Why Ethereum will go to $10,000 and beyond!

The ETH ecosystem is quickly turning into the next major crypto bubble.

In late 2023, at the start of this bull market, I was chatting with YCC members on our Discord saying that I was sure the next big ponzi was being worked on.

What I didn’t expect was it being on Ethereum of all places in this cycle.

We now have confirmation.

The biggest bubbles of them all is being built as I write this across the entire Ethereum ecosystem. This brings both opportunities to profit and risks that will get your portfolio wiped. You will profit or get wiped based on where you will be in this bubble when the music stops.

Let’s explore this further next. TLDR at the end.

The good news is that we’re still at the start of this bubble and bull market. That means there are plenty of opportunities to profit (more on that below) before this starts going totally wrong later on. You can also find my best trades in our alpha newsletters and more live alpha on our Discord.

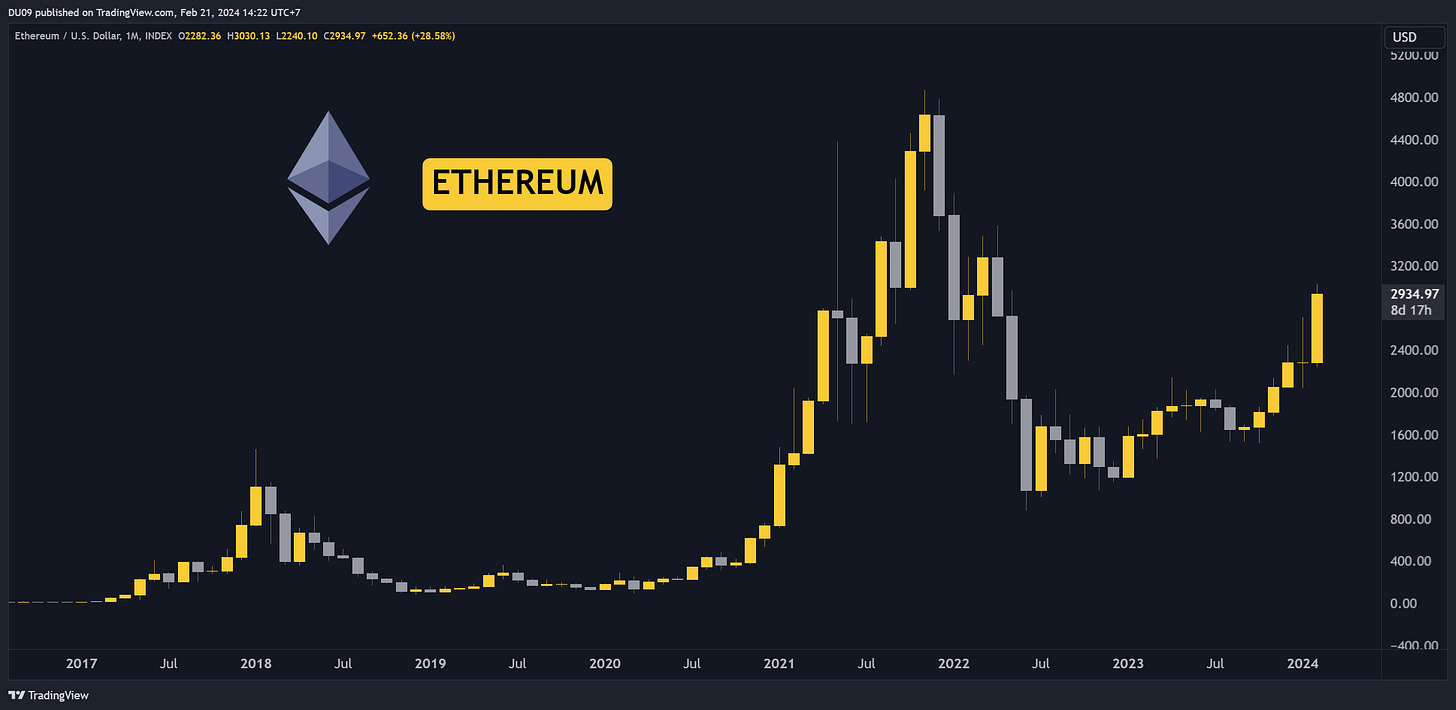

This bubble is quickly picking up speed! Ethereum just broke above $3,000 this week before a pullback started. It pumped 30% in February so far. Biggest pump we’ve had since 2023!

What is creating this bubble I speak of?

