FOMO into the Debasement Trade!

There's a new trade in town and it has a name.

The last time Gold pumped by over 50% in a year it was 1979. That’s 46 years ago. We’re living historic times and such moments deserve a good name.

Wall Street calls it the debasement trade, a label coined by JP Morgan.

Debasement implies that the quality or value of something is reduced. In this case, the value of the US Dollar and most other fiat currencies.

What’s interesting is that JP Morgan paired Gold with Bitcoin when discussing this debasement trade. They are both a hedge to the implosion of fiat money.

Let’s look at that closer.

Become a Patron for lifetime access to our exclusive private alpha!

If we flip the narrative on its head for a second, the USD crashed 50% against Gold this year! If you hold dollars, you’d be pressed to ask yourself if you’re holding the right money in your pocket.

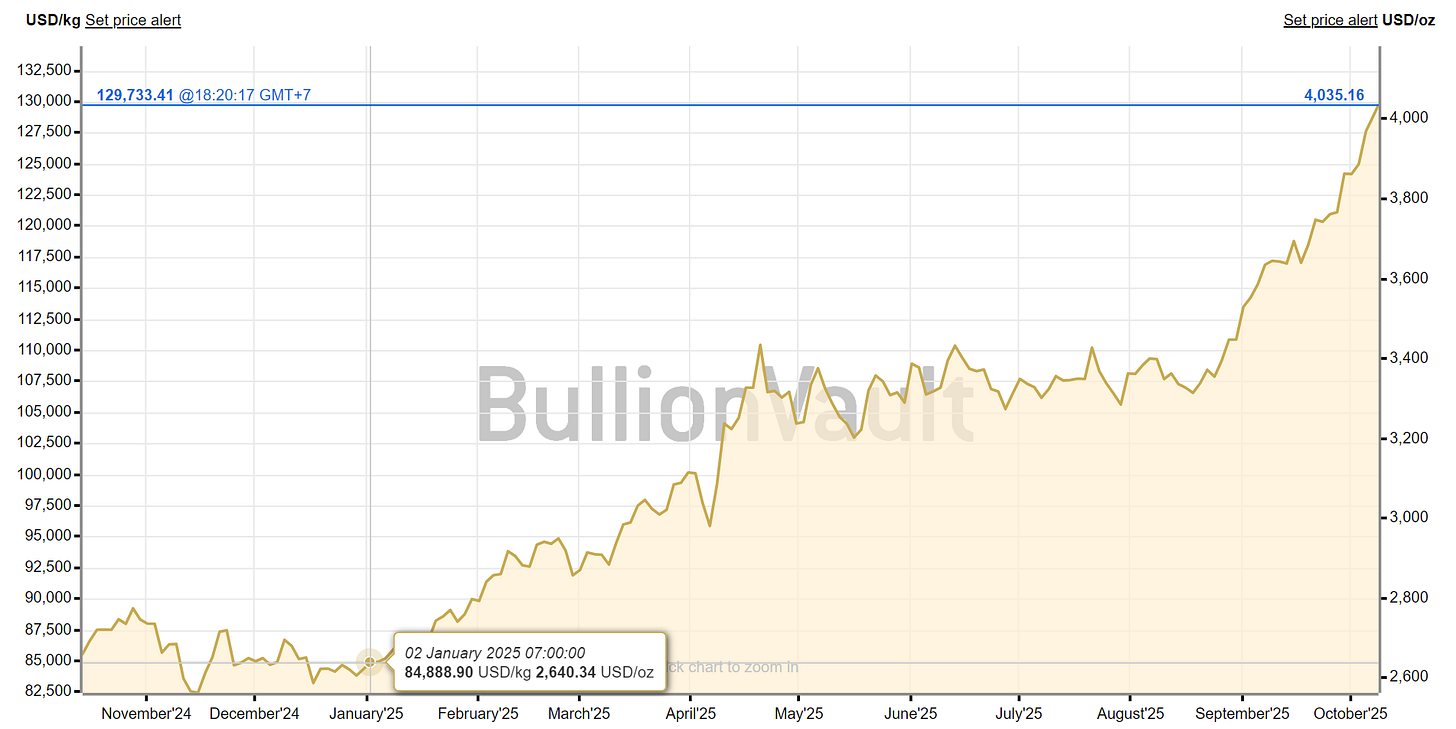

In January, a kilo of Gold was $85,000. Today, it’s $130,000. The fear is not due to missing out on this trade. Rather, this rally may be just the beginning and Gold is nowhere near a top. What would that say about the US Dollar or Bitcoin?

Welcome to the debasement trade!

I flagged Gold to our Patrons Pro (Unlimited plan) before its breakout in late August (see image below). Since then, the price pumped by 20%, and based on the monthly MACD indicator, there are no reasons to think it will stop here.

I was a buyer of Gold back then and will continue to be. That’s because, even before the debasement trade got its name, I knew there are only two assets we can consider hard money: Gold and Bitcoin.

The beauty of what’s happening right now is that this trade is becoming mainstream. Everyone is catching-up to what Satoshi wrote in the genesis block. Moreover, Gold and Bitcoin are being seen as equal partners against debasement.

In the past two years, everything Bitcoin maxis have been talking about since 2009 has become true. Bitcoin got its first ETFs backed by Wall Street in 2024, and in 2025, it is being labeled as a hedge against fiat debasement, on equal footing with Gold!

That is literally why Bitcoin was created. As an alternative to fiat money.

