The Unbeatable Investment Strategy of the Next Decade!

TLDR: short fiat and long scarcity.

This week, gold made a new record price at over $3,500 per ounce. Bitcoin already made an all-time high at $125,000 and is likely going much higher later this year.

Investing in scarcity is the alpha of the next decade.

Today, the trust in central bank fiat money is at an all-time low. One can say that when the denominator is infinite (for e.g. US dollars) the price of bitcoin or gold can also trend towards infinite.

It’s just a matter of time. That’s why I hold mostly gold and bitcoin today.

Scarce assets will continue to break records after records in such an environment. Here’s why you want to hold them.

This newsletter is sponsored by Grvt, the world’s first licensed institutional-grade self-custodial onchain exchange. Open an account to qualify for the $GRVT airdrop and farm maker fee rebates!

What is Happening?

The world is about to enter into a high inflation, low interests environment. If the US Fed cuts interests rates in mid-September and continues to do so in the future there will be only one outcome.

Higher prices for everything, especially scarce assets like gold or bitcoin. To me, it seems these assets are already pricing in that future.

Effectively, central banks cannot stop inflation by increasing interest rates because doing so would crash the market. The fiat ponzi is simply too big of a bubble to do so. Paying high interest on that bubble is impossible.

To avoid the crash, central banks opted for the lesser evil. Inflate the debt away. Meaning, they will print so much fiat money that past debt will become manageable and easily paid.

In the process, anyone holding or saving in cash will be debased, diluted, and left without much purchasing power. In light of that, protecting your wealth with gold and bitcoin becomes paramount.