The first cause is Vitalik’s decision to move Ethereum from Proof of Work (PoW) to Proof of Stake (PoS) in late 2022. This move was necessary to create today’s bubble. It was impossible without it.

Why?

PoS enabled staking and native yield.

This serves as the foundation for what is happening today. Now, new protocols are building on top of this foundation and each layer has more ponzinomic fundamentals than the previous one.

This will pump Ethereum’s price hard as the bubble develops and that is where your opportunity to profit is. However, there are other reasons too. Here are just a few of them, with the last point being critical:

ETH supply is deflationary since going PoS in late 2022

ETH pivoted to scale using Layer-2 chains which increases demand

Speculation around an Ethereum ETF will increase demand as well

ETH is the base layer for DeFi, nothing beats it, and we’re in a bull market

A plethora of new ETH protocols are about to lock-up most ETH available

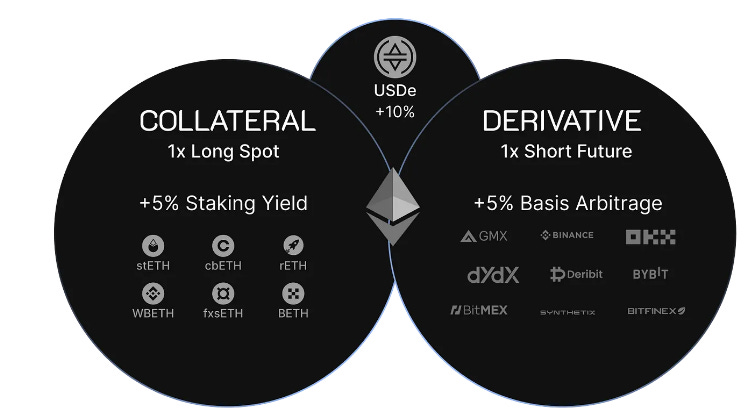

A total of 30 million ETH or 25% of its supply of 125 million is currently being staked in protocols such as Lido which offers in exchange its liquid staked token (LST) called stETH. This token generates a 3-6% yield as a reward for securing the ETH network via the PoS mechanism. But users can use stETH as they please.

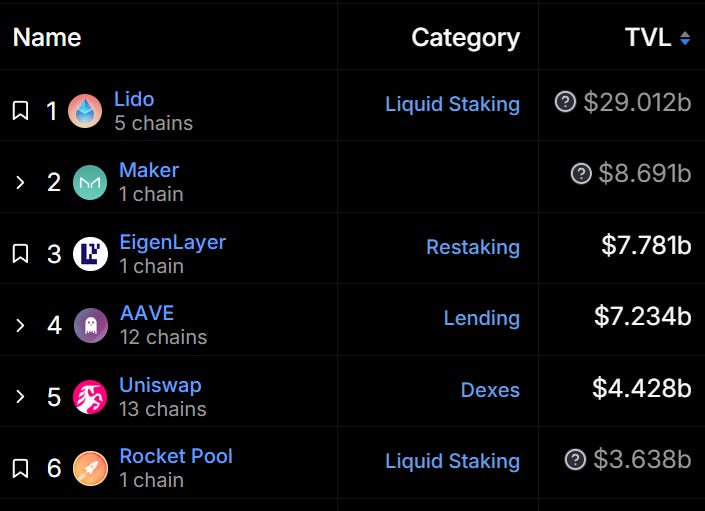

Since late 2023, new protocols have emerged that are also building on top of Lido and stETH locking-up even more Ethereum from its liquid supply. Some of this took the form of re-staking (see #3 in the picture below) and users are incentivized to do it since they get yields from other protocols besides Ethereum.

The staked or re-staked ETH (for example stETH or reETH) can be used in new emerging projects looking to take advantage of the liquidity and security offered by ETH and its derivatives. In exchange, users get additional tokens as rewards. This increases their APY compared to just stacking ETH.

Blast L2 uses stETH to provide native yield on their network to all users depositing ETH. In exchange, users get a derivative (fake) ETH token on Blast and points or the promise of more rewards. Funny how that works, but they raised billions.

EigenLayer also raised billions in staked ETH thanks to similar incentives. If you look closely at the DeFi protocols on ETH you will see three of the top six are in the stacking business. That’s a lot of billions and they will only grow as the bubble inflates.

Why?

There will be less and less liquid ETH and a lot of it will be lock-up in derivative tokens. This will make it easier for ETH’s price to pump which in turn will push those liquid staked tokens - that use ETH as underlying collateral - to be valued higher. This is an illusion. That “new money” does not actually exist. There is no liquidity behind it and that high APY is based on fake money most of the time.

