If you think 2025 was tough, then 2026 will put that to shame!

Are you prepared for a bear market?

I believe we have a few more months of upside before the market turns ugly.

Risks are increasing across the board!

I am not bullish on 2026. On the contrary, early into next year things may start to break down across the board and will spill over to crypto as well. As usual, crypto may be the first to crash.

I’m not a bear just yet as I think the market may do well into December, but those taking more risk in this period will pay a heavy price in 2026. Let’s begin.

Become a Patron for lifetime access to our exclusive private alpha!

In August, I wrote an article about the 4-year cycle that predicts a top between September and November this year. So far, October took Bitcoin to 126k, a new record. However, it also brought us the biggest crash in crypto history soon after.

Despite the volatility, Bitcoin remains above 110k at the time of this post. The market has been very choppy and many traders lost everything trying to beat it. This market is on HARD mode and has been for most of 2025.

If you made any money in 2025, consider yourself lucky.

I don’t believe Bitcoin topped at 126k. There was no euphoria, no FOMO to make that case. This is why I am ready to wait a bit longer for a top until end of December or thereabouts.

After that, my focus will be 100% on wealth preservation. Zero risk taking.

Why?

Risks are at all-time highs!

Let me just give you an example from TradFi.

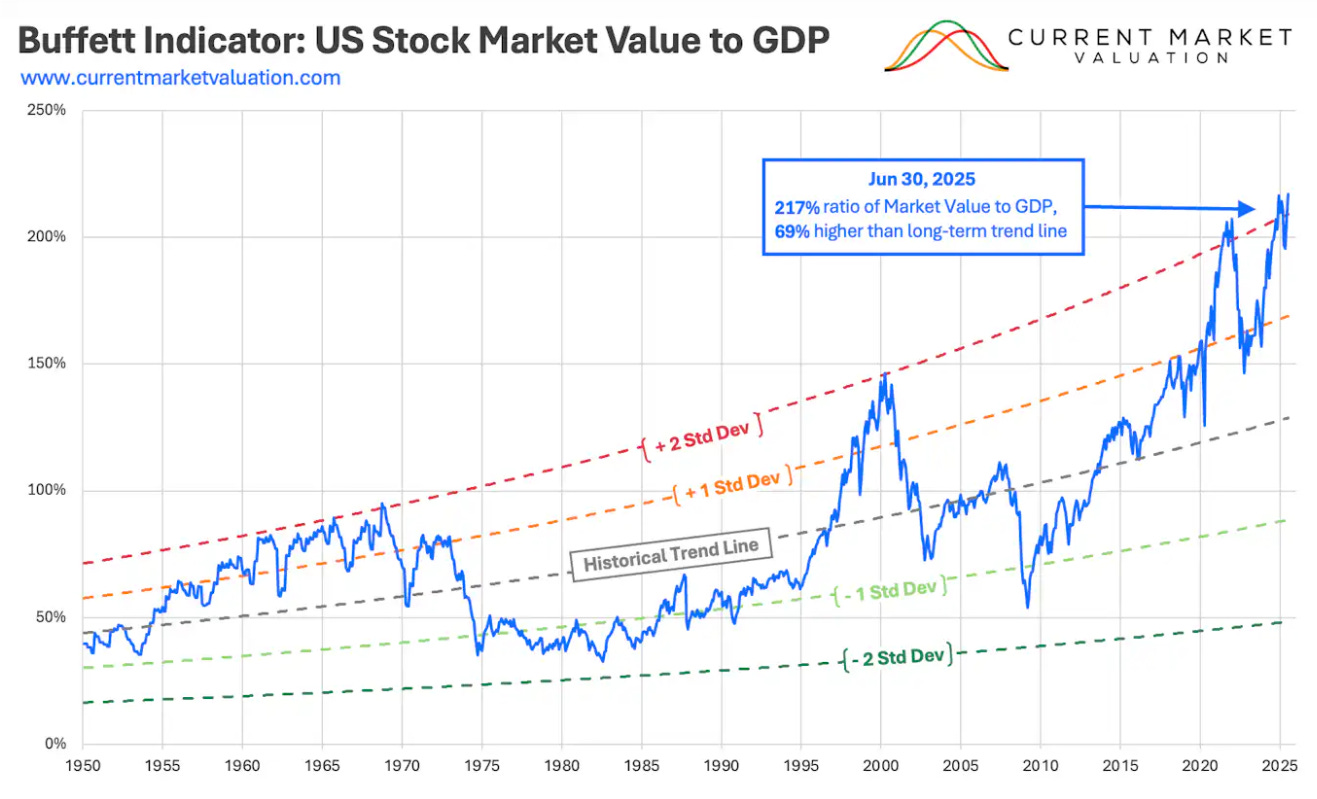

The Buffett Indicator is now showing the most overvalued stock market in history. It’s above 2 standard deviations from the trend line. In a normal distribution, a value above 2 standard deviations occurs only about 5% of the time.

