Fiat World on the Brink of Collapse. Can Bitcoin Survive? #21

Market indicators are flashing red and Bitcoin has never experienced a prolonged financial crisis. Will it act as a hedge or sink with the rest?

There is this unmistaken feeling that clouds are gathering above us. These clouds are not of our own making and are likely to impact everyone, including crypto.

The crypto space just emerged from a long bear market that ended with the start of 2023 and the bull market is still some distance away. During this funny period between crypto cycles, the fiat world appears to be on the brink of collapse.

Let us look at a few market signals that should raise your eyebrows and give you extra reasons to consider Bitcoin.

In this edition, I will also give you my top five cryptocurrency picks to watch this week based on their price action. I plan to always add my top picks in future newsletters. Subscribe to not miss out.

On a long time horizon, I am a perma bull on Bitcoin and crypto in general. This new emerging sector can 100x from here with mainstream adoption still ahead of us. There will be a bull market - I am certain of it - the question is when.

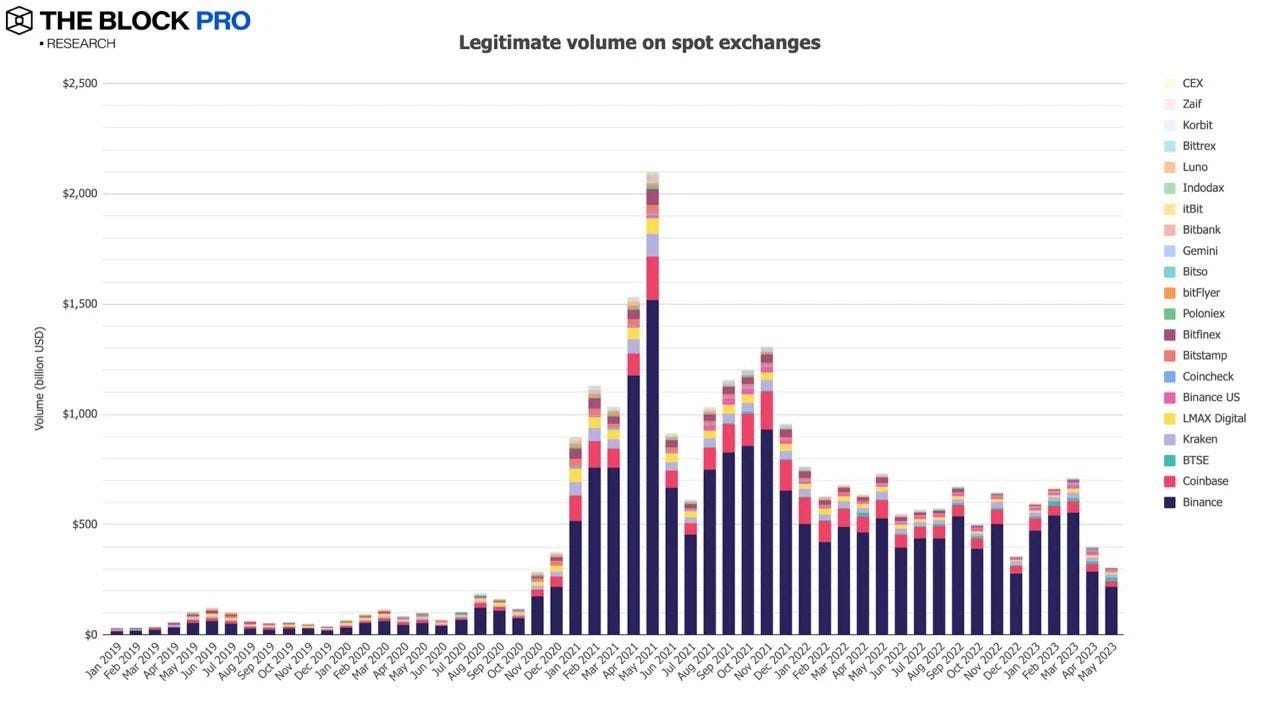

As you can see from my above tweet, crypto users appear to have vanished. This is not a GMX problem, this is systemic across all crypto exchanges, centralized or not. A quick look at volume across major exchanges confirms the same trend.

The volume on exchanges has not been this low since 2020. The funny period continues and I don’t blame crypto for it. On the contrary, the appetite for cryptocurrencies is at an all-time highs (ATH). For example, USDT, the largest stablecoin by market cap, reached a new ATH this week at over $83 billion.

