The crypto revolution is here!

Everything is aligned. Crypto adoption is about to go exponential.

The developments happening across crypto in the last few weeks should make you extremely excited. What is happening right now is similar to the Bitcoin ETF from last year.

All the tools are ready for mass-scale adoption of crypto.

Let’s look at the top five developments which you should keep a close eye on. If you’re in a rush, head to the end for a quick TLDR.

Become a Patron for lifetime access to our exclusive private alpha!

Here are the top headlines. I explain each and why they are important next.

Stripe acquired Bridge and Privy

Circle IPO

Plasma ICO

Microstrategy and its copy cats

Ondo Global Markets and tokenization

Stripe acquired Bridge and Privy

Stripe is one of the largest payment-processing company in the world, doing trillions in payment volume per year. Even this newsletter uses Stripe to process subscription payments with your credit card.

This year, Stripe acquired Bridge and Privy. By doing this they went all in into crypto which will allow anyone, anywhere to accept crypto payments. That can mean paying with USDC to subscribe to this newsletter. How is it possible?

Bridge = stablecoin infrastructure company that allows Stripe to process stablecoins payments like any other transaction

Privy = wallet provider that allows Stripe to create embedded wallets for their users without said users ever needing to manage a wallet themselves

This combo means that Stripe will be able to seamlessly integrate crypto payments into their business. Users do not need to manage wallets, they only have to create an account, and thanks to Privy, all the wallet management is done for them behind the scenes.

Vendors can accept payments of all types, including crypto, and they do not have to worry about the frictions related to wallet creation, seed security, and so on. This also applies to users creating an account with any business. When they do that, a crypto wallet will be automatically tied to it.

This type of integration was the last step before crypto payments become ubiquitous both for users and businesses. Fees and settlement times will also decrease considerably thanks to crypto payment rails.

Circle IPO

Circle, the creators of USDC, were listed on the New York Stock Exchange as CRCL on June 5th 2025. Their Initial Public Offering or IPO was 25x oversubscribed with a listing price of $31.

No wonder, as soon as CRCL was listed its price pumped to $138 within a few days! That’s more than a 4x. This level of appetite for a stablecoin issuer is somewhat unprecedented.

It also raised questions how much Tether USDT would be worth if they would be listed since they are more than twice as big in market cap. Why this FOMO?

Because stablecoins are good business, especially if you reach the size of Circle or Tether. They take your dollars and farm 4% US treasury yields on that, while end-users using USDC or USDT don’t get any yield.

Stablecoins are also one of the most important products with a real use case that came out of crypto. The adoption of stablecoins by Stripe, discussed above, shows that as well. Stablecoins may soon become the most important way to move money around the globe and will likely replace SWIFT and similar outdated payment systems.

