US Crypto Strategic Reserve... or Not?

It's not strategic if it holds altcoins.

This Friday, the White House will host a Crypto Summit where we will find out more information about the US Crypto Strategic Reserve.

However, last Sunday, Trump already gave us a sneak peek.

He tweeted that this Strategic Reserve will consist of XRP, SOL, and ADA. This quickly pumped their prices and made people wonder where is Bitcoin in all of this?

We found out soon after and now we have even more information. Scroll down.

Upgrade to Patrons Pro to access our exclusive content!

This role also grants lifetime access to our premium discord channels.

After the initial tweet, Trump added that BTC and ETH will obviously also be part of this Strategic Reserve. This quickly saw BTC and ETH pump as well.

However, there is a problem with all of this.

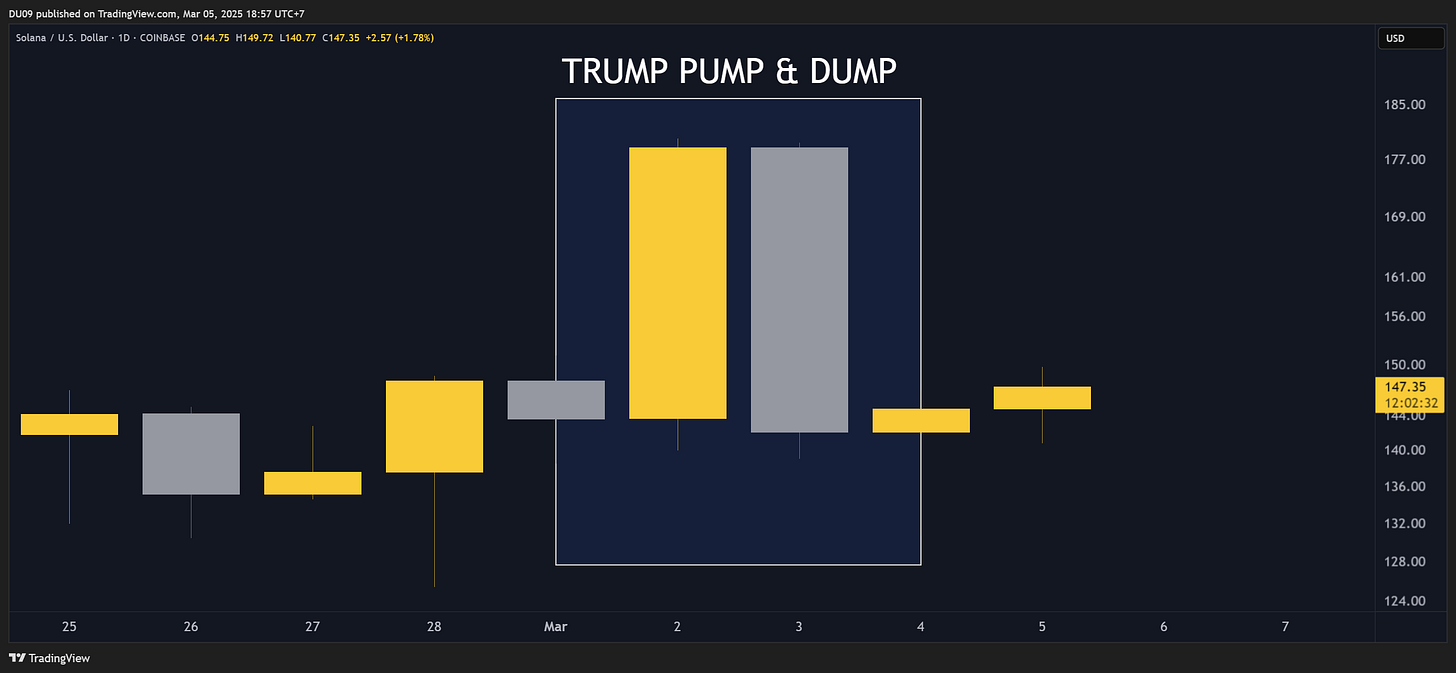

These tweets came on a Sunday when the market was down and quickly pumped the prices of the mentioned coins only to see them crash back down from where they started within 24h. A classic pump and dump or manipulation by insiders.

There was absolutely no need for these tweets, except to move prices for those that had prior knowledge of this. The TRUMP token was a straightforward money grab, and these tweets seemed to be just more of that.

The Solana chart shows it quite clearly below. That pump was fully sold into. The charts for BTC, ETH, or XRP were similar while ADA did somewhat better.

However, the biggest question is why would such a “reserve” even include altcoins. ETH, XRP, SOL or ADA crash between 80% to 95% in a bear market. You can’t build a “reserve” with assets that are so volatile.

There are many reasons why including altcoins is a questionable action, but in light of the above price manipulation, perhaps that is the point. A quick profit on altcoins that are easier to pump and dump.

The below video gives more information on why including altcoins is bad. It seems the US administration also knows this so they plan to treat Bitcoin differently.

According to the U.S. Commerce Secretary Howard Lutnick, Bitcoin would receive unique treatment in the administration's plan, differentiating it from other cryptocurrencies.

This is definitely bullish for Bitcoin and crypto at large since it signals a major positive shift from governments. The market is trending upwards at the time of this post with Bitcoin moving above 90k. Stay tuned for Friday!

If you want to play is safe, there is only one asset that can protect your wealth and that remains Bitcoin. Altcoins will continue to remain highly speculative assets that have a poor track record at maintaining their value over time.

Another interesting development that is bullish for crypto comes as a result of Trump’s tariffs against most of the world. To address the increasing costs, countries will fight this trade war by… printing more fiat money.

Inflation is good for crypto as this additional liquidity will drive prices higher. However, if the real economy crashes in the process, these forces could cancel each other with some forecasting a recession in 2025 due to tariffs.

This year will continue to be bumpy and volatile. It is best to be prudent and risk adverse in 2025 due to the larger context. I already covered five key emerging trends which you definitely need to watch out for.

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.