3 Stablecoins That Will Pay You to Hold Them

Time to ditch USDT and USDC and use a stablecoin that pays you instead.

The stablecoin market is changing. USDT and USDC don’t forward the yield they generate to their users. They keep it!

This has created a major opportunity for competing stablecoins.

Time to explore three such examples with many more in the pipeline. If you’re in a rush, head to the end for a quick TLDR.

Become a Patron for lifetime access to our exclusive private alpha!

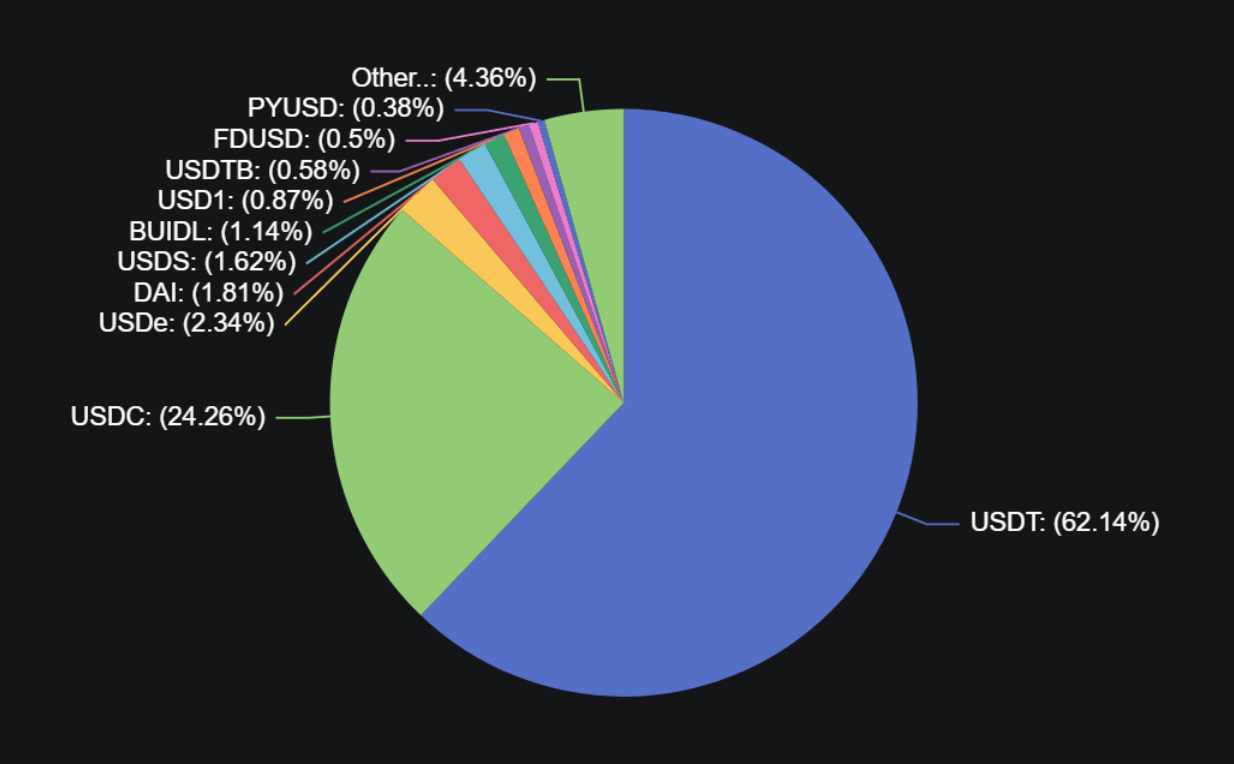

The stablecoin pie is worth around $250 billion today. USDT share of that is 62% and USDC 24%. Together, they represent 86% of total stablecoin market cap.

The problem?

Neither USDT nor USDC pay any yield to their users. All those USD used as collateral are held in US treasuries that generate about 4% yield. This yield goes to Tether and Circle, not you.

