How to Find Your Edge in Crypto? It's a Must!

Without one, you are just gambling.

If you want to be consistently profitable in crypto, you need to have an edge. This can take many forms, but you must have one. Otherwise, you’re left to the mercy of the market.

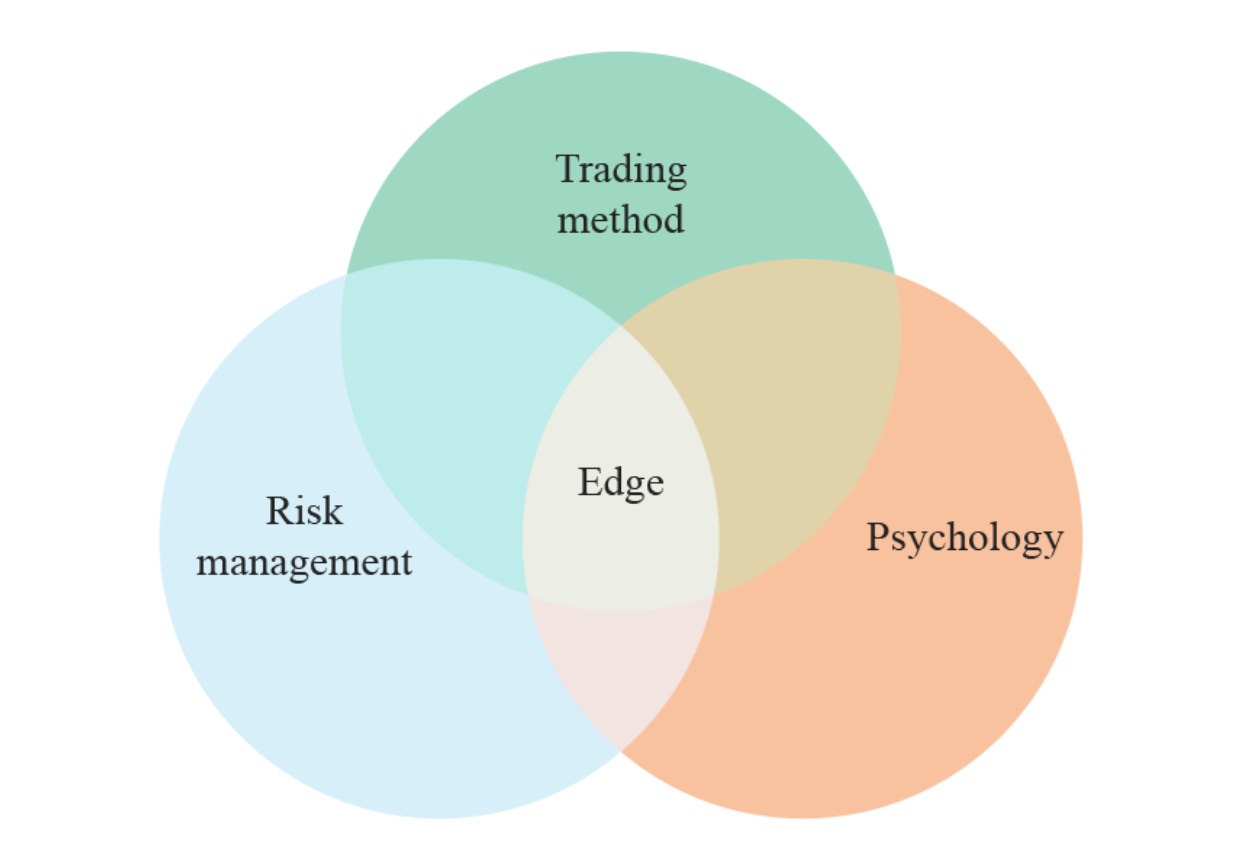

An edge is a strategy, skill, or knowledge that gives you a higher probability of profitable outcomes over the long term.

Think of it as an advantage (say inside information few have access to) that allows you to profit. Crucially, you need to be able to repeat this again and again until the edge is gone. At that point, you change strategy or learn new skills.

In what follows, I share real examples to help you define your own edge. Let’s start!

Receive up to $200,000 in trading capital and keep 90% of your profits. Just purchase and pass an evaluation on Breakout - use code YCC to get a discount!

No hidden rules! Sign in with Kraken or your email below.

A trader that is consistently profitable will tell you that an edge is a clear market advantage that can be exploited for a given period. An example of that is arbitrage.

If Ethereum trades at $3,200 on Binance and $3,150 on Hyperliquid, an arbitrage bot can net $50 (minus any fees) by buying on Hyperliquid and selling on Binance until prices merge and the arbitrage opportunity is gone. This is a very profitable trade during volatile times.

A similar strategy is applied across DeFi and different chains where the price of assets like Ethereum sometimes diverges enough to make such arbitrage profitable.

However, arbitrage is a crowded trade and is mostly automated. The edge there is gone for regular users since that opportunity is farmed as soon as it emerges by market markers paying almost no fees on such exchanges (another clear advantage or edge in their case!)

