DeFi Platforms Blowing Up, Take Cover!

If you're exposed to DeFi, reduce risks! Stream xUSD crash and more.

A few weeks ago, I warned that the October 10th crash may revisit us due to delayed implosions. Behind the scenes, protocols actually went insolvent.

Now, bodies are starting to emerge to the surface and contagion is spreading.

The latest victims are users with exposure to xUSD by Stream Finance which promised high yields on your USDC. They went insolvent after losing $93 million in user money overnight. They also halted withdrawals once xUSD crashed.

The rest of DeFi scrambled to reduce their exposure and panicked users are withdrawing their money from various protocols in fear of a domino effect. When such things happen, you withdraw first and research later.

Let’s take a closer look.

Become a Patron for lifetime access to our exclusive private alpha!

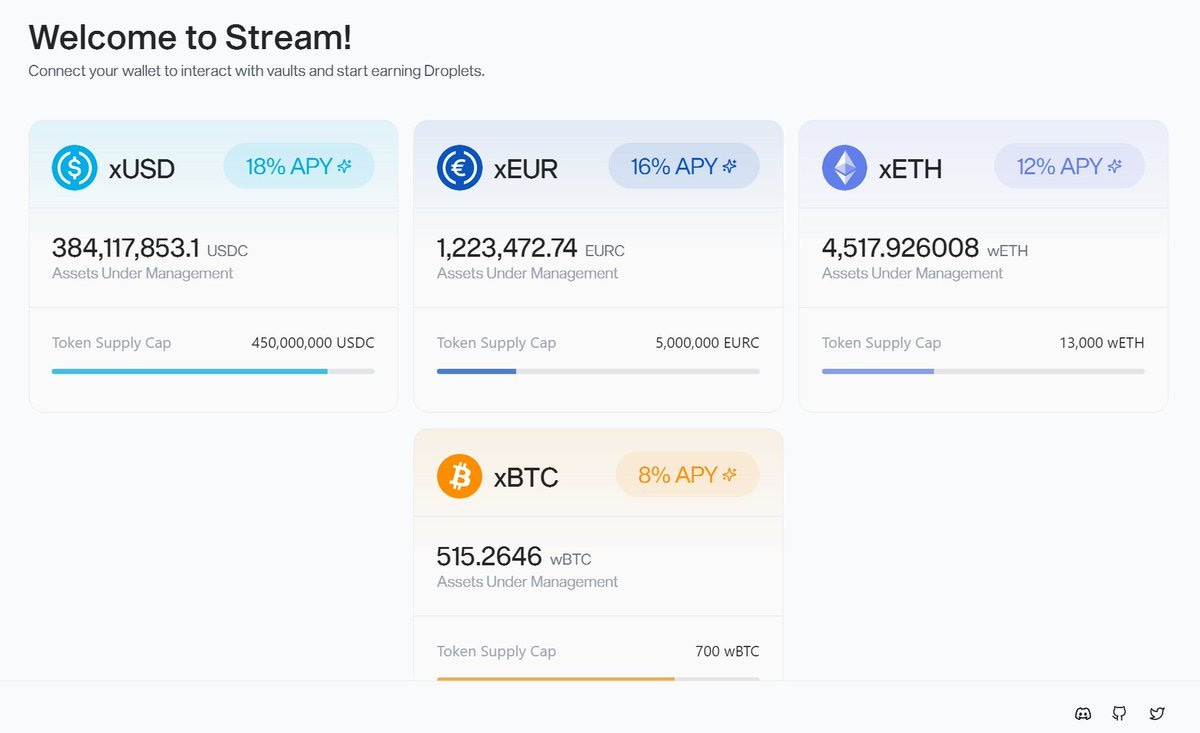

Stream Finance was a protocol that took your hard assets like USDC, BTC, ETH or EUR and gave you in exchange xUSD, xBTC, xETH or xEUR tokens. These x tokens accrued amazing yields.

Just look at their homepage. But there was a catch. There’s always a catch.

The protocol founder, 0xLaw, took the money and leverage looped it 9x times to generate more x tokens. This is how he managed to inflate the market cap of xUSD to hundreds of million.

By creating xUSD tokens from thin air, he could pretend to pay everyone amazing yields and also use them as collateral to withdraw more USDC from users. This only works for a time until the bill comes. The problem is that many other DeFi protocols plugged into xUSD to farm that yield. Woops.

Suddenly, users with exposure to xUSD or users that never intended to get such exposure woke up that they hold a worthless collateral thanks to their curators. Users in effect traded their USDC for a worthless x token.