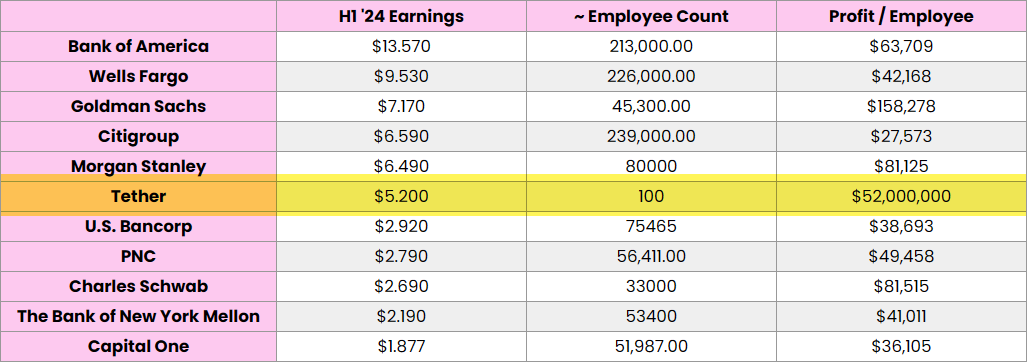

As you can imagine, Tether is the most profitable company in terms of profit per employee at over $50 million based on 2024 data. In 2025, it’s closer to $60 million. This makes Tether the most profitable bank in existence.

But this is also a major weakness.

Users get zero return and they will demand access to that yield. This is a great entry point for competing stablecoins that aim to share that yield with their users. I have three examples to illustrate this point.

Resolv USR - 8.6% APY

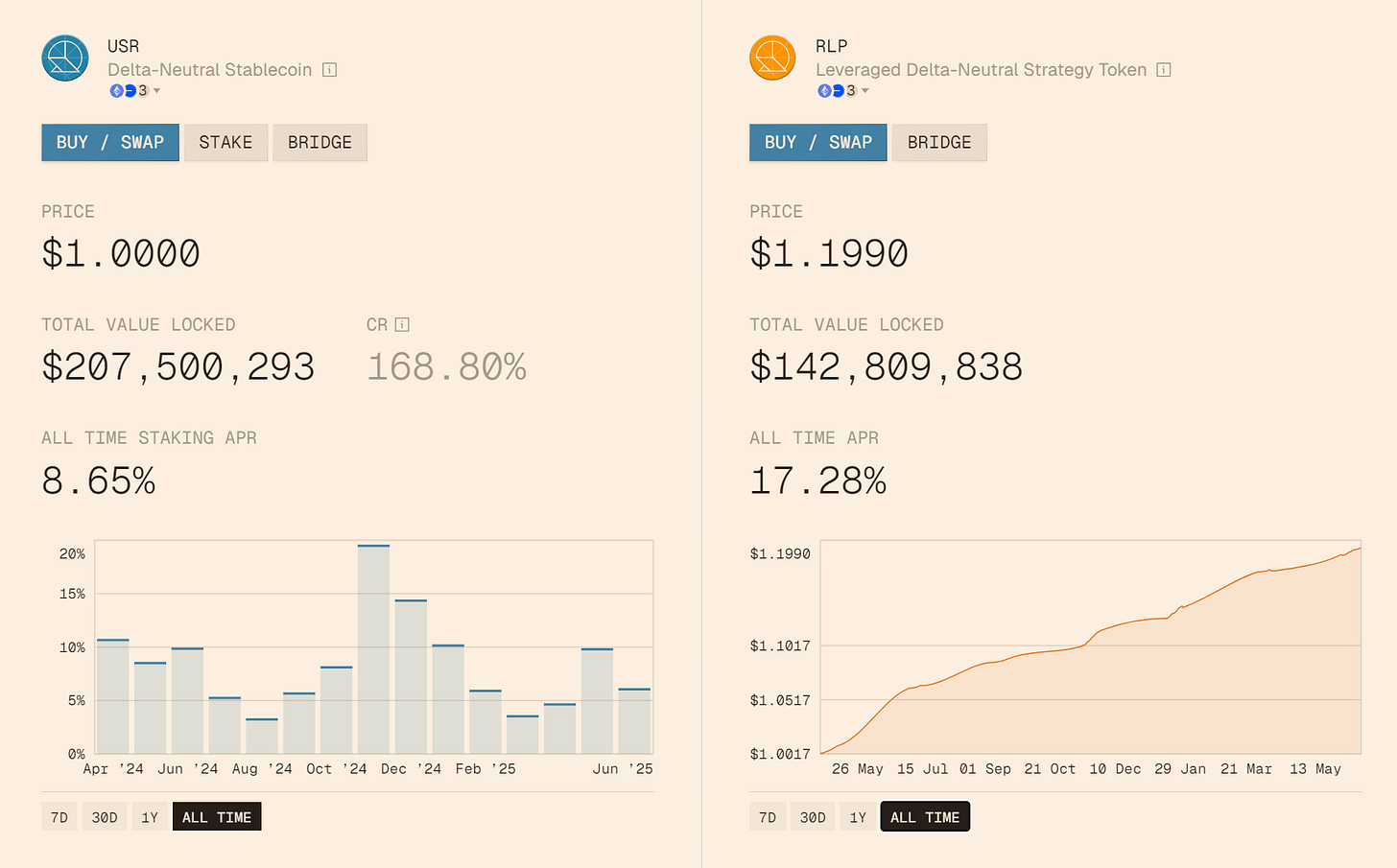

Resolv has two key products:

USR - a 1:1 stablecoins backed by BTC and ETH

RLP - Resolve Liquidity Pool token

Both generate an APY via delta-neutral positions on BTC and ETH as shown below.

USR is backed at 168% by collateral and has a low risk profile because of that. The biggest being a loss of its peg to the dollar. This never happened to date and the average APY at 8.65% is twice the rate of AAVE. Impressive.

RLP is a token that accrues value over time and increases in price thanks to the yield it generates. This comes from excess collateral that is leveraged into the same delta-neutral strategy. RLP has a higher risk profile and the token price can also go down if market conditions are not favorable.

RLP acts as a buffer and protection layer for USR. RLP depositors take more risk in exchange for more return while USR users are protected. This is fair game.

USR Advantages:

Higher yield than AAVE

Fully backed by BTC and ETH

Protected by RLP in case of adverse market conditions

No fees to mint/redeem

Stake/unstake instantly without any lock period

USR Disadvantages:

Only available on Ethereum network which can mean higher fees

You have to stake USR to farm yield

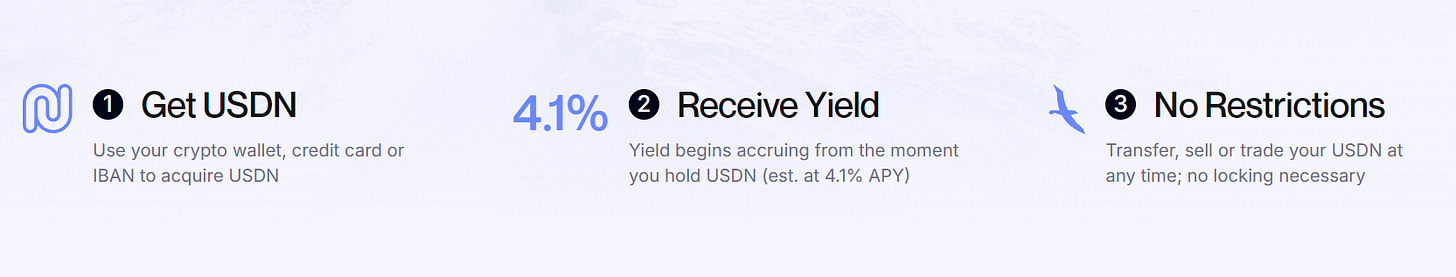

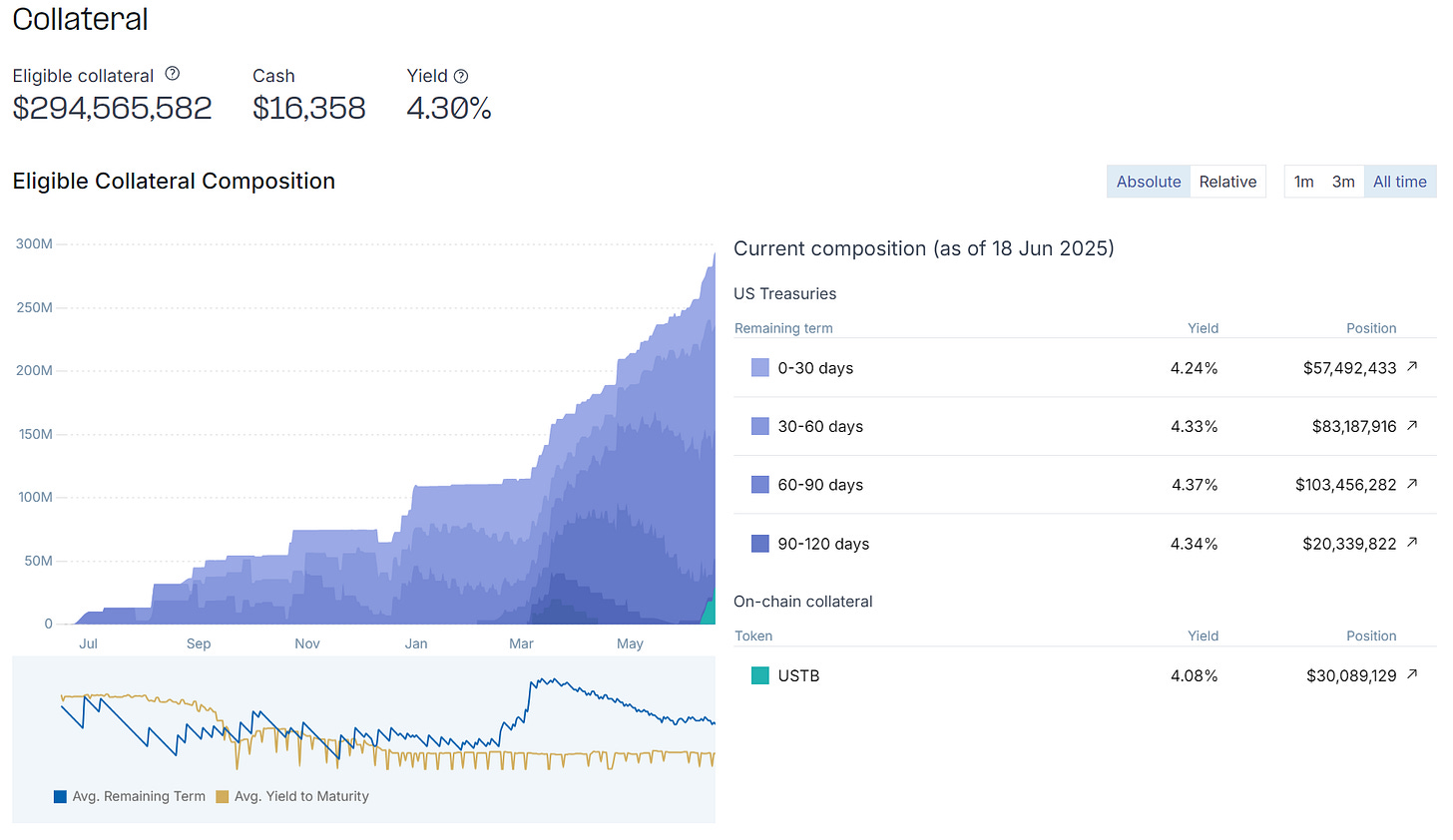

Noble Dollar, USDN - 4.1% yield

Noble Dollar is a product by m0. Its key feature is that you get 4.1% US treasury yield on your USDN daily without needing to lock or stake it. Basically, a free airdrop of more USDN every day into your wallet.

While there is not much you can do with USDN today, it will soon get support across multiple other networks such as Ethereum and its L2s. Imagine staking USDN in AAVE. You get the default 4% plus another 4-5% AAVE will earn you.

The use cases for such a digital dollar are infinite. USDT and USDC may suffer if such a dollar takes off later.

USDN Advantages:

Good yield backed by US treasuries

You don’t need to stake it

Daily payments

Can buy it with fiat on their page

Native bridge to move USDC easily between chains

USDN Disadvantages:

Limited use case (this will improve later)

