Ten Tips to Be Successful in Crypto!

You'll be ahead of the crowd as soon as you read them.

I’m going to separate these tips into three categories:

Security

Alpha

Execution

You are going to pull ahead faster than the rest if you apply this guide, especially if you’re new to crypto. If you are a crypto veteran leave a reply with your best tips.

Zyfi successfully raised over $350,000 during their public sale and the ZFI token generation event is around the corner on November 19th!

With Zyfi, users enjoy a gasless experience across ZKsync chains, aka pay gas with any token or get it sponsored on your favorite dApps like Venus, PancakeSwap or SyncSwap!

Security: Be on the right network and always return there

If you’re new to crypto, imagine this space like a new city you’re visiting. The environment or neighborhood you are in is important for your personal security. Go to the wrong street at night and you may end up robbed of your crypto assets (it happened to those attending a crypto conference in Belgium).

Where you are in crypto matters. Think of different neighborhoods as different networks or chains in crypto. What is the safest neighborhood in crypto?

Bitcoin, followed by Ethereum.

Why is this important?

Because that’s where you should keep your money (or profits). That’s also where you should be spending most of your time. Do not keep a lot of money on the wrong network or you may find yourself in trouble down the road.

Fundamentally, it is about centralization and trusting third-parties with your money. As soon as you leave the Bitcoin or Ethereum chains you’re trusting anywhere between two to nine people with your money. Below are just some examples of such networks.

You never stay too long on the above networks and you never keep your money there. You may visit and be a tourist, but always make sure to leave and take your money with you.

This brings me to wallets.

Security: Buy a hardware wallet if you have more than $1,000 in crypto

The most popular one is Ledger. If your “hardware wallet” is your smartphone, you’re doing this wrong.

That’s because your smartphone is a hot wallet. Same for any desktop computer or laptop using browser-based wallets. With one click or press of a button, you can lose your money. Hot wallets are always connected to the internet and can approve transactions on their own.

Installed a fake application? Drained. Downloaded a malicious update? Drained. These are vectors of attack a hardware wallet prevents as long as you do not manually approve transactions you did not initiate.

The hardware wallet removes the approval process from your smartphone or computer which become just gateways to the Internet. This is crucial to maintain proper operational security when you deal with crypto.

Security: Use a modern wallet like Rabby

On its own, Rabby is a hot wallet, but if you couple it with a hardware wallet, this combo is hard to beat. You install Rabby on your preferred device and then connect it to your hardware wallet and you’re good to go.

The approvals stay on the hardware wallet while you benefit from an excellent user interface to interact with all of crypto via Rabby.

Rabby simulates transactions before approval, warns you about connecting to unknown protocols or if you send money to addresses you don’t know. Rabby is focused on the Ethereum ecosystem which includes Layer-2 networks like Arbitrum or Base.

If you need to move Bitcoin around, just use your ledger device. If you need to use other networks like say Solana, use their dedicated wallets that should also support hardware wallet connections. If a hot wallet does not support such connections, you’re in a dangerous neighborhood.

As long as you remain a tourists on these other networks, you avoid most risks. Book your profits, then move them out to Bitcoin or Ethereum. By default, never keep big amounts in hot wallets.

Alpha: Create an X account and follow Duo Nine

The best place to find alpha and keep up-to-date with the latest in crypto is on X. If you do not have an account, create one today. Then go to my account and follow all the people I follow. Don’t forget to follow me too. :)

You do this if you’re serious about investing time into this space. If your goal is to buy as much Bitcoin as possible and hold, then this is not so important.

The point of Crypto Twitter, as we call it, is to scout for new alpha and opportunities. This usually means altcoins, meme coins, and the like. This is already a dangerous area of the city.

Finding real alpha is not always easy, particularly because a lot of it is fake. Many influencers on X are biased due to their own portfolio allocations that blinds them, others are paid to promote certain tokens, and some are plain scammers doing this as a business.

Even the biggest YouTuber of all times, MrBeast, turned out to be a scammer. He sold over $20 mil in scam tokens to his followers. You may also enjoy my post on the crypto pyramid to understand how this works.

The longer you spend on X, the more you will be able to smell the bs and who’s real and who’s not. Either way, if you want to stay on top of this market, you have to be there. No way around that. It comes with the good and the bad.

