Has a Bear Market Started?

The signs are out there if you know where to look.

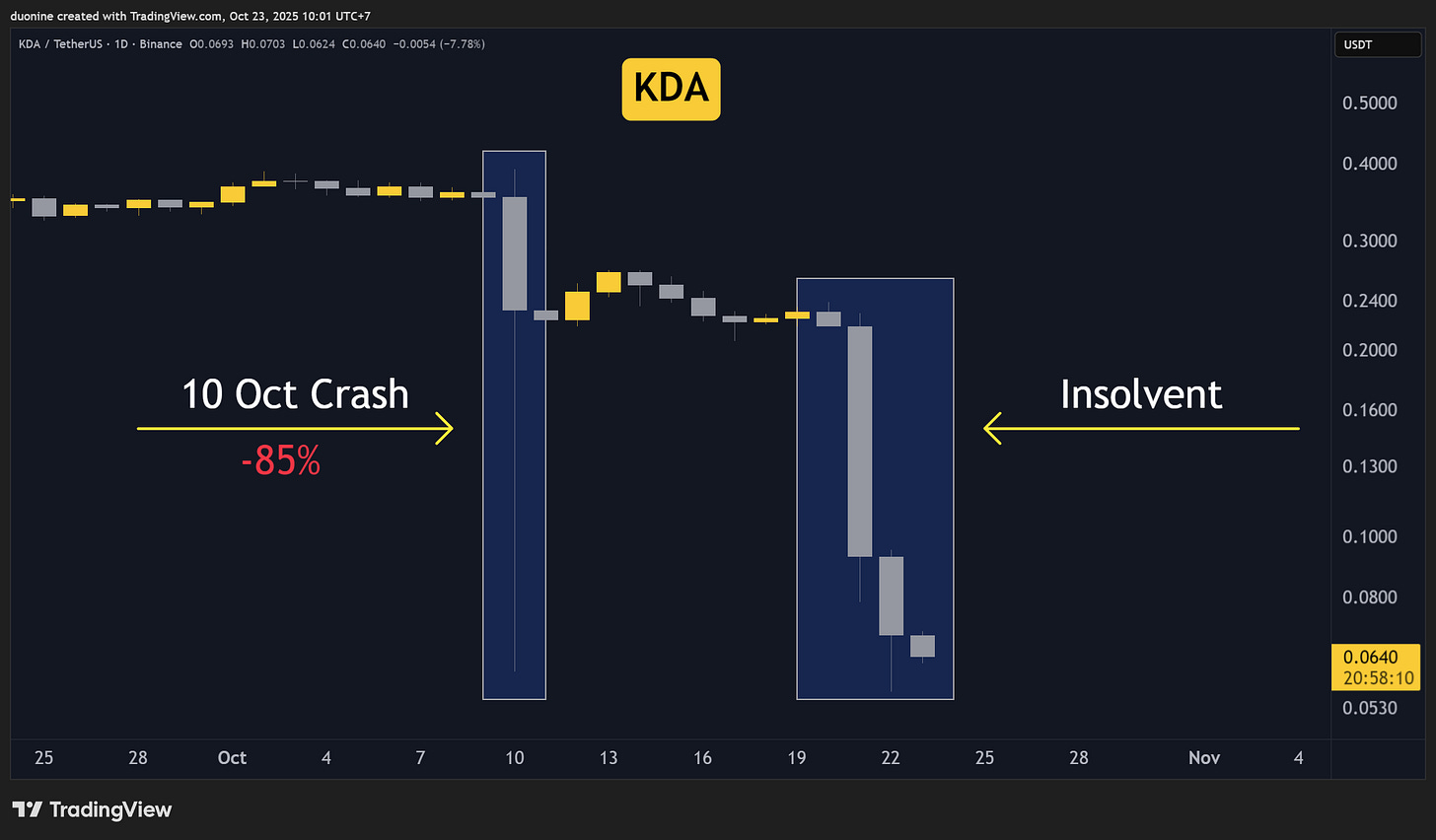

On October 10th, altcoins suffered one of their biggest crash in history. Some literally went to zero. Such events rarely pass without aftershocks.

We now have our first example.

When the market experiences a catastrophic liquidation event, behind the scenes, many projects become insolvent. To the outside world, they pretend it’s business as usual, but the reality is that they are inches from disaster.

This is a classic bear market signal and we just got it this week. Scroll down.

Become a Patron for lifetime access to our exclusive private alpha!

The collapse of Kadena | KDA

Back in 2022, Kadena used to be a multi-billion market cap blockchain. However, its fortune was not so easy after the original pump. The token lingered around a few hundred million in market cap since 2023.

What killed it was the crash on October 10th. See the chart.

