Here's why Bitcoin will go to $100,000!

I am 99.9% sure it will happen and probably faster than we expect.

Many dismissed the Bitcoin ETFs as just hype, but a month later they are proven wrong. Bitcoin broke above 50k on Monday and it does not give any signs it’s going to stop any time soon.

Why would it? The ETFs are buying over $500 million worth of BTC per day!

In my experience, this will only speed up the inevitable. Bitcoin will hit six digits faster than anyone expects because the price moves at an exponential rate the higher it goes.

Bitcoin only has to double from here and it hits that target. Let’s look at the numbers next. TLDR at the end.

This newsletter is sponsored by CoNET, the only protocol that eliminates the need for IP addresses and replaces them with a private wallet-to-wallet Internet!

Mine CoNET points in your favorite browser via a proof-of-time & bandwidth mechanism and be rewarded CoNET tokens when the mainnet launches!

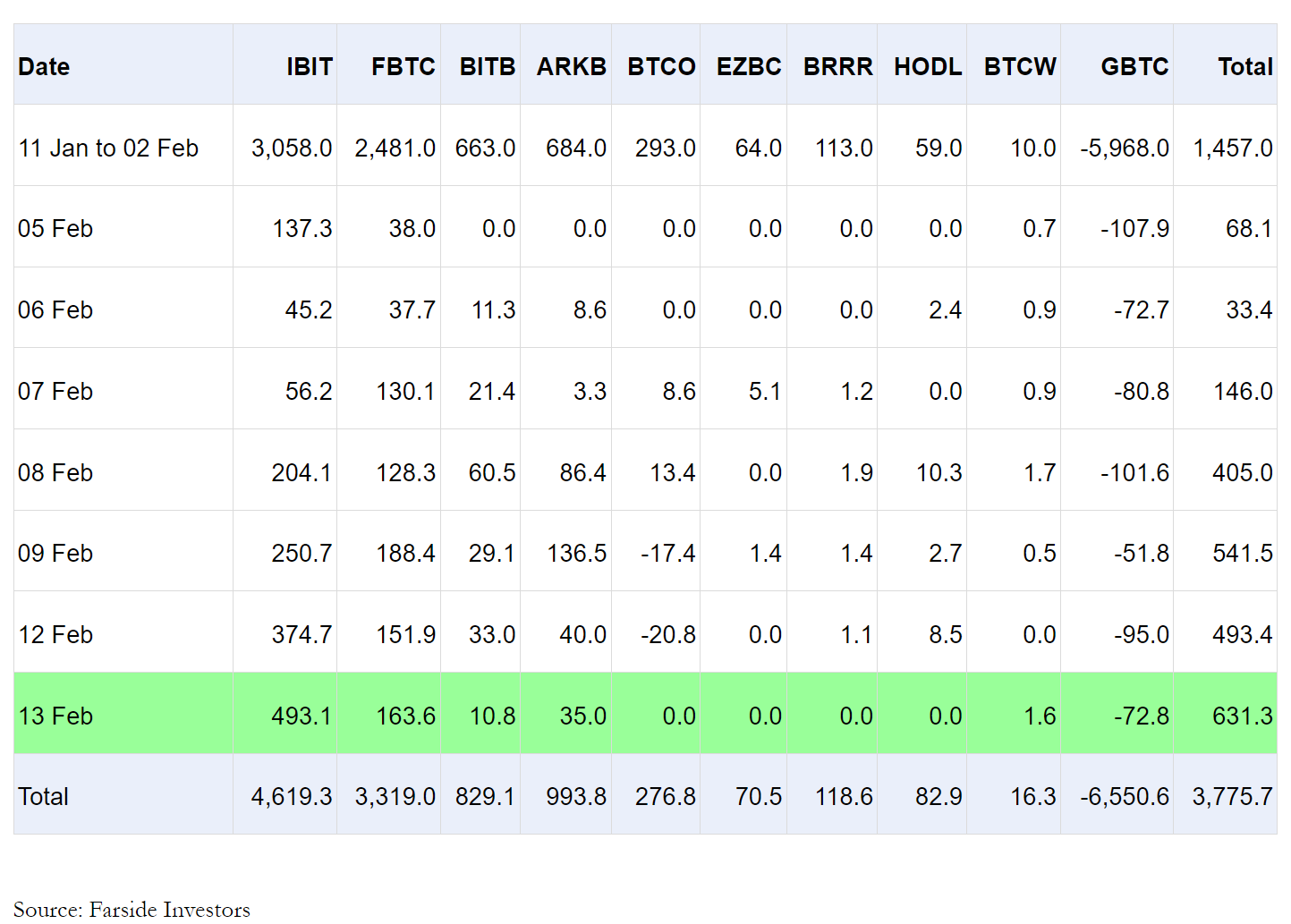

If you haven’t seen this Bitcoin ETF flow table already, then you should follow me on X. I also share more good stuff in my alpha newsletters - keep an eye for those.

This table brings me to three key points I want to draw your attention to. Check the last four days totals first.

The net values are positive and the last four days exceed $2 billion in total

The figures are trending upwards with a record-breaking day of $630 million on 13th Feb!