In other words, 95% of the time the price will be under current levels. If you needed a reason to secure good profits and reduce risks, this is it.

We’re basically at the edge of the cliff.

Every time this happened, see 1970 or 2000 on the chart, a huge crash followed. I don’t pretend to know when the next crash starts, but I know the chance of a 3 standard deviations is 0.3%.

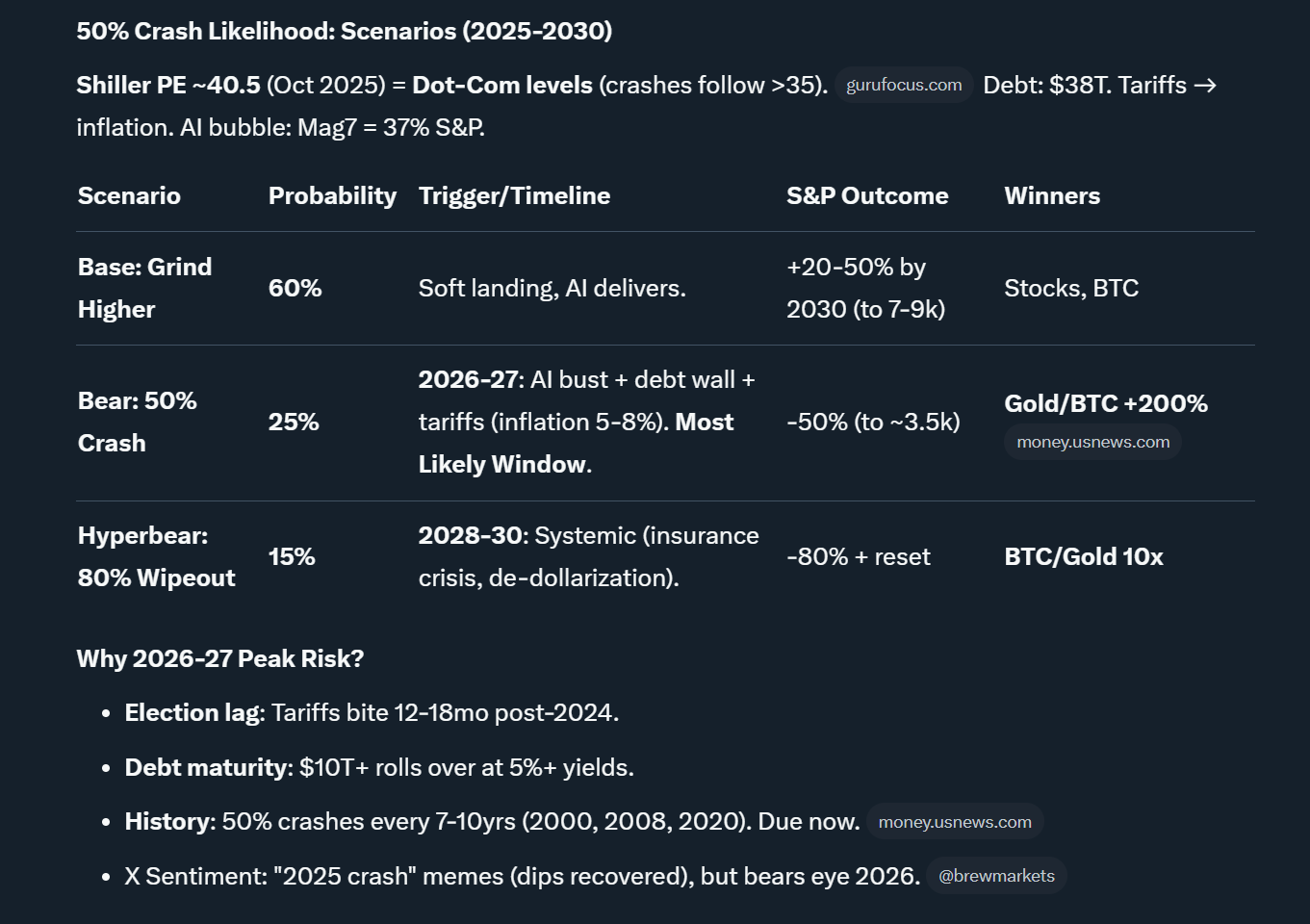

I even asked Grok (the AI from X) if a 50% stock market crash is likely in the next five years. Its odds are at 40% with a peak risk period between 2026-2027. That would fit perfectly with the expected bear market in crypto.