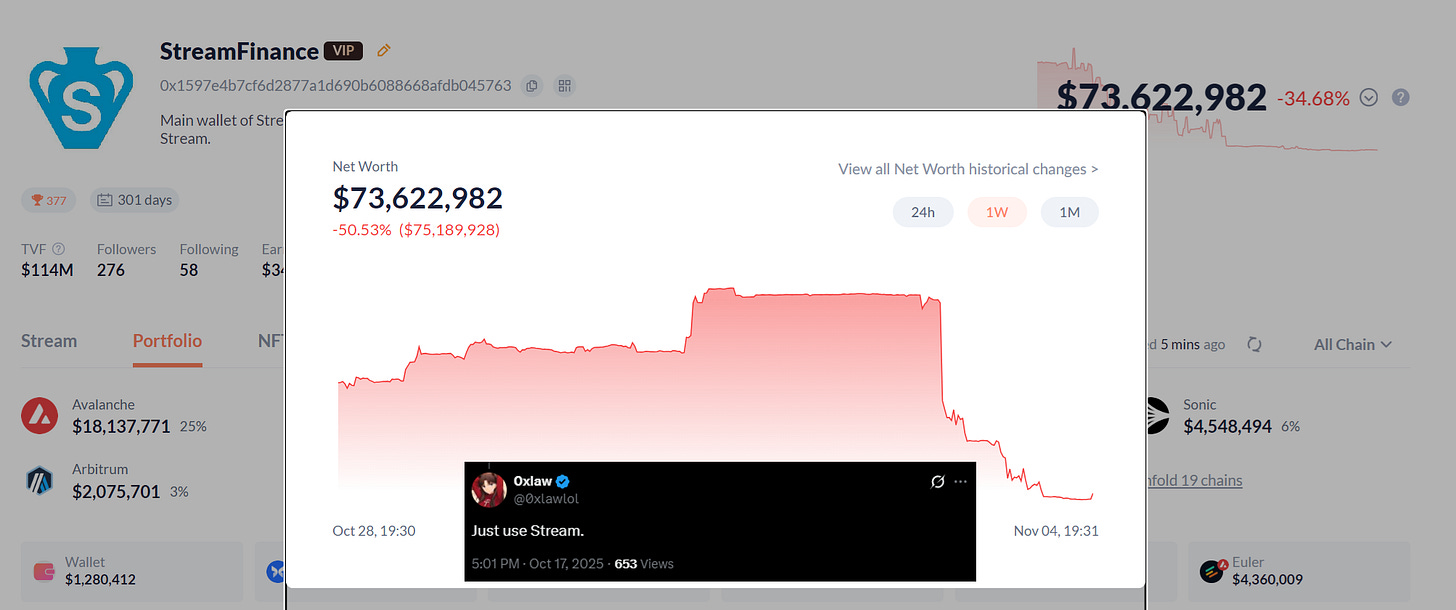

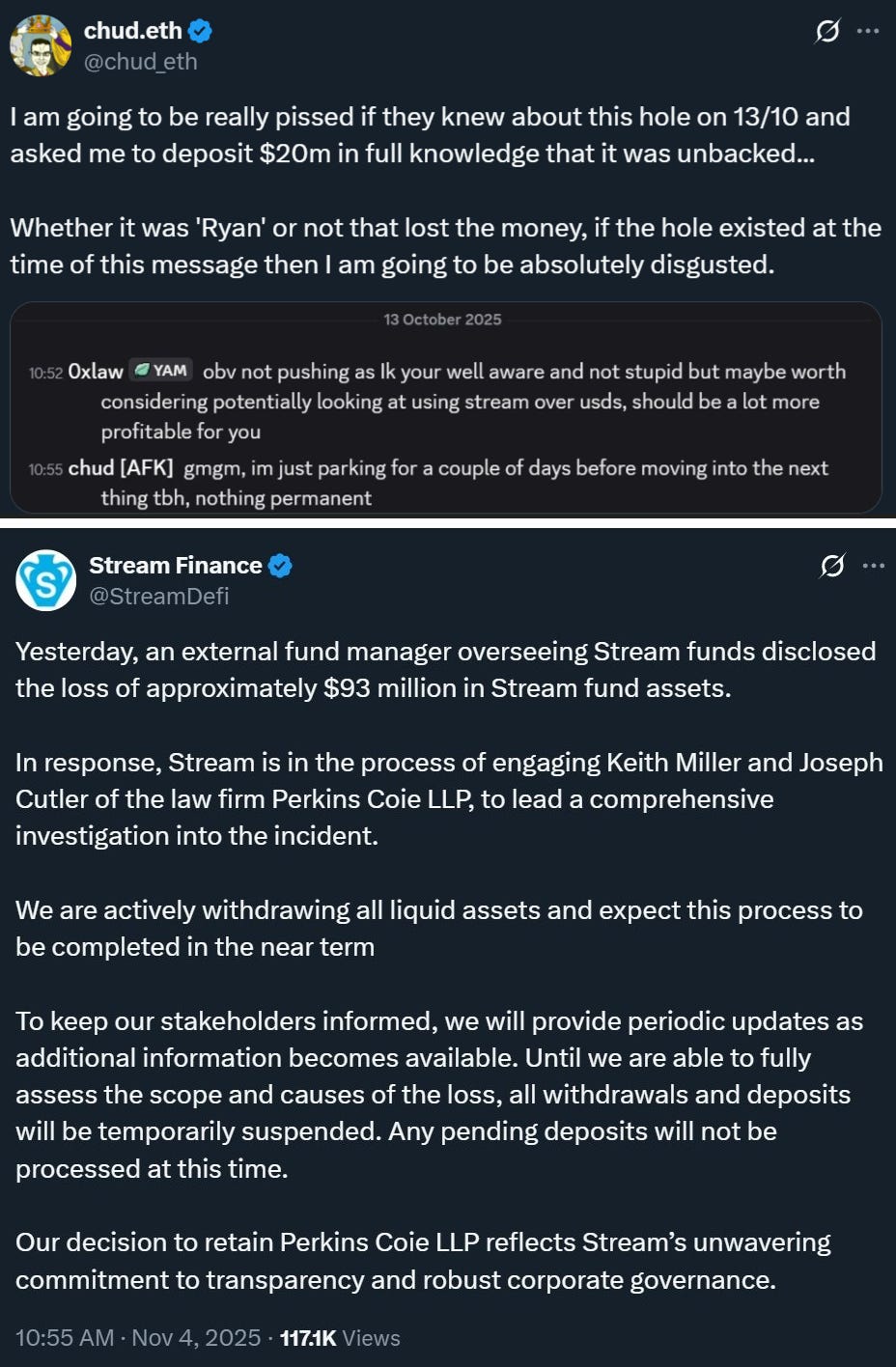

The scam got exposed once Stream Finance admitted to losing $93 million. This is likely a gap they incurred on October 10th and they did their best to plug it by getting more investors trapped before the collapse.

Take a look at the exchange below between the Stream founder and an investor before the collapse, but after the October 10th crash. Rumors suggest Stream used user money to trade with the help of third parties. Those third parties blew up on October 10th and lost the money.

This sequence of events also raises a bigger problem across DeFi.

xUSD was available both on Morpho and Euler Labs and promoted by various curators active on such platforms. Looking back, some of these curators are equally liable since they failed at their prime job, to actually curate and do their due diligence before sending user money into literal scams.

The signs were also there on X before this went south.

But the worst cases are instances where users put money into a low-risk strategy only for the curator to re-package that strategy 100% into xUSD via different wraps.

Just look at this chain of collateral and backing:

eliteRingsScUSD is backed by veUSD

veUSD is backed by locked stkscUSD

stkscUSD is backed by staked scUSD

scUSD is rehypothecated to Mithras

Mithras scUSD is borrowed by xUSD collateral on Silo & Euler

That xUSD collateral is now worthless. Therefore, all those other stablecoins are now worthless in this chain. Even if the user buys veUSD without any information on xUSD, they will be affected by this.

In total, about $500 million worth of xUSD was created against about $170 million of actual collateral like USDC. Stream Finance took their worthless xUSD and used it as collateral to withdraw assets like USDC from users, then lost the money.

The protocols and curators facilitating this process are complicit in this. That includes Morpho, Euler, Silo, and all curators that touched xUSD.

