Time Your Market Exit With This Strategy!

Forget everything you read to date and do this instead.

You need to have an exit strategy! With Bitcoin and Ethereum at all-time highs, it is best to start working on it sooner rather than later.

This exit strategy is simple, but it works!

What I love about it is that it only asks you to do three things. Let’s start.

This newsletter is sponsored by Grvt, the world’s first licensed institutional-grade self-custodial onchain exchange. Open an account to qualify for the $GRVT airdrop!

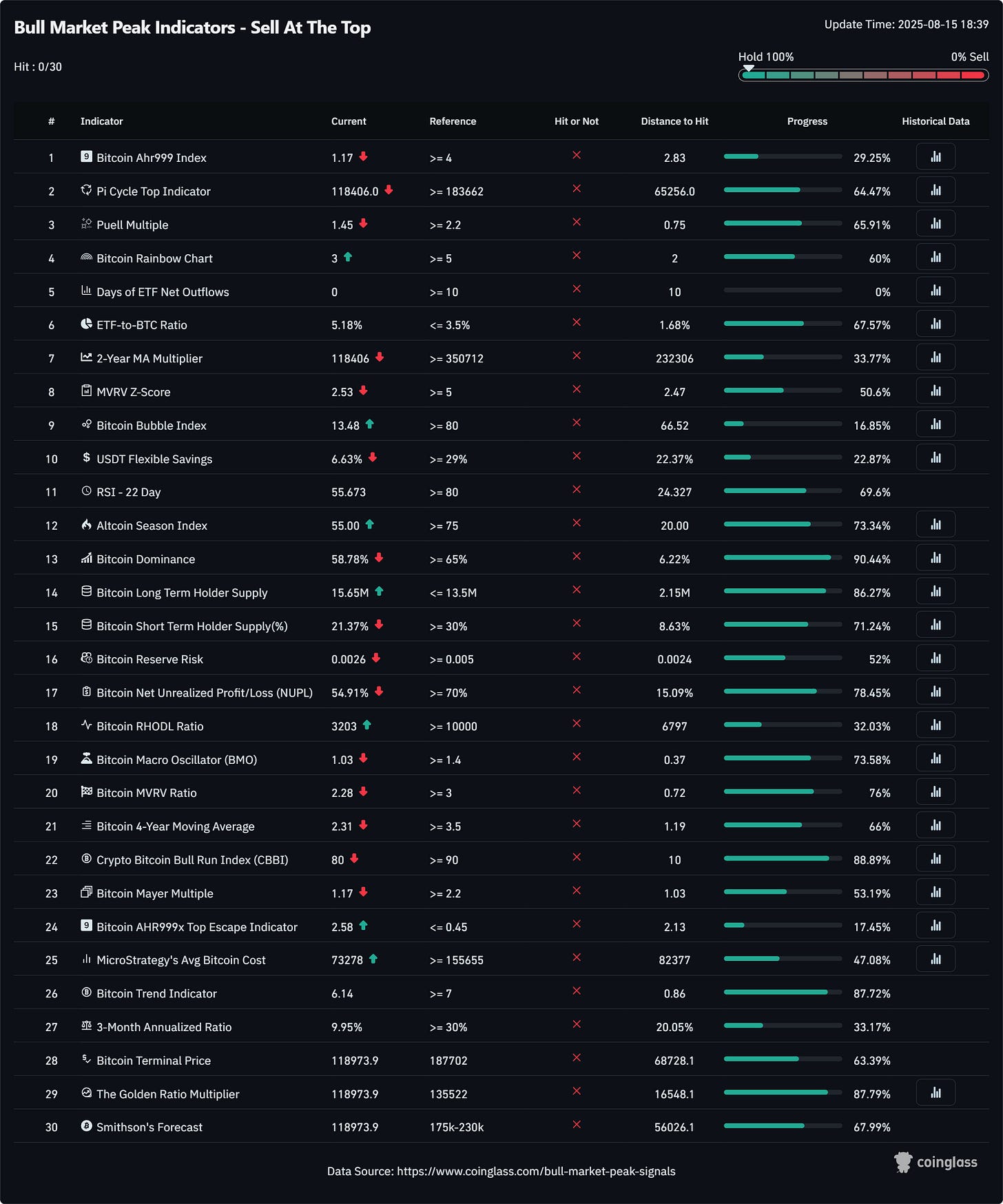

Everyone is glued with their eyes on this list of 30 top indicators for Bitcoin. As you can see below, none of them flag a top. This is good because it gives you time to prepare.

While that list can be useful, it can equally confuse you and scramble your decision making process, especially once they start flashing in red. That can happen overnight in crypto.

To simplify, I have a battle-tested solution we call The Strategy.

The Strategy

Put simply, this exit strategy requires you to sell one third (1/3) of your bag each time you think the top is in.

The first sale may be too early and the third sale too late, but the second sale has a good chance to be perfect.

By splitting your bag into three market orders, you boost your chances at a great exit. Think of it as dollar-cost averaging out.

It’s almost impossible to perfectly time your exit if you put all your chances into one shot. Professional traders and institutions ladder in and out of the market. They rarely go all-in with just one trade.

That’s why you give yourself a few shots at this. Space them in time enough to let the market give you additional signals and hit that sell button when the time is ripe.

With that said, let me add a few more tips.

It’s important to decide what you want to sell now. Ideally, you don’t sell your Bitcoin if you have less than one. That’s because in 10 years from now, you can retire from it. If you have lots of Ethereum, then check this guide I wrote earlier.

Make a plan!

Split your bag into three and if you have a lot of altcoins, make sure you also check their individual pump and dump cycle. Each coin is different. Some top early and some are late to top.

While the majority follow the market leaders, like Bitcoin or Ethereum, some like Tron are in their own market cycle. This is why I recommend assessing each altcoin within its own cycle.

If you are confused on what to do with a particular coin you can always drop by on our Discord and ask. That’s why we’re here. Either way, best to exit altcoins once Ethereum tops.

I provide more tailored guidance in the weekly alpha posts. I encourage you to subscribe below if you want to improve your timing. It will get busy later this year. Prepare for that!

What do you think about this exit strategy - would you change anything? Reply in the comments if you plan to use it and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

🫡🫡🫡

This and your previous message are hitting the nails on the head. In fact you frequently do. Keep it up. The CC needs your voice.