This Crypto Cycle Tops Within 100 Days!

There is not much time left.

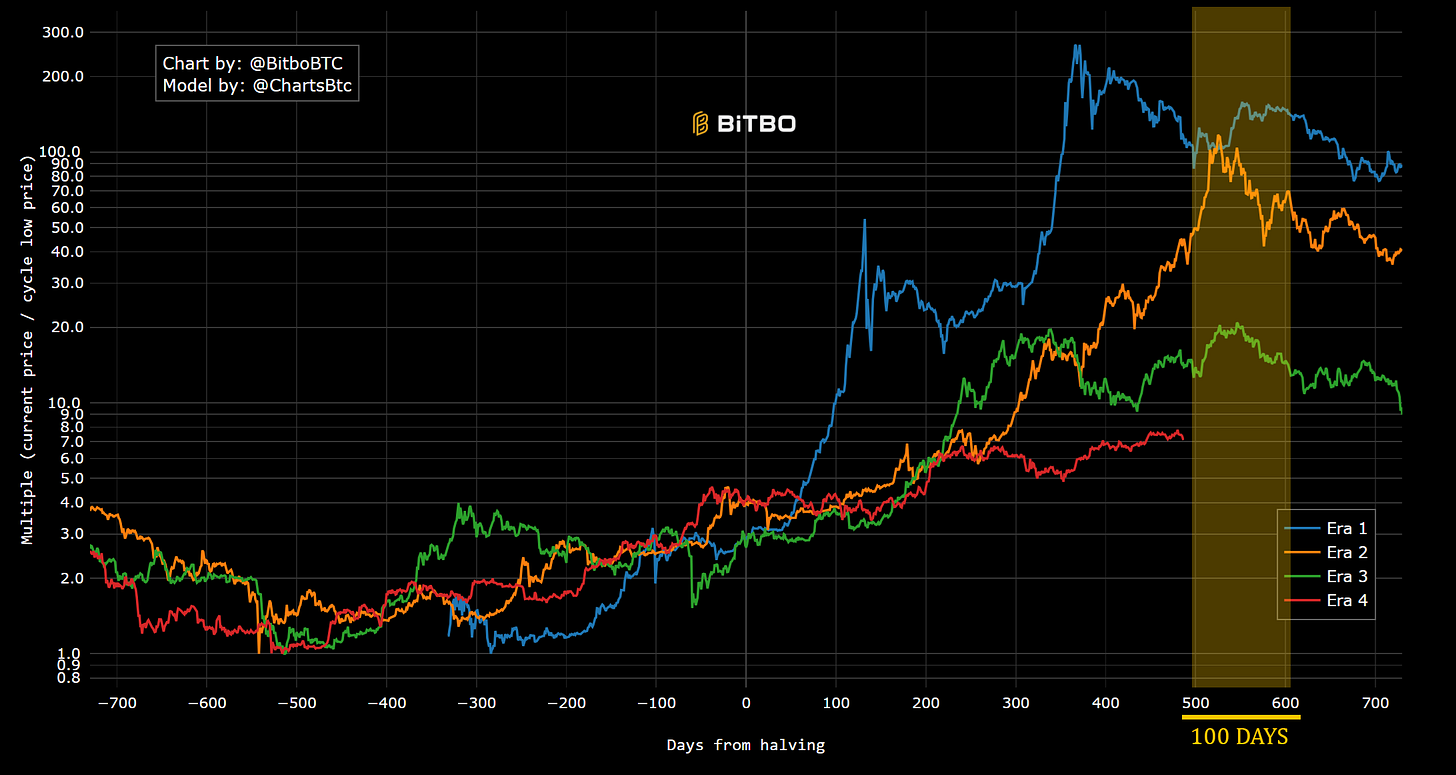

Based on historical price action, this cycle has about 100 days left until the top is in. However, past performance is no guarantee of future results.

Either way, by the end of this year we will know if the four-year cycle is dead or not.

Let’s look at a key chart next.

This newsletter is sponsored by Grvt, the world’s first licensed institutional-grade self-custodial onchain exchange. Open an account to qualify for the $GRVT airdrop!

I’ve seen three full crypto cycles to date (since 2014) and the current one is the most atypical. In the past, the top happened around 1,060 days after the last bottom.

We’re already past 1,000 days in this cycle with no top to speak of. In previous instances, each top was preceded by months of aggressive price action.

In this cycle?

Each time the price moved higher by around 100% the rally stopped and the price consolidated for months. This has been repeated at least three times since 2022. Look at the below chart. Current cycle is in red.

Instead of pumping, Bitcoin is again taking a pause right now.

The next 100 days from here are critical and fall right into the top zone of the previous two cycles. I highlighted that area in yellow on the chart above. Bitcoin and the whole crypto market should top within that time frame.

If not, then the four-years cycle theory will officially be a thing of the past.

Note that institutions came in force after the ETFs were approved in early 2024. Bitcoin rallied hard in anticipation of the ETFs, but afterwards, its rally was less aggressive which brings us to today.