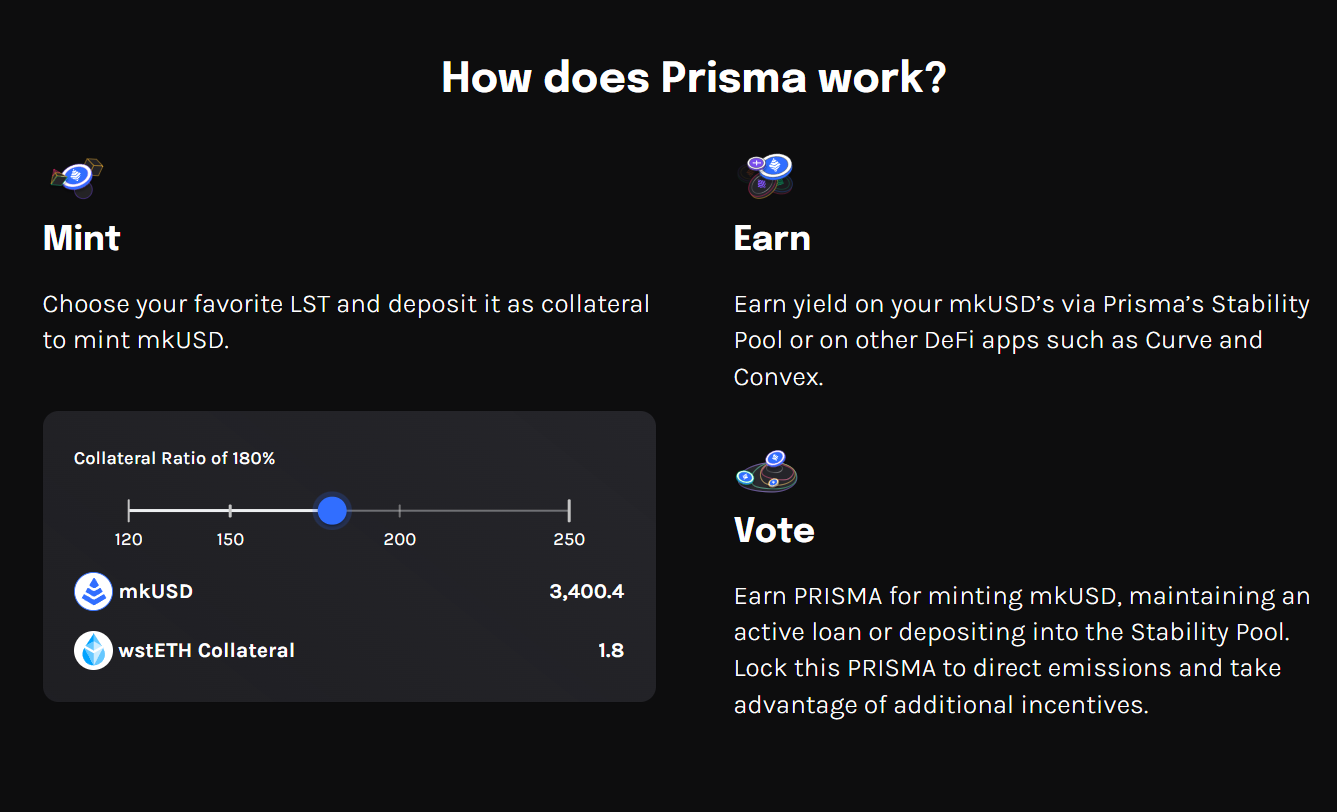

The ponzi starts to become obvious when all these protocols and their liquid staked tokens (LST like stETH) or liquid re-staking tokens (LRT like reETH) start building on top of each other and use such LST/LRT as collateral for new stablecoins.

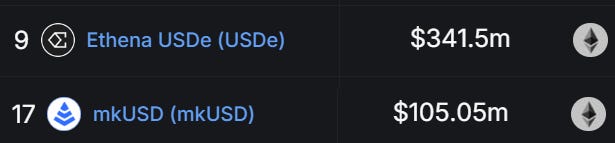

Just in the past few months, two new and major protocols called Prisma Finance and Ethena were launched. Their most important feature? Minting stablecoins called mkUSD and USDe backed by stETH or other similar derivatives. They reached a market cap of almost half a billion overnight! Blast L2 will do the same. But that does not end there.

