Your tutorial to decentralized finance is here!

Afraid to use a DEX or DeFi? Don't know how? This is for you.

Many of you have asked for it, so here it is - a noob guide to decentralized exchanges (DEX) and finance (DeFi):

No bla bla bla

Real alpha with EXAMPLES

Juicy yields to farm (see Step 3)

Trade while being rewarded!

It’s time to transition from Coinbase or Binance to something better. Let’s start.

This newsletter is sponsored by Atani Exchange - One Account, All Exchanges!

Access the aggregated coins and liquidity from top exchanges on a single account. With over 2k tokens and the lowest trading fees, this regulated European exchange delivers!

In this tutorial I’ll take your through three DeFi platforms and two networks:

Arbitrum network (Ethereum ecosystem) - GMX DEX & Hyperliquid DEX

Kujira network (Cosmos ecosystem) - Fin DEX + much more

The reason I chose Arbitrum is because it’s built on top of Ethereum, the king of DeFi, and has low fees with amazing protocols like GMX. Arbitrum is also called a Layer-2 solution to scale Ethereum.

Kujira is an independent Cosmos chain which is, in my opinion, the second most promising approach to DeFi where independent chains live and communicate with each other seamlessly.

Step 1 - Wallets

The first thing you’ll need are two wallets, one for each ecosystem. Rabby is one of the best ETH wallets (by DeBank, follow us!) and Keplr is one of the oldest from Cosmos. Both can be installed as an extension in your Google Chrome browser:

ETH & Arbitrum networks - Rabby wallet (forget Metamask, it’s outdated)

Cosmos & Kujira networks - Keplr wallet (add Kujira to it via this link)

Once you installed them you have to generate a seed and wallet for each if you’re starting fresh. Make sure you backed-up your seeds properly, never store them online like in your email or the cloud. Be smart. These are called hot wallets.

For more advanced users, you can also connect your Ledger or hardware device to these browser wallets and import a new wallet that way. This is the most secure way and we call these cold wallets.

Note that you NEVER type your hardware device seed in these browser wallets, you only connect to them and approve transactions on your hardware device. Generally, you never type your hardware device seed anywhere online as it is likely a scam. Join our community for more good tips. Now onto Step 2.

Step 2 - Moving funds from CEX to DEX

With the wallets ready, time to move some funds to them.

ETH & Arbitrum networks

Check if your CEX supports withdrawals of ETH or USDC using the Arbitrum network. If yes, go ahead and fund your new Rabby wallet that way. This is the cheaper option. If not, then withdraw ETH using the Ethereum network as usual.