Alpha: Join a real crypto community like YCC

These can take many shapes and forms, but in my opinion, the best places will be found on Discord. If you don’t use Discord, I suggest you start doing that as well.

I’ve created my own community in 2021 and I encourage you to join us. Once you do that, you can also check out others communities like Coin Bureau. Simply go to servers discovery and type crypto or Bitcoin then check the results. Find the place that clicks with you.

There is a lot of value in joining communities like YCC. We have hundreds of Patrons sharing alpha on a daily basis in our channels. This can be of real help to fast-track your understanding of this emerging market.

Become a Patron for lifetime access to our exclusive private alpha!

Some communities are focused on one specific thing, say trading. However, many are selling signals, bots, indicators or similar services. Be weary of these, particularly of signals, because sometimes such “trading communities” simply pump and dump low liquidity coins at your expense usually. Then they ban you. See my point on liquidity under tip #9.

Alpha: Learn to use Decentralize Finance or DeFi

This is an alpha in itself. If you’re not using DeFi applications you will miss out on a lot of alpha. Most casual users can’t be bothered to leave Binance or Coinbase. But that comes at a price.

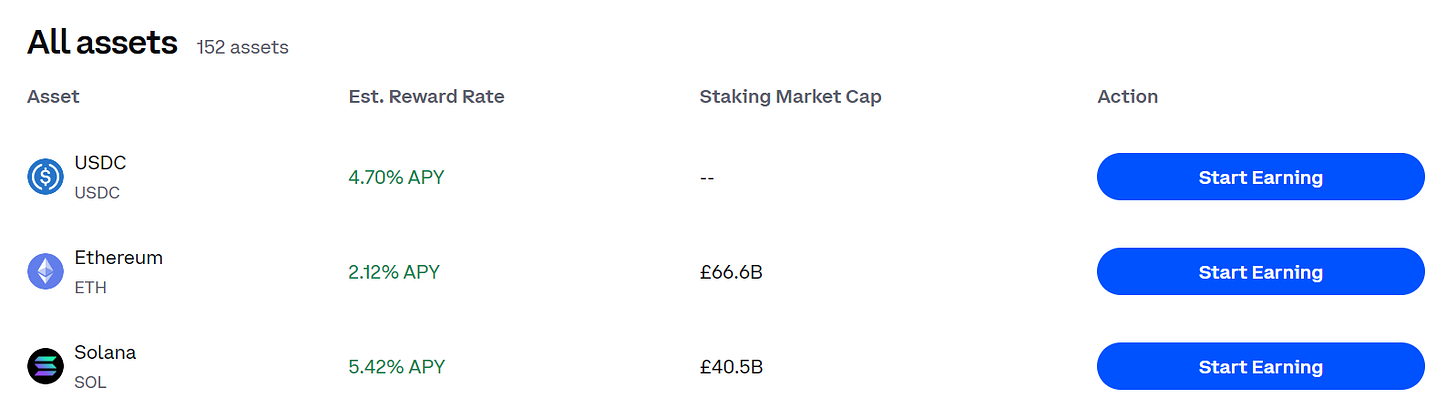

Below is the USDC APY on Coinbase. The rate is around 5%.