How to develop an edge?

Buying and holding is not an edge. Especially if you buy and hold the wrong things. However, if you blend buying and holding with the following, you will have an edge over time:

Understand what sound money is and why it’s important

Plan to accumulate hard assets only, preferably highly liquid ones

Don’t mind waiting years or decades to maximize compounding effects

Have a steady cashflow you can deploy over time to grow your portfolio

Doing the above with Bitcoin, gold, index ETFs, or real estate will likely make you pretty well off in a decade or two. This is a passive way of developing an edge over time by consistently investing in the right assets again and again. That’s your strategy!

Doing the same with altcoins will likely lead to ruin in the same time period.

This method is the most basic way to success. However, if you want to be more active in developing an edge, then follow the next examples.

Have a strategy or create one

Below are three strategies that can give you an understanding of what I mean:

Trade only one asset 30 minutes after the New York Stock Exchange opens every day. If the price makes higher highs in that 30 min window, you go long. If lower lows, you go short. You stay in this trade until lunch time at best. Repeat this every day.

You participate in public or private token sales with a strict list of criteria (no lock times or long vesting after the token generation event). You sell said tokens within a week after the token goes live across exchanges. Repeat this several times a year. Here’s a list with such opportunities.

You split your USD liquidity in five buckets. Each bucket of cash (20% of total) goes into a DeFi protocol farming yields. Your goal is to have an average yield of 10% to 15% per year across your portfolio. That’s up to 4x more than TradFi rates. Review your portfolio and positions daily and update accordingly to maintain an edge. See USDai as an example.

You have an edge if at the end of the week, month, or year you are net positive or in profit. Notice the key to any strategy - it can be repeated again and again. The edge stays valid until it no longer generates a profit or underperforms benchmarks such as Bitcoin or AAVE’s 5% annual yield.

Assess your skills then double down on them

Whatever strategy you pick, evaluate the skills required, and refine them. Just doing that can turn a boring strategy with little profit into an edge that can make you rich. Here’s what I mean, keeping consistent with the above examples:

Learn price action and technical analysis. Spend time watching charts until the price speaks to you. Refine your strategy until you know exactly what to do at every moment. Repeating your strategy should become a boring and predictable set of actions, whatever the market may do. You know when to buy, sell, cut losses and what to do with the profits. Nothing is uncertain.

You build a network and “reputation” onchain over time. This allows you easy access to join private or public sales before tokens go live. This is your edge. For example, the MegaETH sale had 50,000 interested participants, but only 5,000 made it in. I spoke about it in Alpha Post #80. Farm such airdrops, sell for profit, and buy more Bitcoin. Then repeat.

You are an advanced DeFi user. You can easily assess opportunities and risks of any new protocol across various blockchain networks. You deploy cash using the most optimal routes and bridges. You farm yields as long as they are competitive and bail early at any signs of trouble. This agility to move across DeFi is your edge. You also farm points and airdrops with your liquidity on top, that will boost your yields further. Repeat this again and again.

Find and exploit any advantage

Crypto is, in most cases, a zero-sum game. For you to make a profit, it has to come from somewhere. This is why there are plenty of losers in this space. It’s a highly extractive industry and I wrote more about it here.

To differentiate yourself, you need to take a different approach. For example, I started my X account out of curiosity and an interest in posting my analysis about various protocols and coins. That quickly exploded into a following.

Over time, having an audience can generate leverage where you can gain access to information before it becomes public by interacting with teams and protocols that would otherwise not be interested in talking to you. This is a clear edge or advantage. Subscribing to this newsletter and reading my premium posts is another way to access alpha early.

Others are skilled in reading the blockchain or can code bots that allows them to track or mirror whales actions in real time. This provides them with insights that are rarely public.

Another way to have a clear advantage is to simply build something onchain. As a builder, you control your product and can leverage that to your advantage. Just look at Stripe that recently enabled USDC to fiat transactions for which they charge a 1.5% fee! Crazy high, but they will likely print from that.

The bottom line

If you are playing in the crypto casino without a strategy or edge, don’t expect to become rich. At best, you may get lucky on a meme token, but then lose that profit quickly by gambling on the next one.

Take a week or a month to define, develop, and refine your strategy. Start by identifying your skills which can lead to a concrete edge. You will know if you’re on the right track once profits emerge from your actions. If a former profitable strategy is no longer working, seek a new edge.

The market always provides opportunities to those nimble enough to catch them early. Your role is to show up early and maximize the opportunity. When the rest follow, it’s time to exit.

What is your strategy or edge in crypto? Share it below and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

I feel like being a woman is an edge in crypto. Many guys do some surprising, reckless moves.

Really solid breakdown of what separates speculation from strategic positioning. The arbitrage example highlights how edges erode fast, which is why being repeatable matters more than being clever once. Onchain reputation as leverage for allocation access is underrated tho, most traders still think its just about TA when networked information flow is way more valuable long term.