Market Crashed - Here's What I am Buying. #24

This is an opportunity that does not come often. Time for asymmetric bets.

Once Bitcoin lost its uptrend that started in January (see chart below), the price crashed by over 10% in a few days. This was caused by traders protecting profits and by liquidations due leverage longs opened at the wrong time.

Now Bitcoin sits just above the support at 25k. The market can go either way, but altcoins give a clear bearish signal as Ethereum has made a lower low during this most recent crash. Will Bitcoin follow?

Either way, this creates an opportunity not seen since late last year (November - December 2022) when the market was at a huge discount. Scroll down for my latest video update on the current market and what I am planning to buy and why.

I covered the current price action in my latest YouTube video. Take some time to watch it and subscribe to my channel for more updates. If you are into technical analysis, this is the place to be.

Moreover, the current price action was discussed in our Discord server back in April when we assumed the market could dip in August - September, based on cycle analysis. Seems we are right on target.

The biggest question is if BTC will stop at 25k or fall lower. We can’t guess, so what we have to do now is wait to see if the price will bounce and hold above this key support level. If not, get ready for more discounts across the board.

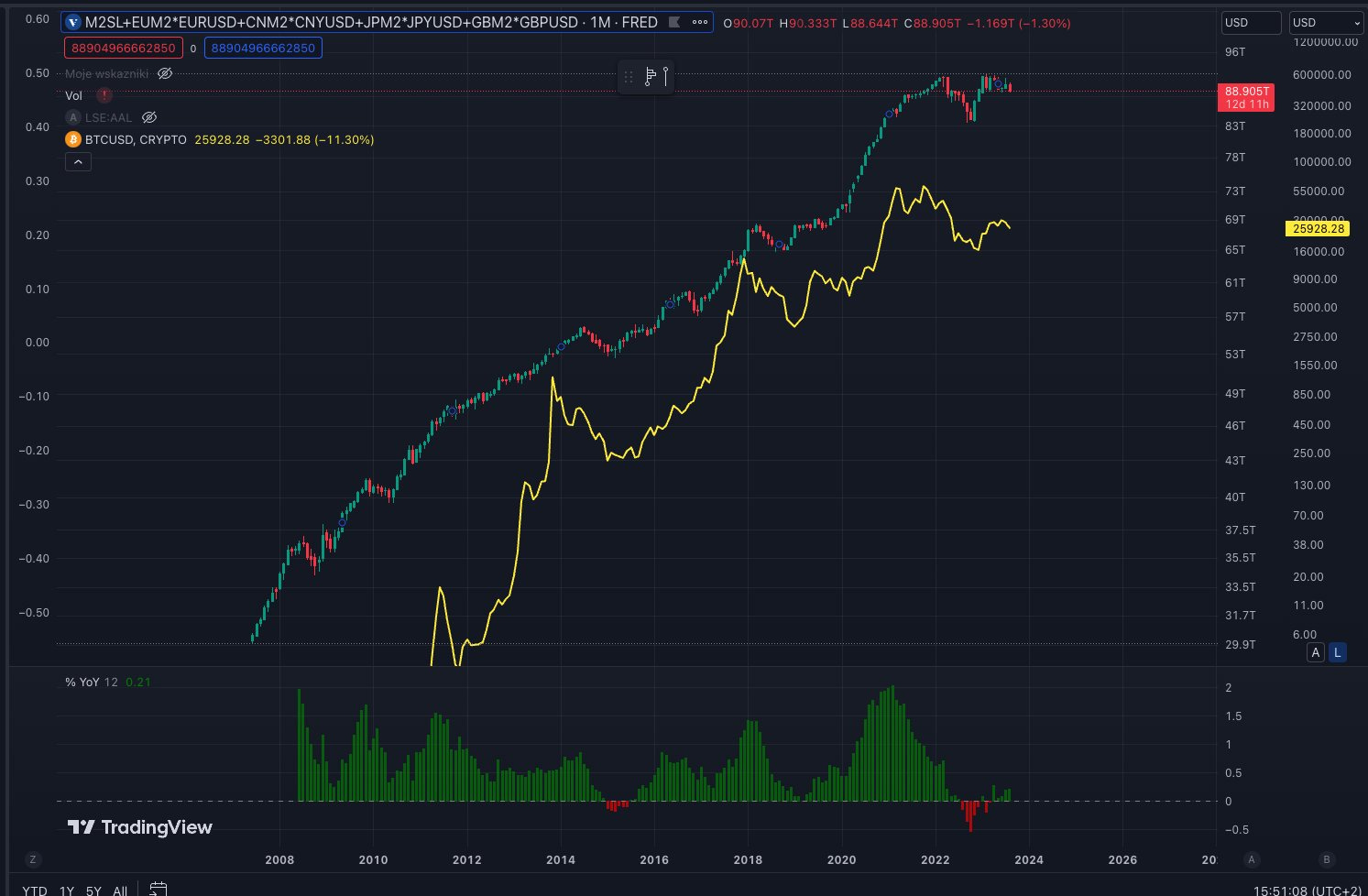

The current bias is slightly bearish because as shown in the below chart, BTC seems to corelate quite highly with monetary inflation. So long the printers stop printing fiat money, crypto will have a hard time pumping. There is no new liquidity. Once the printers will be restarted, BTC should be quick to react and turn bullish.

Therefore, hold onto your cash because you will need it later. For a detailed breakdown on what to buy, you should also check this previous newsletter where I covered some key bets. More on that next.

The bull market is coming. Asymmetric bets you can't miss! #17

As I watch the price action, the obvious is staring in my face. The bear market is over and it’s time to plan for the bull market. Some bulls are calling for all-time highs (ATH) this year. Bold. What could be even better than that? Finding the best asymmetric bets in this market.

Bitcoin

First and foremost, I am a buyer of Bitcoin under $20,000. If those levels are reached again then I will ladder down and buy the dip in increments until a reversal happens. That means you buy at 20k, 19k, 18k and so on. You dollar cost average (DCA) on the way down. Don’t try to guess the bottom. Think long term.

Buying at 20k or 16k when BTC will be over 100k will not make a difference.

Ethereum

Hate it or love it, I believe ETH will continue to have a great run for at least one more bull cycle. For that reason, you want to be exposed to this coin if it falls close to 1k again. There is a lot of development on top of Ethereum via Layer 2 solutions (like Arbitrum or Base by Coinbase) and those accrue a lot of value to ETH. Buy the winners.