Yield is below competitors like Resolv

infiniFi iUSD - 8.5% to 16% APY

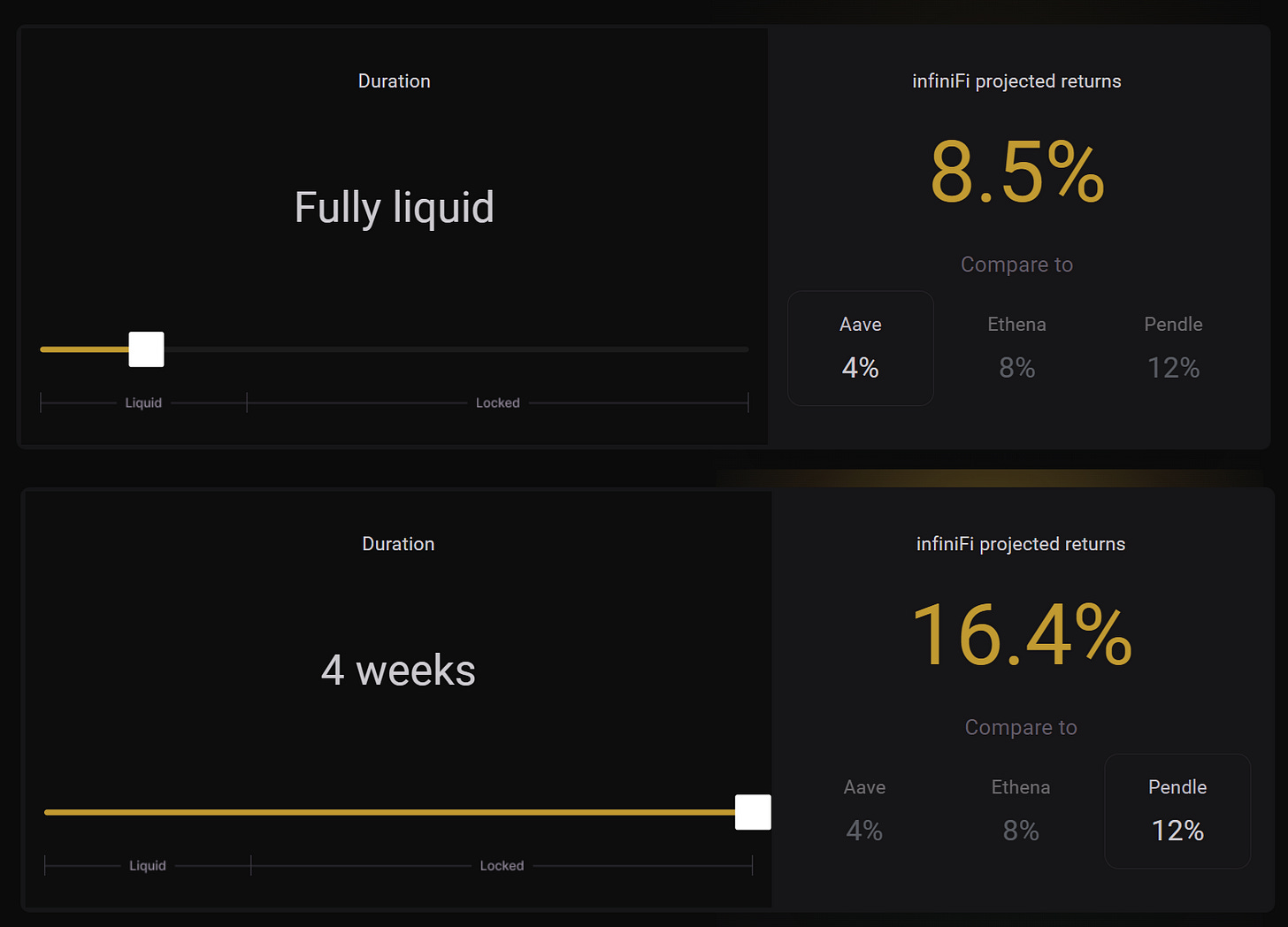

InfiniFi is part of a new generation of “stablecoins” that offer different yields based on the preference of its users and their risk appetite. To get 1 iUSD you need to deposit 1 USDC. That USDC is then invested in different yield strategies.

If you want instant liquidity, meaning you can withdraw your USDC at any time, then the yield is lower. However, if you lock your iUSD longer, the protocol can opt for more advanced USDC strategies that can generate higher yields. This has more risk, but the yield may compensate that.

The ongoing rate for no lock-up is around 8.5%. However, if you are comfortably with locking your iUSD for 4 weeks or more, then the yield can go as high as 16.4%.

Generally, I don’t recommend locking your funds for weeks. This is because if something goes wrong, you’re stuck. Nevertheless, this is a legitimate approach to stablecoins and mirrors in a way short term bank deposits.