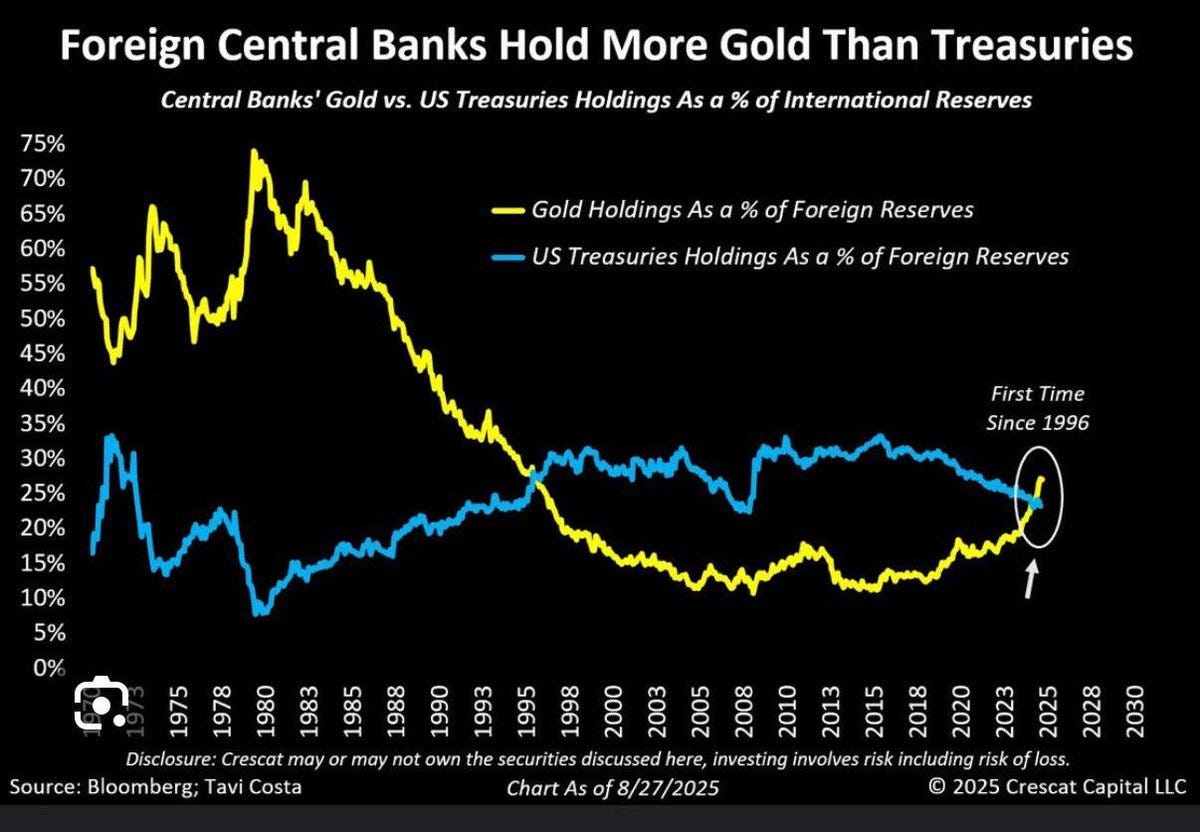

Interestingly, central banks around the world are also buying massive amounts of gold while reducing their exposure to US treasuries (or fiat). They know very well what is going on and are hedging this future.

The Golden Decade

A look at the price of gold in the past 30 years shows something extremely interesting. It seems its price moves in cycles of ten years:

2001-2011, huge rally where the price did almost a 7x

2012-2022, correction and flat trend (long pause)

2023-2033, huge rally after major breakout

We can’t know for sure if this will be another decade-long pump, but the conditions are there for it. I’ve been accumulating gold since 2021 and that bag has outperformed the US stock market since.

In the past two years, I’ve also sold most of my altcoins with the aim to simplify my investments and attention to what matters: Bitcoin. I wrote more about that in this post on X.

Moreover, adjusted for gold or inflation, the US stock market is still in the negative year-to-date. See the chart below. Left side is adjusted for gold and right side is the same S&P500 index priced in Euros.

As you can clearly see, the denominator matters. Simply put, against US dollars, everything went up because the value of one US dollar crashed in 2025. By 25% against gold and by 13% against the Euro.

This is why when mass media reports that the US stock market made a new record price this year, that’s only valid in US dollars. Against gold, the US stock market has been in a bear market since 2000.

In this environment, investing in the US stock market is a risky proposition. Many Europeans are lamenting that they invested in US stocks, but their “profits” are still in the negative when measured in Euros.

The Solution

Some call it escaping the matrix, escaping the debt system, or simply checking out of the fiat ponzi. You do that by buying scarcity and selling fiat. This is also what Saylor is doing with his strategy: shorting fiat.

As indicated before, our global financial system is a giant bubble fed on infinite fiat debt. This bubble can be stabilized in two ways:

if there is growth, lots of growth, and low inflation

if you can export that inflation to others (keeping them poor)

This went out the window after COVID. What is different this time is that the effects of this has hit the golden billion in real terms. The golden billion are the people living in the green countries below.

Inflation has hit home and it cannot be exported out either. Catch-22.

As it happens, the others are growing faster and faster. To make maters worse, they are buying a lot of gold with that growth, knowing quite well that the global financial system denominated in US dollars is broken. The others are hedging as well.