Kadena was listed on dozens of major centralized exchanges. It costs millions to pay market makers to provide liquidity to the token across so many exchanges.

The crash on the 10th likely liquidated and evaporated whatever liquidity they had left to maintain operations. Insiders and the team knew the clock was ticking, so they started to liquidate their positions in advance.

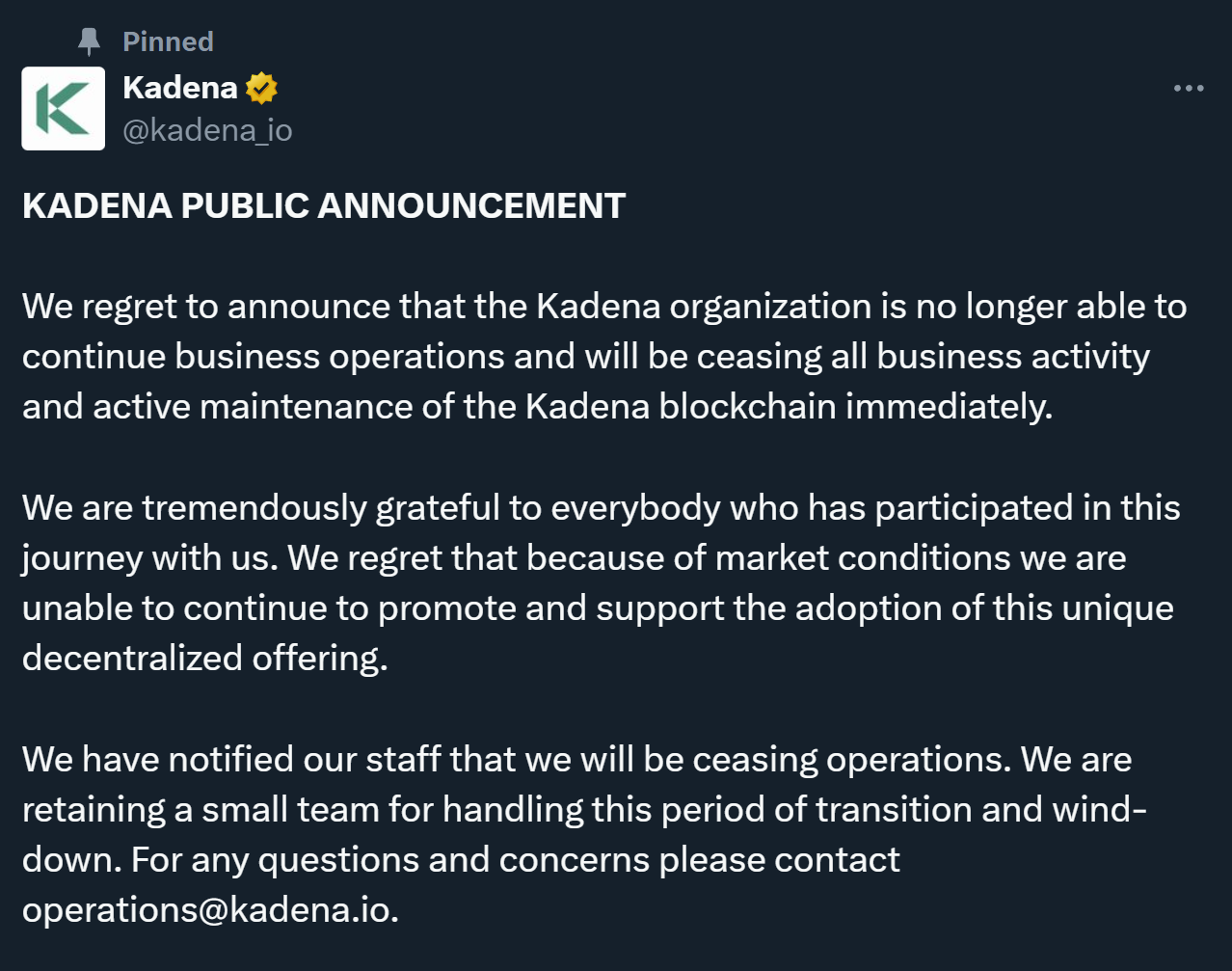

Some even shorted the token to the tune of millions before this message was posted on their official X account. Very greedy and unethical.

It took exactly 10 days for KDA to collapse and close shop after October 10th. I wonder how many other projects are in desperate need of liquidity right now?

