How to choose the RIGHT altcoins - my best tips & tricks! #11

Altcoins are a literal minefield and you are their target. Don't fall for it!

Spotting altcoin gems in a minefield is hard, but I got some tips for you that will surely help. Plus I’ve added some examples of altcoins to guide you below. I already covered Bitcoin (the gem of gems) in my previous newsletter.

The secret to choosing the right altcoins and avoiding the ones that explode in your face was given by Vitalik. He’s the father of the biggest altcoin there is. He knows the way. Scroll down.

When I started crypto in 2014, I only knew Bitcoin at first. Then altcoins started to pour in: Litecoin (2011), XRP (2012), Dogecoin (2013), Vertcoin (2014), Monero (2014), Ethereum (2015) and so many others that followed. It was not that easy to buy them back then. USDT was released at the end of 2014. We all had to buy Bitcoin first to get into altcoins. Fun times.

Today, altcoins are released simultaneously on multiple tier-one exchanges (think Binance, KuCoin, Bybit, FTX) with access to 100x leverage derivatives on day one. How times have changed. Eight years ago, if an altcoin was listed on an exchange it was news for weeks. People were excited.

Today, you should not really be excited. You should be skeptical or even suspicious. Most altcoins - over 10,000 - are after your money and they will do anything to take it from you. More so, they detract you from the biggest gem of all: Bitcoin.

But we’re not interested in that here. We’re interested in what Vitalik said.

Vitalik Buterin, the founder of the biggest altcoin of all time - Ethereum, gave us a roadmap on how to spot gems. It is rather simple, but that is exactly what we are after. Nothing fancy and complex, a simple guideline:

Always seek altcoins that are sufficiently different to stand on their own two feet.

If an altcoin is a copy of Bitcoin, they are NOT sufficiently different to warrant your attention and especially your money. Litecoin anyone? Released in 2011, it still stands today, but it is no match for today’s number two: Ethereum. Ethereum was released in 2015 and it quickly rose to prominence. Why? Because it was sufficiently different from Bitcoin to be its own thing. The emergence of tokens, DeFI, and NFTs on Ethereum is a good example of that.

Ethereum has almost half the market cap of Bitcoin at the time of this post. That in itself is a huge achievement and since 2016, Ethereum has defended its spot. Meanwhile, Litecoin is #13 on Coin Market Cap. There is nothing wrong with Litecoin, but if you are after the next-generation gem. That is not it.

The logic follows - what altcoins today are sufficiently different than Ethereum? If it’s a cheap copy, the verdict should be a hard pass. If it tries to be innovative and copy both Bitcoin and Ethereum, it’s still a hard pass. Seek altcoins that are different enough to stand out on their own merit. Anything else is just a copy. That will quickly filter out those 10,000+ altcoins.

If you see an altcoin promising 100x faster transactions than Ethereum, instant network consensus, and near zero fees, know that there is a catch = it’s centralized. A centralized “blockchain network” managed by a few servers is no different than Amazon Web Services and the exact opposite of what Bitcoin is. You can also call it XRP or Ripple. That is just one example and there are many others.

Bitcoin is the perfect balance of decentralization, speed, network security, and low fees. This balance is also called the blockchain trilemma. Be careful what you give in exchange for that speed or scalability.

This brings us to the gems.

Almost all altcoins are created with one purpose in mind, to take away your money from the true innovators: Bitcoin & Ethereum. In return, they give you a quick high (pump and dump), then most die. This cycle is repeated every four years in line with Bitcoin halvings.

I have my own criticism of Ethereum because Vitalik has decided to trade decentralization for speed with the transition to Proof of Stake consensus. This is because Ethereum became so successful that its original design placed a limit on its growth (high transaction fees). Centralization for the sake of speed may prove fatal for this cryptocurrency in the long term. Such centralization is also the reason Ethereum Classic (ETC) exists. But time will tell how this will end.

SPOILER AHEAD

“Give me the gems NOW. I want my 100x. It’s all or nothing!”