GBTC, the big ETF seller after approval, is no longer selling much

That’s a lot of millions for Bitcoin to absorb per day considering that only 900 new Bitcoins are mined every day, or roughly $45 million at today’s prices. The ETF’s are buying 10x times that. Note that this does not factor in a few elements:

Not all miners are selling their Bitcoins. They can choose to hold as it is in their interests to do so in a bull market and can unload later

The demand from ETFs is on top of all other buyers, including retail

The halving in April will reduce the emission from 900 to 450 BTC per day. Expect a supply shock soon after

There will only ever be 21 million Bitcoins and there is not much left that is liquid

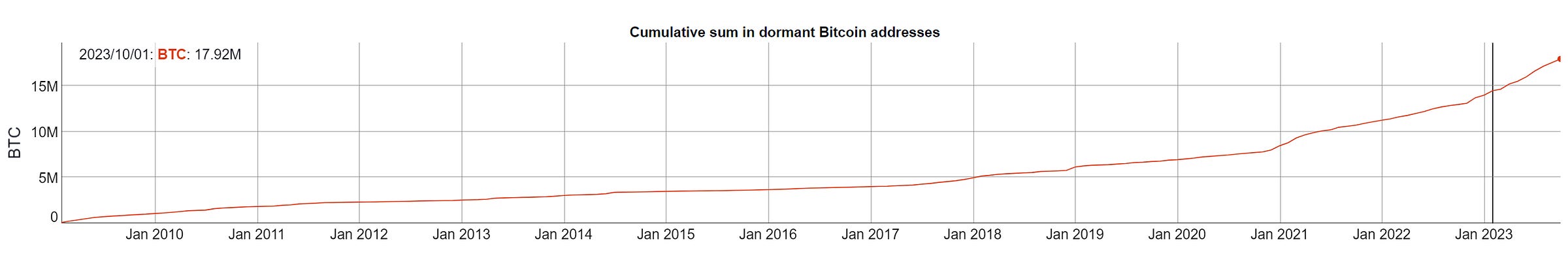

If you look at the below chart you can see that about 18 million Bitcoins are sitting in dormant wallets. They are not moving, or more importantly, their owners don’t plan to sell! That leaves under 2 million BTC for any new buyers or less than 10% of total BTC supply.

Let's imagine that the ETFs continue to buy around half a bill of Bitcoins per day on average. That’s about 10,000 BTC at today’s price. After a simple division we find that those 2 million liquid Bitcoins will be bought in about 200 days at this rate!

Clearly that’s not possible. You can’t run out of Bitcoins, can you?

Well… yes and no. This assumes the ETFs buy to hold and not sell much. But if this buy volume by ETFs does not stop it will 100% lead to a supply shock. That means there won’t be enough BTC for everyone and the price will have to go exponential to compensate for that.

Remember, Bitcoin scales in price, not speed. Hello $100,000! As BTC’s price makes new highs, it will move more wealth per transfer than before. That’s how BTC scales and becomes more secure.

However, higher prices will attract more sellers. There will always be Bitcoin for sale as long as the price goes high enough. Remember those miners holding? Or those 18 million BTC in dormant wallets? They can turn into sellers at any moment. That’s how bubbles burst.

There’s another chart that confirms a bullish trend - the BTC reserves on exchanges. The reserves are falling as BTC’s price moves higher and higher. I’d not be too concerned about those dormant wallets waking up until the purple line from the below chart starts pumping.

When the ETFs become net sellers as the price makes new highs, pay attention. That could turn into a top signal. Smart money exits at the top while retail (or dumb money) buys their bags and are left holding in the next bear market.

Some will sell at 69k which is the current all-time high, others at 100k. However, the fundamentals I just described will not change even at $1 million per coin. Bitcoin will still have only 21 million coins available of which under 2 million are actually liquid.

That’s not a lot of Bitcoin to satisfy infinite demand as shown below. Moreover, the above exercise in imagination did not factor retail and other sources of BTC demand. Retail is not here right now, but after 69k, it will come. After 100k it will come hard. The media will start going crazy. Euphoria will take over the market.

By that time, even ETF investors will likely start getting FOMO (fear of missing out). The sky is the limit and you will have a difficult choice to make. Sell and hold a worthless paper called fiat money or continue to hold the hardest money ever created by man?

Which is it?

TLDR & Tips to Remember

Bitcoin will hit 100k faster than anyone expects

The price moves at exponential rates the higher it goes

ETFs are buying 10x times the amount of BTC mined per day

The Bitcoin halving in April will create a supply shock

Only around 10% of all Bitcoins are liquid to buy

Bitcoin scales in price, not speed. Expect FOMO soon

Someone will always sell Bitcoin, provided the price is high enough

Bitcoin is finite. The fiat money buying it is not

This newsletter is made possible with the generous support of our community Patrons and partners. Upgrade your experience to show your support by clicking the below button or reach out to us on X or Discord to partner.

All info is provided for educational purposes only and is not financial advice.

Been trawling the net and real world for a crypto content, and Duo, I can safely say, that you analysis and write ups are the best. Like legit, no contest. Easy to read, straight forward explanation, great summaries. Just perfect mate! Keep up the great work!