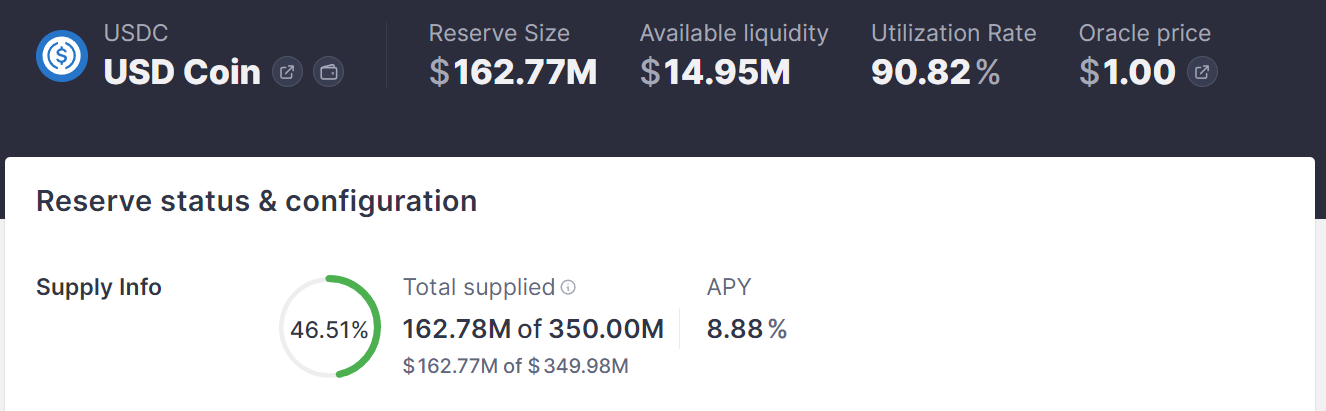

However, in DeFi you have a lot of other options ranging in risk and returns. The safest would be to use AAVE and earn almost 9% APY on the Arbitrum network. That’s almost twice the Coinbase rate. This is the price you pay by not leaving centralized exchanges.

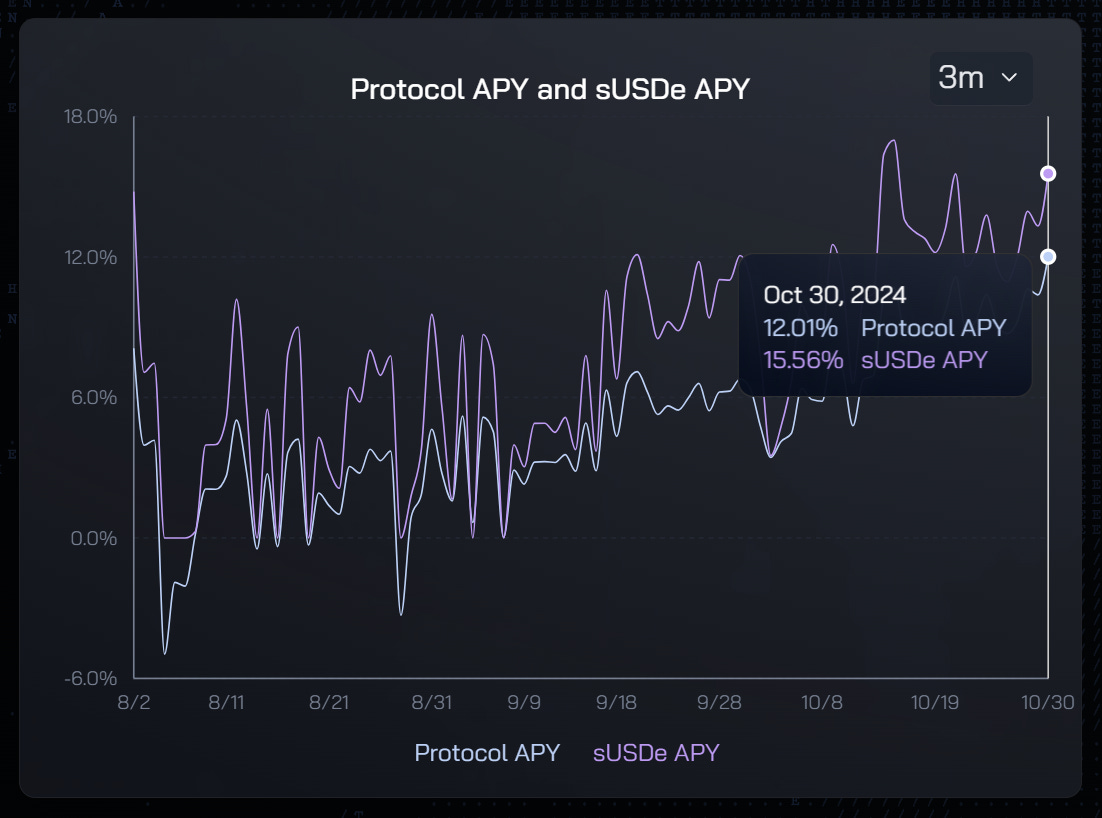

If you want to take it up a notch you can go to Ethena and farm 15%, that’s three times higher, but comes at additional risk. All things considered, Ethena is the safest place where you can park money to earn 15% on a risk-adjusted basis.