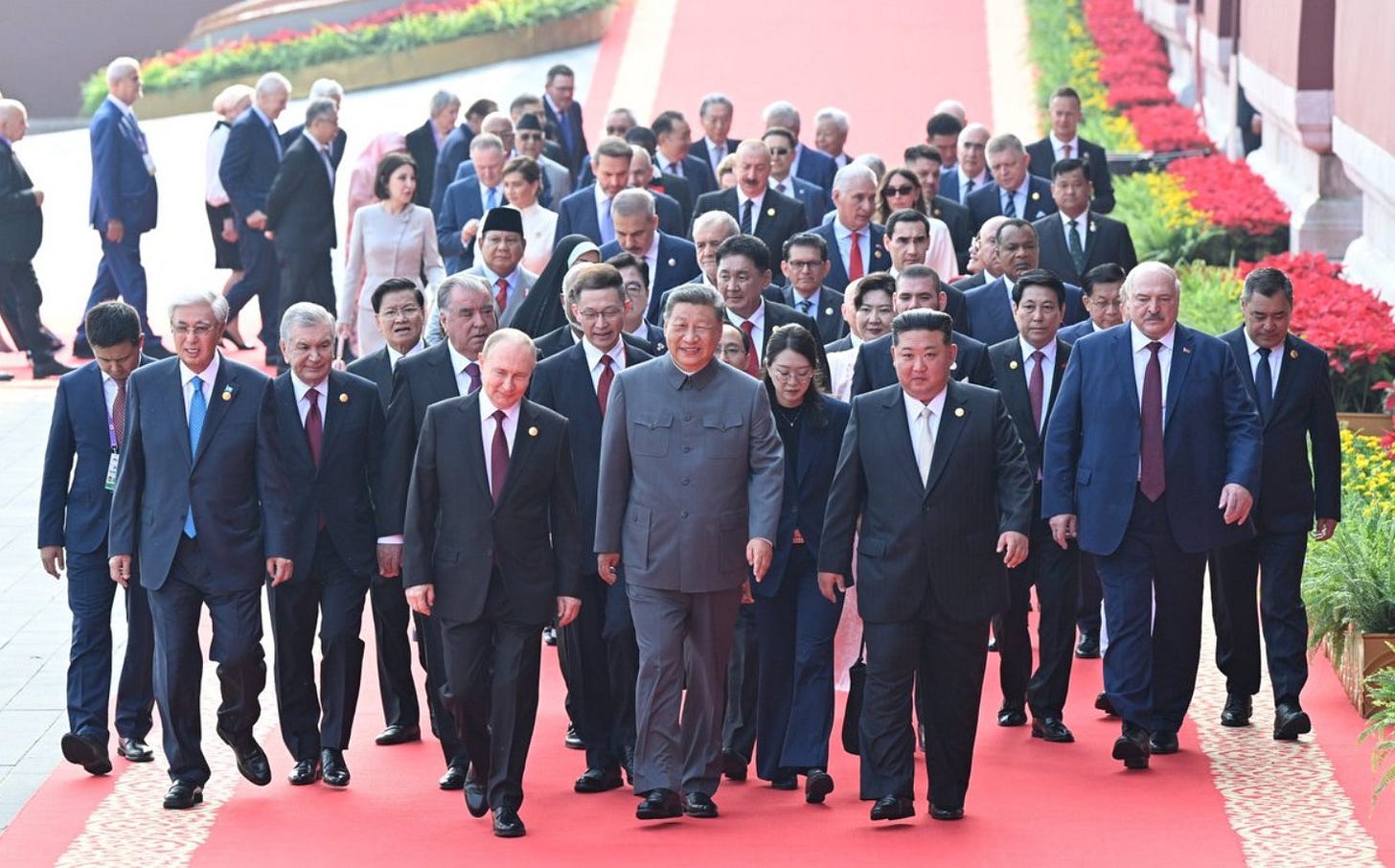

This only speeds up the bubble collapse and makes pictures such as the one below possible. I made an X post on that too. It’s the first time these leaders meet in such a format and sends a strong message.

Regardless on where you are located on the above map, the fundamentals of gold and bitcoin remain unchanged and they protect you from what’s coming. They are the best we have. You cannot buy anything better if you want to protect your wealth.

What’s also concerning about the above image of world leaders is that it signals a massive fragmentation or partition of global power distribution. We no longer have consensus across the globe on the way forward.