Something else is causing this. The most likely candidates are liquidity issues, lack of disposable income and double digit inflation. These are fiat money problems. Crypto users living in the real world (which includes fiat money), simply ran out of cash. If they do have cash and live outside of the US, they will likely buy USDT (as they can’t easily access USD) as an escape from extreme inflation in their national currencies.

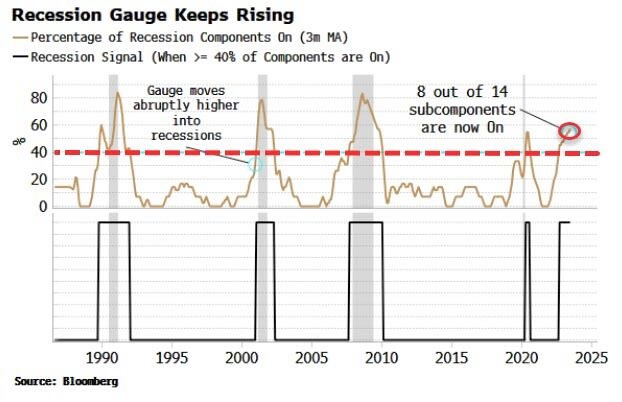

What is more concerning is that Germany is already in a recession. The EU economic engine is slowing down. The US numbers are not better either as the next image illustrates. By all indicators, we’re months away from a global recession. This poses several problems for crypto.

Like it or not, we’re still some distance away from a crypto only economy and until that happens, we’re hostages to fiat money side effects. This includes financial crises, banks collapse, recessions, and ultimately the destruction of your purchasing power and wealth.

As a direct result, the inflows to crypto stop. A quick look at crypto venture capital (VC) investments this years highlights this point. We fell off a cliff. If crypto users have no more money to gamble, so do VCs. The next alarm bell relates to cycles in the traditional US stock market.

As you can see below, the current bull run started in 2009 and so far we’ve been 14 years into it. The last cycle from 1982 to 2000 lasted 18 years before a major bear market. The one before that lasted 19 years (1949-1968). Are cycles shortening?

At best, the S&P 500 has a few more years before a full collapse and we’ve already arrived at a major shortage of liquidity today. Whatever money is left does not seem to trickle down to crypto anymore. One other cause could be the new crypto regulation that came as a result of FTX collapse. It’s called Operation Choke Point 2.0 and I already covered that in my previous newsletter.

These signals make me doubt we will see a major crypto bull market any time soon. Unless, of course, the US starts printing fresh money without limit. The recent lifting of the US debt ceiling could be a trigger for that. But more paper money does not mean more wealth. It means more inflation.

Those with first access to the newly printed dollars could opt to hedge their risk of a systemic collapse by buying Bitcoin. That is the only scenario where crypto could actually benefit once the printers are turned on. That would trigger a major bull run in 2024-2025 and then, in line with the S&P 500 cycles, a major crash could follow. Therefore, we’re at most one more crypto bull market away from a systemic reset.

The coming global recession will be Bitcoin’s biggest test. Whatever happens, Bitcoin remains your best bet at protecting your wealth in the next decade. We have no better alternative.

Will Bitcoin act as a hedge in the future or sink with the rest? Let me know in the comments your take on this.

I promised my top 5 picks for this week, here they are and why (NFA):

GMX

GMX has reached a major support level after correcting over 40% from its current ATH. More so, the daily MACD has turned bullish and the downtrend has broken to the upside. This could be a good entry for a long term position or accumulation.

The only risk, which also applies to the other coins on this list, is BTC failing to hold its current support. That could drag altcoins lower. On the other hand, ETH looks better and could mitigate those risks as I indicate below.

KUJI

Kujira has been making waves in the crypto space, most recently with its price breaking above $1. This is a major milestone and in the process, the price has also formed a large W bottom pattern. This is bullish.

The expectation is that KUJI will continue to move higher and major resistance levels will be found at $2 and around $4 which is its ATH from Terra times.

LTC

You may be surprised to see LTC on this list. However, this altcoin has tried several times to break into a three digit valuation in 2023. So far, it failed to sustain a price above $100, but it is about to try again and eventually it will be successful.

If so, you may want to pay attention.

LQTY

After a sharp correction from almost $4, LQTY - the governance token of Liquity - has reached a key support at $1.2. If this level holds, then LQTY could have a nice bounce off this support and test the resistance at $1.8 next.

ETH

Somehow, Ethereum is looking better than BTC right now and broke into $1,900. If it sustains this price action, then look for $2,000 and $2,100 next. This could also pull altcoins higher.

Pledge your support if you find my writing awesome. You won’t be charged until subscriptions are enabled. I will announce it when that happens.