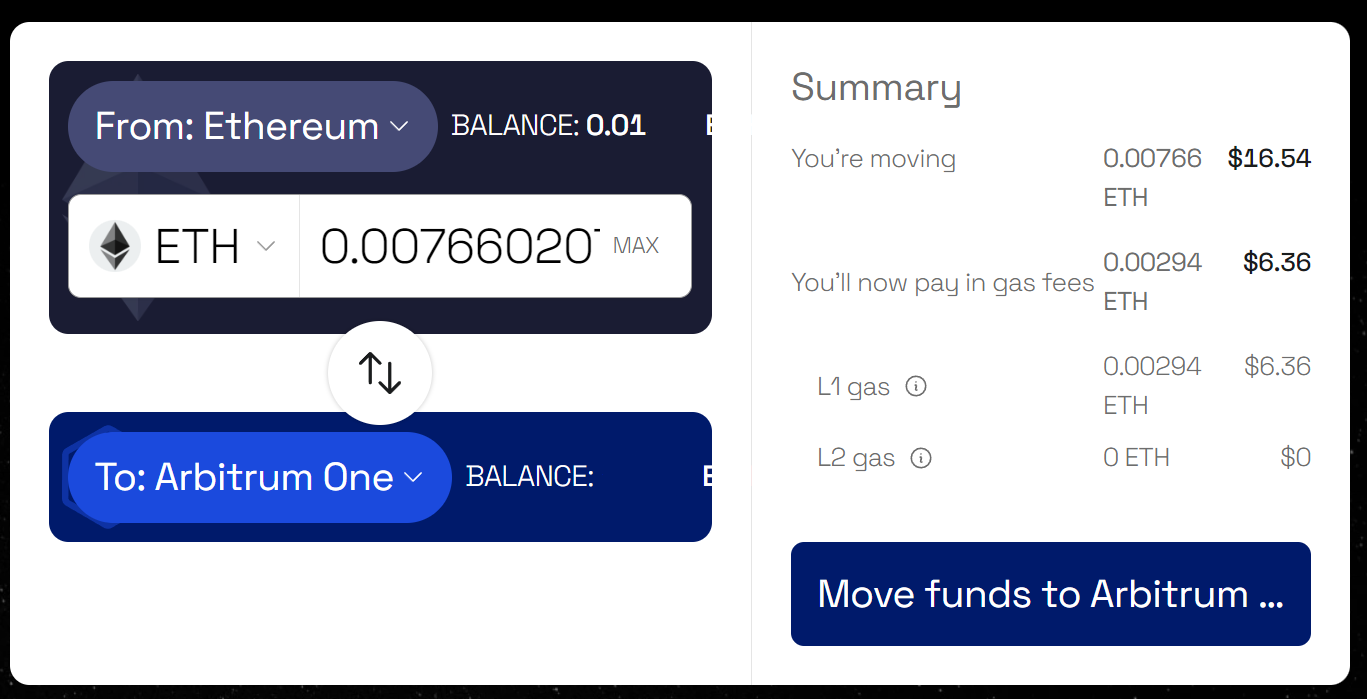

If you had to use the Ethereum network, then once your Rabby wallet confirms the funds were received, you bridge that ETH to the Arbitrum network using the Arbitrum bridge. Fees and completion time will be shown there as presented below. This is the expensive way to move funds (thank you Vitalik).

Understand that you are dealing with two separate networks. ETH on Ethereum and ETH on Arbitrum sit on different networks, but your ETH address is identical on both. Rabby wallet will clearly display that. Always leave some ETH on both networks to cover fees, especially if you have to bridge.

Cosmos & Kujira networks

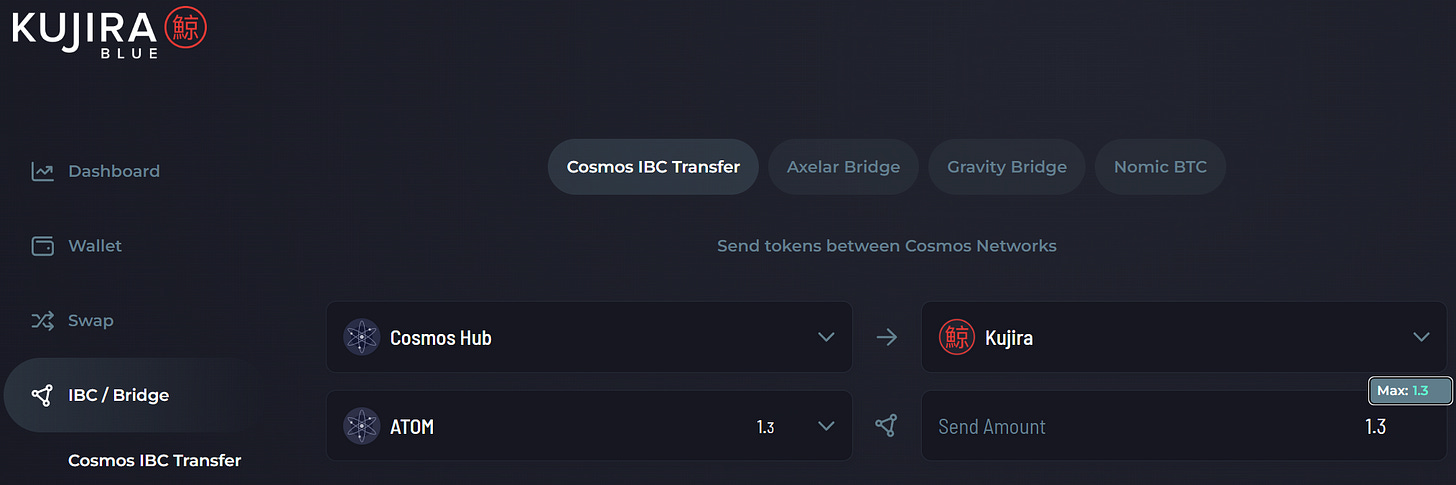

Simply withdraw ATOM from your favorite CEX using the Cosmos network to your Keplr wallet Cosmos address. Cosmos transactions are cheaper than even Arbitrum.

Then move your ATOM from Cosmos network to Kujira network using their IBC bridge as presented below. It’s fast and cheap. As mentioned before, different independent Cosmos networks communicate seamlessly via IBC.

Congratulations, you now have assets on Arbitrum and Kujira networks. You can use these to trade, swap, farm yields, lend & borrow, provide liquidity or participate in liquidations among others. More on that next.

Step 3 - Time to have fun!

Arbitrum network - GMX highlights

Swap between ETH, WBTC, alts and stablecoins with no slippage

Trade using leverage (GMX v2 pairs have better fees)

Provide liquidity and farm real yield (from trader fees)

Buy, stake and farm yield using GLP (liquidity token on GMX) and GMX (governance token on GMX)

I recommend you use GMX to farm yields, buy or stake GLP & GMX tokens and provide liquidity. I also talked about GLP strategies in my previous newsletter for more alpha on that.

The GMX v2 pools have some great yields right now. See image below: 21% APR on BTC, 19% on ETH and 71% on SOL. These are real yields you won’t see on any CEX!