This is just one example involving a boring stablecoin. If you do decide to dive into DeFi, then make sure you follow the steps I covered under the Security section. The most dangerous streets in crypto are found in DeFi!

Execution: Chase reputation, liquidity, and low fees

You buy and you sell on the most reputable exchanges. That holds equally true for centralized or decentralized ones. Never compromise on that. As soon as you do, you’re putting at risk your assets.

The best crypto exchanges should be both liquid and cheap in terms of trading fees. A good example of that is Binance. Coinbase is also liquid, but highly extractive in terms of fees unless you subscribe to their advance options.

Avoid any centralized platforms that do not show a live order book for prices. That’s a sure way to know you’re paying a premium. A good example of this is the Ledger Live app. That convenience comes at a price. Avoid it.

If you’re serious about trading, then you’re in luck. This is because decentralized exchanges have caught up to Binance and other leading centralized exchanges.

A good example of this is Hyperliquid. You can trade there without KYC with good liquidity across all major pairs while holding full custody over your assets. Test it out and use our above referral to get a 4% discount on fees. It’s also a great way to sharpen your DeFi skill as that exchange is on a different network.

After you’re done trading, you move profits out of any centralized exchange and into your own custody on a safe network! That means you put that hardware wallet to good use.

Execution: Replace your banking with DeFi

One of the biggest advantages of crypto is that it can replace banks and money. Literally. The best example of this are lending markets or money markets in DeFi.

For example, if you have crypto assets, you can use them as collateral to borrow cash like stablecoins. If you go to a bank this can be a very cumbersome process while in crypto it takes a few clicks. If you pair that with a crypto debit card (see Holyheld) you’re basically done.

This is also why I encourage everyone to buy and hold Bitcoin. This is the ultimate asset in crypto and the best one to use if you want to borrow cash against it. That’s how you retire early using an appreciating asset! Your collateral goes up in price while your debt or liabilities shrink. A stroke of genius!

The best place to do this right now is on AAVE. You provide assets as collateral and then you can play in DeFi with the cash. Like say borrowing USDC at 5% interest and putting it into Ethena at 15% interest - 10% profit!

But be careful, the market will always seek equilibrium, and once a bear market comes, liquidations start and that juicy APY will crash with the assets.

Execution: Liquidity, Liquidity, Liquidity

The longer you are in crypto, the more you will appreciate the value of liquidity. Bitcoin is the most liquid asset in crypto and this title is always forgotten as people look mostly at prices.

Liquidity is what keeps this market going and it’s also what can kill it. That’s why when everything crashes in crypto, the liquidity of last resort comes from Bitcoin. As you move to more and more exotic altcoins be very mindful of their liquidity.

This is where slippage and spread risks accumulate. If you trade a low liquidity token, you can very well be in profit, but by simply selling you enter into a loss because there are insufficient buy orders at current prices. If you also use leverage you compound that problem further.

Another good example are the Solana meme coins which trade at spectacular market caps, but have very low liquidity. The market cap and token price are an illusion if a few sell orders can empty that liquidity. The token is worth zero once liquidity is gone. That’s how memes with millions in market cap crash overnight.

Always check liquidity in DeFi, not prices. That’s the real metric of success and a common risk in DeFi. You should not put your money in any low liquidity protocols, especially because liquidity can also be faked by double counting the same value twice or more using leverage. That’s how DeFi pumps and dumps. It’s can literally be done on fake money (see point 2).

Execution: Learn to sell and book profits

You need to learn to sell, especially in crypto. Buying is only half of the story and will not make you profitable. Selling does.

When the times are good, that’s when you sell. When the times are bad and people panic, that’s when you buy. Right now, we’re approaching a time when selling will net good results. I wrote more about it in this alpha post.

Have a plan.

My plan is to sell all altcoins as the market pumps and prepare for the next bear market. Bitcoin is a different story due to its fundamentals. I suggest you have a separate plan for BTC and view it as your ticket to early retirement.

Do not trust altcoins. They are a distraction from the real asset - Bitcoin. Play with them if you must, but don’t hold them too long. They will disappoint you.

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page.

All info is provided for educational purposes only and is not financial advice.

Super useful thank you!

Hear! Hear!!