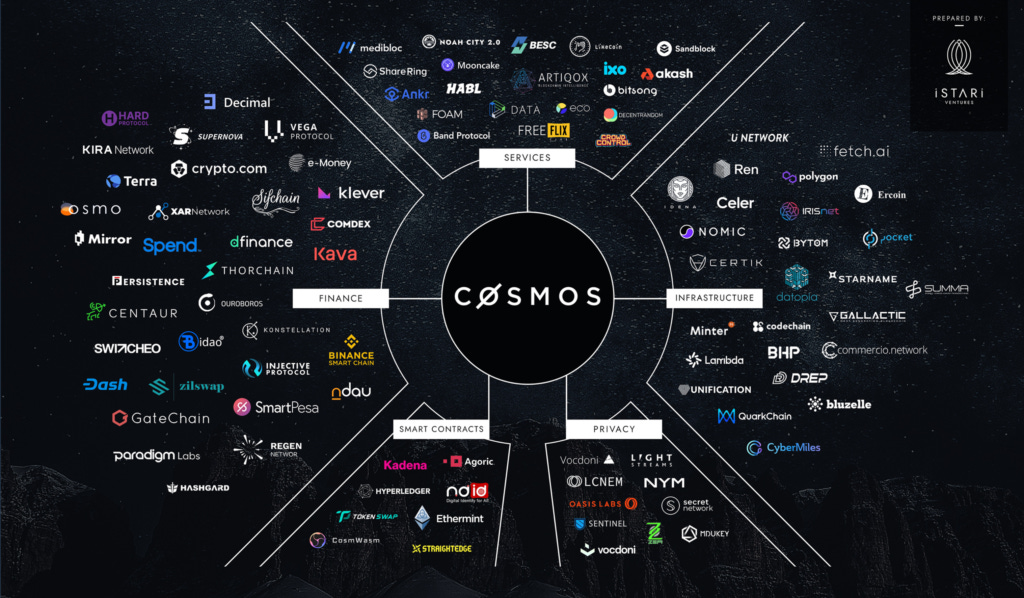

1️⃣ Cosmos ecosystem | ATOM

In interviews, Vitalik talks about the Cosmos ecosystem as if that is what Ethereum 2.0 is supposed to become. Curious right? The reason Cosmos can stay on its own two feet and is sufficiently different compared to Bitcoin or Ethereum is called: Inter-Blockchain Communication protocol or IBC.

In other words, Cosmos allows autonomous blockchains (with their own independent rules, tokens, security, and governance) to exist and seamlessly communicate with each other using IBC. It’s like saying countries around the globe all decided that they will use Bitcoin for international settlements. They can keep their identity, culture, national currencies, and language, but with a press of a button, anyone can send money using Bitcoin from one country to another - instantly & frictionless. Cool right?

Cosmos gives enough flexibility so new developers and users can create their own little universe among the stars. The growth potential is infinite. Taken together, all these autonomous blockchains on Cosmos lead to… decentralization, even if individual blockchains may not be as decentralized as Ethereum or Bitcoin.

This is something unique and Cosmos is the first to experience rapid growth due to this. More so, the collapse of the Terra / Luna / UST ecosystem (built on Cosmos) showed Cosmos is extremely resilient. One universe can die, but more will spring to life. For an example of that look into Kujira.

In general, tokens or coins that build an ecosystem around them will always fare better. See BNB that went from an exchange token to a DeFI ecosystem token. That took its price from $10 to almost $700 in the last bull cycle.

2️⃣ Real Yield Tokens | GMX, GNS, KUJI, LQTY, CRV, UNI

Real yield tokens stand out because you get paid to hold them. Think of them as cash flow tokens where a protocol splits its profits with the token holders. Imagine if the Binance exchange announced tomorrow that all BNB holders will receive 50% of its annual profits, pro-rated based on how many tokens you hold. There would be a rush to buy it. Sounds like dividends, right?

But Binance is a centralized exchange. The tokens I mentioned above are all decentralized to various levels (more or less). For example, GMX is a decentralized exchange where 30% of its fees (or profit, see figure below) is re-distributed to GMX token holders. These holders also get to participate in the governance of the exchange where each token is basically a vote on any important decision.