For example, mkUSD can be minted against stETH and then used as collateral to borrow DAI. Next, you can use DAI to buy more ETH and use it to mint more stETH. Then you can use stETH to mint more mkUSD to get more DAI and ETH. See the problem?

In such scenarios, $1 is counted multiple times and creates artificial demand. The real liquidity is still $1. The fake money is anything on top. This is how the bubble grows.

The concern becomes exponential as more and more exotic protocols build on top of these layers which may have marginal risk considerations because their only purpose is to profit as much as possible before the bubble pops. For example, USDe offers over 20% APY. The APY is real, but for how long?

To address the liquidity problem, these stacked or re-staked tokens and their associated stablecoins have lock-up periods of 1, 5, 7, 21 days, depending on the protocol. That means if you want to liquidate back to ETH or USD, you can’t. You need to wait.

That’s a recipe for disaster and panic in a bear market as people rush to where liquidity is still available. For example, under normal circumstances, it can take up to five days to get back your ETH if you have stETH, as shown below.

When panic starts, everyone will want to swap back their LST/LRT or their related stablecoins into ETH and USD. That means a huge sell pressure on Ethereum to provide liquidity to a panicked market. What went up, now goes down. But the exit door (liquidity) can only fit so much sell pressure before things break down. In the past, stETH already crashed due to that!

Lido, EigenLayer, Prisma Finance, Blast L2 or Ethena do an excellent job at making ETH scarce and in demand = pump. But equally, they have opened the pandora box for the entire Ethereum ecosystem. The risk of contagion is very high. It only takes one protocol to fold, then like a domino, the whole ecosystem follows.

This a systemic risk to Ethereum, in my opinion.

It can lead to a massive crash with various protocols going under, LST/LRT-based stablecoins losing their peg to the dollar and liquid (re)staked tokens falling sharply against ETH. This can be triggered by liquidity concerns alone once the market turns bearish since the bubble is fueled by demand exceeding supply right now.

This happened before. It’s not new. The end result will be ETH’s price crashing until all that fake money is wiped out and entire chains like Blast L2, that use LSTs instead of ETH, may become insolvent. That’s why bear markets are brutal. The bigger the bubble, the bigger the crash.

Just make sure to keep your wealth comfortably on the Bitcoin chain when it happens. You don’t want your money stuck on chains like Blast L2 when the bubble pops. This won’t kill Ethereum or its network, but it may put in question everything they’ve built since 2022 after going PoS. This bubble was also predictable since then looking back.

How can you profit?

Having an ETH bag going into this bubble means you can 3x - 5x your money. That’s realistic in my opinion. Beyond that, it’s hard to guess. You can also gamble on tokens from LST/LRT protocols. The bubble will pop when prices are breaking records and euphoria takes over. Pay attention at that time to not be caught off guard.

Time-wise, you have about 10 to 18 months left in this bubble. I would be particularly careful from late 2024 to mid-2025. By that time, make sure you exit most of these protocols. If Ethereum is over $10,000 and is breaking new records every day, that’s your signal to take heavy profits and exit.

You have at least 10 more months to farm APYs and this bubble, but after that, hard to say when it will pop. Probably soon after Bitcoin tops. Use that as a guide too. Above all, at the end of this bull market you should only hold BTC, USD and Gold. That’s it and good luck!

TLDR & Tips to Remember

Ethereum changing to PoS enabled a bubble to be created

The more ETH is locked-up in staking, the higher its price will pump

As ETH's price pumps, the bubble and risks amplify, like a ponzi

Use this to your advantage, but bail early at any signs of trouble

Greed is fueling the bubble and is creating exotic protocols with high risks

Once the market turns bearish, liquidity will dry up and the bubble pops

Contagion across the whole ETH ecosystem is likely once things break

Make sure you have no locked tokens when the music stops, exit fast

You have 10-18 months left and ETH can go to over 10k in this time

Only hold BTC, USD, and Gold at the end of this bull market

This newsletter is made possible with the generous support of our community Patrons and partners. Upgrade your experience to show your support by clicking the below button or reach out to us on X or Discord to partner.

All info is provided for educational purposes only and is not financial advice.

I love this place. I want to build a personal site like this. And with my art, the art everywhere, street art, life art, magic of life art, everything. But I really want to know what's the best, safest, easiest, affordable, path, to do this - build dapp= how to start my own publication regarding how people locally in my area are affected by my art and by cryptp projects maybe, definitely by social movements, but now, how to distribute free on paper monthly,

Great article.

If any of you need an invite code for Blast: UUZ0J

blast.io/UUZ0J