolio updates.

No time to scroll on X or Discord? I got you covered!

These posts are your gateway to our latest market alpha, top coins to watch, and community updates. They also keep our busy Patrons happy and informed.

This issue covers:

Latest market outlook

Top three strategies to protect your portfolio

YCC portfolio updates

Market tip of the week

Latest market outlook

TLDR: Bitcoin appears to struggle after contagion from global stock markets which are flagging recession signals. It’s not looking great, but Bitcoin can still surprise as as a hedge to global uncertainties.

War escalation in the Middle East, Asian markets in turmoil, US on the brink of recession. This is not a great environment to be bullish. Bitcoin may be the hardest money invented to date, but it can’t fix human nature.

If global market topped and a recession awaits, then prepare for a bumpy ride. It’s not going to be pleasant or easy, but Bitcoin has the qualities to act as a hedge against uncertainty.

This week, BTC lost its support at 64k. That puts the price action into a neutral territory (64k to 58k) from where anything can happen. I will turn bullish if the price returns above 64k and bearish if Bitcoin makes a lower low under 54k.

The macro is not helping us at this time, but in times of panic or desperation, people will seek safety. Right now, there are only three places to store your wealth with peace of mind: Bitcoin, Gold, and USD. No wonder Gold is close to breaking a new record. Can Bitcoin do the same?

With that in mind, lets look at my top three strategies that you can use to protect your portfolio. This is what I do and you can do the same.

Top three strategies to protect your portfolio

I see many people on X complaining their portfolio is down by 50% or more since their all-time high around March 2024. Most of these people fall into two categories:

They allocated a majority of their portfolio to altcoins, or even 100%

They have a portfolio under $10,000 and went full risk during this cycle

There’s nothing wrong with the second group, they are trying to generate wealth and that means risk. However, people that are in the first group and hold more than $10,000 in crypto are playing with fire. They can also be labeled as greedy.

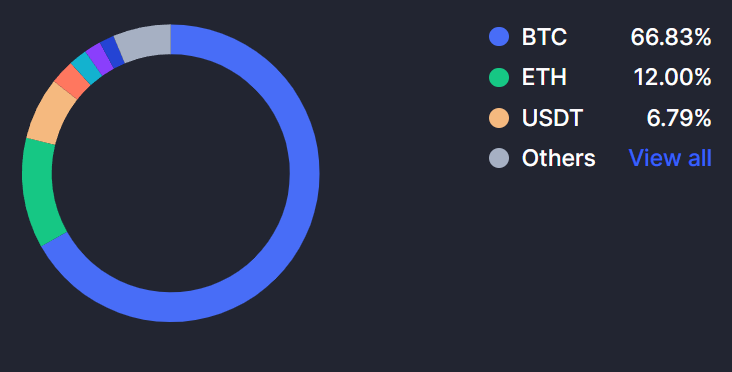

Below is my current portfolio allocation. You will notice that 85% is into BTC, ETH, and USDT. Despite current market volatility, my portfolio is not far away from its all-time high thanks to Bitcoin’s strong performance and gold breaking into new records recently. I’ll talk more about how I use gold a bit later.

I use three strategies that if applied correctly can protect your profits in this cycle and future cycles. They work extremely well for me. Lets explore them one by one.

To continue, upgrade to Patrons below or reach out to make a crypto donation.