Essentially, between September and November, Bitcoin has to start moving higher faster and faster. If that does not happen, then this would be atypical and create even more confusion.

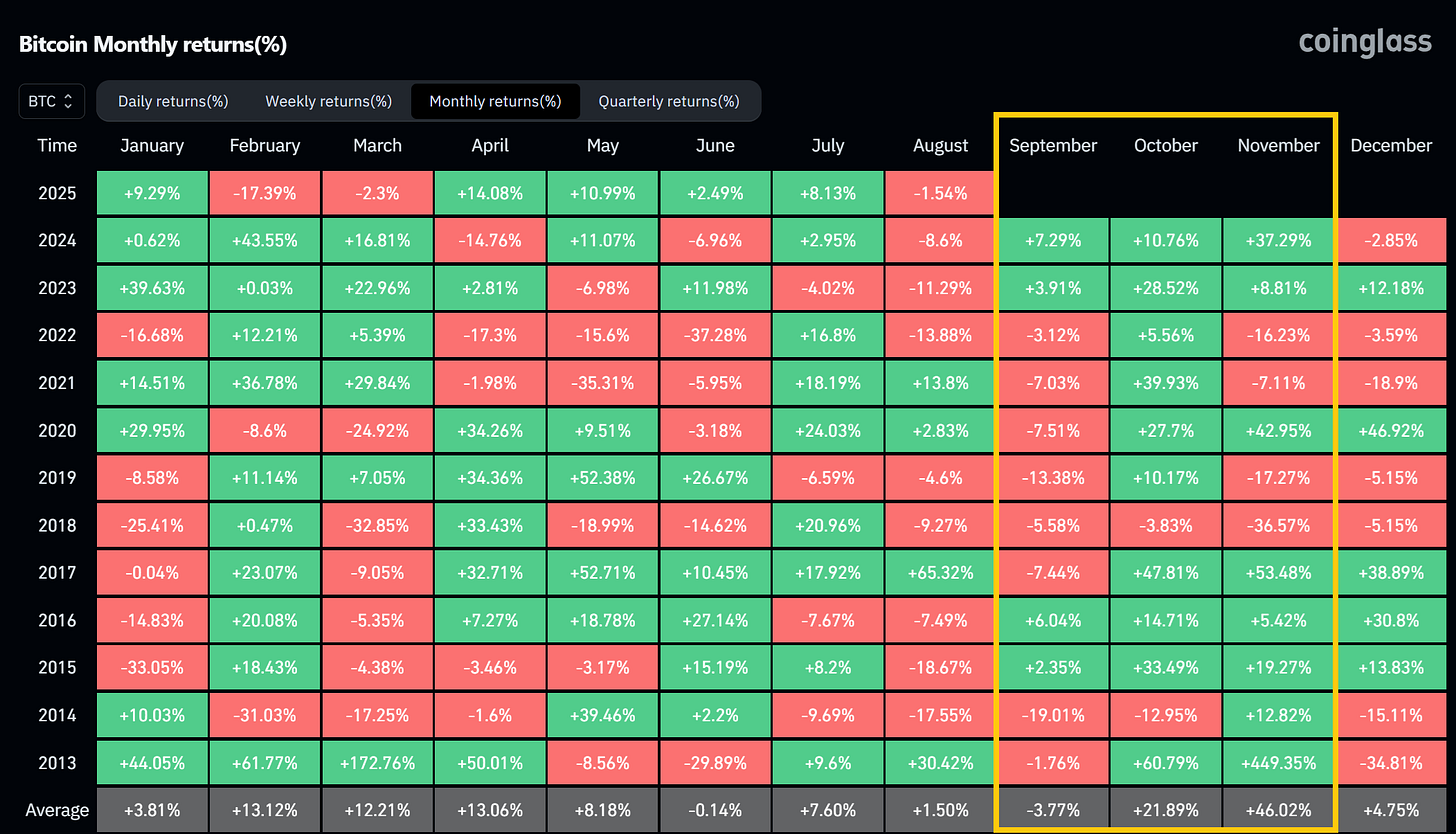

As you can see below, October and November have been strong performers historically. Perhaps September will be slow, but the price should pick up by October to fit the four-year cycle timeline.

There are arguments that say Bitcoin may be more delayed to top with each subsequent cycle and the current pause could delay it into December and the winter holidays which is historically a good period for a top.

What we need to see on the chart to know the top is approaching is FOMO and euphoria starting to take shape. There’s none of that now. Those selling here may miss the biggest gains ahead.

Either way, the clock is ticking and you need to plan for the next 100 days like your life depends on it. I already wrote a guide on the easiest exit strategy you can employ. Split your bag into three and aim to sell a third whenever you feel FOMO.

While we wait for the top, you can farm amazing yields! In my last Alpha Post, I shared a strategy netting 25% APY and an airdrop scheduled in September! Until the bear market returns, these yields will stay high and can boost your portfolio.

When do you think Bitcoin will top in this cycle? Reply in the comments with your best guess and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.

Exciting times huh? Just extend it to 120 days and you will be right

Can you nominate me for monad card sir ?