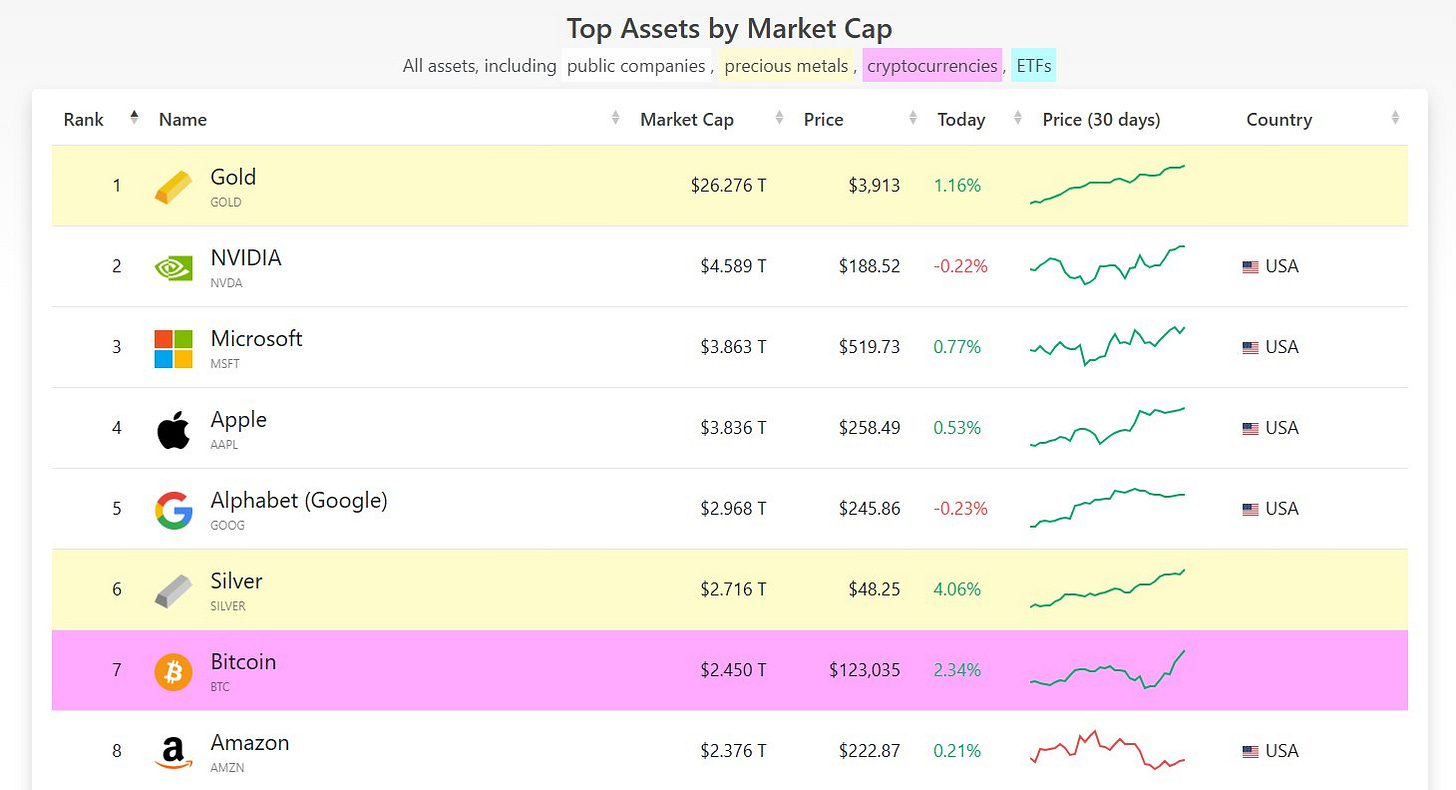

Before we rush to say Bitcoin has won, we must acknowledge that Gold plays a similar role and has far more weight in the debasement trade. This can also be seen in the fact that Gold has outperformed Bitcoin in 2025.

Gold is up 54% in 2025, Bitcoin 32%. All things considered, Gold is leading right now. But that can definitely change when investors and retail rush to safety by looking for alternatives. Bitcoin can catch-up and exceed Gold’s performance.

Just look at their market cap. Number 7 (Bitcoin) will eventually become number 2. Perhaps much later, even number 1 to displace Gold. The trade of this decade is to have massive exposure to these two assets.

When everyone is piling into a trade, is that not a sign of a crowded trade, aka you’re late to the party?

While that is a legitimate concern, I believe a simple risk analysis shows the debasement trade is sticky and will last for years to come.

The US cannot stop printing dollars considering its debt levels. Its only way out is to debase the debt by printing more and more dollars. Doing so makes its past debt more easy to service. Most countries are in the same position.