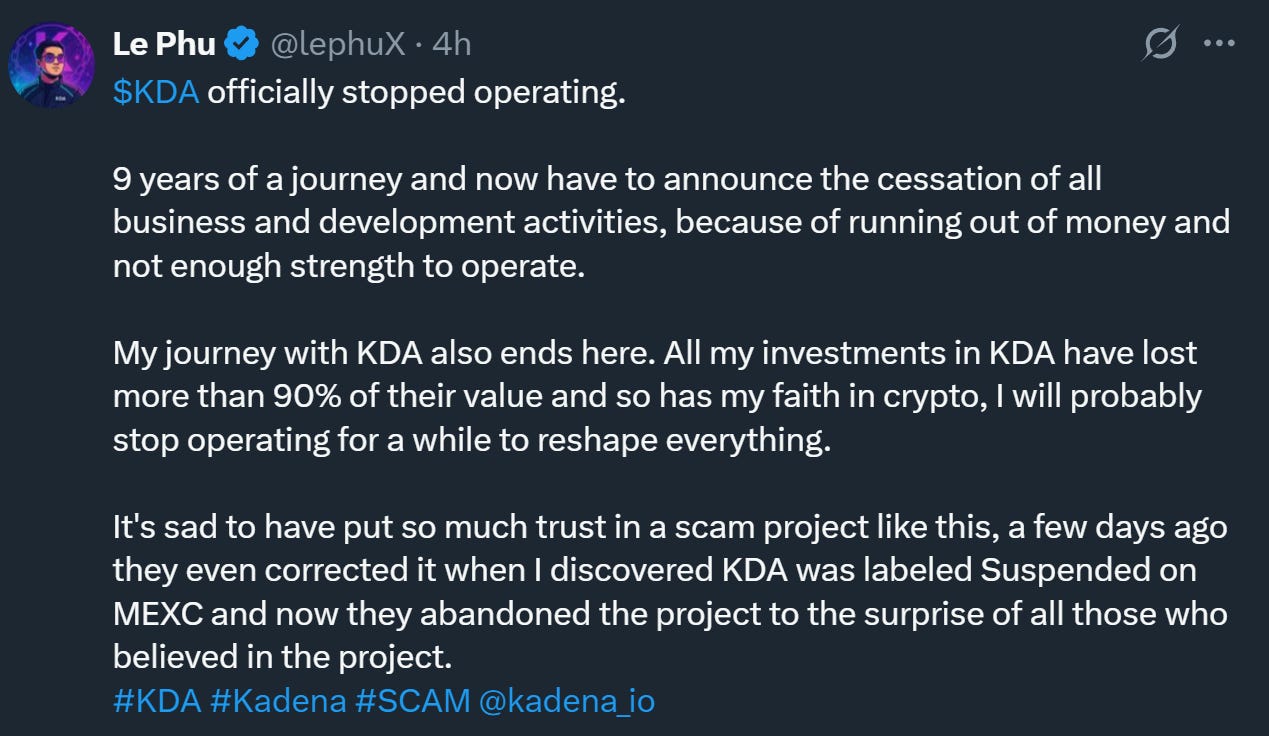

What makes this worse is that contagion is very high once a few projects start to wobble. It impacts the wider ecosystem and creates even more downside pressure. Not to mention people losing everything like this Kadena user that smelled the trouble ahead.

When an exchange flags a token with any label similar to “suspended” or “under observation” it means the project team did not pay their market maker. Without a market maker, the exchange will delist the token soon after, like with KDA.

Centralized exchanges don’t care about projects and their tokens. Their only interest is to make sure projects pay their market makers so that they bring liquidity and fees to their exchange.

Market makers often happen to be friends of the exchange as well. A purely extractive industry where most of the volume you see is fake and just wash trading. Their target is your money.

Contagion?

When projects start to fail overnight, even if not that big like Kadena, it is a sign of market stress. It shows the market has unknown vulnerabilities and it only takes one big player to slip and things compound fast to the downside.