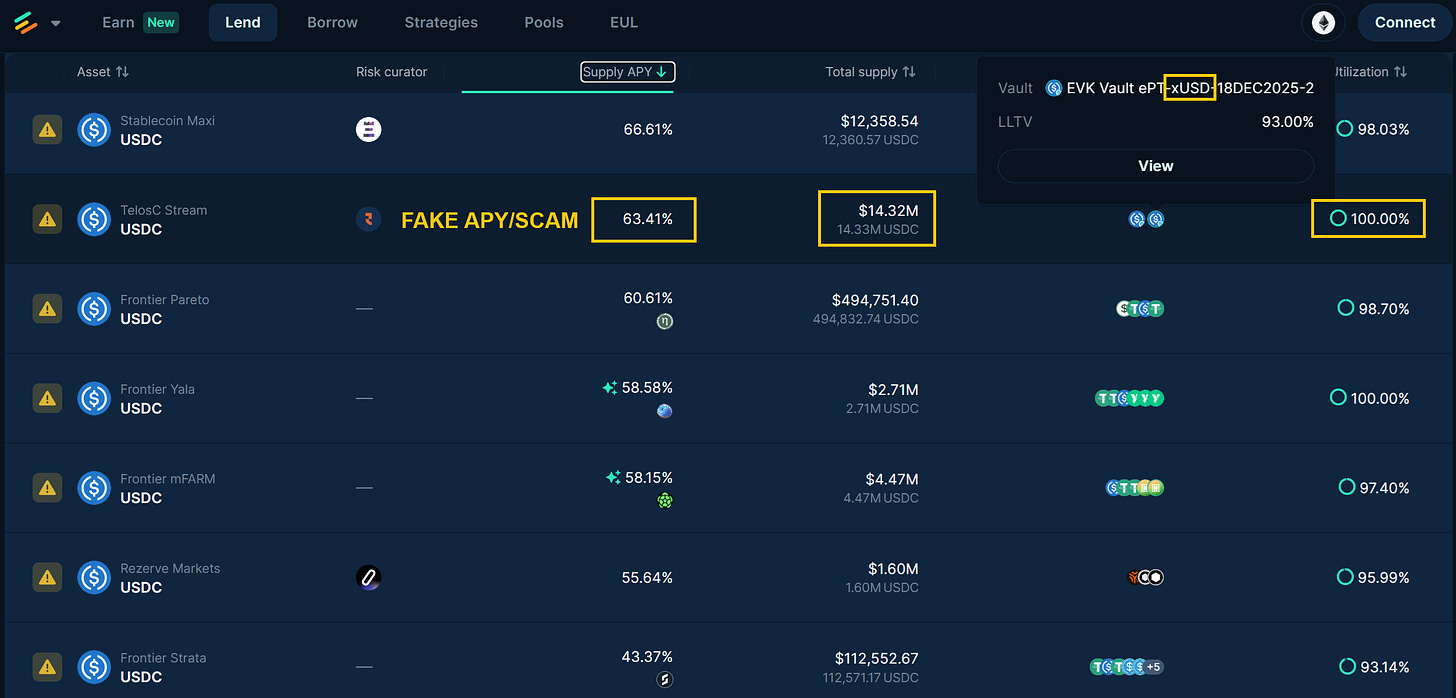

Especially because the xUSD oracle price was hardcoded across protocols above $1 and disconnected from real market rates. Even if xUSD is worth about 20 cents today, its price is still above $1 on Euler, see image.

This prevented liquidations on such platforms that could protect lenders of USDC when things went south. The protocols believed xUSD was valued at $1 and above when in fact its market value was crashing. The pools were drained of all USDC against a crashing collateral because of this price mismatch.

Anyone that deposited USDC in such pools were left holding only xUSD collateral. A worthless token since there is no liquidity to sell it. There are no buyers left for xUSD today, only trapped holders that can’t sell.

I wrote a detailed post on X about this which I recommend you read. Morpho and Euler will claim no liability since the full responsibility is with curators and users according to them. They are permissionless they say. I believe that argument falls flat when they promote such scams on their sites.

Because we do not know how bad things really are behind the scenes, and who’s exposed, we can expect more DeFi protocols to fold in the future.

To make matters worst, Balancer protocol was also drained of $128 million in the same week! DeFi users got hit from so many angles it’s getting hard to keep track.

In such market conditions, I recommend you withdraw funds from DeFi as a precaution until things settle down. With the market also making new lows, DeFi will continue to be put under pressure as liquidity becomes scarce.

Liquidity already left many vaults on Euler as users withdraw funds to seek safety. That’s why the APY on these vaults exploded. It wants you to deposit USDC. Don’t fall for it, especially if they use that to farm scams like xUSD.

DeFi protocols without robust internal management are vulnerable right now and they may have taken more risk than they can handle by chasing yields (like xUSD) and market share (fake TVL via loops). A bear market is quick to expose it.

Stay safe out there.

Are you still farming DeFi yields? Reply in the comments and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

Insightful...you did your due diligence and homework on this piece. These events are outrageous and highlight the perils of greed!

Boggles my mind how people keep falling for this after Luna…