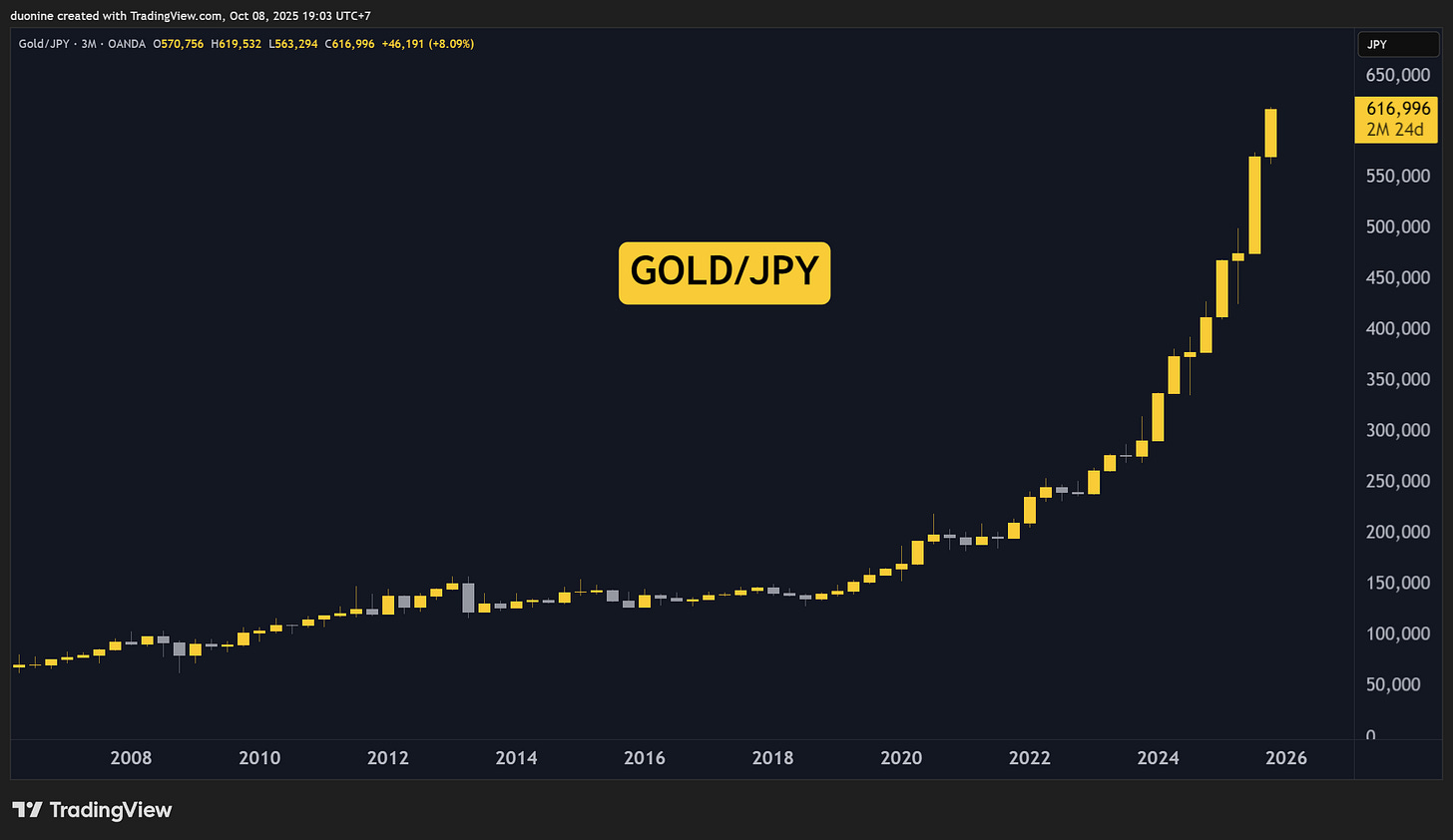

In light of that, can Gold or Bitcoin stop pumping? Hardly. When the denominator (the US Dollar) is crashing, everything else pumps. If you’re confused by this, look at the price of Gold in Japanese Yens below.

That parabolic pump is how BTC and Gold charts will look against most fiat currencies, including the USD, in the coming years. If you hold these two assets, you’ll have a front row seat into the action. Time to FOMO?

If you don’t have any exposure to Bitcoin or Gold, then yes. You can’t go wrong here on a long-time horizon. Should the fiat system collapse, you’ll be well equipped to thrive in the next economic system since hard assets keep their value over time.

If you’re already exposed and have a solid bag, congratulations! You deserve this moment. Enjoy it. Bitcoin will also break many new records as we approach the end of 2025.

The show goes on.

If you still sit on some (soon-to-be) worthless fiat like USDC tokens, I recommend you FOMO into this strategy to farm one of the most exciting airdrops of this year in crypto. Just follow my guide so you can accrue points and get a fat airdrop later.

Our YCC team has reached over 5 million allo points with 50 members. If our team qualifies in the top 100 later, we could get additional allo points as a bonus!

Expect volatility to explode in the coming months and years. This is your opportunity and I talked about it in my last Alpha Post as well.

Are you holding Bitcoin and Gold? If not, do you plan to FOMO? Reply in the comments and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.