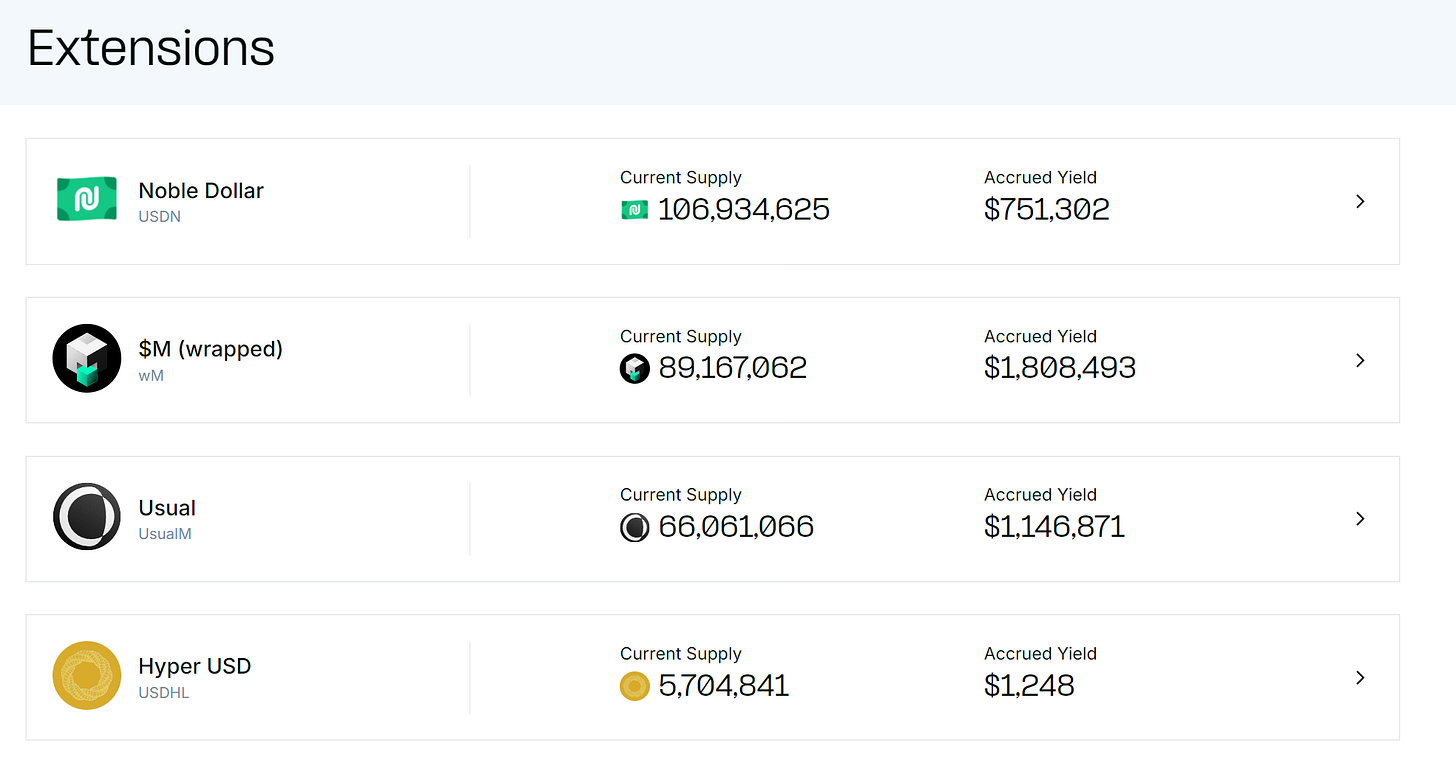

However, USDC and USDT have one major weakness. They do not share the yield with their users. Many new stablecoins aim to do that and I can see a future where a new yield-bearing stablecoin may erode the market share of USDC/T. A good example is Noble Dollar or the recent USDhl on Hyperliquid which uses its yield to buy back HYPE and reward liquidity providers with it.

Either way, the stablecoin market is getting heated and Circle’s success only raised the stakes. This is a great news for crypto at large which may see global adoption thanks to stablecoins.

Plasma ICO

Plasma is a new blockchain purposely built for stablecoin payments. Its main features include zero-fees and near-instant payments using USDT. As you’ve guessed, one of its major backers is Tether. It also has final settlement on Bitcoin and is compatible with all EVM (ETH) chains.

Basically, they want Plasma to replace SWIFT or global payments and do that using USDT and other stables. This reminds me of Ripple’s mission and XRP to some level. Obviously, Circle USDC is on a similar mission. However, with Tether behind, this is big.

The network is not live yet and it just had its Initial Coin Offering (ICO) where users can deposit stablecoins to farm points. These points will turn into an XPL airdrop, the token of Plasma. The stablecoins deposited will also move to the Plasma network once it goes live and users get yield on their deposit based on USDT AAVE rates while they wait.