KUJI, GNS, and LQTY are similar with their own variations. CRV and UNI are not quite the same as they reward liquidity providers instead of token holders. The bottom line is holding real yield tokens has a clear advantage over a majority of altcoins for the simple reason that they are backed by a profitable protocol. Since they are decentralized, everyone can participate and partake in their success (and profits). Their use case is so niche that you could argue they are sufficiently different when compared with Bitcoin or Ethereum.

3️⃣ Emerging Trends | WEB3, DeFI, NFTs, GameFI, AI

Similar to the Real Yield Tokens, I expect more utility protocols, tokens or coins to be released in a Web3 fashion where the next Facebook, Apple, Amazon, Netflix, and Google (FAANG) will share the profits with their users. You are no longer a simple consumer, but you can choose to be a creator, investor, user, and consumer at the same time in a decentralized way. No trusted third party is required (Bitcoin anyone?). Participants are rewarded in a sustainable manner based on their merit.

Emerging trends and associated coins/tokens:

Decentralized Finance or DeFI where you can be your own bank and exchange, lend, borrow, or be a shareholder in such protocols

AAVE, RUNE, GMX, DYDX, CRV, UNI, 1INCH, AVAX, LINK, FTM

Non-Fungible Tokens or NFTs where you can market your art or any creation in a decentralized way using DeFI markets

APE, GALA, MANA, SAND, AXS

GameFI which would be a mix of DeFI, NFTs, and entertainment. Examples include videogames where there is an open market with items (NFTs) created by artists that hold real value, in-game and outside

MANA, SAND, AXS, ENJ, THETA

Artificial Intelligence or AI use cases will explode in all services from text (ChatGPT), image (MidJourney), video (Synthesia), and sound (Eleven Labs). Combined with decentralization and crypto, the potential is infinite

FET, GRT, AGIX, OCEAN

Any tokens or coins that can leverage these emerging markets well, will become the next FAANG. The best part is you can be right there in the center of it all - as long as it is decentralized. Some will likely compromise on decentralization to maximize their profit.

4️⃣ Decentralized Stablecoins | USK, LUSD, DJED, DAI

To date, the biggest “decentralized” stablecoin proved to be a scam. It was called UST and was the product of the Terra ecosystem which collapsed to zero after reaching a market capitalization of $50 billion. Having said that, it is important to understand that most stablecoins (especially if decentralized or algorithmic) are created to scam you by taking your money and pretending they are “stable”. Don’t fall for it!

A truly decentralized stablecoin is still to emerge and the current iterations all suffer from shortcomings. Either they are centralized, capital inefficient, or simply redundant. DAI is becoming a centralized stablecoin simply because it is increasingly backed by USDC and is on the Ethereum network. This also makes is a bit redundant vs USDC. LUSD is 100% backed by ETH which is better, but as mentioned before, Ethereum has chosen a dubious path to scale. USK is backed by various cryptocurrencies, but it is capital inefficient (you need to lock too much collateral to issue USK) and over its peg. DJED shares similar concerns.

Simply put, there is no perfect decentralized stablecoin at this time. A reason for this could also be that crypto is trying to replicate a fiat currency on its networks. The future is not more fiat money. The future is found in the values that created Bitcoin. For this reason, there is no requirement for a USD-pegged stablecoin to exist. We already have a better form of money and it’s called Bitcoin.

5️⃣ What are your gems?

Let me know if I missed any promising altcoins that are sufficiently different to make a difference. Leave a comment below or join the discussions on Discord or Twitter.

Hey you,

If you enjoyed the above, I invite you to be part of my community and share this newsletter. If you want to learn more about YCC, head to the About page.

To get started on your crypto journey use one of my referrals (scroll down on the link) and then consider becoming a Patron. You can find me on Discord for any questions and if you want to start a collaboration, reach out!

Don’t forget to follow YCC @ Twitter ◇ YouTube ◇ TradingView

Yours,

Duo Nine - YCC Founder

Solid newsletter!

Glad to see my biased opinion and coin ownership reflected by the choice of coins in this article.

Triple thumbs up!