LINK

Chainlink is the backbone of DeFi. I don’t expect this to change and in the next bull market DeFi will explode again. With it, LINK can also have a fantastic run if the developers manage to accrue value to its token. Plus, with a price under $10, LINK is at a discount not seen since 2020. It’s been consolidating in a flat trend for years. Once it breaks out, it will run hard.

RUNE

Those that understand decentralized finance and crypto will certainly be exposed to Thorchain and its token RUNE. This network allows you to seemingly swap between native coins like BTC and ETH. Most recently, they’ve also launched their lending module which almost doubled RUNE’s price in a few weeks.

KUJI

Kujira is one of the best networks in the Cosmos ecosystem. The devs are simply fantastic and they’ve been building a lot of DeFi infrastructure on their chain. Most of this happened during this last bear market and once things pick up again in the market, I expect KUJI (which is a real yield token) to skyrocket. At under $1 per token right now and 117 million total supply this is a no brainer.

FXS - CRV - SNX - DOGE

These coins performed well in the last bull market and are all at -90% discount right now. If the price falls lower, they should provide a good entry. They are different and unique enough to warrant a bag that should net good results later.

What about ADA, SOL, AVAX, ARB, OP?

As long as ETH is around, buying competitors like ADA or SOL is an inferior bet. They could provide some good returns if you get them at a nice discount, but over a long time frame, they are a poor hold. In general, only hold BTC long term. You never sell BTC. You take profit on altcoins to buy more BTC.

Final tips

Make sure you get exposure to BTC and ETH first. Then focus on other altcoins. Diversification can sometimes be a big trap, especially in crypto. Warren Buffett has 50% of his portfolio in one stock: Apple. Apple has the biggest market cap in the world. The equivalent of that in crypto is Bitcoin. Buy the winners. Obviously if you have 1k to invest, buying BTC may not be the best risk/reward play. See my previous newsletter for more on that.

Do not buy any altcoins that are not at minimum -90% from their most recent ATH. Ideally -95%. By buying at a -95% discount or more you are maximizing your upward potential and you minimize the risk of a significant future fall in price. As long as you buy reputable altcoins, buying at such levels will give you a good chance at a nice return in the next bull market.

Above all, don’t risk money you can’t lose. Know the risks. This is not financial advice and reflects my opinions on the market.

Pledge your support if you find my writing awesome. You won’t be charged until subscriptions are enabled. I will announce it when that happens.

![OC] Buffett's Portfolio in Q2 2023 : r/dataisbeautiful OC] Buffett's Portfolio in Q2 2023 : r/dataisbeautiful](https://substackcdn.com/image/fetch/$s_!7oBb!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa5e62b46-3b5f-4a8b-8067-d958302022c6_1080x1080.png)

What's your view on Matic token?