Just look at USDC-USDC.e. This is a stablecoin pool with 8.6% real yield! That’s better than anything traditional finance or Coinbase can offer on USD or USDC. Why are you still on Coinbase, Binance, or JPMorgan Chase?

The catch is that these yields vary based on market demand and the pools paired with a coin or token (like BTC/USD) also have impermanent loss (not applicable for stablecoin only pools like USDC-USDC.e).

GMX exchange is ideal for larger investors and traders since you can trade without slippage (the exchange uses oracles for prices, not an orderbook). This means you can market buy $1 million of ETH and have no impact on its price. While that can justify a higher fee (around 0.5% to buy or sell on v1), it’s not ideal if you plan to play with under $10k.

Trading fees are quite good on GMX v2 pools (pictured above), but v1 remains quite expensive. This is why there is a better way to trade with even lower fees on Hyperliquid - more on that next.

Arbitrum network - Hyperliquid highlights

Perfect if you want to get into trading and save on fees. It’s like any good CEX, but with all the benefits of a DEX such as self-custody

Get paid to trade with limit orders! You read it right, you get a 0.002% rebate on any limit order. This is much better than GMX or any CEX

Create or join vaults from other traders to earn 90% of their profits

Use the YCC referral to register & save 4% on fees! Code: YCC

Hyperliquid has 91 trading pairs, but suffers from lower liquidity as a newer DEX. This is not a big issue unless you plan to trade with over five figures due to slippage (decrease your leverage to reduce it!).

To move funds to Hyperliquid you need USDC.e. WTF is USDC.e?

Remember I mentioned the USDC-USDC.e pool on GMX above? USDC.e is USDC that was bridged to Arbitrum from the Ethereum network. These two versions of USDC are essentially the same thing. One is native, which was introduced later (USDC) and one is bridged which is the oldest (USDC.e).

If you need USDC.e, just get it via the swap function on GMX. Then go to the trading interface on Hyperliquid and click the deposit button on the top right corner after you connect to it with Rabby. Deposit USDC.e and you’re set.

What this means is that your USDC.e is on a separate network on top of Arbitrum. Thinks of it like this: ETH > ARB > Hyperliquid. Hyperliquid is a dedicated network designed as a trading engine for high speed and low fees.

In contrast to GMX v1, Hyperliquid uses a traditional orderbook. That means a $1 million buy or sell order on ETH-USD will have a significant price impact on the orderbook = slippage.

To avoid slippage, which represents trades at less favorable prices, use pairs with a high open interest. That means many limit orders are on the orderbook that can absorb your trades. See below an example. ETH is first by open interest, followed by BTC, SOL and DOGE.

You can also leverage trade on Hyperliquid, but I don’t recommend leverage in general. If you must use it, then use up to 3x leverage depending on the pair. That means a price move of 30% against you can trigger a liquidation. Note that a higher leverage also means higher slippage on pairs with low open interest.

Lastly, Hyperliquid has vaults where you can deposit USDC to earn 90% of the profit (or loss) from other traders. Hyperliquid also has their own trading vault and you can create or join any vault that is listed (do your due diligence first!). YCC also has a vault if that interests you. You are free to join or leave vaults at any time.

Kujira network - Fin highlights & more

Trade, lend & borrow, stake, farm real yield, mint USK or participate in liquidations

You can go to Fin exchange and trade your bridged ATOM (as indicated in Step 2) for any of the other pairs like KUJI, USK (Kujira stablecoin) or USDC. Fin DEX is one of the easiest way to get KUJI. Just watch for slippage.

You can also stake KUJI to earn real yield (now at 21%, but watch the unlock period of 2 weeks!) or provide liquidity across many assets to farm yields (including ATOM). Below a table with yields when lending your assets. You can also borrow assets or stables.

It’s not often that you see a real yield of 25% on gold (PAXG) as shown above. You can also mint USK against different assets or participate in liquidations where you can snipe KUJI and other assets under market prices. You can’t do that on a CEX! They keep all the profits instead. On Kujira, you join the fun!

As you can see, Kujira is a complete ecosystem and you can easily move funds via IBC bridges to any of the many Cosmos independent networks (like Osmosis). This is also a way to scale DeFi as a network of networks. Good stuff.

BONUS - ThorChain ecosystem

Lastly, there is one more ecosystem in the DeFi landscape that deserves your attention.

It’s called ThorChain and you can trade, swap and provide liquidity using native coins - that includes native BTC and ETH! This is unique in the space because it does not use derivatives like WBTC on Arbitrum. It uses real BTC!

This is actual decentralization that connects independent networks with no ways of communicating with each other (in contrast to the IBC bridge from Cosmos). But more on that will be for another time.

If you got any questions, jump on YCC Discord and I’ll be happy to help! Thanks for reading and share this with your friends. If you have more suggestions, leave a comment!

This newsletter is made possible with the generous support of our community Patrons and partners. Upgrade your experience to show your support by clicking the below button or reach out.

Such a treasure trove of information, that is easily understandable. Thank you Duo.