What made this ICO special was that their deposit limit of $500 million was hit in 5 minutes and later they raised the deposit limit to $1 billion which was hit in 30 minutes! Here is how it went:

$250M, initial ICO - was filled in 3 minutes

$250M, extra capacity added soon after - was filled in 2 minutes

$500M, extra capacity a few days later - was filled in 30 minutes

A network that is not even live raising a billion dollars in less than one hour shows that there is a huge appetite in the space and money is literally waiting to be allocated to a good opportunity. This was an extremely bullish signal for the market.

We do not know if Plasma will raise the deposit cap again since that dilutes their original depositors (in terms of XPL airdrop). If you’re interested, follow them on X and turn notifications on.

Microstrategy and its copy cats

One of the reasons Saylor and his Strategy (to buy Bitcoin) may eventually fail is because of copy cats. Saylor is farming a premium on his MSTR shares to buy more BTC, but that premium only holds as long as MSTR remains somewhat special.

This premium will be eroded as more and more companies copy his strategy. I already wrote extensively on this. The reason I mention it here is because it relates to Bitcoin adoption.

While the first three topics I covered above focused on stablecoins and how everyone is competing in that space to come on top, what Saylor and his copy cats are doing is somewhat similar, but the subject is Bitcoin.

There is a literal gold rush to add Bitcoin to the balance sheet of public companies in the US and other countries. Most that did this saw a quick appreciation of their stock price.

This is great for Bitcoin and its price. However, this is also a classic FOMO started by Saylor that will likely end up with multiple companies blowing up once the market turns and Bitcoin enters into a prolonged downtrend.

The copy cats could be the first to blow up and make a bear market worse with Saylor as the last man standing. What he has started may force his hand to sell Bitcoin later on due to the leverage he is building within his own company and this space in general.

The first signal that things are about to blow up will be when copy cats start selling Bitcoin to cover their debt. This can make things worse for Saylor and lead to a death spiral if he’s forced to sell.

For now, this rush into Bitcoin by institutions is just a new version of the Bitcoin ETFs. Regardless of any ups and down in price, the net result of this will be that Bitcoin sees even more adoption with each cycle.

Ondo Global Markets and tokenization

Another exciting area where crypto and traditional finance merge is in the tokenization space. More specifically, Ondo Finance is aiming to bring onchain US stocks, bonds, and ETFs. They call it the Ondo Global Markets.

Instead of opening an account with a broker, you simply have a crypto wallet where you can buy S&P500 tokens that track this index or stocks like Apple or Nvidia.

Ondo already created tokens that farm yields on US treasuries and this is their next major development. This integration between crypto and traditional finance is just another example of mass adoption. Ondo is expected to launch its Global Markets later this year.

Crypto has huge advantages in terms of technology, speed, and fees. By tokenizing TradFi both sides can benefit tremendously. Crypto gets legit and regulated exposure to real assets and TradFi gets into a new market environment that benefits end users.

Blackrock is full on into tokenization and we will likely see major investment funds and banks issuing their own tokens and stablecoins in the future. All these will be accessible with a push of a button in your wallet.

Regulating this may become a headache, but the US Government and the SEC announced that they plan to ease regulation on DeFi aka “Don’t blame the tools for the actions of its users”. Sounds pretty good to me.

If you are new to the crypto universe, it’s not too late to get started! Lots of major developments ahead and the above list was just the tip of the iceberg. Hit a subscribe and join our Patrons group for more alpha!

TLDR & Tips to Remember

Stablecoins are seeing global adoption as one of the strongest use cases

The Circle IPO success has triggered Wall Street attention

USDT & USDC may be challenged by yield-bearing stablecoins later

Plasma and Tether are launching a zero-fee stablecoins chain

What Ripple and XRP wanted to do is now being achieved by stablecoins

Saylor copy cats may be forced to sell Bitcoin in a bear market and implode

The risk of contagion in a bear market may put pressure on Saylor & MSTR

Ondo Global Market will bring US stocks, bonds and ETFs onchain

Regardless of volatility, each cycle sees Bitcoin & crypto adoption increase

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

You can add to the list that Polymarket (crypto prediction/betting market) and X partnered as well! Huge development.

Which other developments got you excited this year?