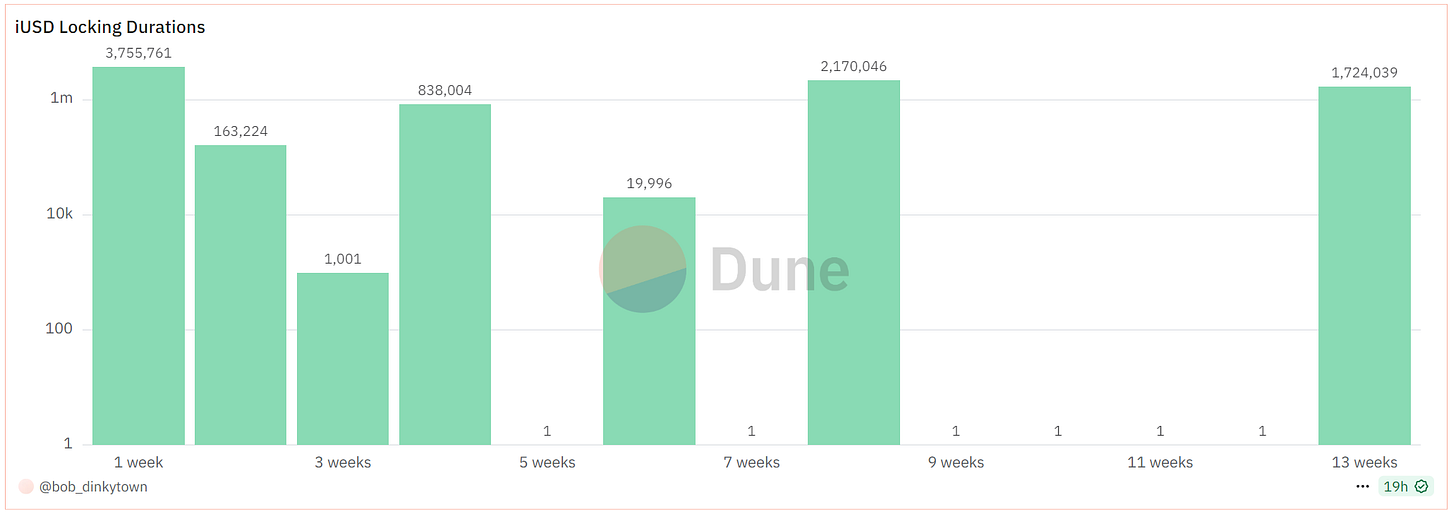

The way iUSD works is that users locking up their iUSD for one or more weeks protect the users that keep their iUSD liquid (no lock-up). If something goes wrong, the ones earning the highest yield get hit first. This is similar to how Resolv RLP users protect USR holders. Why is this important?

Imagine a scenario where everyone holding iUSD wants to withdraw and get their USDC out. Those holding liquid iUSD can exit first only if there is enough liquidity!

If there is insufficient liquidity, because a lot of USDC is stuck in various long term strategies, then iUSD can lose its 1:1 peg to USDC or incur losses. This is because exiting early on a strategy that locks USDC for 8 weeks can incur additional costs.

These losses are passed on first to the users with the highest lock period. In principle, this will protect the iUSD peg and holders of liquid iUSD. Still, a black swan event can lead to peg volatility on iUSD if they can’t liquidate USDC fast enough.

Generally, such a risk is low as long as InfiniFi does not leverage USDC or incur substantial losses in their strategies. This can become an issue if the DeFi protocols they use for long-term strategies get hacked or drained, like Ethena. iUSD users with lock-ups will get hit hard or lose their investment in such cases.

iUSD Advantages:

Good to great yield

Instant liquidity for lowest yield bracket

Higher yield brackets protect lower yield brackets

Caters to different users and risk profiles

iUSD Disadvantages:

Not really a stablecoin, it’s a receipt token of USDC deposits

Risk of illiquidity, i.e. not enough USDC to meet withdrawal requests

iUSD can lose peg if illiquidity happens

High-yield strategies could underperform or lead to losses

Inherits the risks of other DeFi platforms used to generate yields

I recommend testing such protocols with low amounts and definitely wait for a bear market to pass before deploying size. Such new protocols have to be tested under stress before being vetted properly. In the case of InfiniFi, their protocol feels more like a hedge fund that takes money from users and then invests it.

Either way, it is important to be aware of such new developments in the space which can offer plenty of options to users with various risk profiles. By mixing different protocols such as the ones above, your cash can reach a given yield with a risk you are comfortable with.

Don’t miss this yield strategy!

Head to my Patrons page and subscribe to access my top strategies for double digits yields such as the one I mentioned in Alpha Post #63.

TLDR & Tips to Remember

There is a gold rush to create new stablecoins in the market

USDT and USDC do not share the yield with their users

Stablecoins sharing yields may challenge current incumbents later

Higher yields does not mean better. There is no free lunch!

Historically, stablecoins are prone to failure, especially if exotic

Nevertheless, a yield of 10% can be achieved with relatively low risk

As the market matures and DeFi grows, options for users will multiply

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

What's your favorite place to park your stablecoins and farm yields?