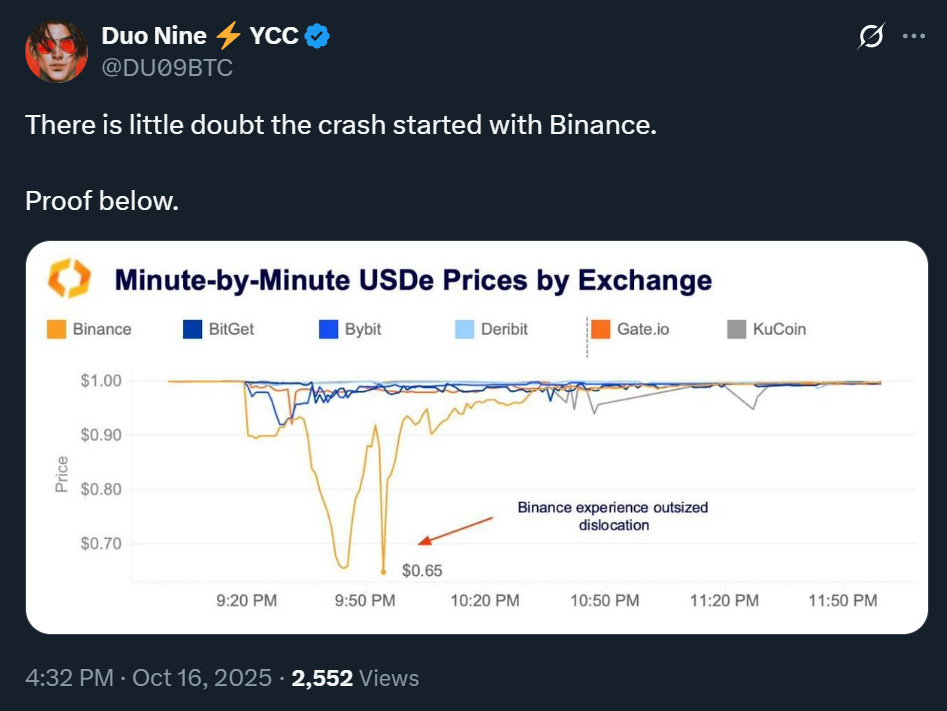

Binance slipping on October 10th and causing the flash crash in alts almost wiped out everyone. There is a lot of damage that is still to emerge from that.

This is the biggest unknown.

Behind the scene, we have no idea how bad things actually are. Just like Kadena, you can wake up one day with your money locked or lost forever in a project, protocol, exchange, or network that goes under.

That’s why you need to be extremely prudent and selective with the protocols, exchanges, and networks you are using right now. Do not take unnecessary risks. Your first priority is to guard your money and wealth.

A look at altcoins paint a grim picture. Most are down 60% to 95%. That includes projects like Aster, XPL, ENA, or PUMP. Such collapse in valuations is typical of a bear market.

As far as I am concerned, altcoins are in a bear market and have been for some time now.

For example, Ethena is one of the most successful projects of this cycle. They mainstreamed the basis trade with the help of USDe across crypto. Yet, their governance token ENA still crashed 90% this year compared to its all-time high.

I’ve already expressed my concerns about Ethena and their USDe token. It’s a perfect catalyst for a major crash across DeFi later. USDe already lost peg on Binance and liquidated many on 10th October, but luckily, it was contained there.

While most altcoins are in a bear market, exceptions apply.

One good example is Binance Coin. This one is highly managed by Binance and they pumped it to new highs in 2025.

Why is BNB different?

Because to list any coin on Binance, projects need to buy or hold a lot of BNB. Moreover, projects listing there need to give up or airdrop their own tokens to BNB stakers. Essentially, Binance cannibalizes other projects to move value to its token. They sell the airdrops and put buy pressure on BNB with the proceeds.

Farming other projects is a business model that proved successful for Binance Coin. However, Binance was also the actor behind the liquidation of $20 to $100 billion on October 10th. Such extractive actions can only go so far before they bite back.

No wonder they got a lot of hate since. They went too far.

A word about Bitcoin

The only thing keeping this market away from disaster is Bitcoin, nothing else. Its uptrend is still intact, but for how long?

Ethereum and Solana failed to sustain new price records and were quickly sold off from recent highs. XRP is rather irrelevant because it has no DeFi ecosystem. Binance Coin is performing well only at the expense of other altcoins.

Major altcoins are not able to generate the needed liquidity, hype, and flow to push this market up. This is why Bitcoin is doing the heavy lifting of keeping things afloat right now.

If Bitcoin folds and falls under 100k later, it’s game over.

In such a scenario, expect most altcoins to drop by 90% to 99% from their all-time highs. Only then consider buying and be very selective when doing that. I’ll make suggestions in my Alpha Posts as usual. Even so, it’s best to wait about a year for the bear market to hit rock bottom first.

Buy when nobody talks about crypto.

I can’t tell you when Bitcoin will top, but it will top. Either at 125k, 150k, or 200k. I hope we can see 150k before the nuke comes and sends us to goblin town

My position in this market

Since 2024 I’ve been recommending everyone to sell altcoins when rallies happen. I’ve already sold all my altcoins since then, except RAT Escape. I only hold Bitcoin and RAT. That’s it. If I hold other altcoins is just to trade them briefly.

The reason I hold RAT is because our meme token already experienced a bear market and sellers are exhausted. Most altcoins are still due to experience that. For this reason, I see RAT as having more upside going forward than downside.

We also plan something special for our token’s one year anniversary in late November. If you are a RAT holder and want to partake in that, send me a message on Discord.

Good luck and stay safe!

Do you still hold altcoins? Reply in the comments and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

good one as usual! thanks!

No, it will start in January/February