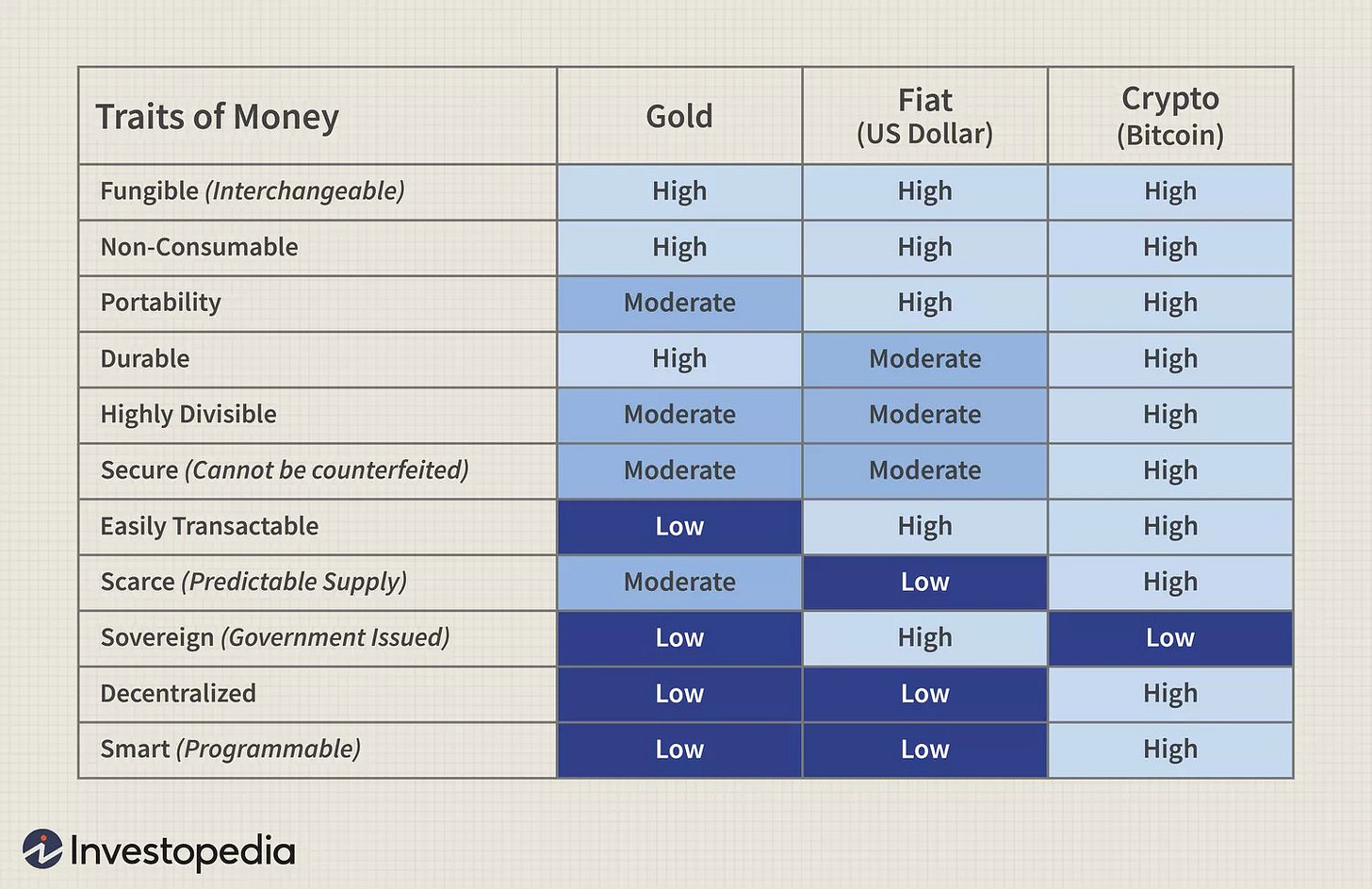

This will bring instability, conflict, and currency collapse. In uncertain times, the traditional hedge is gold. Thanks to the digital age, we now also have bitcoin which is even better for several reasons shown in this table.

The thing that makes gold and bitcoin unique is that they are both apolitical and they are in demand in any country, irrespective of their politics, governance, or financial system.

This is the perfect hedge in an uncertain world.

Are you already hedging the fiat ponzi? Reply in the comments if you hold gold and/or bitcoin and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

![r/MapPorn - The Walled World [1280x827] r/MapPorn - The Walled World [1280x827]](https://substackcdn.com/image/fetch/$s_!NelB!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd5cd6c7e-1acf-4994-99d9-9fe0a7623913_1280x827.jpeg)

What about the HUGE rotations BTC->ETH based on the "rails narrative" ("...tokenized rwa's will be issued on Ethereum and most tx's are happening there and... ...")? Do you still stick to BTC and XAU?

🙏🏽