If the crash happens, Grok recommends holding real assets like Gold, Bitcoin, commodities, or farmland. My aim is to maximize those and reduce risk vectors like altcoins.

My Plan Going into 2026

Here’s a tentative timeline:

October to December 2025 - I lean bullish, but remain on guard

January to March 2026 - first signs of a bear market emerge

April to December 2026 - wait in cash, buy panic or a dead market

You could argue the October 10 crash was already a first sign of a bear market. I agree with that if we narrow the discussion to altcoins. However, Bitcoin is still in an uptrend and a proper bear market does not start until BTC crashes too.

Regardless, aim to sell altcoins into December if a good relief rally happens. I’ve already sold all my altcoins (except RAT Escape) between late 2024 and 2025. I recommended everyone to do the same. My exposure is now mostly to Bitcoin in crypto. That’s one way to reduce risks if you expect a bear market.

If this is your first crypto cycle, know that altcoins crash 90% to 99% in a bear market. You don’t want to hold them, nor buy any discounts until news articles declare the market dead.

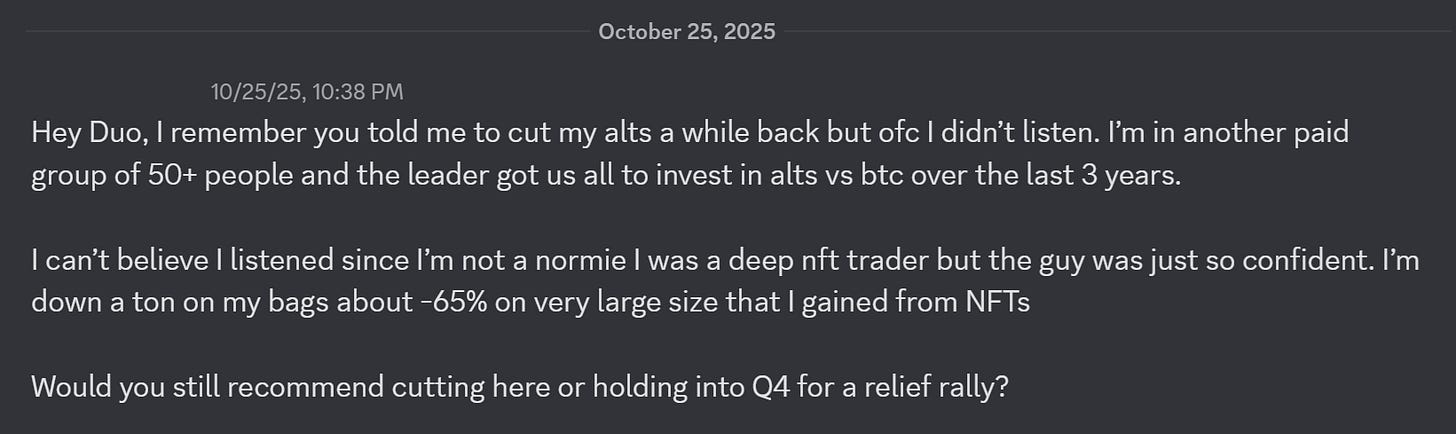

Until then, hold cash with any profits taken and let the bear market develop. Don’t buy back or you’ll lose your profits. Anyone shilling you altcoins here should be taken with a grain of salt, see image above from a member.

You can also hold profits in Gold or Bitcoin. However, these will also fall during any wide market crash because they provide liquidity to forced sellers that need to cover debt and other obligations.

Gold and Bitcoin always recover because they are sound money, most altcoins never recover. Know the risks and limit them going into 2026, do not increase them! If a bear market starts in early 2026, wait at least a year before buying anything. Guard that cash, don’t waste it.

I will be here whatever happens and will update my views as the market evolves. Right now, I have no reasons to be bullish into 2026. There are just too many red flags. If anyone tells you otherwise, they are probably using you as exit liquidity.

The opportunities to make money that make sense to me in such a market are quite niche, rare, and require very specific credentials to be worth a bid. I wrote about such an example in my last Alpha Post.

Is a bear market waiting for us in 2026? Reply in the comments and don’t forget to subscribe!

This newsletter is made possible with the generous support of our Patrons and partners. Upgrade your experience by becoming a Patron for lifetime access to our exclusive private alpha! Details are available on our Patrons page. All info is provided for educational purposes only and is not financial advice.